Not only is gold one of the oldest investment assets around, but it’s the ultimate symbol of wealth. Most investors either own gold or wonder if they should invest in gold. So, is gold a good investment?

In this post, we look at the reasons for a gold investment, how to invest in gold and the pros and cons of doing so. Investing in gold can be a controversial topic, so we have tried our best to keep things balanced, and include both the opportunities and the risks of gold investments.

In this post:

- A Brief History of Gold

- What Is Gold Worth? Supply, Demand and the Price of Gold

- Gold Investment as Inflation Hedge

- Gold Investment as Portfolio Hedge

- Gold Investment as Hedge Against a Global Financial Collapse

- 6 Ways of Investing in Gold

- Investing in Gold Stocks vs. Investing in Gold Itself

- The Physical Gold vs. Paper Gold Tradeoff

- Is Gold a Good Investment Compared to Silver?

- Is Gold a Good Investment Compared to Bitcoin?

- Pros and Cons of Investing in Gold

- Is Gold a Good Investment in 2022?

A Brief History of Gold

Both gold and silver have been used as currencies and financial instruments for at least two thousand years. It is believed that gold was used for decorative purposes over 40,000 years ago, and that gold was the first metal that was used by man. Precious metals were already widely known, used, and valued when the first coins came into being.

Prior to using gold as a form of money, crops and livestock were used as a store of value and a medium of exchange. However, using these commodities as a currency presents all sort of logistical problems. Objects like sea shells and feathers were also considered, but lacked the durability something of value requires.

Gold was an obvious choice to replace these primitive currencies. Its scarcity meant a small quantity carried significant value. It was durable, it could easily be divided into small quantities, and it could be minted into individual “units”.

The earliest known coins, which were made of a mixture of gold and silver, were used in what is modern day Turkey approximately 2,600 years ago. Until not long ago, gold and silver have continuously been used as currencies ever since.

Gold, silver, and various forms of gold-backed paper money remained the primary monetary system until the second world war. In the period since then, the global monetary system has moved away from precious metals, although most central banks still hold some gold reserves.

By decoupling currencies from gold, governments have been able to more effectively use monetary and fiscal tools to manage their economies. However, money that is not backed by gold is also more prone to inflation. The increase in the global money supply has led to concerns of instability and hyperinflation in the future.

What Is Gold Worth? Supply, Demand and the Price of Gold

Gold does not generate cash flows in the way that real estate or a company does. This means it cannot be valued, and the price is purely a function of supply and demand. The major swings in the gold price are often the result of speculative demand, which in turn depends on sentiment and inflation expectations. However, beyond this demand there is also an underlying relationship between supply and demand.

As more gold is extracted from the earth, the cost of extraction rises. This is simply because the remaining gold is harder to reach. Each gold mine has a cost of production (COP), so when the gold price falls below that COP, the mine is no longer profitable. If this happens the mine may suspend production or halt new investments. The net effect is that as the gold price falls, the supply of new gold coming into the market slows.

On average, about 50% of the gold produced each year goes to the jewelry industry. In addition, 5 to 10% of production is used by technology industries. The remainder of the demand comes from sources that could be considered speculative: central banks, investors, and speculators.

The point here is that there is still residual demand beyond the more speculative demand. And, as the price falls this residual demand increases. So, while we can’t “value” gold, we know that there is a stabilizing relationship between supply and demand.

Gold Investment as an Inflation Hedge

One of the key arguments for a gold investment is as a hedge against inflation. Central banks can effectively print as much paper money as they want, and rising money supply can lead to inflation. On the other hand, we know that the relationship between gold’s supply and demand is relatively stable, which means its “value” can’t be debased.

History has shown that over long periods of time gold has maintained its purchasing power. Over short periods of time, its purchasing power has fluctuated about as much as its price.

When we talk about inflation, we are talking about the purchasing power of currencies. It’s important to point out that while gold has maintained its purchasing power far better than currencies, over the last 150 years, stocks have done an even better job. If your only goal is to beat inflation, stocks have proven to be a better hedge. However, as we will see, there are other compelling reasons to invest in gold.

