Table of contents:

Quick Stock Overview

Upstart by the numbers.

1. Executive Summary

A brief discussion of Upstart and its potential appeal to value investors.

2. Extended summary

A more detailed explanation of Upstart’s business and competitive position

3. AI Revolution in the Loan Industry

How AI is changing an ossified 5 trillion dollar industry.

4. Upstart’s Business

An overview of Upstart: unique technology, competitive positions and exposure to recession

5. Financials

Upstart by the numbers: balance sheet, cash reserves, expenditures, and valuation

6. Conclusion

Why Upstart is worth a closer look.

Quick Stock Overview

Ticker: UPST

Source: Yahoo Finance

Key Data

| Industry | Finance / Loans |

| Market Capitalization ($M) | $1,412 |

| Price to sales | 1.5 |

| Price to Free Cash Flow | – |

| Dividend yield | – |

| Sales ($M) | 998 |

| Free cash flow/share | – |

| Equity per share | $8.78 |

| P/E | – |

1. Executive Summary

Upstart is both a tech company and a financial company. They provide AI-driven risk assessment and borrower rating services to lenders, offering greater accuracy than traditional credit scores.

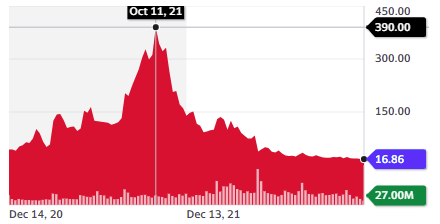

Upstart’s stock price over the last two years would put a roller coaster to shame. UPST went public on Dec 18, 2020, selling shares at $20 each. Less than a year later, in October 2021, the stock peaked at $390, an 1850% gain. A year later, it was trading at less than its IPO price.

This extreme trajectory appears to be driven almost entirely by the market’s view of growth tech stocks, which went from being the belle of the ball in 2021 to being absolute pariahs in 2022. There’s no visible connection between the price movements and the performance of the company itself.

Still, the company is still holding a strong market position. Its technology is also performing remarkably well against traditional credit scoring systems. They have signed more partnerships with banks and credit unions and entered new markets with explosive growth potential.

So while it is true the sector as a whole could suffer from a recession, it would still be a huge business – lending isn’t going away – and Upstart could come out of it on top.

Upstart is losing money because of its very high R&D spending but has a relatively long period before needing fresh cash. With the recent massive stock price decline, we might just have enough margin of safety in the stock price to be worth a second look.

If the company returns to the 2021 net income level, its stock price would mean a P/E of just 8, despite the fact that the company has grown revenues 117% yearly in the last 3 years.

Upstart stock was unquestionably overvalued at $390/share, but is it now undervalued and oversold at under $20?

Let’s take a closer look.

This report first appeared on Stock Spotlight, our investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 rational investors!

2. Extended Summary: Why UPST?

The AI Revolution in the Loan Industry

The 5 trillion dollar lending industry still relies on decades-old methods to assess the risk of a potential borrower defaulting. More abundant data and new AI able to process the information can replace outdated methods with more precise and usable results.

This technology can dramatically expand the pool of potential borrowers with no significant increase in risk.

Upstart’s Business

Upstart is a leader in the personal loan FinTech fintech market. It has just entered two major new markets: auto refinance loans and small business loans.

Upstart is not a lender. It evaluates the creditworthiness of loan applicants and refers them to partner lenders. This business model allows it to leverage the money and network of its banking partners and to be a partner, rather than a competitor, to traditional lenders.

Financials

Upstart has been affected by high interest rates and recession fears. Revenue growth has stopped and the company is losing money after three straight profitable years from 2019 to 2021. It is currently burning cash due to its large R&D spending. Still, the company has up to 2 years of cash runway and the capacity to reduce spending if needed. If it survives the downturn, it should be well positioned to resume aggressive growth.

3. AI Revolution in the Loan Industry

The Limits of Traditional Credit Scores

For decades, the financial industry has issued loans following a standardized procedure. They look at the applicant’s financial profile, mostly through credit scores, and decide on their risk profile. They then decide whether they are willing to approve the loan and what interest rate they need to charge to cover the risk of default.

This is pretty standard and a well-oiled machine. It is also woefully outdated.

