Table of contents:

Quick Stock Overview

CoolCo by the numbers.

1. Executive Summary

A brief discussion of CoolCo and its potential appeal to investors.

2. Extended Summary

A more detailed explanation of CoolCo’s business and competitive position.

3. The Not-Over Energy Crisis

Europe’s permanently increasing need for LNG.

4. The Coming Supply Chokepoint

Why shipping is the most in-demand part of the LNG supply chain.

5. CoolCo

A rare pure player in LNG shipping.

6. Financials

Growing cash flows, generous dividends, and low valuation.

7. Conclusion

Quick Stock Overview

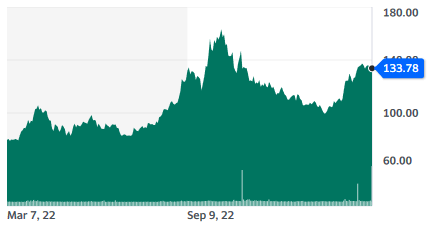

Ticker: CLCO

Source: Yahoo Finance

Key Data

| Industry | Energy / Shipping |

| Market Capitalization ($M) | 687 |

| Price to sales | 4.26 |

| Price to Free Cash Flow | 5.97 |

| Dividend yield | 3.05% (12.5% annualized) |

| Sales ($M) | 161 |

| Free cash flow/share | $4.18 |

| P/E | 16.4 |

1. Executive Summary

The Ukraine war has put a spotlight on the danger of Europe’s dependence on Russian energy supplies. This is especially true for natural gas, which the EU consumes in massive amounts to power it’s electric grid, run its industries, and stay warm in winter.

The pipeline gas that Europe received from Russia was inexpensive, but a pipeline can only move gas from one source, and Russia’s political instability makes dependence on Russian gas unacceptable. LNG terminals make an ideal alternative. An LNG terminal can receive gas from anywhere, avoiding the problem of being tied to a single supplier.

This led to a flurry of construction aimed at building infrastructure to receive and process LNG. This leaves one unsolved chokepoint that is little discussed: LNG shipping.

LNG can only be shipped on specialized vessels, and the current fleet is not dimensioned for the sudden surge in European demand. At the same time, shipbuilding capacity is not able to add new supply quickly, as it is already running at 100% capacity after many shipyards went bankrupt in the 2010s.

Worse, new pollution regulations are forcing the retirement of a large portion of the existing fleet.

This gives a unique opportunity for CoolCo, a pure play in LNG shipping. Its modern fleet is unaffected by pollution regulations. Its ships will be able to capture most of the upside when buyers outbid each other to obtain precious supplies ahead of the coming winters.

2. Extended Summary: Why CoolCo?

The Not-Over Energy Crisis

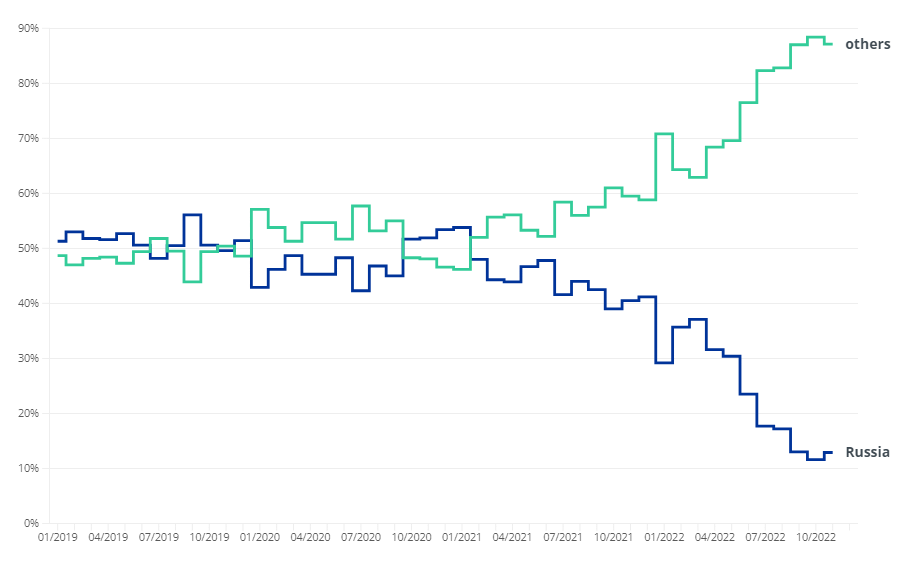

The Ukraine war has dramatically increased Europe’s need for LNG. This has dramatically increased global demand, as Russia’s pipeline gas cannot be redirected elsewhere for years. 75% of Russia’s gas pipeline net runs to Europe, and the existing pipelines to Asia can carry only a small fraction of Russia’s output.