Gold Investment as Portfolio Hedge

A gold investment has a very solid track record as a portfolio hedge. If you are investing in stocks, you can reduce portfolio risk by adding safe haven assets to your portfolio. Safe haven assets, which include precious metals, bonds and cash, are assets with stable values.

The prices of risk assets, like equities, are closely tied to global growth and economic stability. The price of these types of assets usually falls when a recession is expected or when market volatility increases. When this happens, capital usually flows to safe haven assets. T

This is known as flight to safety. This negative correlation between risk assets and safe haven assets can be used to reduce the volatility of an investment portfolio.

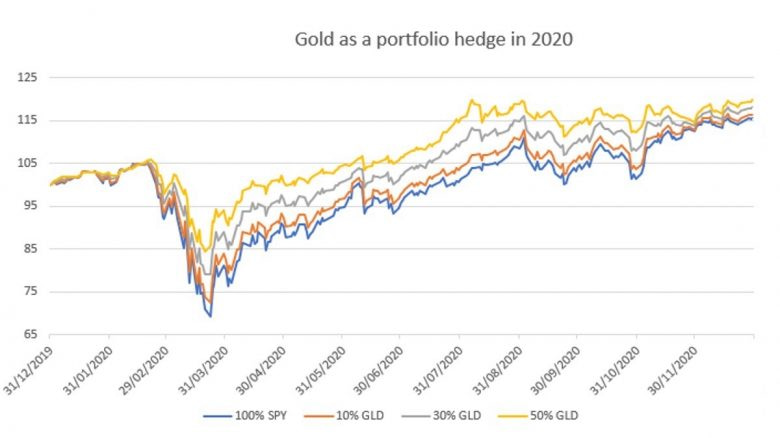

The charts below show the effect of allocating between 0% and 50% of a portfolio to gold, with the rest allocated to stocks. For gold we are using the GLD ETF and for stocks we are using the SPDR S&P 500 ETF (SPY). The first chart illustrates the extent to which investing in gold would have reduced the downside risk of an equity portfolio during the global financial crisis in 2008.

The second chart illustrates the extent to which a gold investment reduced volatility during the COVID-19 correction in 2020.

The two charts above show how investing in gold reduces portfolio volatility during equity market corrections. However, it’s important to note that over long periods of time, including gold in a portfolio has resulted in lower overall returns. The following chart, which includes both corrections, illustrates the performance of the four portfolios from 2008 to 2021.

Gold Investment as Hedge Against a Global Financial Collapse

The world has never really experienced a complete collapse of the financial system. We are talking here about a catastrophe that results in banks and institutions not being able to operate. This would obviously have catastrophic consequences for the economy and financial assets could lose most of their value.

It’s impossible to assign a probability to this scenario. It’s probably not zero, but it’s probably quite low. During the last few market crashes, central banks have shown a willingness to do whatever it takes to make sure there is liquidity in the system. They have also shown they are prepared to bail out banks and institutions if necessary.

Perhaps the bigger risk is the fact that so much of the financial system is now electronic, and the fact that cybercrime continues to rise. If there is a complete financial meltdown, cyberterrorism might be a more likely cause. But again, the probability is probably quite low.

So, is gold a good investment as a hedge against a scenario like this? Prophets of doom have been warning about the imminent collapse of civilization for decades – and gold is often touted as the only solution. If there is a financial meltdown, gold would almost certainly retain its value better than other assets. But there are also practical issues to consider – like buying everyday goods when all you have is a one-ounce gold coin. The good news is that investing in gold as a portfolio hedge should give you some protection against this “end of the world” type scenario.

One thing to consider is that unless you hold physical gold that is actually in your possession, it may be difficult or impossible to actually claim your gold holding in the event of systemic collapse. Holding gold in your possession exposes you to possible theft or loss, which is probably more likely than a global economic collapse!

6 Ways of Investing in Gold

There are now several ways to invest in gold. These range from owning physical gold to “paper gold” and gold stocks. Each type of gold investment comes with its own advantages and disadvantages.