This procedure emerged during an era when the data available on loan applicants was very limited. Essentially, banks and other lenders could only look at past credit performance and salaries. The real risk profile of an individual might be significantly different from what the model calculated from this limited information.

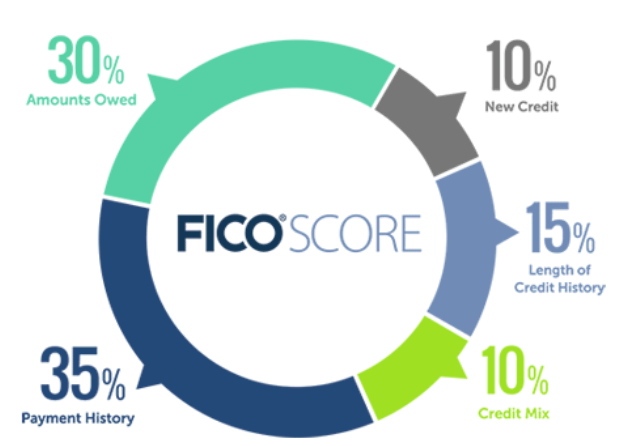

One standard credit score that uses these methods is the FICO score. It is used by 90% of top lending financial institutions in the US. FICO scores are primarily based on past credit history and current credit standing.

This is not a bad method, but it has limitations. For example, people who don’t use credit and live within their means will not have credit scores, though they may be financially stable and reliable.

This is why you can see personal finance advice like “get a credit card and always pay back the balance, so you have a build a great credit profile“. To get a good loan, you need to first have debt for as long as possible. This is not the most logical way to look at it.

And there are a lot of things a FICO score doesn’t include. Many of these have an impact on the real risk of defaults:

- Age

- Education

- Salary and employment history

- Family situation

- Place of residence

Of course, banks and lender each have their way of trying to integrate these data on top of the FICO score and into their decision about giving loans. But this is far from a perfect process or a standardized procedure, especially for national lenders relying on automated procedures.

Enter the AI Credit Score

The idea behind Upstart’s technology relies on a simple fact. 80% of Americans have never defaulted on any credit or loan. Despite this, only 48% have access to the best credit conditions.

So there is a significant part of the population, tens of millions, that are judged unfairly by the standard credit scoring system. This is especially hurting minorities and other groups that have traditionally suffered from discrimination.

This has serious financial consequences. Many borrowers pay excessively high interest rates, potentially costing them thousands of dollars annually. Many more are effectively excluded from borrowing.

This is also costly for the lenders, as it artificially limits the customer pool and excludes viable customers.

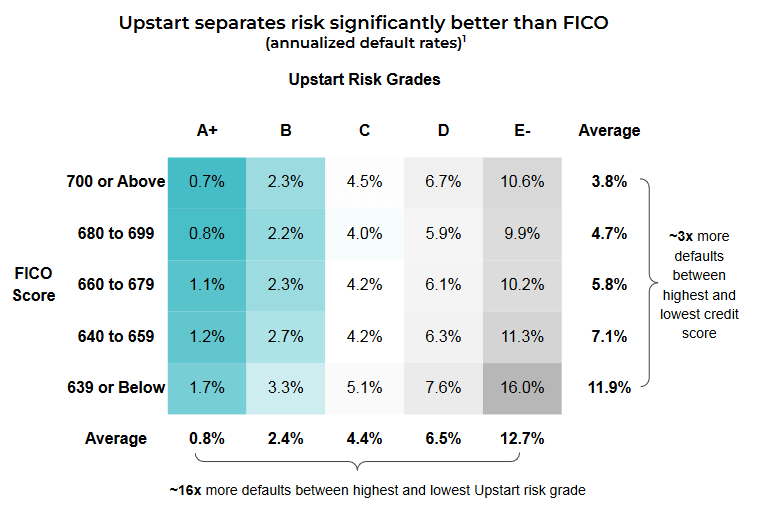

Upstart has developed an AI system that looks at any data available about a potential borrower. It ranks borrowers along 5 grades, from A to E.

This gets interesting when you cross-reference the Upstart grades with the FICO scores.

FICO accurately predicts that the risk of default drops as the FICO score rises. But in reality, it agglomerates together a lot of different profiles. It just does not have enough data to distinguish between them.