This created a logistical nightmare for the EU.

The Coming Supply Chokepoint

Gas and LNG producers are expanding capacity as fast as they can. The EU has also rushed new facilities to process and collect this supply. But shipping is a chokepoint that cannot be solved as easily. Limited shipping capacity is leading to increasing day rates, multiplying the margins of LNG shipping companies.

CoolCo

CoolCo is one of the only publicly traded pure-play LNG carriers. It operates a modern fleet that will benefit from its competitors being forced to retire vessels due to new stringent pollution regulations. Increasing shipping day rates could bring its Free Cash Flow to Equity up to a 30-50% yield.

Financials

CoolCo has growing revenues, profit, and cash flows. It has some debt, but most repayment is scheduled for 2025 and 2027. Its policy is very shareholder friendly, with most free cash flow distributed in dividends and expected double-digit dividend yields.

A New Listing

CoolCo filed for a direct listing on the NYSE on February 14, 2023. The Company completed the regulatory process on March 10 and asked the SEC to declare its registration effective on March 14.

The registration has been approved, and CoolCo shares commenced trading on the NYSE on March 17, 2023, under the symbol CLCO. Trading on the Oslo exchange will continue.

Up until this time CoolCo has traded on the Oslo Euronext Growth exchange in Norway, restricting access for US investors and limiting the stock’s visibility and profile.

This report first appeared on Stock Spotlight, our value investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 like-minded investors!

3. The Not-Over Energy Crisis

EU Gas Hunger

In January 2022, the EU was blissfully unaware of the coming war in Ukraine. The sudden Russian invasion has forced all of Europe to reconsider its business with Russia.

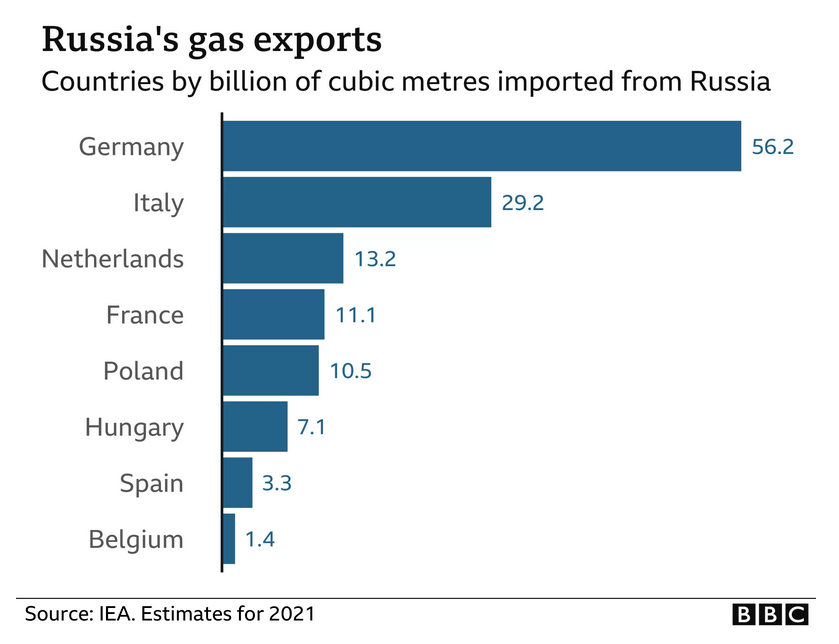

At the center of the relationship was the sale of energy, especially gas. During the Cold War, the USSR developed an intricate network of pipelines to carry gas from its Siberian gas fields to its conquered Eastern European vassals. It also exported gas to West Germany, Italy, and Austria.