1. Gold Bullion

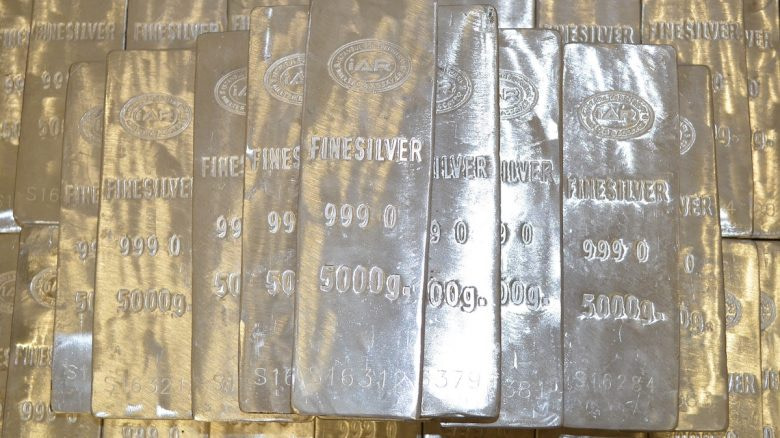

Gold bullion is the traditional way to own relatively large quantities of gold. The word bullion actually refers to bars, ingots and coins. For gold bars to qualify as bullion they must have a known purity (usually above 90%) and must be produced by accredited refiners.

Gold bars range in size from 1 gram to 400 ounces, so a gold bar can be worth anywhere from $60 to $735,000. Larger bars usually need to remain stored in approved vaults to retain their provenance. Smaller bars can be stored in a vault or wherever the owner chooses.

2. Gold Coins

Buying gold coins has been the traditional way for most investors to invest in gold. Gold coins of various types have been around as long as gold has been used as a currency. They allow investors to accumulate small quantities of gold over time.

It’s important to know that there are two very different categories of gold coins. The first category is gold bullion coins like American Gold Eagles and Krugerrands. These coins are made of pure gold or 92% gold alloy and generally contain one ounce of gold. They are minted by government mints. These types of gold coins often trade at a small premium to the gold price, but their prices track the gold price closely. Owning these coins is the same as owning gold bars and a direct investment in the price of gold.

The second category consists of numismatic, rare, and limited-edition coins. The price of these coins reflects the gold they contain as well as a premium that reflects their age and rarity. Investing in these types of coins is more like investing in antiques. Investing in these coins requires specialized knowledge and caution is advised.

3. Gold Jewelry

Buying gold jewelry can also be considered a form of gold investment. But, just like rare and numismatic coins, there is more to the value of jewelry than the gold it contains. In the case of jewelry it’s usually the aesthetic qualities that contribute to the value. Investing in gold jewelry gives you added utility, which is probably worth something. You just need to remember that the premium you pay will always be subjective, both when you buy it and when you sell it.

4. Gold ETFs

Exchange traded funds (ETFs) have emerged as a very convenient way of investing in gold. ETFs are vehicles that trade on the stock market, just like any other share. Gold ETFs are trusts that own physical gold stored in a vault. They allow you to hold your gold investment alongside your stock portfolio in a trading account.

Gold ETFs are cheap to trade and own, and eliminate the need to worry about storage, insurance or transport. The SPDR Gold Shares ETF (GLD) is the largest ETF that tracks the gold price, and was briefly the largest ETF in the world. There are similar ETFs listed on most major exchanges.

5. Gold Derivatives

Futures, options and CFDs (contracts for difference) based on the price of gold are another way to trade gold. These instruments are all derivatives that can be traded on margin, which allow for leverage. Derivatives are probably the best instrument for active traders, but not necessarily for investors.

6. Gold Mining Stocks

Investing in the shares of companies that mine gold is an indirect way of investing in gold. Gold mines have relatively stable costs, while their revenue fluctuates according to the gold price. In most cases, gold stocks offer leveraged exposure to the gold price – their profits rise faster than the gold price when it rises, but fall faster than the gold price when it falls. Some gold miners have fairly predictable cash flows, while others are very speculative. The more stable companies have low production costs, which means that they remain profitable even when the gold price falls.

More speculative mines, known as marginal miners, have higher production costs and are at risk of losing money if the gold price declines. Junior miners are companies involved in exploration and development of mining operations, and are even more speculative. The following are prominent examples of gold mining companies in various categories along with their US stock tickers. Be aware that some of these companies may have exposure to other precious metals too.