Upstart grades create MUCH more homogenous cohorts (see the vertical columns below). This strongly indicates that the AI model is much more predictive than traditional scoring. The groups are homogenous enough that it makes sense to give them a similar interest rate.

Upstart’s system also gives a much more accurate picture of risk. Upstart can identify a cohort of borrowers (grade A) defaulting only 0.8% of the time. By comparison, even the best FICO score cohort still defaults at a 3.8% rate (horizontal lines).

This allows Upstart’s partners to give a much better deal to the best borrowers, as they are no longer grouped together with less reliable borrowers.

This produces outstanding deals for the Grade A borrowers that somehow happened to have a lousy FICO score.

This greater accuracy gives Upstart a strong advantage against traditional scoring methods. It’s also a strong selling point for partner banks: more accurate risk forecasting means higher profits for them.

The technology allows lenders to reduce the focus on past credit records and emphasize lending no more than the borrower can afford to pay.

This model is particularly useful for serving younger borrowers. Many younger borrowers don’t have an extensive enough credit record to be effectively rated by traditional models.

4. Upstart’s Business

Growing Conviction from Partners

Looking at the stock chart, you could believe Upstart was an established company that ran into operational problems in 2021.

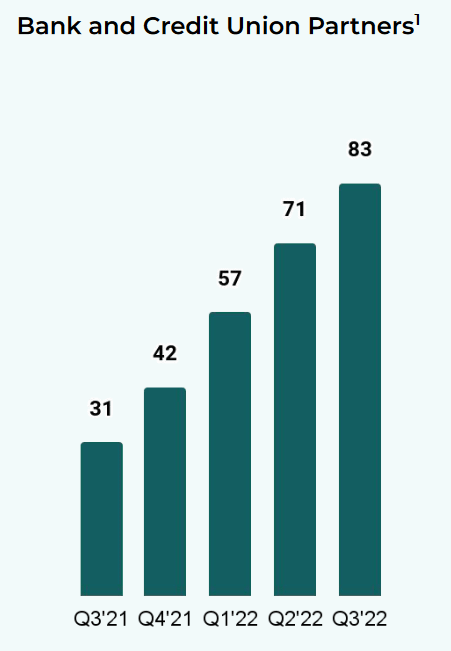

In fact, it is only now getting out of the “start-up” phase and turning into an established company. For example, Upstart has doubled the number of bank and Credit union partners since its stock price peak at the end of 2021.

The dramatic rise and fall of the stock were less driven by the company’s performance than by a rapid climate transition from irrational exuberance to equally irrational terror. Of course, valuation matters and a triple-digit P/E ratio was way too high, but the subsequent selloff may have swung the pendulum too far in the opposite direction.

So while investors are running away from the company, actual business is still growing in new categories. Small personal loan volume is up fourfold from last quarter.

The company is also quickly growing new lines of products, notably, car refinance loans. The 291 car dealers using Upstart systems grew to 702 by the last quarter, and Honda just added more than 1,000 of its dealerships in October 2022.

Another very new business line for Upstart is small business loans. The volume of these loans originated through Upstart grew from $1M to $10M in the last quarter.

For reference, the entire small business loan market is $644B, and the auto loan market is $786B. While I am not a big fan of relying solely on TAM (Total Addressable Market), there is certainly space for Upstart to keep growing. Even originating only 1-5% of the loans of these sectors would be multiplying these business lines by x10 to x100.

The takeaway is that the company profile is changing quickly for the better, and markets don’t seem to realize it.

Upstart’s Competitive Position

Competition from Traditional Lenders

The reason Upstart is growing so quickly is that its performances are impossible to overlook, even by the very conservative established loan industry.

