Table of contents:

Quick Stock Overview

Volkswagen by the numbers.

1. Executive Summary

A brief discussion of Volkswagen and its potential appeal to value investors.

2. Extended Summary

A more detailed explanation of Volkswagen’s business and competitive position.

3. The Electrification Challenge

Why electrification is Volkswagen’s chance to take the lead.

4. Re-learning to Innovate

Turning VW into an industrial tech company

5. Porsche IPO, Risks and Valuation

The upcoming Porsche IPO, a potential limit to VW’s investment thesis, and a discussion of its current valuation

6. Conclusion

Why Volksagen is worth a closer look.

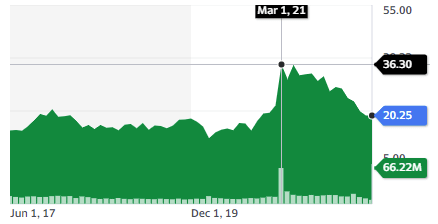

Quick Stock Overview

Ticker: VWAGY

Source: Yahoo Finance

Key Data

| Industry | Automible |

| Market Capitalization ($M) | $102,751 |

| Price to sales | 0.4 |

| Price to Free Cash Flow | 4.7 |

| Dividend yield | 4.1% |

| Sales ($M) | 263,651 |

| Free cash flow/share | $3.6 |

| Equity per share | $28.03 |

| P/E | 5.2 |

1. Executive Summary

Volkswagen is the world’s second-largest car company by revenue, behind only Toyota. The Volkswagen Group consists of ten European brands from five countries: Volkswagen, Volkswagen Commercial Vehicles, Porsche, Lamborghini, Audi, Bentley, Ducati, CUPRA, SKODA, and SEAT.

Volkswagen is the type of company markets have hated for decades. Capital intensive, “old industry”, polluting, based outside the US. Making cars has definitely not been glamourous lately unless you make electric vehicles (EVs). The dominant narrative has been that legacy automakers are doomed to go the way of the dodo birds, replaced by Tesla and its countless copycats.

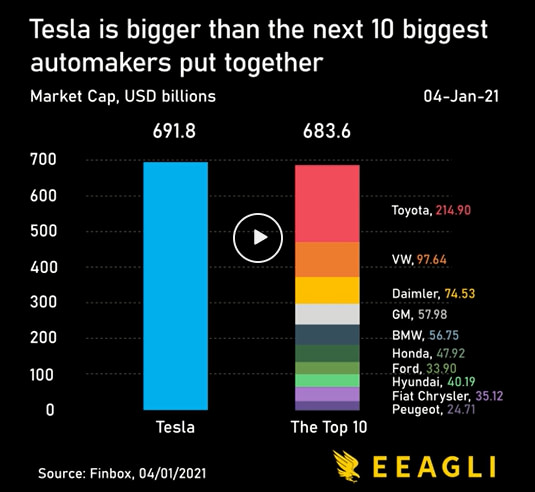

You can see a video of the meteoritic rise of Tesla’s market cap in the tweet here. In 2021, it was as large as that of the next 10 biggest automakers TOGETHER.

I think this is about to change, for the simple reason that the leading automakers are catching up and challenging Tesla’s domination of the EV (Electric vehicles) market. Volkswagen is at the forefront of this shift and is ideally positioned to bring affordable EVs to the market.

The group has the industrial capacity, financial resources, technology, and branding power to manage successfully the transition to electric mobility.

The switch to electric will also provide VW with the perfect occasion to modernize its corporate and financial structure. A lot has been done in this direction already, as you will see in this report. VW has also invested heavily in turning the industrial giant into a tech company, from software to self-driving cars.

Lastly, the VW group might also benefit from the planned Porsche IPO and has other prestigious brands that they could spin off in the future.

None of these developments seem priced in at this point. Tesla skeptics have been beaten down by years of failed shorts strategy, so no one seems to notice that the world’s second-largest car manufacturer is going all-in on electric cars.