With the fall of the Berlin wall, the relationship deepened. Russia desperately needed the hard currency the sale of fossil fuel would bring, and Europe’s industry benefited greatly from the cheap energy supply.

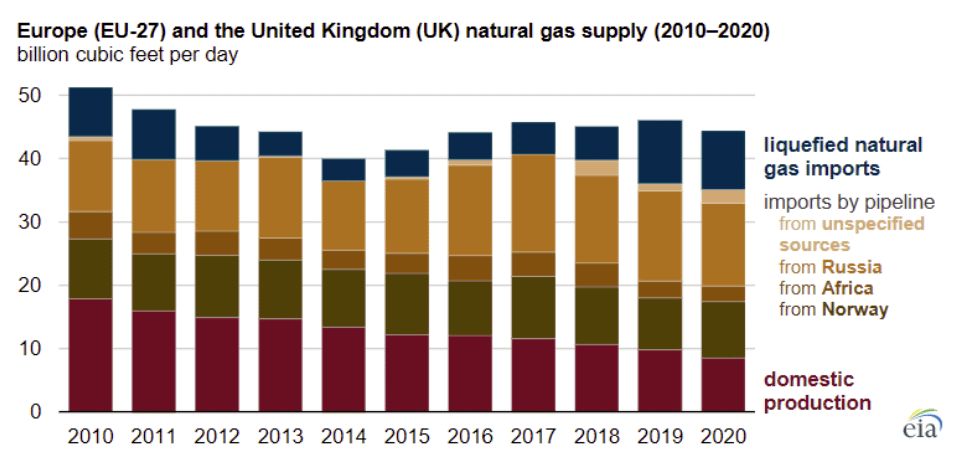

This gas supply was a massive part of the German success in heavy industries, from car manufacturing to the chemical and pharmaceutical industries. Most of this gas was imported, with domestic production in steady decline and Norwegian production stagnating.

In recent years, gas has also become the main solution for a smooth energy transition. Gas is much less carbon-intensive y than coal or oil, so it became a central part of keeping the lights on and houses warm in Northern Europe.

Gas power plants are also extremely reactive and can be powered up or down in a matter of minutes. This made them the perfect candidate for pairing with carbon-neutral but unstable renewables like wind and solar. Whenever the sun does not shine, or the wind does not blow, gas power plants can pick up the slack.

A Changed European Energy Landscape

The attack on Ukraine has put Europe in a difficult position. On one side, it is widely considered unacceptable to keep financing the Russian state and military, especially with NATO sending a massive amount of weapons to Ukraine.

At the same time, the entire energy infrastructure of Europe, and especially of Northern Europe & Germany, was highly reliant on Russian pipelines. So an instant interruption would have likely brought down the power grid and done dramatic damage to the EU economy. Once again, counter-productive when you need to produce weapons and keep the economy afloat.

With the Nord Stream pipeline sabotaged and the conflict escalating further, Russian gas is pretty much out of Europe.

