Compound Interest Calculator

The Compound Interest Calculator below is designed to auto-format values, allowing you to easily change the default settings to suit your specific needs.

Please wait while the calculator loads. You need to have JavaScript enabled in your browser to use this calculator

Please wait while the calculator loads. You need to have JavaScript enabled in your browser to use this calculatorYou can use our free compound interest calculator in order to understand the impact of compound interest on your investments. If you are looking for an investment interest calculator based on compounding, you found the right calculator.

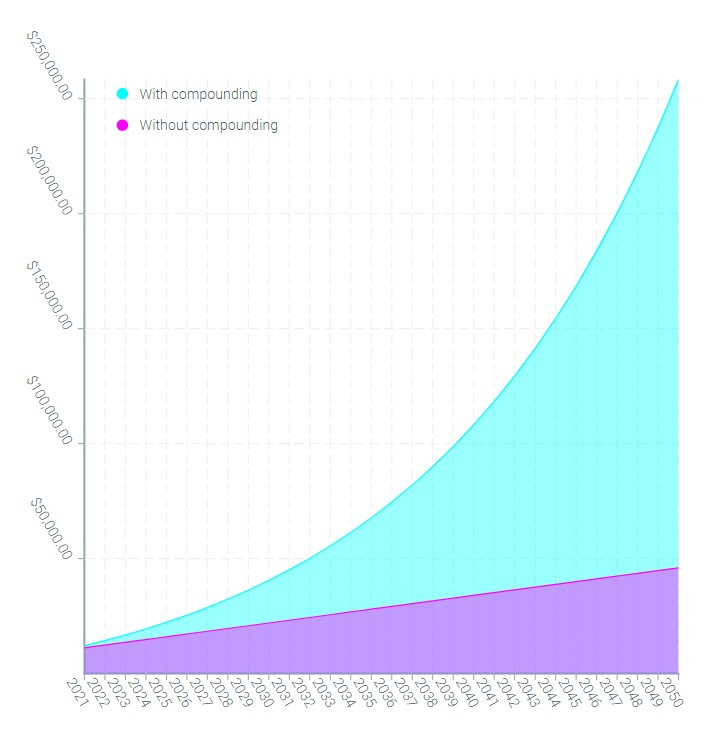

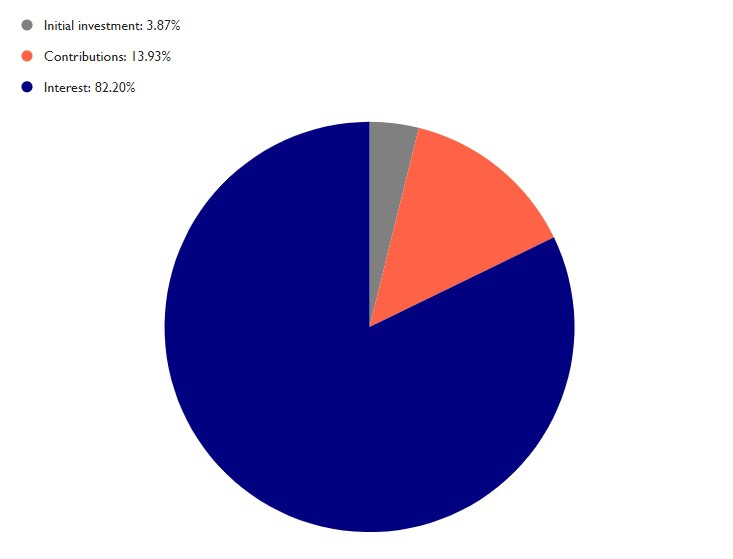

Immediately after the calculator, you can see a chart that displays the difference between compounding interest and just saving your cash, and a pie chart that highlights the weight of the compounding interest in your overall balance.

There are also a number of FAQs further down for your reference.

Disclaimers and Assumptions

When using the Compound Interest Calculator, please understand that’s a model and not a prediction. Yearly returns tend to fluctuate and most financial products provide average returns as guidance.

For example, the S&P 500 index has returned on average around 8% over a long period of time. That doesn’t mean you will receive 8% going forward every year. Some years will be better than others, and the entry and exit points of your investments matter.

The model above assumes the initial deposit is made at the beginning of a year, and each monthly deposit is made at the end of each month. The compounding interest formula does change slightly if you deposit at the beginning of at the end of each month. That said, over a long period of time, the difference in the amounts won’t be significant.

Our model also credits the interest on a yearly basis. Not all financial products will do that, so please take that into account when using the model above.

Why Yet Another Compound Interest Calculator?

There are many compound interest calculators out there, so why did we decide to build yet another one? There are three main reasons.

First off, we are working on a big surprise for you and the compound interest calculator is part of our learning process for that surprise. You can read more about it in the section below.

Another reason is that compound interest charts and tables are powerful ways to visualize how much your investment can possibly grow and compare the amount invested with the amount you earn in interest. It’s a great way to show that money makes money. For more details, please read our use case in the section below.

The final reason why we chose to build this calculator was that we found a few drawbacks on the first search results for compound interest calculators:

- Some calculators have a cluttered UI;

- Many don’t show any charts or tables, which makes it hard to visualize the compound interest effect;

- Some aren’t intuitive to use and try to cater to too many use-cases;

- The monthly contribution field isn’t available in some calculators.

- After trying the same input data in different calculators, we got different results. This means different calculators use different formulas, but many don’t share the formula they use to calculate the compound interest;

- Not all calculators are mobile-friendly.

We built a simple to use, clean, and clear compound interest calculator.

In terms of input, we reduced the mandatory fields to the minimum.

