Most of us would like to know more about credit. It’s a key part of personal finance, and it can be either a huge asset or a terrible liability, depending on how you handle it. Many people start trying to learn more but stall out when they encounter terms they don’t understand. To help you past this hurdle we’ve put together this list of common credit terms that you should be familiar with.

1. Credit

Credit is money that someone (like a bank or credit card company) lets you borrow. You must sign an agreement committing you to pay them back on a set schedule, usually with interest. It is essential to understand that credit is all about your level of responsibility and reputation. You are giving your word that you will pay back whatever you borrow.

There are four basic types of credit:

- Revolving credit

- Charge credit

- Installment credit

- Service credit

Each serves a different purpose and works in a different way.

2. Revolving Credit

Revolving credit gives you the ability to spend continuously on a credit line while making regular payments. You can spend up to a fixed limit. You make monthly payments against the balance.

Usually, there is a relatively low minimum payment that allows you to keep the account in good standing. The unpaid balance “revolves” into the next statement period. You can keep spending on the credit line while you make payments.

Credit cards are the best-known form of revolving credit. A home equity line of credit or HELOC is another form of revolving credit.

3. Charge Cards

These cards look the same as traditional revolving credit cards and are used in precisely the same way. The difference is that you have a fixed period, usually 30 days, to pay the full amount.

If you have a $15,000 credit limit that you maxed out on your charge card, you will only have to the next billing cycle (usually 30 days) to pay this balance in full, or it will be considered late. You can continue to use the charge card once you have paid the balance.

Charge cards usually require excellent credit and a substantial income.

4. Installment Credit

Installment loans give you a fixed sum of money, which you pay back according to a set schedule. Student loans, car loans, and mortgages are all installment loans.

You will usually pay a fixed sum every month until the loan is paid off. The period during which the loan is paid off is called the loan term.

You will pay interest on an installment loan. Many loans also have origination fees and other closing costs, which you must pay at the start of the loan period.

5. Service Credit

Many people don’t think of service credit as a form of credit, but it is. Things like your Netflix Account, Amazon Prime, your electric bill, or cell phone plan are all types of service credit. They provide you with services and allow you to pay for the services later.

6. Credit Bureaus

People who are thinking of extending credit want to know how much risk a borrower poses. There’s a system in place for evaluating borrower risk, and the three major credit bureaus are at the heart of that system.

These three companies – Experian, Equifax, and TransUnion – keep detailed records of your credit accounts. These records are called credit reports. The information in your credit reports is reported by your creditors.

Not all creditors report to all three credit bureaus, so your three credit reports may be slightly different.

There are other credit reporting bureaus, but most of them serve niche industries. Experian, Equifax, and TransUnion are the ones you need to be aware of.

The Consumer Financial Protection Bureau has a complete list of credit reporting agencies (PDF).

7. Credit Report

Your credit report is like a report card, but instead of showing grades, it gives you and potential lenders an overall picture of your reputation and responsibility with other lenders.

This report is going to show several things like:

- All Of Your Accounts – You can view all of your accounts that are open or closed on your report.

- Account Balances – You can see any balances you owe.

- Credit Limits – It will show all of the credit limits for each account.

- Your Payment History – It will show if your payments are on time or if they are late.

- Average Age Of Accounts – This shows lenders how long you have been using your credit.

- Hard & Soft Inquiries – A list of anyone who has requested your credit report.

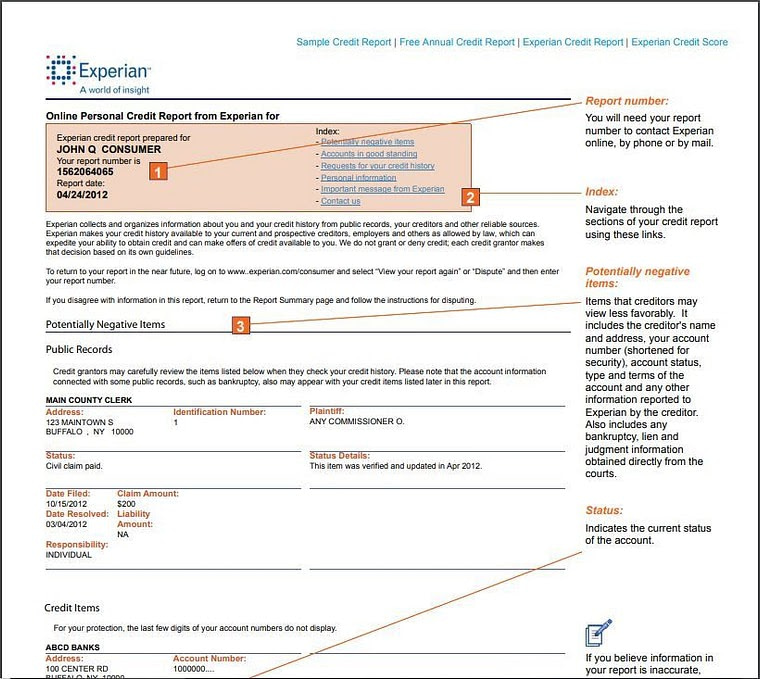

This is what a credit report looks:

🔎 Learn more about credit reports:

8. Credit Score

Your credit score is a number rating derived from the information in your credit report. It summarizes the probability that you will default on a loan. The lower the score, the more likely you are to default.

- Free Credit Scores

- Free Credit Monitoring

- Free Credit Report Card

- No-Fee Debit Card Account That Pays You For Improving Your Credit.

- Build Credit With Debit Card Purchases

There are two major providers of credit scores: FICO and VantageScore. The way they analyze the information in your credit report is similar, but there can be significant differences. Each of these companies provides different types of scores designed for different types of lenders.

