There are many reasons to want a better credit score. One of the most important is to save money by getting lower interest rates on loans and credit cards. As a result, paying someone to improve your credit can feel somewhat counterproductive. Fortunately, it’s entirely possible to build credit for free.

If you’re looking for ways to start raising your scores without opening your wallet, here are some options you should consider.

Best ways to build credit for free:

📘 Required Reading: Before proceeding, make sure you understand credit building basics. If you need it, here’s our introduction to the subject: Credit Scores 101: A Beginner’s Guide

How to Build Credit for Free

Creating a robust credit profile requires multiple credit accounts. If you want to improve your scores as efficiently as possible, aim to take out around three tradelines using the following products.

1. No-Fee Secured Credit Cards

If I could only recommend one solution to people who want to increase their credit scores, it would be secured credit cards. In fact, they’re the only tool I used to establish my credit when I got started.

Call me traditional, but I like the fact that they force you to build your payment history the old-fashioned way. That means spending within your means and making your payments on time. Developing these habits and learning how to use credit cards wisely is essential to increasing your score and maintaining it.

Secured credit cards require you to transfer a cash deposit to the card issuer. It’s usually somewhere between $200 and $5,000. That deposit then becomes your credit limit.

Because you give the card issuer a deposit, they can give you an account even if you have a bad credit score or no credit history. If you fail to pay your balance, they can always use your deposit to cover their losses.

Fortunately, there are plenty of secured credit cards with no annual fee. In addition, most will refund your deposit and upgrade you to an unsecured line once you’ve demonstrated responsibility with the account.

Finally, credit cards have an interest-free grace period, so you can improve your score without paying anything, as long as you make all of your payments on time.

🚀 Take Action

Interested in getting your first secured card? Check out our list of recommended account options:

2. Authorized User Status

An authorized user is someone other than the primary account holder with the right to borrow against a credit card line. Though they’re not legally responsible for making payments on the account, they still get points for its payment history.

Fortunately, becoming an authorized user is usually as easy as having the primary account holder add you through their card issuer’s online portal. There’s generally no credit check involved in the process, and you need only be a minimum age to qualify. You will not need to use the account or even have a card.

As a result, becoming an authorized user is one of the easiest ways to boost your credit score without any additional work. Just keep in mind that if the primary account holder misuses the account, it might hurt your credit.

Some credit bureaus don’t include negative payment history on an authorized user’s credit report, but that’s not guaranteed. Other issues, such as a high credit utilization ratio on the account, could also damage your score.

As a result, it’s best to pursue authorized user status when you have a trusted family member, close friend, or long-term significant other with good credit.

⚠️ Try to stay away from buying authorized user tradelines. Not only do they cost you money, but they may get you into trouble with a credit bureau or card issuer.

3. Grow Credit

Grow Credit is a service that turns your streaming subscription payments into a tradeline on your credit report. Hundreds of subscriptions are eligible, including Netflix, Hulu, and Spotify.

When you sign up, Grow Credit gives you a virtual Mastercard that you can use to pay your subscriptions. Afterward, it’ll automatically deduct the same payment from the bank account you provide during the application.

Because you won’t ever carry a balance from month to month, you don’t have to worry about incurring interest or keeping your credit utilization down. However, if you don’t have sufficient funds in your account when they charge you, they’ll report a late payment after 30 days.

Fortunately, Grow Credit has multiple account tiers, one of which is a free option. It lets you pay up to $17 worth of subscription fees monthly for an annual limit of $204. The higher tiers have an annual limit of up to $1,800. Whatever level you choose, they report to all three major credit reporting agencies, Experian, Equifax, and TransUnion.

