Kikoff’s offers a revolving line of credit that doesn’t require a credit check. You can use it to shop at their store and pay off your purchases in interest-free installments. Plus, they take the extra step of reporting your activity to the credit bureaus, helping you build and boost your credit score.

Kikoff Credit Account

Kikoff’s revolving line of credit has no credit check, fees, or interest, and it can help you build your credit. Unfortunately, you can only use the account to buy items in Kikoff’s store, which offers nothing but self-help e-books. In addition, Kikoff only reports your activities to Experian and Equifax, and their customer service is poor.

Pros

No credit check

No interest on balances

No enrollment or late fees

Cons

Only usable at the Kikoff store

Only reports to two credit bureaus

Poor customer service and support

What is the Kikoff Credit Account?

The Kikoff Credit Account is a credit-building tool for people who might not have the credit score or the finances necessary to get a traditional credit card or use one safely.

It’s a $750 revolving line of credit you can get without a credit check. That means the account doesn’t add a hard inquiry to your credit report and is much more accessible to people with low credit scores or no credit score.

There’s no interest on the balances you carry, and they don’t charge you any fees to sign up for or maintain the account besides a $5 monthly membership fee. In short, you don’t have to pay for anything except what you purchase and the $5 monthly membership fee.

Once you sign up, Kikoff reports the details of your account usage to Experian and Equifax each month. That includes the timeliness of your payments, the size of your credit limit, and any outstanding balances.

If you make all your payments on time and keep your balances low, you can use the account to improve your score. Unfortunately, building credit is its only practical function. It won’t help you finance anything or save money.

You can only use the credit line to buy from Kikoff’s store. Their site doesn’t discuss what you can purchase there except that everything costs between $10 and $20. However, customer reviews note that their stock is limited to educational e-books.

How Does Kikoff Work?

The Kikoff Credit Account is a revolving line of credit, which means it functions similarly to a credit card. It has a $750 credit limit that you can draw against to make purchases. Once you pay your balance off, you can reuse the funds.

Here’s a more comprehensive review of the account’s specifics.

How to Sign Up for the Kikoff Credit Account

Acquiring a Kikoff account is more like a sign-up process than an application. They don’t check your credit, and just about anyone can qualify. To get access to the line of credit, you need to provide identification information, such as your name, email, address, and Social Security Number.

Kikoff available to U.S. citizens or legal residents in 49 states. You can’t sign up for an account if you live in Delaware.

☝️ Note that it may take up to six weeks for Kikoff to show up on your credit report. They send updates to the credit bureaus at the end of each month, and it can take up to two additional weeks for the bureaus to process the new information.

How to Use the Account and the Kikoff Online Store

Once you have the Kikoff Credit Account, you gain access to the Kikoff store. As I mentioned above, they offer various e-books that typically sit in the price range of $10 to $20. They cover topics like personal finance and wellness.

Kikoff won’t start reporting your account to the credit bureaus until you buy something from the store. Once you do, you’ll pay off the amount in a series of monthly installments with no interest, and they’ll report your payments, credit limit, and outstanding balances.

That helps you establish a payment history, and it should help your credit utilization too. If you only ever buy one e-book at a time, your utilization should stay far below the 10% threshold, which is the ideal upper limit.

👉 For example:

Say you buy an e-book for $10, then pay the balance off over five months in $2 installments. That would benefit your payment history by adding five timely payments to your credit report.

Your score would also benefit from having such a low utilization ratio. $10 is only 1.3% of $750, and that will only decrease as you pay off your balance.

📗 Learn More: Your credit utilization ratio is one of the most significant metrics affecting your credit score. Find out how it works and how to improve yours: What Is Credit Utilization, How It’s Calculated and How to Improve It.

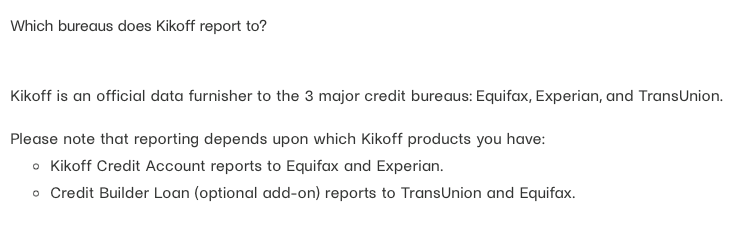

Credit Bureau Reporting

KIkoff has this to say about their credit bureau reporting.

The Kikoff credit account described in this review reports only to Equifax and Experian. It will have no impact on your TransUnion credit report or any credit score derived from your TransUnion credit report.

We’re a bit confused by the mention of a credit builder loan product that reports to TransUnion and Equifax. We don’t see any discussion of this product elsewhere on the site or in customer reviews, and it’s not clear whether it’s available.

The Kikoff Credit Builder Loan: Kikoff’s FAQ describes a credit builder loan product available to Kikoff users. The site says “…this is an optional add-on for customers that want to build even more credit. This is a 1-year savings plan for $10/month. You’ll be able to add this product after your first payment with the Kikoff Credit Account.”