- Largest gold producers

- Lowest cost gold producers

- Junior and marginal gold producers

- Gold royalty and streaming companies

Largest Gold Producers

- Newmont Corporation (NYSE: NEM)

- Barrick Gold (NYSE: GOLD)

- AngloGold Ashanti Limited (NYSE: AU)

Lowest Cost Gold Producers

- Kirkland Lake Gold (NYSE: KL)

- B2Gold (NYSE Arca: BTG)

- Centerra Gold (NYSE: CGAU)

Junior and Marginal Gold Producers

- Yamana Gold (NYSE: AUY)

- DRDGOLD (NYSE: DRD)

- Seabridge Gold (NYSE: SA)

Gold Royalty and Streaming Companies

Another category of gold stocks are royalty and streaming companies. These are companies that provide capital to gold producers in return for royalties or a percentage of the gold produced. These companies have less exposure to the risks and costs associated with gold mining. Some examples of royalty and streaming companies include:

- Franco-Nevada (NYSE: FNV)

- Wheaton Precious Metals (NYSE: WPM)

- Sandstorm Gold (NYSE: SAND)

There are also a few gold miner ETFs to consider:

- VanEck Gold Miners ETF (NYSE Arca: GDX)

- VanEck Junior Gold Miners ETF (NYSE Arca: GDXJ)

Investing in Gold Stocks vs. Investing in Gold Itself

Gold stocks can generate higher returns than gold itself, but gold stocks are also a lot more complicated than simply investing in gold. There’s a lot more to a gold miner’s profits than the gold price. You must also consider a producer’s cost of production, gold reserves (the amount of underground gold a mine has access to), labor costs and the balance sheet. In addition some gold mines are in countries with significant political and legislative risk. Some mines hedge their exposure to the gold price, and this also needs to be considered.

Investing in the largest gold producers will have slightly more risk than gold itself, along with more upside potential. These companies are well diversified with mines around the world, and have relatively low production costs. Investing in the junior and marginal gold stocks requires a lot more knowledge, research and time – and carries a lot more risk. Junior gold miners are definitely not suitable for buy and hold investing.

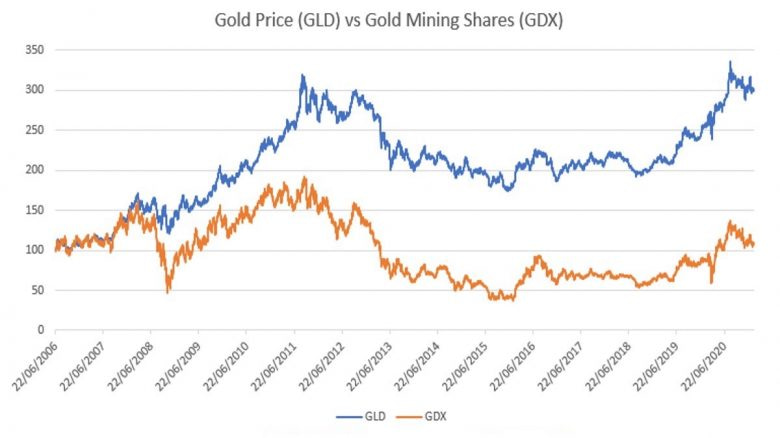

This chart illustrates the relative performance of the gold price represented by the GLD ETF and the GDX ETF since 2006 when it was launched. As you can see, gold stocks underperformed the gold price by a significant margin. However, it is worth noting that this has been an historically difficult period for gold miners and gold mining shares.

The Physical Gold vs. Paper Gold Tradeoff

ETFs like the SPDR Gold Shares fund are probably the most convenient and cheapest way to trade and own gold. Gold ETFs, futures and other instruments based on the gold price are sometimes referred to as paper gold. Some investors who invest in gold as a hedge against the stability of the financial system believe paper gold is almost as risky as other financial assets. There is some truth to this as you cannot trade ETFs and futures if exchanges don’t open for business. More skeptical investors even question the existence of the gold held by ETFs.