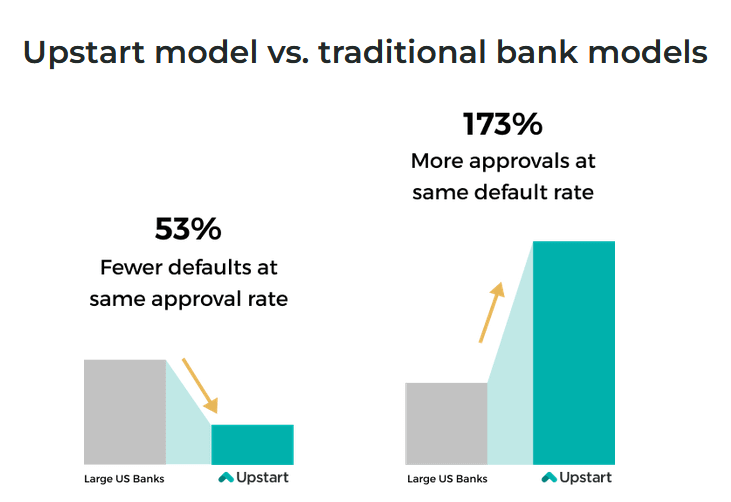

Depending on how you want to see it, Upstart can reduce the default rate by 53% while keeping the same approval level (more profitable for the same business volume) or increase the approval rate by 173% and keep the same default rate (more business at the same profitability).

Lenders simply cannot ignore those figures.

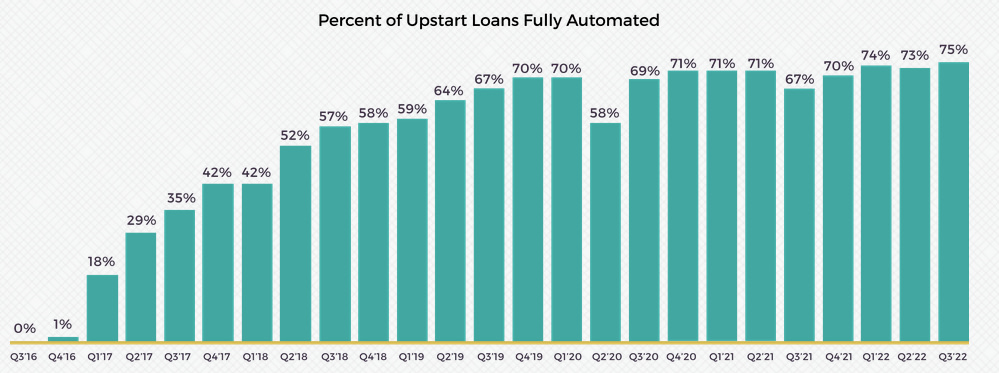

Upstart has also massively automated the lending evaluation process. While there is still a manual component to 1/4 of the loans, this is a much more cost-efficient process than traditional lending methods.

Generally, Upstart’s competitive position against traditional scoring and traditional lenders’ methods seems very solid. AI allows either for more business, more profitability, or both, and it requires less costly human labor.

Some traditional lenders may choose to develop their own equivalent AI risk assessment capacity, but for most, using Upstart’s service provides immediate adoption and a much less cost-intensive approach.

But what about other FinTech companies?

Competition From Other FinTechs

Early in 2022, FinTech companies accounted for 57% of all unsecured personal loans. In itself, this illustrates how quickly the loan industry is changing with the arrival of nimbler, more innovative competitors.

In Q2-22, Upstart was the originator of $2.8B of loans, followed by $2.7B LendingClub by and $1.3B by SoFi. The difference is in the business models.

LendingClub uses AI but serves only the best borrowers with FICO scores above 700.

Both LendingClub and SoFi are banks, while Upstart is focused on being an AI risk assessment tool and loan originator for other banks.

In my opinion, this gives Upstart much more room to grow, as it can leverage the network, experience, and balance sheet of its banking partners. It also serves all types of borrowers, not just the top-quality ones.

In comparison, these others finTech companies are going head-to-head with the established financial system. They might succeed, but this is a harder path to take. Their eventual success relies on the loan industry staying archaic and inefficient. Upstart success depends solely on being a solid alternative to more traditional methods like the FICO scores.

I think this can offer Upstart a lot of leverage to boost its growth, as traditional lenders have a clear incentive to partner with Upstart to compete against other FinTech companies.

Another interesting aspect of Upstart is that its team is mostly made of IT specialists, not bankers (Upstart was founded by 2 ex-Google employees, a former President of Enterprise and a Manager of Global Enterprise Customer Programs and Gmail Consumer Operations).

I think ultimately, this gives Upstart’s partners more trust that Upstart will indeed act as an “outsourced lending evaluation team” than if it was trying to turn into a bank or was founded by people with a banking background. To survive competing with the likes of SoFi and LendingClub, conventional lenders need Upstart.