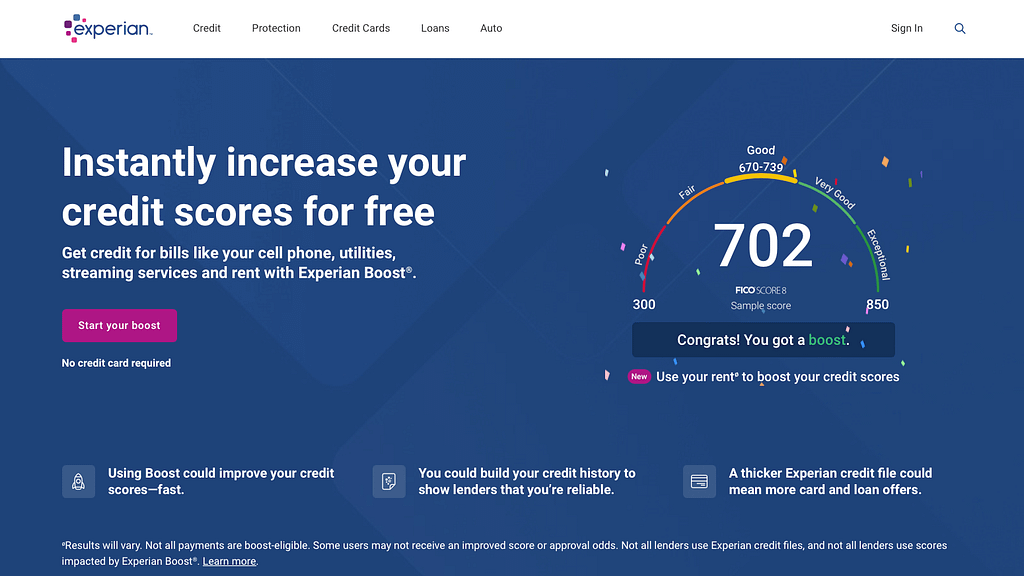

4. Experian BOOST™

Experian BOOST™ is another free service that can help you build credit with payments that wouldn’t otherwise get reported to the credit bureaus. Experian BOOST™ can add phone and utility payments to your credit report.

Once you sign up for the service, connect it to the bank account you use to pay your eligible bills. You can then choose which payment history you want Experian to add to your credit file, ensuring you only report positive activities.

Unfortunately, Experian BOOST™ only adds the data to your Experian report. As a result, your credit scores with lenders who calculate them based on Equifax or TransUnion data won’t improve. That limits the value of the service, but since it’s free and there’s no risk of damage to your credit, there’s nothing to lose from using it.

👉 Note: Each credit score treats payment history on non-credit accounts differently. For example, all FICO Scores give you credit for phone and utility payments if you report them. However, FICO Score 8 and those prior don’t factor in rent payments, even if you pay a rent reporting service to add them to your credit reports.

📗 Learn More: It’s essential to understand how the various credit score versions work and who uses them. Check out our helpful guide to the types of scores: Types of Credit Scores: How Many Different Credit Scores Are There?

5. Sesame Cash Credit Builder

The Sesame Cash Credit Builder (provided by Credit Sesame) is one of several fintech products that let you build credit with a debit card. The account shows up on your credit reports as a revolving line of credit and functions similarly to a secured credit card.

Once you sign up, Credit Sesame gives you a Sesame Cash bank account and a debit card. Next, you’ll need to transfer a cash deposit into the Sesame Cash account, which you can spend using your debit card.

Meanwhile, Credit Sesame will ask you to set a preferred credit utilization ratio for a virtual line. You can’t spend with the line of credit directly. Instead, as you make payments with your debit card, they’ll automatically select some of your transactions and add them to the virtual credit line.

After each billing period, your credit account will show a balance that reflects your specified utilization ratio. Credit Sesame will then automatically pay off the balance using the funds you transferred into the bank account they gave you.

As a result, you don’t have to pay any interest on your balances or risk paying late. There’s also no annual fee, so the product is free. Credit Sesame doesn’t check your credit when you apply, and they report to all three major credit bureaus.

6. Chime Credit Builder

The Chime Credit Builder Card functions very much like the Sesame Cash Credit Builder. It’s essentially a secured credit card with a variable security deposit you can change each month instead of a fixed deposit that’s locked away for an extended period.