On the other hand, investing in gold bullion or coins requires storage, security and insurance. There are also logistical issues to consider when you buy or sell physical gold. And there’s an argument to be made that if you own physical gold that is stored at a financial institution, all you really have is the receipt which is once again like paper gold. The alternative is to store the gold yourself in a safe or hidden somewhere. Ultimately, there is no single best way to invest in gold. It really comes down to your reasons for a gold investment and your preference for convenience.

Is Gold a Good Investment Compared to Silver?

Some precious metals investors prefer silver to gold. There are pros and cons to both, which can be summarized by the following points:

- Investing in gold has delivered higher returns over the long term.

- Silver has more industrial uses, and is used by the growing solar energy industry. This means demand may rise as economies grow, but also means recessions could dampen demand.

- For several reasons, the silver price is more volatile, and is likely to remain so.

- Gold is preferred by central banks.

So, is gold a good investment compared to silver? With lower volatility and higher long-term returns, gold is probably a better asset to own over the long term. However, if you track the precious metal market closely, you may identify periods when silver makes more sense.

Is Gold a Good Investment Compared to Bitcoin?

The emergence of cryptocurrencies, and notably Bitcoin, have given investors a new asset class to consider. Bitcoin is often referred to as digital gold – but is it really? The correlation between Bitcoin and speculative assets remains very high. This suggests that Bitcoin is really a speculative risk asset, while gold is the opposite. Bitcoin returns increase when risk appetite rises, while gold returns increase when risk appetite falls.

Investing in Bitcoin is really an investment in an emerging technology and monetary system, and a speculative one too. It could also be considered a hedge against a total collapse of the financial system. But it hasn’t proved to be a very good hedge against portfolio volatility, and the high volatility also outweighs its ability to hedge inflation.

In the last decade, the returns from Bitcoin have eclipsed the returns from gold. Whether this continues in the future remains to be seen. When comparing the two, you really need to consider your goals and see the two as very different assets.

Pros and Cons of Investing in Gold

There are pros and cons to investing in any asset, and gold is no exception. We can summarize the case for investing in gold by listing these pros and cons.

Pros of Gold Investments:

- Gold has a long history as a tradeable asset, and has a proven track record as a store of value. As a real asset, the value of gold is not linked to the financial system.

- Gold has also proven to be an effective safe haven and portfolio hedge during periods of market instability.

- The increase in the global money supply is leading to growing concern about inflation and the stability of the monetary system.

- Cybercrime continues to increase, and the global economy is becoming more digital and connected. This means there is more at stake from a major cyberterrorism incident.

- If you hold gold as a permanent hedge in your portfolio, you do not have to rely on market timing to avoid volatility.

Cons of Gold Investments:

- Gold doesn’t generate profits, dividends or rent.

- Because gold doesn’t generate yield, it can’t really be valued. The price of gold fluctuates with supply and demand, and is prone to speculative bubbles.

- If Bitcoin or another cryptocurrency becomes an integral part of the financial system, it may live up to its promise as a form of digital gold. This could make gold a less compelling investment.

Is Gold a Good Investment in 2022?

To get an idea of how the gold price may perform in 2022, we need to go back to the first half of 2020. During the first few months of the COVID-19 pandemic, the gold price rallied as much as 30%. This move was largely driven by speculation and the fact that central banks were “printing” money at unprecedented rates. This created a situation where most of the potential buyers were already long, and there were few buyers left to take the price higher. Some of the buying was done with leverage, which meant there were forced sellers when the momentum ran out.

The result has been that the gold price has underperformed other asset classes for most of the last 18 months. The strong performance of cryptocurrencies and growth stocks also resulted in little interest being shown in gold. Global inflation is now the highest it has been in decades. Whether it remains high, or declines remains to be seen.

As various forms of quantitative easing come to an end, there is some risk that gold becomes less attractive. However, this is probably offset by the fact that ending quantitative easing is likely to lead to more stock market volatility. Predicting a massive rally in the price of gold would be pure speculation. However, as of early 2022, there are a few compelling factors in gold’s favor:

- Gold probably carries a lot less risk now than it did during the speculative rally in 2020.

- At the same time, equity market volatility has increased and there are fears of further downside.

- Recent volatility in the cryptocurrency market make gold a more compelling hedge against inflation or a financial crisis.

- With rates rising, bonds are also becoming less attractive safe haven assets.