You can also read more about Upstart’s history in this 2017 interview with its founders. Rakuten Capital, which we covered in a previous report, was an early backer.

Recession Risks

Financial companies have been out of favor due to rising interest rates and recession fears. There are some good reasons for that. Lending is a very cyclical activity, with bad loans invisible until they cause losses.

Since 2008, banks have learned to be extra careful ahead of a recession. For this reason, even if Upstart has more partners, the actual volume of loans has decreased significantly since last year.

In Q322, loans dropped to $1.9B compared to $2.8B just a quarter before. It is not that Upstart has suddenly become less good at evaluating borrowers but that the bank partners are feeling they should be more cautious for now. The revenue drop is rather brutal and has contributed to keeping the stock down.

While lending stocks generally are at a cyclic low point, there is a strong argument for acquiring the strongest stocks in a sector during cyclic lows.

5. Financials

Growth Companies in a Recession

When looking at a battered-down stock from a growth company in a cyclical industry, we want to see how risky it can get. So I will look primarily at cash on hand, debt, and cash flow to determine the company’s future risks, including bankruptcy risk.

The question that needs to be answered is how high the risk of total failure is for the company. Considering its technological prowess and growth, if it can go over the current slump, it should resume growth and turn durably profitable.

So we need to ponder bankruptcy risk against the current valuation and decide whether this is already priced in.

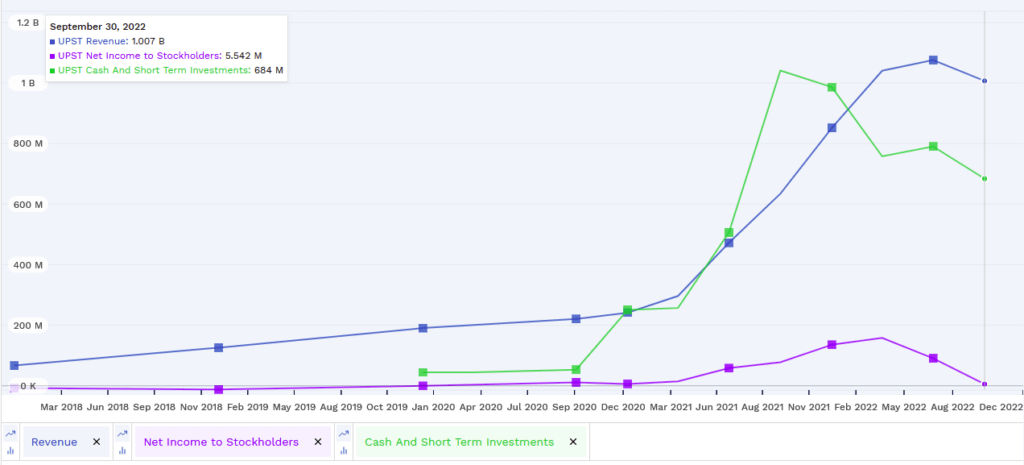

A Decline in Revenue and Income

Revenue has declined, but not catastrophically, at least yet. Still, as we might be in the first innings of a recession induced by rising energy prices and global geopolitical tensions, worse might be coming.

The company has solid cash reserves but has consumed some of those reserves since August 2021. The company has consumed around 300 million since the end of last year. Total liabilities stand at $1.2B.

Net income has taken a nose dive toward losses after the first profitable period, which lasted one and a half years.

The cash burn level indicates a cash runway for the company of approximately 2, maybe 3 years. This is not a dire situation but could turn serious if losses grow or a recession lasts too long.

Possible Cost Reductions

As cash burn is the key problem here, how could it be reduced?

One big area of spending is R&D, as Upstart works to improve its AI and mathematical models. The company is spending around $450M per quarter on R&D, which is more than the entire cash burn.

In itself, this indicates the company as it stands today would be profitable if not for R&D investment. So even if I don’t think this is something they should do, Upstart could cut R&D expenses to reduce cash burn if the company’s survival was at stake.

This is not a company that has intrinsically non-profitable operations like, for example, Uber. It has simply not reached the scale where operations cover the large R&D costs.