This report first appeared on Stock Spotlight, our investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 rational investors!

2. Extended Summary: Why Volkswagen?

The Electrification Challenge

The transition to electric vehicles is the biggest challenge the car industry has faced in decades. Tesla has been consistently leading the pack, creating a moving goalpost for legacy manufacturers. VW is uniquely positioned to catch up and shows early signs of doing so. Competitors are focused on other technologies or ultra-low price ranges.

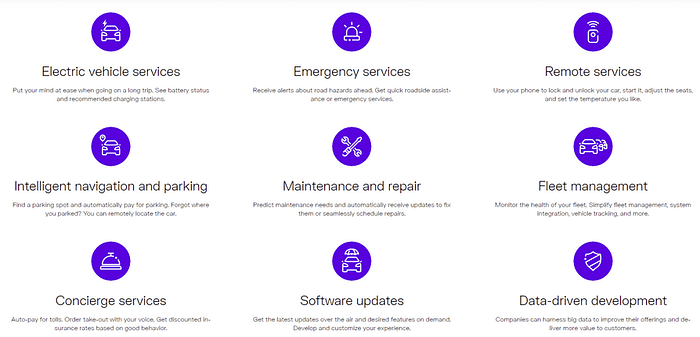

Re-Learning Innovation

VW has built a new ground-up development process for building EVs, which it is sharing across the Company’s different brands. This dramatically increases the synergy between the group brands, reducing waste on redundant R&D. VW is also embracing the future of cars as connected devices, with massive progress on software, dedicated electronics hardware, and investments in self-driving technology.

Porsche IPO, Risks & Valuation

VW plans to sell 25% of its Porsche ownership this fall. Half of the proceeds will be used to finance electrification, half distributed as a special dividend. The VW group’s brands are likely to command a premium when trading separately.

VW risks are mostly related to actual and potential supply chain problems. A recession would obviously hurt as well, but valuation and earnings seem in line with the 10-year average and do not reflect the highs of a cycle.

3. The Electrification Challenge

One Battery To Rule Them All

If you are following financial markets, I doubt you have missed the hordes of devoted Tesla investors. Tesla’s value has recently reached a point where it was worth more than the entire traditional car industry.

The picture is very different when we look at the number of cars sold. With the industry churning out a total of around 70 million units/year in 2021, the 1 million production capacity recently reached by Tesla seems a lot less impressive.