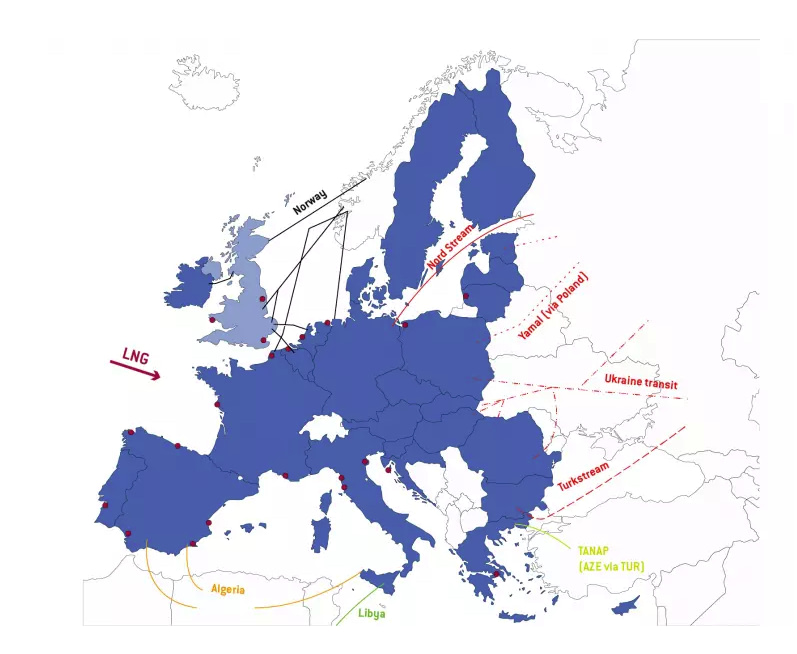

This is most important for gas. Oil is another product the EU bought in large amounts from Russia, but oil tankers are more numerous and are easier to redirect. Gas is, well, a gas, so it is difficult to carry it over long distances.

The only 2 options are pipelines and LNG.

The possibility for extra supply to Europe by pipeline is pretty much maxed out, as pipelines from Algeria or the Middle East are already running at full capacity.

LNG stands for Liquefied Natural Gas. It is almost always more expensive than pipeline gas, as it requires the gas to be turned into an ultra-cold liquid. But because it is carried in massive tanker ships, its supply is a lot more flexible. As a case in point, a lot of China-bound American LNG shipments turned around mid-journey when rising European prices made it worth the trouble.

The situation is even worse for Russia. If it’s not selling its gas to Europe, it can’t sell at all. Russia lacks the infrastructure to transport gas to Asia in large quantities, and will likely have to reduce its sales volume by 50% or more. This might be changed by building pipelines toward China, but this will take many years or even decades.

For example, the existing Russia-China pipeline, Power Of Siberia, connects to only one Russian gas field, and its maximum capacity is only 5.4% of Russia’s output. POS 2, a larger network, is scheduled for completion in 2030 and will carry another 8.7% of Russia’s output. Combined, these pipelines will only carry 14.1% of Russia’s current output.

So Russian gas cannot redirect its gas output elsewhere, like to India or China. This suggests that demand for LNG will be elevated for decades to come.

Quantifying the New Gas Supply

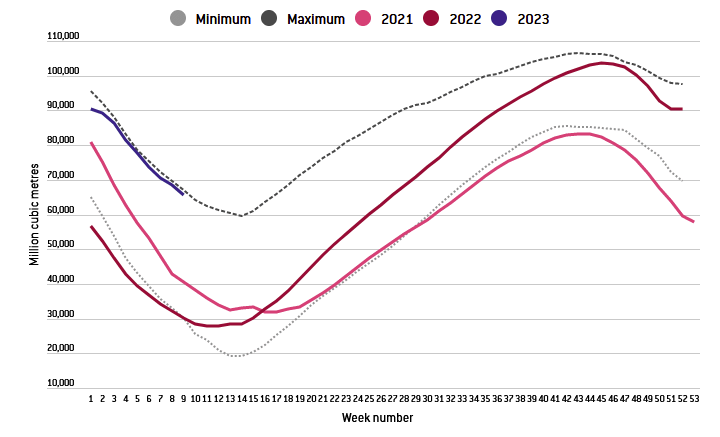

Pre-war Russian gas supply to Europe was 150 billion cubic meters per year. When this supply became uncertain, speculation and fear of shortage caused a skyrocketing price for EU gas, equivalent to $400/barrel of oil at one point.

To give some perspective, in 2021, the world’s total LNG supply was standing at 450 billion cubic meters. So replacing the Russian gas supply with LNG is a massive increase in demand overnight.

With a lot of effort, the EU has managed to diversify away its gas supply from Russia. It was not without costs, as the EU energy crisis is estimated to cost a total of 1 trillion dollars … so far.

Nevertheless, gas storage is at an all-time high and close to the maximum. An extremely mild winter has also helped a lot, as so much of EU energy consumption is from dealing with the winter surge in demand.

Part of the success of the EU in finding enough gas came from the extreme prices of last summer. In a nutshell, it outbid anyone else, especially poorer countries. This caused all sorts of issues in countries like Pakistan, which suffered massive power outages and energy shortages (“Pakistan’s dependence on natural gas is turning into a nightmare“).

Not Over Yet

Another reason the EU managed to get enough gas, beyond paying a lot and a mild winter, was China’s harsh lockdown policy, which constrained LNG demand. It is probably not going to be that easy in 2023, with Chinese consumption ramping up quickly. This will keep demand for LNG high, as either China or Europe will need it enough to keep buying at almost any price.