Operating expenses have been brought down to $215M from $260M a quarter earlier, so the company seems able to cut some overhead costs if needed.

Loan Default Risks

In the lending industry, one large risk can be surprise losses from suddenly non-performing loans.

Luckily, Upstart is not holding most of the loans it evaluates and originates on its balance sheet. The partner banks fill this role instead. Currently, Upstart holds a value of “just” $700M of loans at fair value on its balance sheet.

Losses from this loan portfolio could rise and make the company lose a few hundred million at most. This would not be a life-threatening event in itself. This leaves Upstart less exposed to possible rising consumer defaults than a traditional financial company.

Valuation

It is always difficult to determine an exact valuation for stocks displaying an aggressive growth profile. Models like discounted cash flow are extremely sensitive to assumptions about the future. When the growth rate in the next 5 years is, at best, a guess, such models are almost worthless.

What we can say is that the company was VERY richly valued at the high of the pandemic speculative bubble in 2020 and 2021. With P/E of 172 and 185, respectively, the company had to grow its profits by x10 to x20 to “grow into its valuation”.

The current valuation is an absurdly brutal 23 times lower than its peak. If the company simply got back to its 2021 profitability and never grew ever again, it would have a P/E of 8 at the current stock price.

Considering the massive size of the Total Addressable Market and Upstart’s young and disruptive technology, I think quite a lot of growth should be expected in the next 10-20 years.

So we have the combination of large growth expectations and a valuation that prices Upstart to never get back to 2020 net income. As long as the company has a believable path for going through the current recession, its current valuation seems very low.

Financials Overall

Upstart has all the hallmarks of a typical growth tech stock: large R&D costs to develop a durable competitive advantage, elusive profitability for now, and extreme volatility in its valuation.

The company seems able to cut costs if needed.

If we enter into a dramatic recession, it would likely be able to reduce the cash burn to survive. This would reduce the speed of its tech development but would do the same for all its competitors.

The possibilities of reducing cash burn or raising debt give a reasonable expectation that Upstart can survive the current downturn in reasonably healthy shape.

This is not reflected in the current stock price, valuing the company at single-digit multiples of its earnings just a year ago.

6. Conclusion

Upstart is a very asymmetric bet. It is the kind of company with a non-zero chance of crashing and burning if all the macro conditions align against it. But it is also a company that has massive growth potential, a solid business model, and a unique and valuable technology.

It is also operating in an extremely large industry, worth trillions, that has not really evolved for decades. Any improvement in efficiency could produce outsize gains, which Upstart’s shareholders will be able to partially capture.

In addition, Upstart has forged almost a hundred (and growing) partnerships with some of the largest financial institutions in the US. These banks and credit unions have a vested interest in seeing Upstart succeed.

Upstart’s competitors are looking at replacing the incumbent institutions. Upstart is there to improve their operational efficiency and increase their profit.

So I find it likely that if it really came to that, Upstart could always lean on one or several large banks to stay afloat during the recession, maybe in the shape of loans, capital raise, or similar forms of support.

In that perspective, an investment in Upstart could have a few outcomes, with the average likely to turn out profitable:

- Bankruptcy or large dilution of existing shareholders at 10-30% probability.

- Slight dilution before resuming quick growth at 30-50% probability.

- No dilution, and a return to profitability and aggressive growth after the recession at 20-30%.

Please note that these percentages are, at best, estimates. This is something you should evaluate yourself.

The key point is that IF Upstart survives this downturn and resumes growth, it is likely to grow massively from there. It is today originating a few billion in loans in 1.5 trillion dollar markets. And at some point, it might also get involved in the almost 4 trillion dollar mortgage market.

So expecting the company revenues to grow x10 or x20 over the next decade, with profits following accordingly, is not unrealistic.

When Upstart stock was at $390 dollars, it was priced with the expectation that growth would happen smoothly and in a straight line. That obviously was a mistake. At the current valuation, the risk is much more moderate, and the stock price incorporates a large margin of safety.

There is a relatively small chance of losing the investment, but with even greater chances to win anywhere from x10 to x100 in the next 1-2 decades, that seems to me an acceptable risk. It’s the kind of asymmetrical bet legendary investors like George Soros or Michael Burry would have welcome (see our profiles of Soros and Burry).

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in UPST or plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this article.