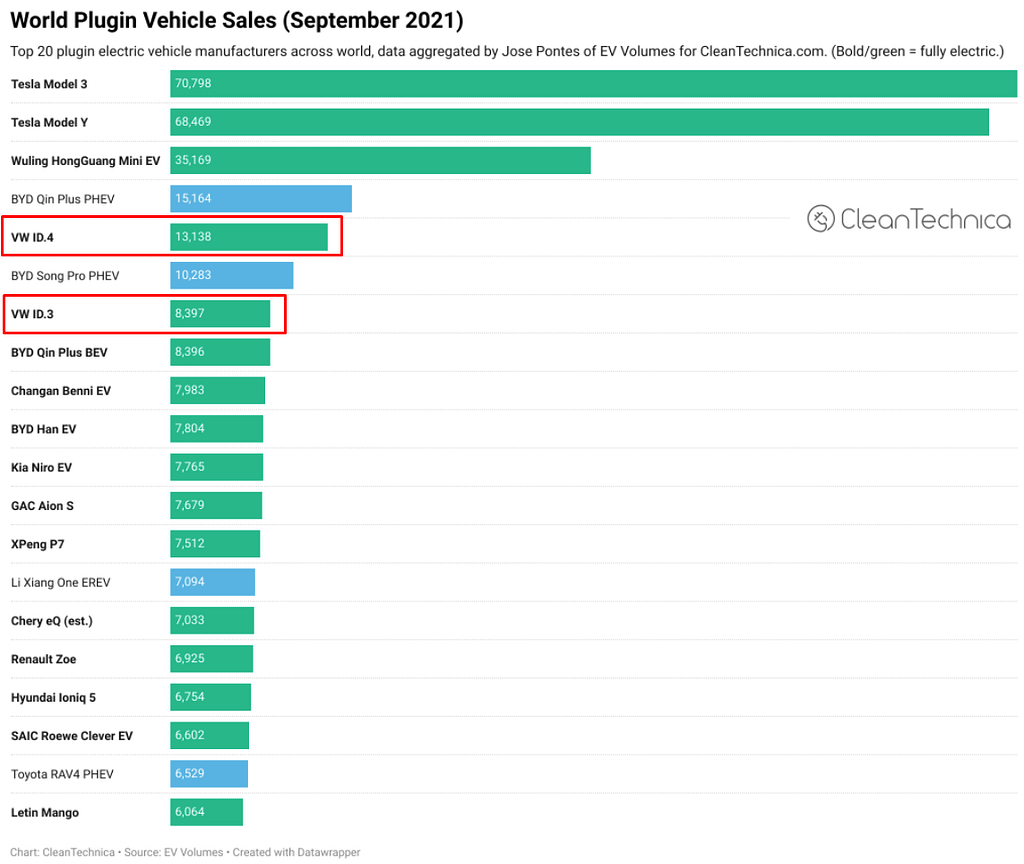

Of course, Tesla’s market cap is predicated on the assumption that traditional automakers will never catch up with the EV market leader. So let’s look at the latest EV sales numbers. The image below from September 2021 would indicate that Tesla indeed still completely dominates the industry.

I highlighted VW electric cars. You can see that besides an ultra-low-cost “soapbox” car from China, VW was the second-best behind Tesla, but still far behind.

But this is old news. The ID.4 is quickly rising as a serious competitor, with sales up 65% in Q1 2022. At 30,300 units sold, the ID.4 is now above every other model but Tesla models 3 and Y. You can see a review of the ID.4 in this article.

The ID.4 starts at $40,760 in the US, significantly cheaper than Tesla’s cheapest entry, the Model 3, which starts at $48,440.

More importantly, the ID.4 was less than a third of the VW group sale of EVs. The VW group sold close to 100,000 EVs in Q1 2022, spread out between Audi e-Tron, Porsche Taycan, etc. Each of those is of equivalent quality to Tesla’s luxury models. It probably could have done even better, but “VW supply of EV for the US market ran out“.

Altogether, The VW group EV sales in Q1 2022 are roughly 1/3 of Tesla’s sales. If market caps followed EV sales volume, VW should be valued at $276B, compared to the current $118B.

VW also delivered 1,800,000 traditional cars in Q1 2022, or x18 of its EV volume. I would not base a VW valuation on Tesla, clearly an overvalued company, but still, it put things in perspective.

Is Tesla the Apple of Automakers?

If you need to remember only one thing from this report, remember this section. When studying Tesla, the best parallel would be Apple. Fanatical supporters, high prices, top-level tech, and sleek or surprising design. And that is alright. I think this is the perfect niche for Tesla, and judging by Apple’s history, it could be a very profitable one.

If the smartphone market is a good indication of the future of EVs, this means a counterpart to the Apple strategy. You could as well identify and buy the future Samsung, which slightly outsells Apple in total unit number.

| Apple / Tesla | Samsung / Volkswagen | |

|---|---|---|

| Product numbers | Few, driven by new interaction | Very large, cover any use case |

| Technology level/Performance | Always at the top | From cheap to good enough to high tech |

| Pricing | Higher range | From cheap to high-end |

| Branding power | Maximal | Well known but not outstanding |

| Corporate nature | Founder-led, focused on innovation | Faceless, large old corporation, with multiple brands or activities |

| Competitive advantages | Low marketing cost Brand power High margins | Large industrial capacity & experience Plenty of cash flow Cost-efficient R&D and production |

The Apple/Tesla strategy is a powerful one. It is also a limiting one. By tying so much of the product and brand to luxury and identity, it locks itself out of parts of the market. A low-cost iPhone wouldn’t be a “real” iPhone. It seems the road to a $25k Tesla is similarly slow. The “cooler” cybertruck is going to arrive before the “boring” semi-truck (a project lingering in Tesla limbo since 2019) or “just cheap” models.