No other details are provided, but if you have a Kikoff account this would be worth looking into!

How to Cancel Kikoff

Because there’s no fee to maintain the Kikoff credit line, there’s generally no need to close out your account. In fact, it’s probably best to leave it open, as long as it’s one of your older credit accounts.

The length of your credit history is worth 15% of your FICO score, and it incorporates the average age of your accounts, as well as the age of your most recent one. In both cases, older is better, so leaving the Kikoff account open may benefit you. Fortunately, it doesn’t expire.

That said, if Kikoff is bringing down the age of your credit accounts, you may wish to cancel. You can do so by contacting their customer service via email at [email protected]. Unfortunately, Kikoff doesn’t offer phone support.

Kikoff Pricing

Unlike many other credit-building services, the Kikoff Credit Account is almost free of charge. They don’t charge interest on your purchases or fees for the privilege of using the account, besides a $5 monthly membership fee. There’s no charge even if you miss a payment, though they’ll lock your credit line until you make up for it.

Kikoff Customer Reviews

Kikoff began operations in 2019, so they’re a relatively young company. There are a limited number of reviews available and the reviews give very different impressions.

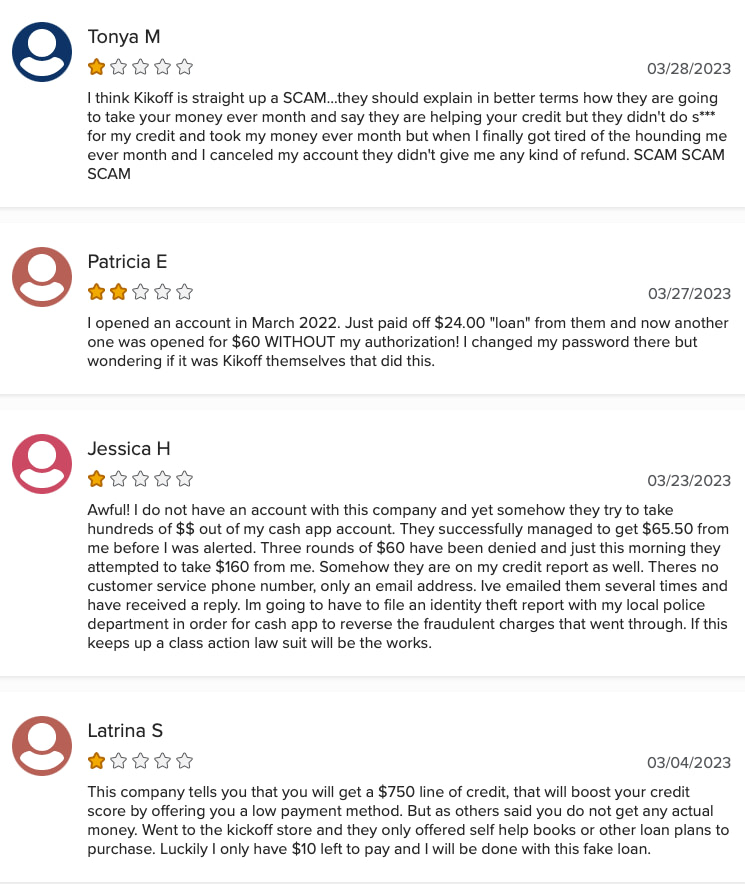

BBB Reviews: Mostly Negative

Kikoff’s file with the Better Business Bureau (BBB) opened on July 13, 2021. Kikoff has a C+ rating and isn’t accredited by the BBB.

There are only 34 customer reviews, and they’re predominantly negative, with a rating of 1.5 out of a possible 5 stars. Here are some examples.

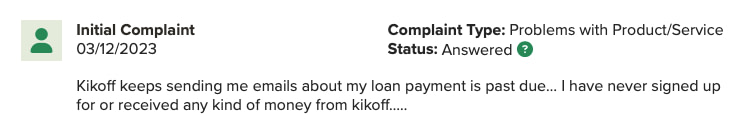

In addition, there are 222 complaints. The complaints are similar, but there’s a recurring theme of complaints claiming that accounts were opened without an application.

It is common for new companies to have customer service issues, but the recurring complaints of credit damage due to erroneously reported late payments and accounts opened without the user’s knowledge are more serious. Kikoff has not responded to the complaints so we don’t know their side of the story.

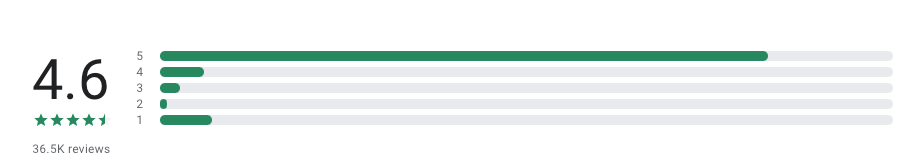

Google Play Store Reviews: Mostly Positive

The Google Play store has 36,5K reviews of Kikoff. The reviews are overwhelmingly positive, with the app carrying a rating of 4.6 out of 5 possible stars.