All of this suggests gold is very well positioned as a hedge against other asset classes in 2022. The possibility of further inflationary pressure would add to the case for gold.

Conclusion: Is Gold a Good Investment?

At any given time there will be market pundits predicting gold’s imminent raise to $5,000 and higher. This is pure speculation, but there are other good reasons for gold investments. The most compelling reason to invest in gold is as a hedge against portfolio volatility and potential inflation. What are your views on gold as an investment? Please let us know in the comments below.

What moves gold prices? What are the steps to trade gold?

I think the price of gold is mostly influenced by supply and demand. Gold is considered a wealth preservation asset by most investors. It is not very volatile and not excessively risky. Usually demand, and therefore the price, goes up when investors are looking for safe investments (such as during the pandemic). On trading platforms that offer the possibility of investing in commodities you can trade gold the same way you can trade stocks or currencies.

I’ve always wanted to invest in gold, but is it more profitable than crypto now?

It is not the most profitable, at least not if you want to invest long-term, but it is still considered a good asset for wealth preservation. Cryptos can be more profitable, but they are also more risky than gold.

What is currently the better investment, gold or Bitcoin?

At this very moment in time, probably Bitcoin is the better investment. Back in January when this question was asked, gold definitely would’ve been the right answer.

I would also choose Bitcoin. Not that I don’t like gold, but I find Bitcoin and the whole cryptocurrency space much more interesting. It is the future and also cryptocurrency is easier to store as I only need the wallet on my smartphone instead of storing gold at home or at a bank.

Gold is wealth preservation and insurance against a rotten financial system, inflated by $100s of trillions of credit and printed money as well as quadrillions of dollars of derivatives. If you understand the bubble that this has created in all asset and debt markets, you will also understand that gold is your best protection against the coming implosion of all these markets. Our group is keeping 20% of our holdings in gold.

It is great for wealth preservation. 20% of wealth in gold sounds like a great idea. I personally wouldn’t necessarily go any higher though, I’m afraid it would make a portfolio less diverse.

Well, I’m not so keen on Gold because it is such a risky investment. I’ve tried trading Gold in the past, but I had a terrible experience. Unfortunately it’s completely impossible with a wrong broker like Etoro, so I don’t really want to go with another broker since I can’t afford to lose more!

That’s strange. But I have seen many traders who only trade gold and make good profits, even if the market is bearish too. The thing they usually do during a bearish market is to sell gold short in my opinion.

Compared to other, less politically stable countries and areas, Quebec’s mining friendly environment and excellent infrastructure makes it an ideal location for gold mining. Aurvista’s Douay property is advancing one of the largest undeveloped gold projects in the province.

Gold is seen as a great investment, whenever there is the threat of rising inflation. It helps people convert volatile assets into a precious metal that will continue to be valuable regardless of what happens to the economy.

Gold is a very secure and stable investment. It’s usually best to buy gold directly in form of bullion and coins or depositing into a managed gold investment fund. These kind of investment funds offer security and good results, also if the gold price falls, because the fund managers will check the market and act. The deposit limit to gold investment funds is also lower than buying real gold.

Gold investments can be some of the most rewarding alternative investments, especially when they are significant. But even investing in small quantities of gold can be rewarding. Gold is inversely correlated with the dollar. Hence, as the dollar weakens, and the fears of it further weakening increases, the investment demands for gold increases.

Looking to get started in investing, particular in gold and silver, and have done some research on the web as well as Facebook. Stumbled across Gold Retirement / Regal Assets – anybody familiar? What are some of the more reputable gold investment companies? I’ve been looking at a few but can’t make a decision quite yet.

A good start for a new retail investor is to buy solid gold, which comes in the form of gold coins, gold bars and gold bullion. There is nothing better than holding the gold coins in your hands.

How to get the best returns from gold and silver investments?

Gold and silver are a good choice for investment because their value is stable and will increase over the years. I recommend you start with gold and silver coins or gold bars. It’s best to start with gold and buy a five-gram gold bar when the price of gold is very low. See how much you will earn only in a few months when the price of gold rises again and reaches new highs. When this happens, you can sell your 5-gram gold bar and buy a 10-gram gold bar.