Even with gas prices in the EU temporarily down, demand is ramping up, both in Europe and in emerging countries.

Because the global demand for LNG has shot up, there is plenty of fresh supply coming up as fast as possible.

So while we might see a strong LNG price for a few years, LNG oversupply might happen as soon as 2025-2026. This is because Qatar is ramping up production, the USA is increasing its export capacities, and Mozambique is launching its first exports.

If Iran reaches an accommodation with western nations and sanctions are lifted, another major gas supplier will enter the market.

North America is very rich in gas and only limited by its export infrastructure. USA’s main export facility, Freeport, is still on partial standby. But it should be getting back online soon.

Demand volumes will stay high, but LNG prices might fluctuate widely, and go down from 2025-2026 onward, which will only stimulate demand further.

This makes a bet on LNG producers or liquefaction facilities tricky for investors.

There’s over a trillion dollars of natural gas infrastructure being built in the world today. There’s a set secular shift and natural gas that is here to stay.

CEO of LNG exporter Cheniere Energy Jack Fusco

Instead, this report will discuss an often neglected but vital step between the gas producer and consumer, which is much less likely to see a collapse in prices and profits in 2-3 years: shipping.

4. The Coming Supply Chokepoint

A Simple Business

Energy shipping is a rather simple business model. An oil & gas company produces in place A and wants to move its product to a consumer in place B. It hires a specialized company to do so, using dedicated ships custom-built for this purpose: oil tankers or LNG carriers.

This is a business entirely driven by supply and demand. Shipping companies will prefer to get the ships moving no matter what, as an idle ship costs almost as much as a hired one. If there are too many ships for too little cargo, the day rate for transportation is barely or below costs.

Alternatively, if there are not enough ships, day rates can explode, as shipping is only a small part of the value of the cargo. Paying a lot for shipping makes more sense than being unable to sell the gas or oil.

Due to geopolitics, the demand for LNG will stay elevated for years, maybe as much as 10-15 years. The EU will need that long to start building more renewable and nuclear power plants, and even then, gas will be needed as a backup for renewables.

China is also looking to consistently replace some of its coal capacity with environmentally cleaner gas power plants.

So we know that demand will be high for the foreseeable future. As a result, correctly forecasting the supply of LNG shipping is all we need.

The Supply Chokepoint

The supply chain of LNG can be quickly summarized:

Gas well -> pipeline -> liquefaction -> LNG ship -> regasification -> distribution

The steps “Gas well -> pipeline -> liquefaction” already have a decent and growing supply.

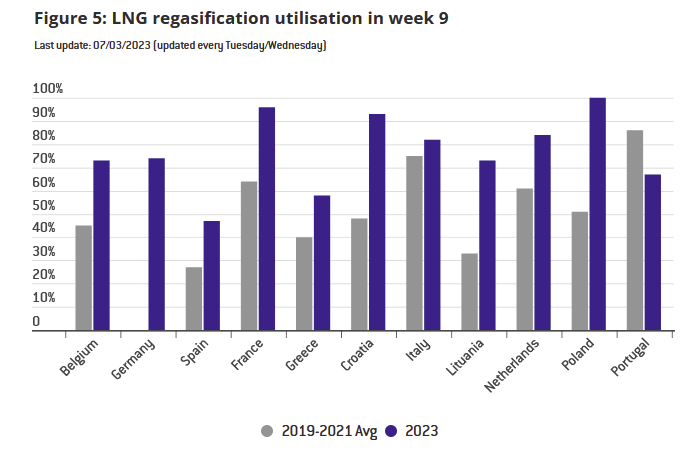

The EU has also rushed to build as many new LNG regasification facilities as possible. As a result, the almost saturated regasification capacity in 2022 now has spare capacity in 2023. With still some more in construction and coming online soon, this will not be the limiting factor for EU’s LNG imports.

This leaves the shipping part of the supply chain unresolved.

The great thing about shipping as an investment is that it is easy to forecast future supply. We know exactly how many ships are at sea, and it takes years for a shipyard to produce a new ship. So by looking at the (well-known and tracked) order book of shipyards, we can forecast the future supply.