Volkswagen (whose name means “the people’s car”) doesn’t have such a problem. It can commercialize cheaper and mid-range models under the VW, Seat, and Skoda brands. It sells sports cars under Porsche and luxury models under Audi, Lamborghini, Bentley, and Cupra. If it wants to, it even can enter the market for electric bikes with Ducati. It also provides electric versions of its Scania trucks, MAN buses, and VW commercial vans.

For a perfect illustration of how VW is creating casual vehicles that fill niches unfit for the Tesla brand, we can look at the reimagined iconic VW van ID Buzz.

So if Tesla is the Apple of EVs, Volkswagen has the potential to become the Samsung of EVs.

It will likely be the master of the mid-price range section for EVs, while also taking a sizeable chunk of all the other sectors, from low-cost to luxury and sport. This should be helped by the arrival of multiple new products, notably the ID.5, ID Buzz, and Long-range Aero, but also the cheaper ID life.

The Other Competitors

The automotive industry is a rather fragmented one, and I expect it to stay this way. For example, I expect at least one of the Big 3 (GM, Ford, Chrysler) to stay important in the US market and be joined by Tesla on top of that market.

Judging by this list of the cheapest EVs, with Mazda, Kia, Nissan, and Hyundai, the low range segment is likely to be controlled by Japanese firms. This leaves VW virtually alone in the profitable mid-range segment.

I also expect the Chinese and Southeast Asian manufacturers to take over the niche of the ultra-cheap market, below $15k-$20k EVs. In that segment, we will also find Renault-Dacia with the Duster Spring. Their small batteries will confine them to urban and suburban usage.

The one competitor that could or should have been a serious threat to VW was Toyota. It had the critical mass, reputation, and resources to duplicate VW and even beat it. Instead of competing head front on battery EVs, though, Toyota seems to believe in a focus on hybrids and even hydrogen. Depending on the speed of the electric transition, this might prove a uniquely insightful strategy or a terrible blunder.

This is nevertheless the biggest threat to VW in the future, probably much more than Tesla. I encourage any investor in VW to pay close attention from 2025 onward to Toyota’s progress on solid-state batteries.

You will notice I did not mention other pure EV startups. This is because after Nikola’s outright fraud, the closest contender, Ford-backed Rivian, is in freefall after failing to ramp up production. Simply put, making cars is a tough business, and there is a reason why there were very few new entrants in the markets in the last decades.

4. Re-Learning Innovation

Re-Mastering the Art of Automaking

By its own admission, VW was too slow to react to the trend of electrification. It is now working overtime to correct that mistake. In part, its attention was distracted by fighting a rearguard battle against pollution control on diesel cars. This led VW to falsify pollution reports in a scandal now known as the Dieselgate.

The scandal resulted in costly fines and several executives were arrested or fired. It also pushed VW to embrace the EV revolution. The company was punished with $2.7B in damages but was also forced to invest $2B in clean emission infrastructures. You can read more about the turn to electric vehicles from the company’s CEO in this interview.

VW is an expert at making great ICE (Internal Combustion Engine) vehicles. So it needed a few years to learn how to transfer this expertise into electric engines. The skills were already there for great steering, gearboxes, brakes, suspensions, and all the other components that go into a modern vehicle.

Until now, VW has essentially been a conglomerate of brands. Each of the brands had its own designs, with limited overlap. This led to a very complex supply chain with, for example, hundreds of different gearboxes. The switch to electric has become an opportunity to redesign ALL the VW group’s new cars around common core hardware and software through the shared Scalable System Platform.

