Recessions are very much in the news these days. Is the US in one? If so, when will it end? If not, when will it start? How bad will it be? To answer these questions we need to learn more about what a recession is, what causes it, and how it works.

Let’s clear up some common questions.

What Is a Recession?

A recession is, according to the National Bureau of Economic Research (NBER), “a significant decline in economic activity that is spread across the economy and that lasts more than a few months”.

There is some confusion over what specifically constitutes a recession. Many popular sources define a recession simply as two consecutive quarters of economic contraction.

The NBER, which is officially responsible for defining what is and is not a recession, uses a more complex formula. The St. Louis Fed says:

“The committee considers a wide range of indicators with particular emphasis on payroll employment and several measures of domestic production and income, such as gross domestic product, gross domestic income, and industrial production. A number of other monthly indicators are also considered”

The NBER’s process for defining a recession has been in place for decades – the document cited above is from 2009 – and has been used across administrations of both political parties. It is not a politically driven definition.

How Common Are Recessions?

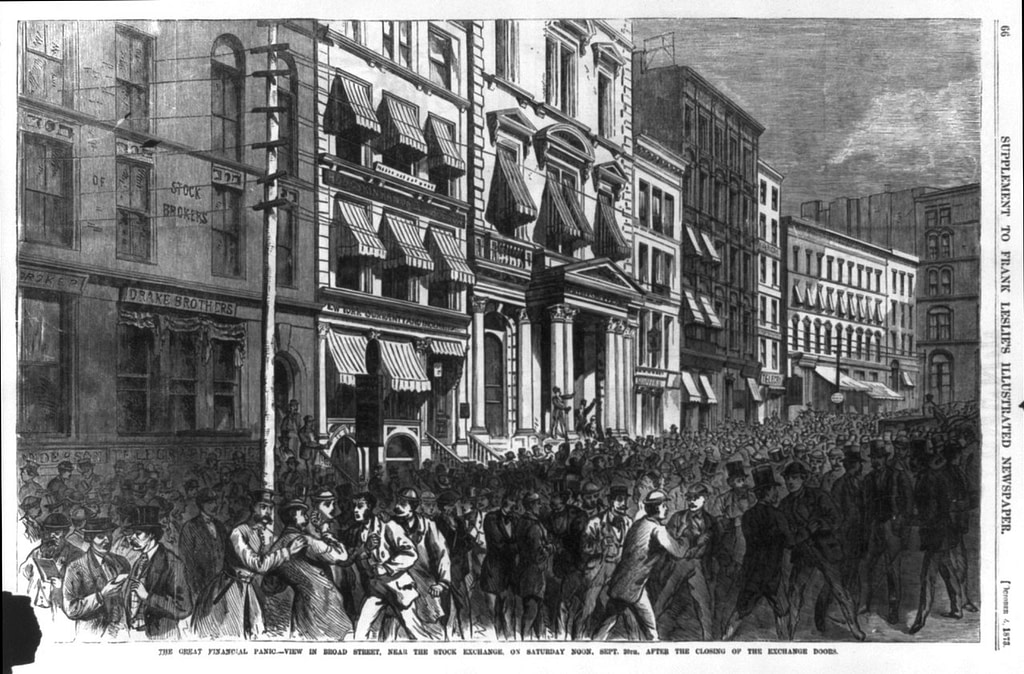

The collection of economic data in the US was only standardized after the Great Depression (1929-1933), Before that time the country experienced frequent bank runs, panics, and other dislocations, but reliable data on these is often lacking.

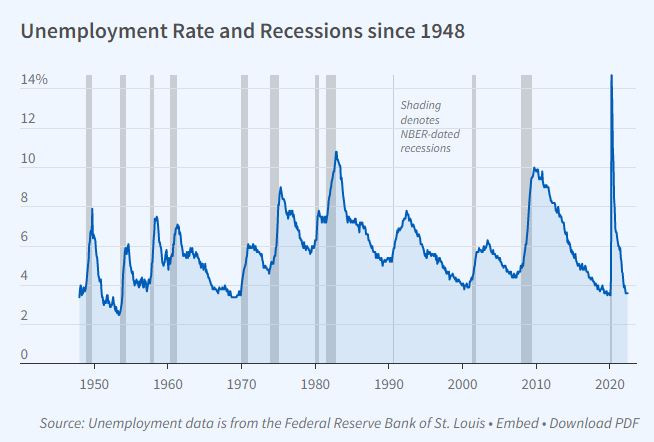

Since 1945 the US has experienced 13 officially declared recessions or an average of one every six years.

What Are the Worst Recessions in US History?