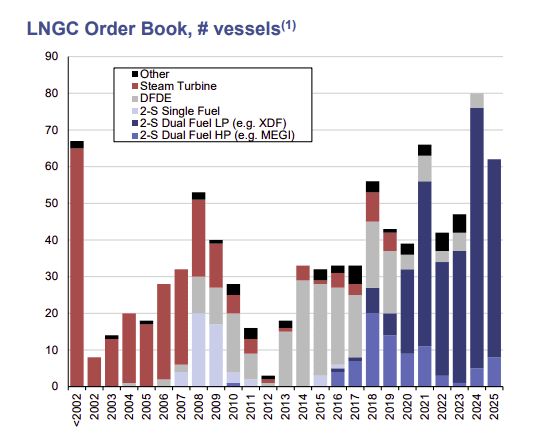

The 2014 crash in energy prices (from shale oil and gas overproduction) had a drastic impact on the shipping industry. Almost no new orders came in for 3 years, and many companies went bankrupt.

So there is very little ship-building capacity in the world right now, especially for the highly specialized LNG carriers. Worldwide, all shipyards able to manufacture LNG ships are fully booked until 2027. There is no chance of a sudden unexpected surge in LNG shipping capacity.

A superficial look might let you think a lot of ships are coming online, which could crash day rates. But this is not fully true, as a lot of the ships currently operating are from before 2002, and are getting retired because they can’t comply with current environmental standards set by the International Maritime Organization (IMO).

Pollution Regulations

The new 2023 IMO Sulfur regulations will impact older designs (steam turbine types, in red-orange in the graph above).

When the regulation comes into force in less than two years, many VLGCs will rush into shipyards to make improvements to their energy efficiency. Most common modifications will be installation of energy saving devices, or to install Engine Shaft Power Limitation (ShaPoli) and/or Engine Power Limitation (EPL) system, which is used to lower the maximum speed of the vessels.

S&PGlobal.com

This means that the oldest ships will have to be either retired or entirely retrofitted with new engines. Some others will need to be upgraded with pollution scrubbers. And many others will have to travel slower, reducing total shipping capacity.

Overall, the newly built ships in the next few years will barely compensate for the retiring older designs. And remember that no extra supply than the existing shipyard backlog can be added for that period.

So the total fleet size will stay stagnant for many years, unable to grow in synch with demand.

👉 If you are curious, you can learn all about the intricacies of different LNG ships at this link.

The consequence of rising demand and limited/constant supply is a direct and persistent rise in shipping rates. And this was before Freeport – the largest LNG export facility in the US – resumed operations.

The US has been the world’s largest LNG exporter since 2022, and Freeport’s outsized liquefaction complex restarting will increase the demand for ships able to carry its production. US gas producers will be happy to export as much as physically possible, as the US gas prices are much lower than the Asian and European ones.

In short, shipping rates depend on global demand. Short of Europe (or the world at large) entering into a catastrophic depression, the elevated demand for LNG should persist.

5. CoolCo

A Rare LNG Pure Player

In commodity and cyclical businesses, a sure sign of a turn in the market cycle is when companies are turning more profitable, and are taken private by the majority shareholders. This is because often, share prices are not (yet) rising much, but operators can see the writing on the whole, and snatch the company at a cheap price.

And like clockwork, Höegh LNG, a pure shipping play, was recently taken private.

Such pure plays in LNG shipping are rare. There are hundreds of LNG ships crossing the seas, but most are owned by small subdivisions of shipping giants, where LNG is 2-10% of the whole business. This makes LNG day rates largely irrelevant to the overall business and the stock price.

So CoolCo is rather unique to my knowledge in being a publicly listed, pure LNG carrier play. The company has also very recently been listed on the NYSE in addition to its native Oslo listing, making it a lot easier for US investors to buy shares.

Business Overview

The company is owned at 58.2% by Eastern Pacific Shipping, and the rest of the shares are publicly traded. Eastern Pacific is one of the largest private shipping companies in the world. Considering the recent listing in the NYSE, there is no indication that Eastern Pacific is looking to take CoolCo private.