This is now handled by the newly formed Volkswagen component Group division. Management seems confident that they can strike the fine balance between keeping brands uniqueness and common designs:

“There are a lot of similarities which we can leverage in scale — even more so on the software side. If you drove an Audi or Porsche and Volkswagen today, you would probably have different hardware and software for navigation, for climate control, and even for the window lifter. That’s not necessary. … Software offers a huge opportunity for economies of scale, still allowing for brand differentiation.

Now, a Porsche can remain a Porsche, even better than today. An Audi can remain an Audi, and Volkswagen will offer a broad range of products, but the basic software stack can be very, very similar. Software is relatively expensive in automotive. Now it’s a one-time expenditure. … We think that we have a good chance to also become very competitive in software if we build a common basic software for all the brands. “

Embracing the Digital Revolution

Dieselgate was the shock VW needed to turn toward the future. Its innovation is focused on 3 areas: Batteries, Software, and Autonomous Driving

Batteries

VW is developing a hybrid solution between complete reliance on large third parties (CATL, Panasonic) and Tesla-style vertical integration. Its 2 main partners are smaller battery manufacturer NorthVolt and QuantumScape, a solid-state battery startup. It was considering an IPO for its battery division in 2021 but that seems to be on the back burner for now, with the Company focusing instead on the Porsche IPO (more on that later).

VW is also investing heavily in startups with valuable technology. For example, a $400M investment in Group14, replacing the traditional graphite anode in lithium-ion batteries with a silicon-carbon material, is boosting battery capacity by 50%.

VW’s low-carbon profile is also helped by investment in new facilities, notably $10B in solar-powered factories in Spain for electric cars and batteries.

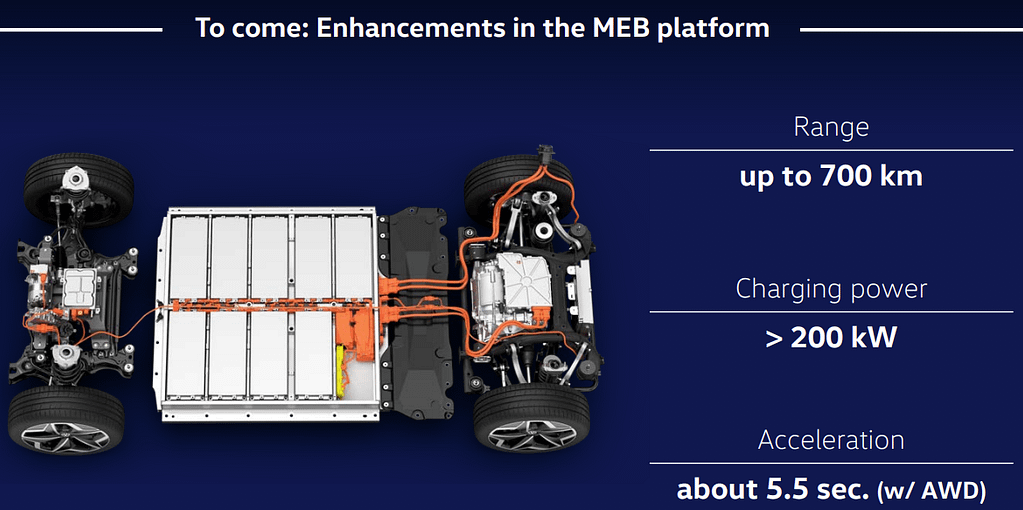

The end goal for VW is to keep the high acceleration performance of EVs while also having very long range and fast charging. All of these will probably be fully achievable only when solid-state batteries are fully implemented.

Software and IT hardware

The CARIAD division is in charge of developing a group-wide software stack, to be used by all VW brands by 2025-2030. This will make all VW cars connected devices, following the footsteps of the On-the-Air updates by Tesla. It also handles the design of dedicated hardware allowing the removal of up to 1 kilometer of cable per car compared to previous designs.

Autonomous Driving

VW is partnering with and investing in Argo AI to develop autonomous driving solutions. Autonomous driving is a contentious topic among tech enthusiasts. Some expect it yesterday, others see it at best 15 years in the future. Considering the constant delays of Tesla Full Self Driving, it seems a tough nut to crack. You can read more about Argo AI methods in this interview with its CEO.