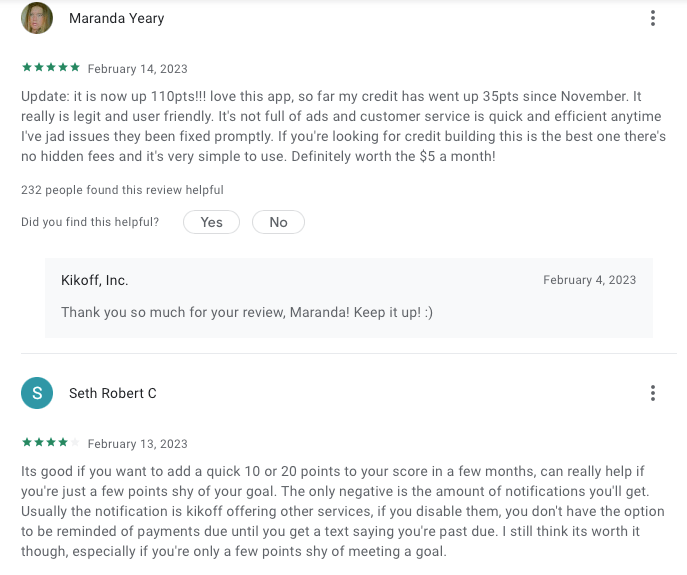

Many of the users report that the service is easy to use and effective.

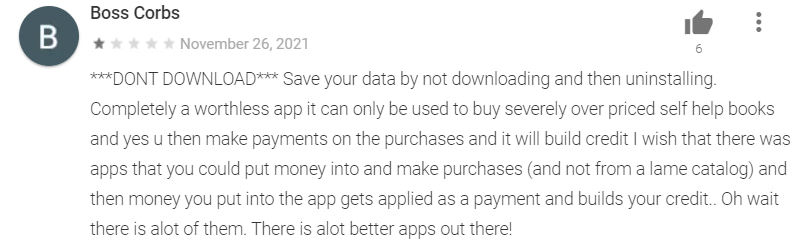

Most of the unhappy customers on the Google Play store are complaining about problems with the app itself. If they take issue with Kikoff, they’re usually disappointed in how the service works in general. For example, they complain that the credit line only works in Kikoff’s store and that it only sells books.

So why the difference in reviews? The Better Business Bureau is typically a place where disgruntled customers go to complain, in hope of getting their issue resolved. It tends to attract negative reviews and complaints.

The Google Play store reviews are much more numerous and overwhelmingly positive, which balances out the smaller number of negative reviews. Still, the complaints about unauthorized accounts and credit damage due to late payment reports are a concern. We’d love to hear the Company’s side of those stories.

Sites Like Kikoff

Kikoff has many competitors in the fintech industry. There are countless companies offering tools, tricks, and services to help increase your credit score. Even if you limit the list to other sites offering cards that build credit with no credit check, there are plenty of Kikoff alternatives. For example:

- Self and Chime offer credit builder cards that use one of their other accounts as an alternative form of collateral

- The Extra debit card is one of the few debit cards that lets you build credit with your purchases

👉 Credit builder loans are another alternative to Kikoff and follow a similar strategy but with installment debt. They typically use your principal balance as collateral, so you don’t get any money until you pay off your balance.

Self offers both a credit builder loan and a card, and you have to have the former to get the latter. Credit Strong specializes exclusively in credit builder loans, and they have many more varieties available.

Is Kikoff Worth It?

Because Kikoff doesn’t require a credit check or charge you anything besides the $5 monthly membership fee, there’s little downside to using the account. You don’t have to sacrifice much to use the service other than the time it takes to sign up.

However, the upside to the account is also limited. For example, you can only use the credit line to purchase e-books from Kikoff’s store. That means you may have to buy things you wouldn’t have otherwise.

In addition, Kikoff only reports your activity to two of the major credit bureaus. If you’re going to use an account whose sole purpose is to build your score, try to focus on ones that report your efforts to all three.

Ultimately, the Kikoff Credit Account probably works out to be a net positive for most users, but it’s not the optimal way to build credit or save money. If you can qualify for a credit card that can finance your day-to-day purchases and earn you some cash back, that’s probably the better option.

Consider using an account meant for people with bad credit or limited credit history before you sign up for Kikoff, such as a secured credit card.

👉 If you’re interested in a secured credit card to establish or rebuild your credit, check out our recommendations for the best options available today: Best Secured Credit Cards of 2023.

FAQ:

Kikoff is available to U.S. citizens or legal residents in 49 states, excluding Delaware.

In order to use Kikoff Credit, you need to sign up for the Kikoff Credit Account. Once you do, you’ll have access to the Kikoff store where you can make purchases. The company will then report your payments to Equifax and Experian.

There are no hard inquiries when applying for the Kikoff Credit as it doesn’t check your credit during the application process.

Kikoff credit can only be used to buy items in Kikoff’s store. The Kikoff store offers books that are typically in the $10-$20 price range.

Kikoff costs $5 a month for the credit service membership. You are not charged interest on your purchases or fees for using the account. No fees will be charged if you miss a payment, though they’ll lock your credit line until you make up for it.