CoolCo operates 12 LNG carriers, a modern fleet with an average age of only 7 years. Four of these ships were bought recently (November 2022), after the sale of one older vessel, and it has an option on 2 ships under construction, with delivery expected at the end of 2024.

The Company also manages and operates 17 LNG infrastructure units for other companies, including former partner Golar LNG and New Fortress Energy, mostly floating storage and floating regasification units. While this generates some income and cultivates industry connections, this is not the core of the company revenues.

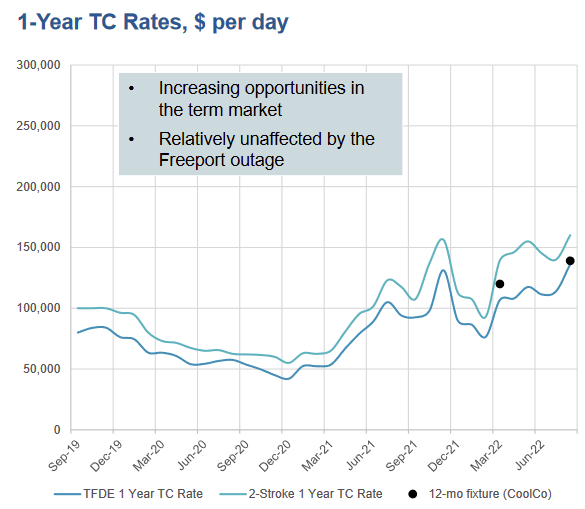

Improving Conditions

In 2022, the TCE (Time Charter Equivalent, or essentially profit per day per ship) was around $69,800; in the last quarter, it had risen to $83,600.

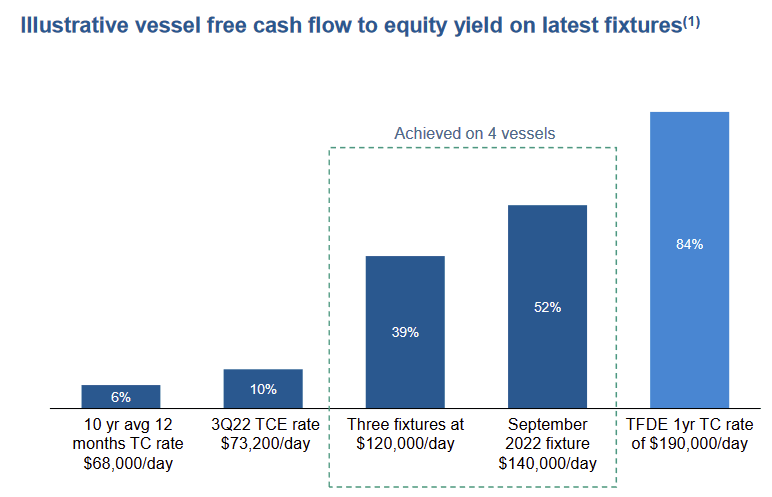

The company is aiming for the whole fleet to reach the $120,000-$140,000 range, something already achieved for 4 ships (out of 12) and expected for 4 more soon.

You can see below the expected equity yield if the whole fleet was chartered at these prices.

And that’s pretty much all to be said about CoolCo operations.

The business is hyperfocused on LNG carriers. The investment thesis relies on day rates staying high or rising.

So returns from CoolCo will depend on two factors: the day rate levels and the current valuation.

6. Financials

Focus on Cash

The company is not a long-term growth play due to the industry’s cyclicality. Instead, the focus is on profits from the current rise in day rates and CoolCo’s ability to capture this trend.

The company generated $115M in free cash flow last year.

Revenues were $90M in Q4 22. Net income in the last quarter was $33M, and EBITDA was $42M.

It is worth noting that CoolCo was IPOed only in March 2022, so the financials are a little complicated. At one point CoolCo shared ownership of most of its LNG vessels with Golar, making the accounts rather complex.

The recent purchase of 4 ships in November 2022 does not make it simpler, as they are not showing in the last quarterly report. The recent $120,000/day charter rate is also not fully reflected.

So overall, both cash flow and earnings mentioned above are likely to be significantly below the last reported level, but we will need the next quarterly report to have a better estimate.

Hence I prefer to refer to Q4 22 for the latest earnings, as they best represent the company moving forward.