The ride pooling solution MOIA and its dedicated 6-seater are planned to complement the autonomous driving solutions.

VW’s approach is a cautious one, focusing on limited autonomy in a defined area, and expanding slowly from there. The cultural difference between US startup culture (the hare Tesla) and German industrialist (the tortoise VW) is probably at play here.

Our aim is to be able to drive a car as Volkswagen. We have two areas: one is pushing robotaxi technology with Argo. This involves shuttle services, limited areas, relatively slow speeds — they are typically ODD, which is learned and programmed. Then it goes area by area and city by city. The other way we are pushing is private mobility: we have the Audi team and CARIAD team working on that because we think that autonomous driving will not only cover this area of robotaxis, but also private cars. Step by step: first we tackle driving at level three or level four on open highways — German autobahns — and then we get into more complex areas.

The Verge

5. Porsche IPO, Risks & Valuation

Porsche AG IPO

A side notice: I am speaking of Porsche AG, the company manufacturing and selling the Porsche cars. Don’t confuse this with another company, Porsche SE. Porsche SE is the holding of the Porsche family, which owns a large part of VW, which in turn owns Porsche AG, the car company. Quite confusing I know. Welcome to German corporate structures.

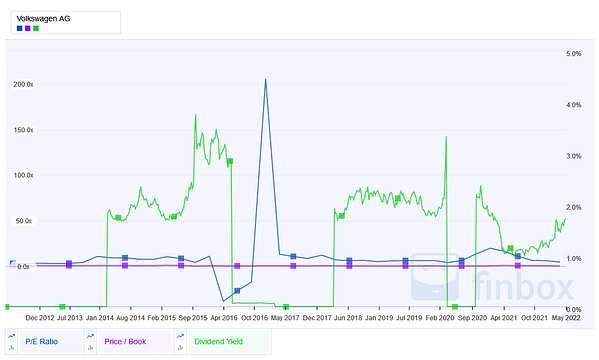

VW acquired Porsche AG in 2012 and is planning the sale of 25% of the Company this fall. Porsche AG has recently shown a great gross profit margin of 18.6%. The intended pricing of the IPO is not yet clear. For example, Mercedes, BMW, and VW trade at 5-6x earnings; Ferrari at 40x earnings. So the multiple on Porsche earnings will be a major factor. The idea behind the IPO is to let Porsche AG trade at luxury/supercar multiples, instead of “boring” large automaker multiples.

At a middle ground P/E between Ferrari and German automaker, this would give Porsche AG a valuation of $84B. Even at half of that, a $42B would be a significant part of VW’s $102B current valuation. Plenty of debate exists about VW’s ability to lift its current “conglomerate discount”. The second part of this article provides more information on this issue and will help you form your own opinion.

Half of the proceedings of the IPO will be distributed to VW shareholders, and the rest applied to advancing VW’s electrification plans.

Other Brands?

No plans have been announced for a similar IPO for the other luxury brand in the VW portfolio. Nevertheless, if the Porsche IPO is a success, I could easily see Lamborghini, Audi, Bentley or even Ducati receive the same “25% sold in an IPO” treatment. This would help price discovery for these brands/companies, while still maintaining VW’s total control over the brands.

This is not as far-fetched as you could think. Last year, VW received a $7.5B offer for Lamborghini for example. VW refused the offer.

Risks

VW’s plans for electrification are the main attraction to the stock. Whichever of the top 5 legacy automakers will manage the electric transition will reap outstanding rewards. Nevertheless, the industry is facing quite a few headwinds:

Recession Risk

After one of the longest bull markets in history, rising rates, inflation, and war in Europe have all contributed to an increased risk of a global recession. The automotive industry is notoriously cyclical. All the recent high profits of VW and its competitors should be taken with a pinch of salt. We might be at the highs of the economic cycle, and car sales in the next few years might turn out lower than hoped.