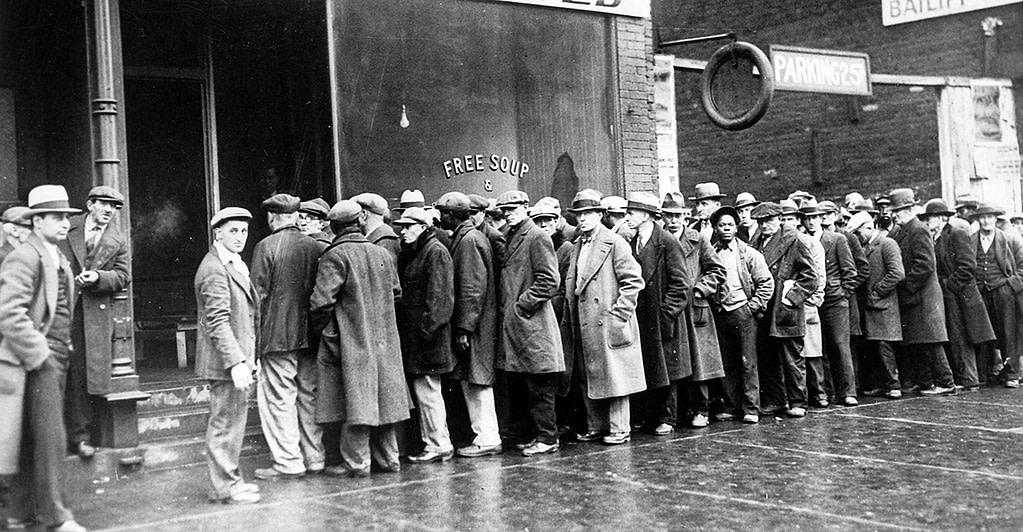

The worst recession the US has experienced in the last century was the Great Depression of 1929-1933, which lasted 3 years and 7 months. GDP decreased by 26.7% and unemployment peaked at 24.9%.

The is a quiet but steady stream of depositors at every bank in Youngstown this morning quietly withdrawing their funds. The closing of banks in Toledo and Warren received much publicity and distrust of all banks is growing like a cancer. It is a movement which feeds on itself and is hard to stop.

Benjamin Roth, The Great Depression: A Diary

The Panic of 1873 and the subsequent “long depression” lasted over 5 years and saw an estimated 33% reduction in GDP. Unemployment data are not available.

The “Great Recession” of 2008-2009 lasted for 1 year and 6 months. GDP dropped 5.1% and unemployment peaked at 10%.

Photo by Ed Yourdon

How Long Do Recessions Last?

Recessions vary dramatically in length.

The shortest recession on record is the COVID-19 of Feb-April 2020, which lasted only two months. It is still considered a recession because of the dramatic drop in GDP (almost 20%) and a spike in unemployment (almost 15%).

Only two recessions since 1945 have lasted over one year: the 1973-1975 recession (1 year and 4 months) and the “Great Recession” of 2008-2009 (1 year and 6 months). The average length of the other post-1945 recessions is around 9 months.

These figures indicate that while recessions have continued in the post-depression period, they have been much shorter and much less severe than their earlier counterparts.

What Causes a Recession?

Recessions can have multiple causes, and there may be more than one cause in play at any given time.

- Overheating. In an overheated economy, demand rises and unemployment falls to the point where producers can no longer hire new workers to meet demand. A combination of rising prices and unusually low unemployment indicates an overheated economy.

- Asset Bubbles. When one or more asset classes see prices rise beyond rational levels, a bubble forms. A bubble may be driven by low interest rates, which encourage speculation with borrowed money. The bubble draws in new investors chasing the gains and eventually, the price becomes unsustainable. Panic selling drives prices down and investors who are using borrowed money default on their loans. People lose money and cut back dramatically on spending, pushing the economy into recession.

- Rising interest rates. Higher interest rates discourage spending on major purchases like homes and cars. They also tend to reduce investment, which affects employment growth and may restrict money flowing into asset markets, which can trigger a recession.

- Supply-Side Shocks. An interruption in the supply of vital commodities or goods can push prices up, draw spending away from other sectors, and push an economy into recession. An example would be the oil price shock of the early 1970s.

- Black Swan Events. War, disease, terrorist attacks, and other unpredictable events can generate recessions. The COVID-19 pandemic is an obvious example.

Overheating or asset bubbles generally present some warning. Inflation and unusually low unemployment indicate an overheating economy. Rapidly rising prices of stocks, real estate, or other assets indicate an asset bubble.

The cause of a recession and the trigger of a recession may be different. The 2008-2009 recession was triggered by the collapse of Lehman Brothers, but the underlying cause was an unsustainable bubble in real estate and real estate derivatives like mortgage-backed securities.