Balance Sheet

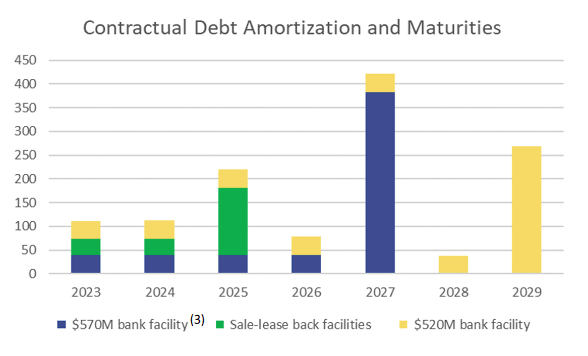

At the end of 2022, Net debt was $1.1B, with “only” $129M in cash.

The average interest rate was 5.65%. Interest rate risk is hedged at 83%, so rising interest rates should not be a threat to CoolCo. If anything, if interest and/or inflation were to rise, it would help it neutralize part of its debt.

Debt maturity is also rather good, with the bulk of it scheduled for 2025 and 2027.

This is far from a pristine balance sheet, but also not a dramatic problem for a company with capex-heavy industrial assets. Overall, risks from the balance sheet and debt seem relatively limited and would only materialize in case of a collapse of day rates.

Management also seems aware of the risk and is careful not to let the debt put the future cash flows of the company at risk, using a conservative hedging strategy.

Valuation

CoolCo is currently valued at $687M.

With a P/E of 16, it is reasonably valued relative to earnings.

The price-to-free-cash-flow ratio is a low 5.97.

In addition, the free cash flow reported at the end of 2021 fails to include the extra 4 ships recently acquired, and much higher day rates and TCE in the last quarter.

So I would guestimate the current price to free cash flow is even lower (3 to 4?), depending on cost control and the operating costs associated with the acquisition of the 4 new ships.

We seem early in the day rate cycle, and the cycle is likely to last much longer than normal, due to the EU’s geopolitical incentive to stay off Russian gas. The underlying trend of coal-to-gas switch in China, India, and elsewhere helps as well.

So the current valuations are great if the company returns cash to shareholders.

With shipping a very cyclical industry, it is important to have a company distributing profits in good times, instead of expanding too aggressively and finishing the rising part of the cycle with massive excess capacity.

Returns to Shareholders

The company is expecting a Free Cash Flow on Equity (FCFE) yield of 23% in 2023, assuming a spot day rate of $91,000. To compare, in 2022, the FCFE was standing at 15%.

The company’s management targets to return most of the free cash flow to the shareholders. So only the options on the 2 newly built ships for 2024-2025 previously mentioned should consume cash, with the rest of the cash generated being redistributed.

CoolCo recently (10th March 2023) distributed a dividend of $0.40/share, giving it a dividend yield of 3%.

With a current valuation of $12.8/share, the same dividend every quarter would bring the annual dividend yield to 12.5%, and would be in line with management forecasts.

7. Conclusion

CoolCo is a company that would normally need to be trading at a deep discount to be interesting, like a single-digit P/E and a below 4 price-to-free cash flow ratio.

This is because shipping business cycles are short and can show brutal downturns. So with a P/E of 16 and some debt, CoolCo would be a little too expensive if the cycle was to turn negative in the next 12-18 months.

The difference from the normal business cycles of the past is the Ukraine war and the growing tensions between the West and Eurasian powers. These factors increased the global demand for LNG by 30% almost overnight, an increase that is not temporary but structural. So this cycle is to be expected to last abnormally long, at least 5 years, and potentially 10-15.

Since 2022, the LNG industry has tried to respond and is managing quite well in terms of production, liquefaction, and regasification. But the reduced global shipbuilding capacity leaves shipping as the weak link in the chain and the one with the most enduring pricing power.

Being one of the only pure players publicly traded, CoolCo is likely to attract a lot more attention following its recent NYSE listing.

The current price is attractive, and management seems focused on redistributing profit to shareholders. With the interest of the main shareholders aligned with the minority shareholders, we can expect CoolCo to be a solid income stock and provide some inflation protection as well.

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in CLCO or plans to initiate any positions within 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this article.