Energy Costs

VW is a German company, and exploding energy costs in Europe are a real concern. The company is producing outside of Europe as well, but this can still hurt its home market disproportionately. If Russian gas stops flowing entirely because of the Ukraine war or sanctions, this would likely cause exploding prices for energy-intensive materials like steel and batteries.

Supply Chain Disruption

This one is less a potential risk as an ongoing concern. It also applies to most VW competitors. Chip shortages have plagued automakers for 2 years now. The recent wave of Chinese lockdowns is not going to help improve the supply chain either.

On top of that, a cheap but essential component, a wiring harness, was mostly supplied from Ukraine.

Supply chain issues limit production, and output levels are likely to be disappointing in 2022. I expect VW to handle it better than its smaller competitors, but this might still hurt sales volume.

Lastly, some supply issues might emerge in the long run. The supply of lithium, copper, cobalt, and nickel might be too short to cover all the batteries automakers are planning to build. New mines might take 10 years to get operational, so this is a serious risk. In that respect, VW might make a good pair in a portfolio with the miner Rio Tinto (covered in a previous report a few months ago). The rising costs of VW would be Rio Tinto’s profits, reducing the overall risk of the portfolio.

Valuation

An investment in VW is a bet that the company emerges on top of the electrification trend, or at least as a major player. Due to Toyota’s focus on hybrid and alternative fuels like hydrogen, I think this is likely. The persistent delays in an affordable Tesla car, build quality issues, and branding issues, make Tesla at most an equal, but not the domineering force people think it is. I think the recent ID.5 sales volume reflects this change in consumer perception when it comes to EVs.

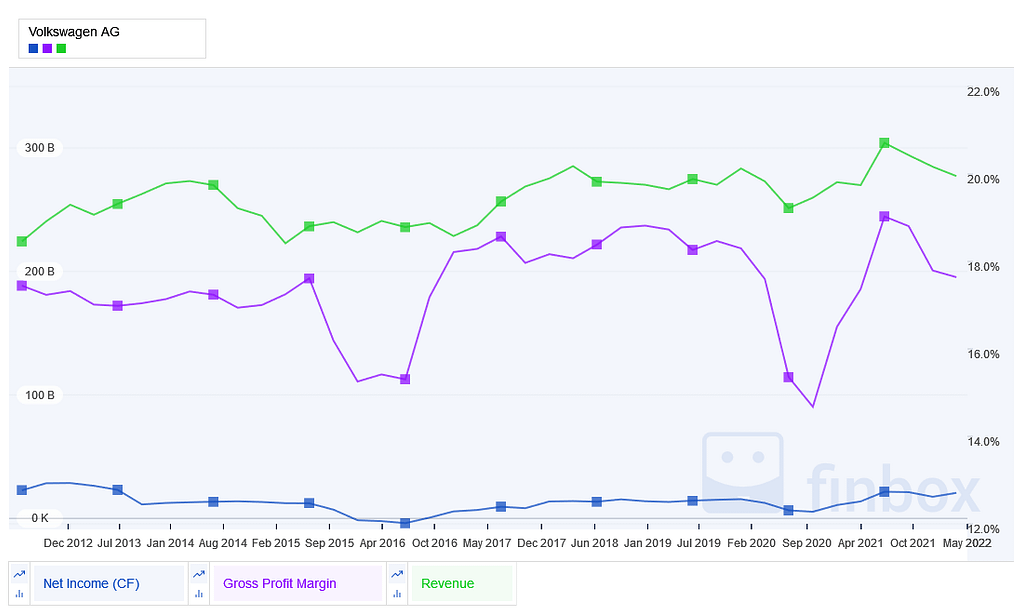

With a P/E of 5.3 and a price to free cash flow of 4.3, it would be tough to argue that VW is overvalued. My main concern would be for this coming from abnormally high earnings or revenues in the last few years.