To sign up for the Chime Credit Builder, you must first apply for a Chime Checking Account. Once you have it, you can move cash from the Chime Checking Account into your Credit Builder Card each month.

Whatever you transfer over effectively becomes your credit limit on the Credit Builder Card for the period. You can then manually pay off the balance with your allocated funds or set up Chime’s autopay feature, Safer Credit Building, which does it for you.

That protects your credit score and prevents you from having to pay interest on your balances. There’s no annual fee either, so the card won’t cost you anything.

Chime doesn’t report your credit utilization ratio. As a result, you don’t have to worry about how much you transfer in or spend each month. And because Chime doesn’t check your credit when you sign up either, there’s no way the account can hurt your score.

7. Cred.ai Unicorn Card

At its core, the Cred.ai Unicorn Card functions a lot like Chime and Credit Sesame’s credit builder cards. It comes attached to a bank account, and the funds inside that account determine your spending limit.

You’ll never pay interest because you can’t spend more than is in the account or carry a balance over, and there are no annual fees. In addition, Cred.ai reports your timely payments and credit utilization to the three major credit bureaus.

There are a couple of notable differences, including the following:

- Cred.ai automatically pays down your balance throughout your billing period, so you report low credit utilization ratios

- The card’s physical version is solid metal with a unicorn on it, which Cred.ai is inexplicably proud of

In addition to helping build credit, Cred.ai includes some unrelated bells and whistles that we’ve covered in our in depth Cred.ai review. For example, you can use it to access your paychecks early, generate one-time credit card details to protect your data, and manually approve or block transactions.

8. LOQBOX

Most of the solutions on this list are various forms of revolving credit. LOQBOX shows up on your credit reports as an installment loan. That makes it a great option since the diversity of your credit mix is worth 10% of your FICO scores.

LOQBOX functions like a credit builder loan. The difference is that credit builder loans charge you fees and interest, while LOQBOX can be completely free.

When you sign up for the account, you set a savings target for the coming year. LOQBOX then puts that amount in a locked savings account, and you start making monthly payments to “pay off” the balance over the next 12 months. Meanwhile, LOQBOX reports each one to the major credit bureaus.

Payments range from $20 to $200 in $5 intervals, which means you can “borrow” between $240 and $2,400. Fortunately, you can cancel any time during the year without penalty, and LOQBOX will refund you the balance you’ve paid to that point.

The only significant catch is that LOQBOX will charge you a $40 fee on the back end if you withdraw your savings to your own bank account. However, you can avoid that and make the process completely free by opening an account with one of their partner banks and transferring your funds there.

9. SeedFi Credit Builder Prime

Last but not least on our list is SeedFi’s Credit Builder Prime account. It’s very similar to LOQBOX, except it shows up as a revolving line of credit on your credit reports rather than an installment loan.

Once you sign up, you pledge to save at least $10 per month. SeedFi then opens up two savings accounts and a line of credit in your name. Each month, they’ll borrow against the line of credit and transfer the amount you pledged to save into the first savings account.

In December 2022 SeedFi was acquired by Intuit and became part of Intuit subsidiary Credit Karma. The offerings remain essentially the same but are now branded as both SeedFi Credit Builder and Credit Karma Credit Builder.

Next, you’ll place your pledged savings into the second savings account. SeedFi then uses those funds to pay off the credit line and reports the payments to the credit bureaus, helping you build credit.

Like all the other entries on this list, SeedFi won’t charge you interest or fees. However, you can only withdraw savings in increments of $500. For example, you can’t take out anything until you reach a $500 balance. If you continue saving past that, you’ll have to hit $1,000 before you can withdraw the amount over $500, and so on.

It Takes Time to Build Credit for Free

Building credit is something people often try to rush. There are countless articles on the internet about how to do it quickly. However, the strategies they suggest are typically risky, ineffective, and, above all, cost you money.

In practice, building credit takes time, especially if you want to do it for free. It’s a lot like building muscle or losing weight. You can’t really rush it, and you’re probably better off not buying anything from someone trying to sell you a shortcut. So if you’re trying to improve your scores, take your time and save your money.