On the output, we show two charts and one table. In the first chart, you can see the growth over time. In the second chart, you can compare how much you will invest with how much you might earn. Finally, on the table, you can see the yearly balance. Each chart and the table have a brief description explaining what they represent.

All of this was built using a simple and intuitive UI. We also mention which formula we use to calculate the values we show, giving transparency to our users.

We also ensured the calculator works well on mobile devices.

That said, we are looking for feedback on it. Please drop us an email or reach out on Twitter with your comments and suggestions!

Use Case

Let’s analyze a scenario where using the compound interest calculator would be useful.

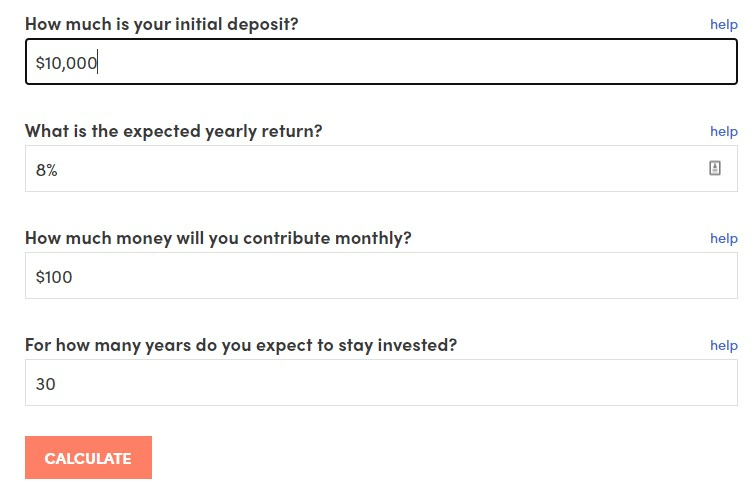

John is planning to invest $10,000 in an index fund for 30 years. Every month, John will invest $100 in the same index fund. Historically, the index fund John wants to invest in returns on average 8% yearly. For this case, we insert the following data in our calculator.

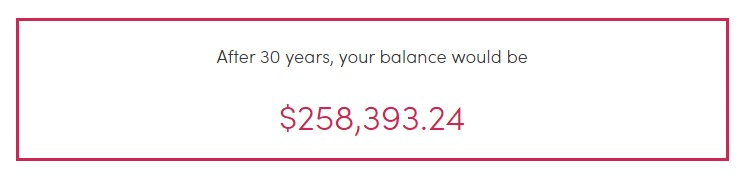

After clicking the “calculate” button, we get our results. At the top of the results, we can see John’s balance after those 30 years.

This is an impressive amount! With an initial investment of $10,000 and $100 a month for 30 years, John’s balance is over $250,000.

In the first chart, we can see that the balance increases faster in the later years. This is the true power of compounding!

In the second chart, we can see that the amount earned in interest is much higher than the amount invested. This is yet another representation of the power of compound interest.

Compound Interest Calculator FAQs

Here are a number of frequently asked questions related to the Compound Interest Calculator.

All you need to do is to fill in the input fields and click on the “calculate” button. You need to fill in the following fields:

– Initial deposit amount;

– Yearly interest rate;

– Monthly contribution (it can be zero);

– For how many years do you expect to stay invested?

Compounding interest is a powerful way to make money. Over time, it leads your investment to exponential growth. If we compare the same amount invested with and without compounding interest, we can see a big difference. Let’s see an example:

– Initial deposit: $10,000

– Yearly interest rate: 10%

– Monthly contribution: $100

– Number of years investing: 10

After 10 years, the balance in the investment account with compounding interest is $47,554.91. Without compounding, the balance would be $22,000.

Compounding interest is the addition of interest to money invested. It is the result of reinvesting interest so that interest in the next period is then earned on the money invested plus the previously accumulated interest.

This calculator is based on a model that considers regular contributions for your investments. The formula contains two parts: one for the initial investment, and another for the contributions. Here are the two:

Compound interest for the initial investment:

Initial Investment x (1 + interest/12 months)(12 months x years invested)

Compound interest for the monthly contributions:

Monthly Contributions × {[(1 + interest/12 months)(12 months x years invested) – 1] / (interest/12 months)}

The final formula is:

[Initial Investment x (1 + interest/12 months)(12 months x years invested)] + [Monthly Contributions × {[(1 + interest/12 months)(12 months x years invested) – 1] / (interest/12 months)}]

When you make a compounding interest investment, the interest you earn is added to your initial investment. Consequently, the interest rate will then be applied to a larger amount – the addition of the initial investment and the interest earned. Over time, compounding interest will lead the initial investment to exponential growth.

$10,000 are deposited in a savings account paying 10% per year and the interest is deposited and reinvested in the same account yearly. Let’s see what the balance is at the end of each year, up until 10 years:

Year 1: $11,047 with compounding and $11,000 without compounding.

Year 2: $12,204 with compounding and $12,000 without compounding.

Year 3: $13,482 with compounding and $13,000 without compounding.

Year 4: $14,894 with compounding and $14,000 without compounding.

Year 5: $16,453 with compounding and $15,000 without compounding.

Year 6: $18,176 with compounding and $16,000 without compounding.

Year 7: $20,079 with compounding and $17,000 without compounding.

Year 8: $22,182 with compounding and $18,000 without compounding.

Year 9: $24,504 with compounding and $19,000 without compounding.

Year 10: $27,070 with compounding and $20,000 without compounding.

10 years later, the balance with compounding is 35.35% higher than without compounding.

This calculator was built using React, which is a modern JavaScript framework for building user interfaces. Therefore, in order to use this calculator, you need to ensure your browser has JavaScript enabled.