Most free credit score providers use VantageScore, but most lenders use FICO. If you get your credit score from a free provider it may not be the same score lenders see.

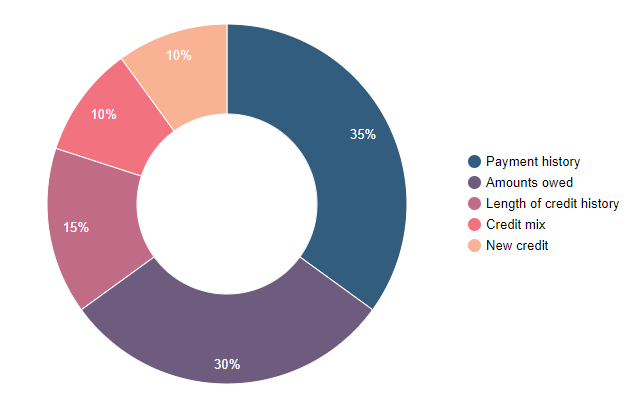

Below is a breakdown of the critical factors that make up a score:

As you can see, Payment History and Credit Utilization are the most critical factors and the ones you can most control.

🔎 Learn more about credit scores:

- Credit Scores 101: A Beginner’s Guide

- How is My Credit Score Calculated? 5 Most Important Factors

- Credit Score Ranges: What They Mean and Why They Matter

- Types of Credit Scores: How Many Different Credit Scores Are There?

- What is a FICO Score? Range, Good Score, Highest Score

- How To Get A Free Credit Score In 2021

9. Credit Utilization

Credit utilization is the percentage of your available credit that you actually use.

For example, if your first credit card has a $1,000 limit and you haven’t used it, your credit utilization for that card is 0%. If you spend $500 of the $1,000, then your credit utilization is now 50%.

Lower credit utilization is better. Many experts recommend keeping your credit utilization below 30%. Consumers with FICO score above 795 have an average credit utilization of only 8%

Credit utilization is based only on revolving credit. Installment loan balances do not contribute to your credit utilization.

🔣 Use our credit utilization calculator to see what your ratio is.

10. Credit Inquiry

When you apply for new credit, potential lenders request your credit report and credit score. They use this information to decide whether they want to offer you credit, and on what terms.

There are 2 types of Inquiries, a “soft pull” and a “hard pull.”

A “hard pull” or “hard inquiry” happens when you apply for credit. These inquiries require your permission. When you sign a loan or credit card application you give the lender permission to request this information.

Hard inquiries affect your credit. The impact of a single hard inquiry is small, but a series of inquiries looks as if you’re desperate for credit, a sign of financial distress.

If you are shopping for a loan or credit card, keep all of your applications within a 15-day period. The credit bureaus will recognize that you are shopping and record only one hard inquiry.

A “soft pull” or “soft inquiry” is a less aggressive request for credit information. When you ask for your own credit report, that’s a soft inquiry. Companies that are seeking to prequalify you for credit or insurance can make soft inquiries.

Soft inquiries have no impact on your credit.

When you review your credit report you will see lists of hard and soft inquiries. Check for unauthorized hard inquiries. They could indicate that someone else is applying for credit in your name.

11. Collections

If you are unable to pay your bill and your account is closed due to non-payment, your debt is probably going to be sold to a collection agency.

These agencies exist solely to collect the money that was owed to your original creditor. Some of these collection agencies are retained by the original creditor, but most of them have just purchased your debt.

A collection agency will report a collection account to the credit bureaus. That can do serious damage to your credit.

A collection agency is required to tell you the amount of the debt and the name of the original creditor. Always ask the collection agency to verify the debt. Debt collectors are not allowed to use abusive or deceptive collection practices. Know your rights!

12. Credit Monitoring

Your credit report is often the first place you’ll see signs of identity theft. If you aren’t watching, you could miss them.

Credit monitoring will alert you to any changes in either your credit report or to your score. This gives you the ability to stay on top of any type of identity theft that could happen.

Credit monitoring also allows you to keep an updated copy of your credit report so that you can review it. Many monitoring services also provide you with regular access to your FICO score.

👉 Learn more: Credit Monitoring: What Is It and Do You Actually Need It?

13. Authorized User

A credit cardholder can add another person to their card as an authorized user. Many card issuers will report the authorized user as a separate account. That makes authorized user status a great way to establish a credit record.

If you’re asking someone to add you to their card as an authorized user, be sure that person is a responsible spender. Their spending will also be part of your record!

🔎 Authorized user resources:

14. Dispute

Many credit reports contain errors. These errors can harm your credit.

If you see something on your credit report that doesn’t belong there, you can challenge it using the dispute process. The credit bureaus are required to investigate and respond to your disputes.

Think of a dispute as to your way to defend yourself if a creditor puts incorrect information on your credit report. You can dispute any item on your credit report at any time.

If your dispute is verified the item will be removed or corrected. If the credit bureau finds that the information is accurate, it will not be changed. .

If it doesn’t look right or if you don’t remember it, dispute it!

🔎 Learn more about disputing information on your credit report:

15. Credit Mix

Your credit mix describes the different types of credit on your credit report. These can include:

- Credit Cards

- Installment Loans

- Mortgages

- Auto Loans

- Merchandise Accounts

- Store Credit Cards

When you have several of these accounts on your credit report, it is considered to have a good credit mix. You should try to have both revolving credit and some form of installment credit on your record to boost your credit score.

This is Just a Start

These terms are the basics, and there’s a lot more to learn about credit and the way it’s discussed. Start by understanding these terms, and look up any others that you don’t understand.

If you don’t understand something, ask someone or look it up online. That’s part of the learning process, and the learning process is a core part of building better credit!