Want to know the current state of retirement savings in America? We compiled the latest stats on retirement savings in the US, including average and median retirement savings and breakdowns by age, race, income level, and education.

Let’s dive right in.

Key Findings

- The total value of retirement assets in the US is $39.3 trillion dollars.

- Most retirement assets are held in IRA accounts – $13.9 trillion dollars.

- Median retirement savings are highest among heads of households who are 55 to 64 years old.

- Connecticut, New Jersey, and New Hampshire are leading the ranking with the highest average retirement savings.

- College graduates hold, on average, 5.52x more retirement savings than those who didn’t graduate high school.

- Only 39% of adults started saving for retirement in their 20s.

- The average monthly retirement household income for Americans aged 65 and over is $6,271.

- The most commonly reported sources of retirement income include social security (94%), personal retirement savings (69%) and a defined benefit or traditional pension plan (58%).

We will refer to average and median retirement savings:

- The average is the total retirement savings of the group divided by the number of individuals in the group.

- The median is the point where 50% of the group is higher, and 50% is lower.

An average can be skewed by a small group with very high or very low savings, so the median is usually a better indicator of overall conditions.

How Much Do Americans Have in Retirement Savings?

The latest data available shows that the total value of retirement assets in the US reached $39.3 trillion in 2021, a 12.2% increase from 2020[1].

Types of Retirement Accounts

The value of IRAs in the US amounted to $13.9 trillion, followed by 401(k) plans with $7.7 trillion in value and state, local government defined benefit (DB) plans at $5.8 trillion as the most common types of retirement assets[1].

Average American Retirement Savings

Let’s look at the latest statistics on average and median retirement savings broken down by age, race, income level, and education.

Average Household Retirement Savings

According to the latest available data from the Federal Reserve Board Survey of Consumer Finances, the average retirement account savings of American families reached $255,130. That’s a 4.9% increase since 2016[3].

The median retirement savings paint a different picture. Among all families in the US, median retirement savings are only $65,000.

In addition to the big difference in value, median retirement savings have been growing at a slower pace than average family retirement savings[3].

Employee Benefit Research Institute (EBRI) analysis suggests similar findings – $258,453 in average household retirement account balance as of 2019 among families with at least one IRA/Keogh account or DB plan[2].

Note: All values are in 2019 dollars.

Average Retirement Savings By Age

Average household retirement savings vary from $30,354 to $413,814, depending on the age group of the family head[2].

Median retirement savings are highest among a group of 55 to 64 years old ($134,000), whereas they were lowest among those under 35 ($13,000)[2].

It’s expected that younger families have lower retirement savings. It’s still a concern that 50% of those aged 55-64 have retirement savings of less than $134,000, and 50% of those over 65 have less than $125,000. That indicates that many retirees will be financially stressed in the coming years.

Average Retirement Savings By State

Connecticut, New Jersey, and New Hampshire are leading the ranking with the highest average retirement savings.

Utah, North Dakota and Washington, D.C are at the bottom of the list, with the lowest average retirement savings[4].

Average Retirement Savings By Income

Expectedly, average retirement savings differ depending on the income level, from $66,058 among families in the bottom 25% income tier to $487,783 among families in the 75% and higher income percentile[2].

The median family retirement holdings for all families in the US vary between $13,000 and $200,000, depending on the income level.

Average Retirement Savings By Race

When grouped by race of family head, there is a significant gap in average family retirement savings, which shows a 2.74x difference between White and Hispanic families. Specifically, average white households hold $298,418 in retirement savings, typical Black households hold $109,719 and Hispanic families hold $108,849 in retirement savings[2].

Average Retirement Savings by Education Level

College graduates hold, on average, 5.52x more retirement savings than those who didn’t graduate high school.

Among US families headed by college graduates, the retirement account balance on average amounted to $384,834, while their counterparts with some college experience had $140,669 in retirement account balance. Those with only a high school diploma and no further higher education reported $120,445 in mean family retirement savings, and those who didn’t graduate high school averaged $69,735[2].

When Do Americans Start Saving For Retirement?

Around 65% of people say that they started saving for retirement in their 20-30s.