Looking at the past 10 years of revenue, net income, and profit margin, I do not see anything out of line. Only drops in 2016 (DieselGate) and 2020 (Covid) break the trend. VW is a very steady and stable company. I am also pleased to see that net income is stable even with the massive investment in electrification.

This is not a company that will see a 10x rise in value. But it gives a small dividend and might be much more stable than other overvalued portions of the market. A company with a major focus on software, electrification, and self-driving is also offering the low valuation of an aging industrial giant.

As we move to bear market territory, will market perception change from looking for risky hypergrowth to stability. You could argue that it’s already happening. If it does, VW stock will be there to capitalize on it. The Porsche AG IPO is another possible catalyst, with the special dividends seemingly not priced in.

In my view, if you’re considering adding a company like VW to a portfolio, the main focus should be on providing less volatility to the portfolio while retaining the potential for decent returns. Dividends and stable net income should provide that, given the low multiples. Short of a brutal worldwide recession, VW should provide decent returns, with a chance of a stock price surge driven by positive EV sales and production figures or a successful Porsche IPO.

The risk with these old industrial giants is the possibility that they will be caught unaware of a technology shift. You don’t want to end up owning the next Kodak all the way to zero. Considering the efforts VW has put into modernizing its line and innovation, I am confident they will benefit from the EV trend instead of being harmed by it.

6. Conclusion

Volkswagen is the type of investment that will probably never provide the highest returns in a portfolio. It is a safer, more mature type of company, reducing overall volatility. I would not necessarily have looked deeper if it was not selling at a rather cheap price.

On top of the price, I am appreciative of the strategy. The company did not rush into electrification, but when it decided to do the switch, it did it right. The product performances in mileage, quality, and price show a level of engineering equal or superior to Telsa, the market leader. The only maybe lagging part, software, is catching up at a breathtaking speed.

Developing the ID.4 and ID.5 was a massive endeavor in design, battery technology, electric engine, and specific parts like gearboxes. This EV expertise acquired in mid-price cars can now be brought quickly to all price ranges, as well as commercial vehicles, trucks, buses, or even bikes.

I expect VW scaling up electric vehicles will catch most observers by surprise. The EV market got used to seeing the opening of a new Tesla Factory on a new continent as big news. With companies of the scale of VW entering the market aggressively, this will be a common occurrence.

VW will also be able to draw from its almost 2 million traditional cars per year sales to finance the transition. Its “legacy” operations also give it access to a very deep pool of talented engineers, designers, researchers, designers, testers, etc, whose skills can relatively easily be repurposed for EV models. The same old true for brand strength, PR contacts, and sales networks.

The ability to still make money for ICE (Internal Combustion Engine) cars while turning to EVs seems especially useful for me. If the transition to EVs turns out slower than expected, or raw minerals for batteries are too rare or expensive, VW can simply slow things down a little and keep making money selling the cars that made the business strong for decades.

Lastly, the rich panel of brands in the VW group could be a source of hidden value. Luxury or sports brand tends to trade at a premium. After Porsche, VW could progressively consider IPOs for Lamborghini, Bentley, Audi, and Ducati. I suspect that the parts are worth more than the market value for the whole group together.

Using the Porsche IPO as a template, VW keeping 75% ownership would allow just enough price discovery, while keeping the brand safely at home. They will all benefit from the Group R&D and common base architecture for the transition to EV. This is something independent supercar companies like Ferrari could not afford without becoming over-reliant on third-party suppliers.

Finally, self-driving solutions contain a lot of options. I suspect that even if Argo AI turns out not to be the best technical solution, its methods will appease regulators better than Teslas. No one wants 2-tons of metal driving around by itself without enough data and feedback to be sure it’s safe.

So I expect the adoption of self-driving cars will be slow for regulatory reasons no matter how good the tech is. It will only be adopted on highways and well-known routes at first (like between airports for example) and expand from there. A reputation for slow and steady corporate methods seems more appropriate than the somewhat reckless and brash style of an Elon Musk.

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in VWAGY or plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this article.