As I look back now to the 1922-29 period it seems to me unreal and almost unbelievable. After the war pressure people wanted to have a good time and to spend money. The flapper appeared upon the scene. Women’s dresses became shorter and shorter until they hardly reached the knee and in the latter stages of the delirium they wore their stockings rolled and their bare knees rouged. Morality and religion were pushed into the back-ground and in its place came Negro jazz bands and night clubs and all its attendant evils. To an older man it must have seemed inevitable that we were heading for a crash but to most of us it seemed that we were in a “New Era” which would never end.

Benjamin Roth, The Great Depression: A Diary

Can a Recession Be Prevented?

Recessions always happen, so they cannot be entirely prevented. It may be possible for government policy to delay a recession or reduce its impact in some cases. This is very difficult to quantify because it’s impossible to know what would have happened if a given policy was not adopted.

The Federal Reserve can try to cool an overheated economy or deflate an asset bubble by raising interest rates. This can be a politically controversial decision. Both politicians and voters enjoy a “red hot economy” and a soaring market for stocks and other assets, and they don’t like seeing them disrupted even when the risks are clear.

There may be political pressure on the Fed to hold interest rates low even when markets are moving into bubble territory or the economy is dangerously overheated.

Using interest rates to cool the economy or deflate a bubble can be seen as deliberately risking a mild recession in order to prevent the more serious recession that could emerge if the bubble or the overheating goes on unchecked. It’s difficult to gauge success and the decision is usually unpopular.

Could the Crash of 1929 and the Great Depression Happen Again?

Nothing is impossible, but it’s extremely unlikely that the Great Depression will be repeated.

Before the Federal Deposit Insurance Corporation (FDIC) was founded in 1933, bank panics and bank runs were a regular occurrence in the US. If a bank failed, depositors simply lost their money. Because of this, depositors rushed to banks and pulled their money out at the first sign of trouble. If the bank didn’t have the cash to meet the withdrawals, it failed.

A third of all banks in the US failed in the Great Depression, and millions of Americans saw their savings vanish, driving nationwide deflation. Consumers who lost their money stopped buying. Demand for goods evaporated and businesses failed, leaving even more workers destitute and adding to the lack of demand.

There are now robust systems in place to prevent bank failure and insure depositors if it occurs, making this very unlikely. Unemployment insurance, adopted in 1935, prevents complete demand destruction as workers lose jobs.

Before the Great Depression, the banking and financial industries were virtually unregulated. Insider trading, stock manipulation, and speculation with borrowed money were rampant.

There is still controversy over financial regulation. Some believe that regulation is excessive and constricts growth, while others believe that it remains insufficient. Those points are arguable, but it is certainly true that control over financial markets is far, far greater than it was in the 1920s, and policymakers have a wider range of tools and a wider base of knowledge that can help them alleviate the impact of a downturn.

What Can I Do to Survive a Recession?

There’s an old saying: “a recession is when your neighbors lose their jobs, a depression is when you lose yours”.

That’s a bit flippant, but it underscores an important truth: recessions affect different people differently.

Most of us will not lose our jobs. We may see higher prices and lower incomes. Small businesses will come under stress. Times will be harder. There are still steps we can take to navigate the recession.

- Don’t panic. Recessions come and go. They will end. There’s no need to do anything radical.

- Protect yourself. It’s a good time to beef up your emergency fund, reassess your budget, and trim spending. Avoid taking on new debt and be careful about changing jobs, unless your employer looks shaky.

- Look for opportunities. As recessions run their course many assets will be available at bargain prices. If your own position is reasonably secure it’s a good time to buy.

If a worst-case scenario has come to pass and you have lost your job, don’t give up. All recessions pass, and as the economy moves back to growth there’s typically high demand for experienced workers.

Most people did not realize the depression was over until a year or more after the turn had been made. If the fellow had waited until 1933-34 when prices were shooting up he could still have bought at bargain prices. In 1932 with stock prices at 10% of normal he could not have gone far wrong in buying stocks with 20 or 30 years earnings record and with a good chance to survive the depression. However, not one man in a million succeeded in doing this and that is why the millionaires club is still exclusive.

Benjamin Roth, The Great Depression: A Diary

Why Does the NBER Delay Announcing a Recession?

Some observers have speculated that the NBER has delayed an announcement of a recession for political reasons.

NBER announcements have always been late, often as much as a year after the actual events. This is primarily because of the range of data considered and the variations in the schedule by which data are released. The NBER did not declare an end to the 2008-2009 recession until months after the economy was back on a growth track.