Only 39% of adults started saving for retirement in their 20s[5].

Here’s a breakdown of when people start saving for retirement by age group:

Retirement Plan Participation Rates

The retirement plan participation rate in the US is 64.3%. These are families in the US who had a current or previous employer’s retirement plan (including defined-benefit plans) or an IRA/Keogh plan. The participation rate in 2019 has slightly dropped from the reported 64.9% in 2016[2].

Average US Retirement Income

The average monthly retirement household income for Americans aged 65 and over is $6,271 as of 2021, representing a 5.34% average annual change[6].

Here’s the average monthly retirement income in the US among adults aged 65 years and over by year:

Sources of Retirement Income

According to the 2023 Retirement Confidence Survey conducted by the Employee Benefit Research Institute, the most commonly reported sources of retirement income include social security (94%), personal retirement savings (69%) and a defined benefit or traditional pension plan (58%).

While 75% of workers expect work for pay to be their income source in retirement, only 23% of retirees report it is. Nearly half – 42% – of workers expect that financial support from family or friends will be among their sources of retirement income, but only 14% of retirees reported receiving this source[2].

What Is The Average Retirement Age?

The median retirement age in the US is 62[7].

Here are some details on American retirement ages:

What Is The Average Lifespan After Retirement?

Assuming a retirement age of 65, American retirees can expect an average lifespan of 18.3 years (16.9 years for males; 19.3 years for females) after retirement.

Where Do Americans Retire?

Nevada, Florida, and Arizona are among the top 3 states attracting retirement-age populations, with 89% or more of the retired population coming from elsewhere.

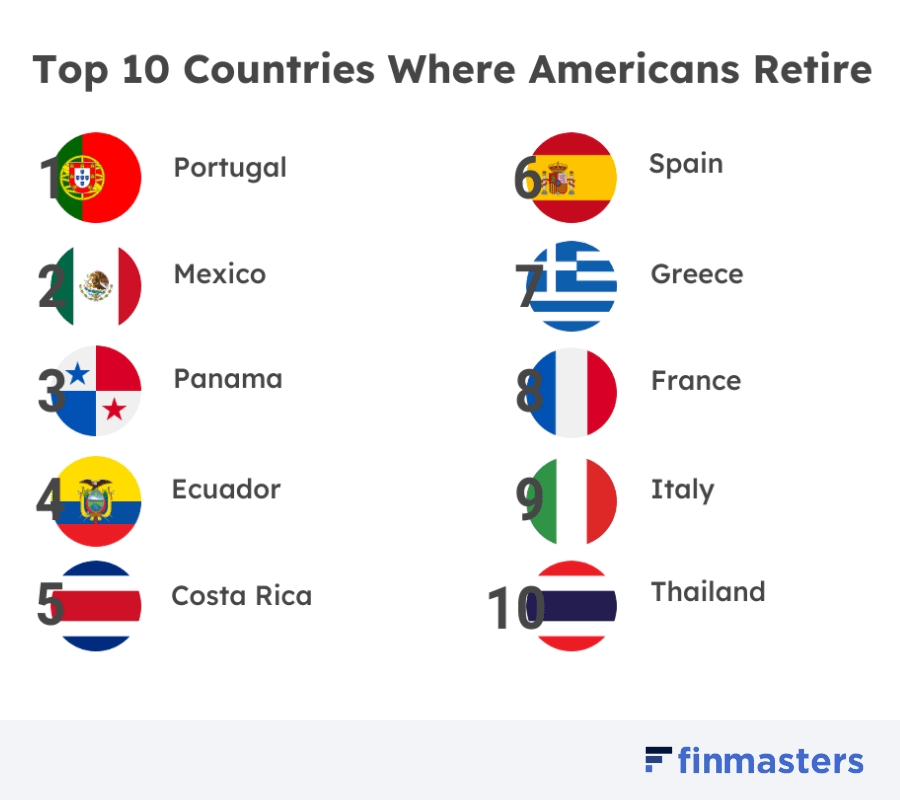

Among international destinations, Portugal, Mexico, and Panama are commonly cited as top retirement destinations[10].

Here’s a full ranking of the top 10 countries for Americans to retire across the world: