Table of contents:

Quick Stock Overview

Bayer by the numbers.

1. Executive Summary

A brief discussion of Bayer and its potential appeal to value investors.

2. Extended Summary

A more detailed explanation of Bayer‘s business and competitive position.

3. RoundUp on Legal Issues

A recap of Monsanto acquisition and Roundup trials.

4. Bayer Profile

An overview of Bayer’s business model and its unique competitive advantages

5. Financials

Bayer by the numbers: balance sheet, free cash flow, and a high dividend yield

6. Conclusion

Why Bayer is worth a closer look.

Quick Stock Overview

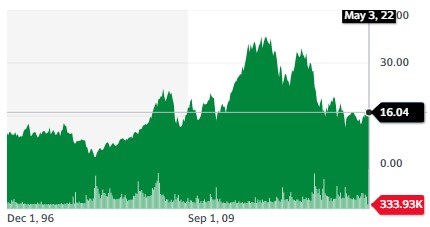

Ticker: BAYRY

Source: Yahoo Finance

Key Data

| Industry | Healthcare/Agriculture |

| Market Capitalization ($M) | $71,274 |

| Price to sales | 1.5 |

| Price to Free Cash Flow | 26.2 |

| Dividend yield | 3.1% |

| Sales ($M) | 48,715 |

| Free cash flow/share | $0.70 |

| Equity per share | $9.12 |

| P/E | 64.9 |

1. Executive Summary

Bayer is a German juggernaut in life science. Bayer is a very well-established company, operating since 1863. The company operates in the agriculture and pharmaceutical sector. It evolved from producing dyes to other chemicals and then pharmaceuticals.

Since 2000, Bayer has refocused its activities around life sciences, spinning off branches involved with plastics (Lanxess AG) and material sciences (Covestro). The sales and spin-off financed the first acquisition of Schering AG, a pharmaceutical company initially pursued by a hostile acquisition from Merck, for €14.6B.

In 2018, the German company merged with the American Monsanto, another leading agricultural business established in 1901. The deal was enormous, $66B, compared to Bayer’s market cap at the time of $88B.

The merger quickly went wrong, with Monsanto getting sued over allegations that its flagship product, the herbicide Roundup, causes cancer. The following negative press led to a crash in Bayer’s stock price and a November 2020 low of a $46B market cap. Today, the market cap of the merged company has partially recovered to $73B but is still below the pre-acquisition value. This compares to the estimated theoretical value of $177B of the combined companies.

The current stock price is explained by the lingering risk of legal action and settlement costs. In this report, I will argue that the market is likely overestimating this risk, ignoring recent developments, and ignoring the long-term strengths of the company’s products and R&D pipeline.

It also ignores the multiple secular positive trends in Bayer’s markets, as well as the dominant positions (number 1 or in the top 3) it holds in them.

The company’s stock has finally started to wake up in the wake of a growing realization of the vital importance of agriculture and food production due to the Ukraine invasion. With food prices rising, agro-businesses are becoming a trendy sector, with fertilizer companies seeing often stock prices up x2 or x3 in just a few months.

By comparison, Bayer stock has still barely gone up, still below its June 2020 levels. I believe that the combination of the following factors will make Bayer a strong buy-and-hold stock for the decade to come:

- Limited future damage from the already partially settled lawsuits.

- Dominance over the agro sector.

- Strong pharma products and R&D pipeline.

- Durable OTC pharmaceutical catalog.

- Secular trends supporting each of the 3 branches (agriculture, pharmaceuticals, OTC).

This report first appeared on Stock Spotlight, our investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 rational investors!

2. Extended Summary: Why Bayer?

The Monsanto Acquisiton

By acquiring Monsanto in 2018, Bayer became by far the largest agribusiness firm in the world, dominating the sale of herbicides, pesticides, seeds, and other agricultural products. It also inherited a wave of lawsuits accusing Monsanto’s flagship product of causing cancer. After a stock crash and $16B in provision for damage later, the company is finally seeing the end of the tunnel, with 80% of cases already settled.

The Business Behind the Controversy

Bayer is a global leader in crop sciences. It is also a profitable and steady pharmaceutical company. It is also the home of OTC pharmaceutical brands like Aspirin, Alka-Seltzer, Bepanthen, and Claritin.

It should become even more dominant in agriculture and keep growing in pharmaceutics from its massive R&D and investment program. Synergies from the Monsanto acquisition are still ignored by markets.

Bayer’s Financials and Valuation

Bayer’s profits are yet to fully recover from the Roundup crisis. Nevertheless, the company is now priced lower than before the $66B acquisition, despite the legal costs being mostly already paid. It is also in a perfect position to respond to the increasing demand for more food production, as well as the ongoing food crisis developing from the Ukraine war.

3. Roundup Of Legal Issues

A Brief History of Monsanto

I must warn you, Monsanto, and by extension now Bayer, is (was?) something of a caricature of the “evil” corporations as imagined if you are leaning left politically. I will refrain from giving my personal opinion about Monsanto and simply declare that indeed, some of Monsanto’s past actions are dubious. It was involved with various toxic (or used in overseas wars) and now banned products, like DDT, PCB, white phosphorus, and Agent Orange.

In more recent years, the company refocused its chemical expertise toward agricultural products like herbicides and pesticides, as well as GMOs (Monsanto was the first to create a GMO plant in 1983). For some people, this might make Monsanto extra evil. As a former plant biochemist before I studied financial analysis, I am rather favorable to GMOs as long as the right precautions are taken. They can drastically reduce the use of dangerous chemicals, and the gene modifications are not so different from other ways to create new varieties. But again, I can understand the discomfort that many people have with the topic.

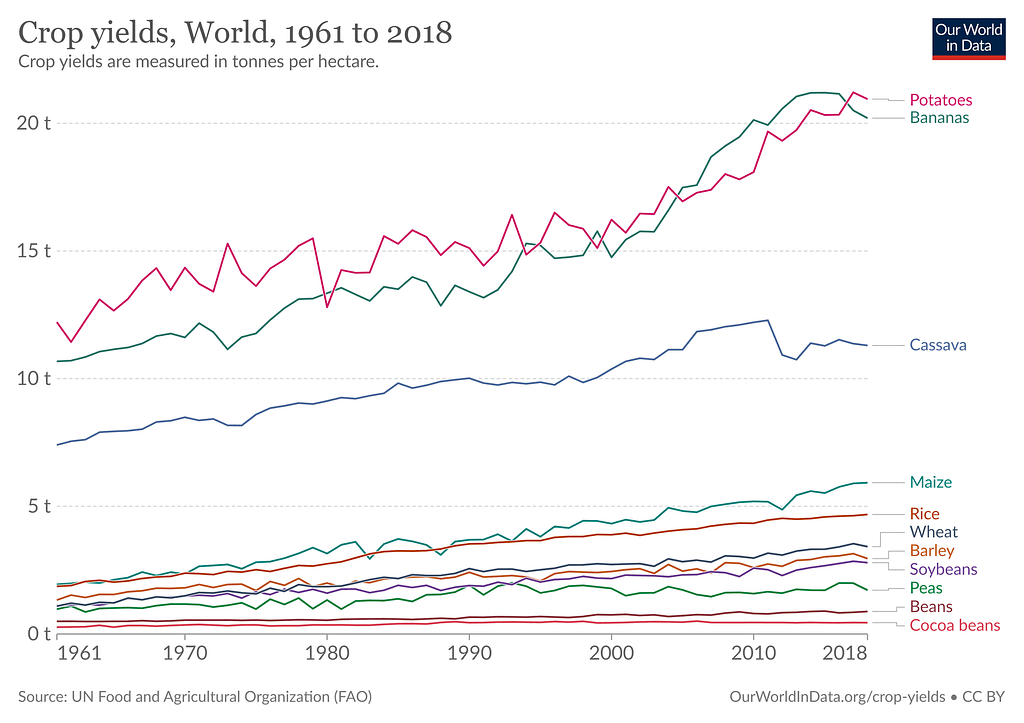

Many investors might feel that Bayer is not an ethical investment. Still, I would like to play the devil’s advocate, and discuss the benefits of modern agriculture. The last decades have seen the world population exploding. Despite that, hunger and starvation have generally receded, even if not fully eliminated yet. This was largely due to steady growth in crop yield for staples like potatoes, maize, rice, wheat, soybeans, etc…

Contrary to common misunderstanding, such progress was not easy or just the result of fertilizer application. The Green Revolution is the only reason why the apocalyptic predictions of the 60s and 70s happened to be wrong. Notably, Paul R. Ehrlich, in his 1968 book The Population Bomb, said that “India couldn’t possibly feed two hundred million more people by 1980“.

Between 1975 and 2010, the population of India doubled to 1.2 billion, reaching the billion mark in 1998. The 1,352,642,280 Indians alive today have companies like Bayer and Monsanto to thank for proving Ehrlich wrong.

Many agricultural chemicals are inherently somewhat toxic. This is true for herbicides and pesticides. But I would argue that the chemicals which powered the Green Revolution have saved a lot more lives than they killed. And if properly used, their dangers can be managed.

Glyphosate’s Magic and Dangers

The Magic Crop Yield Booster

If you know something about farming or gardening, you know that keeping a crop alive and optimally growing is a constant war against weeds. Other plants would like to use the soil and sunshine and replace our corn, bean, or wheat crops. Applying herbicide is always somewhat tricky as you want to kill the weed, but not the crop one centimeter away, and chemical molecules generally don’t care about the difference.

This is why glyphosate and GMO glyphosate-resistant plants were such a game-changer. Monsanto discovered glyphosate in 1970 and started commercializing it in 1974. It was a powerful herbicide that quickly became one of the most used herbicides in the US and the world. Commercialized under the Roundup brand, it produced a significant portion of Monsanto’s revenues.

This is when plant genetic modification came into play. By inserting a gene in a plant, making it resistant to glyphosate, Monsanto created corn, maize, cotton, and other crops that are insensitive to the herbicide. This allowed the free use of the herbicide in the field during the growing season, keeping the land fully utilized by the crop and not the weeds. Overall, GMO crops, glyphosate-resistant, and other GMOs created a jump in yield from 6%-25% depending on the country.

The Dangers

The problem with glyphosate was not its efficiency, but its toxicity. While toxic in high concentrations, glyphosate had been deemed safe for use in fields by regulatory agencies. Most notably, it was declared “not likely to be carcinogenic to humans.” by the EPA.

Nevertheless, doubts remained about the link between cancer and the controversial herbicide. Virulent opposition to the type of intensive farming it empowered made the debate extra partisan, as GMO plants and herbicides are viewed by many as evil in themselves.

Nevertheless, upon further investigation, significant doubts persisted and it is now admitted that at least some level of exposure is likely to increase the risk of cancers. You can learn more about it from Bayer here.

Court Cases & Consequences

Just when the acquisition by Bayer was closing, Monsanto lost a lawsuit in June 2018. A 42-years old had got himself covered in Roundup after a malfunction of his sprayer. He later developed non-Hodgkin’s lymphoma. The courts considered Roundup was a likely cause and awarded the plaintiff $289M. This was followed by quite a few other lost trials.

Quickly after, the number of plaintiffs swelled dramatically, reaching up to 125,000 people. Obviously, if each of these cases was awarded tens or hundreds of millions in damages, this would be much more than Monsanto-Bayer could ever pay. So instead of valuing the merger’s synergies, markets started to value the company as a dead man walking.

4 years later, the situation and risks are a bit clearer. 100,000 lawsuits have been settled, for a total of $11B. This leaves roughly 25,000-30,000 lawsuits left. The court case is now likely to involve the Supreme Court. Bayer has already put aside $16B to cover the claim.

Will $16B be enough? I consider it nearly impossible to put certain probability or cost on the leftover cases. Previous settlements put the average lawsuit cost at $110,000, so leftover claims would be $3.3B. Bayer provides its side of the trial and its plan to end all future litigation here.

And I am not a legal expert, so I will not venture into judging the fairness of these court cases. I however believe a historic parallel in financial history can be illuminating: the history of cancer trials against tobacco companies.

“The first big win for plaintiffs in a tobacco lawsuit occurred in February 2000, when a California jury ordered Philip Morris to pay $51.5 million to a California smoker with inoperable lung cancer.”

Nolo.com

The situation was similar, with an initial big win by the first successful plaintiff seemingly indicating a cost so high it would for sure destroy all tobacco companies. Similar claims of manipulation of sciences, willful misinformation, and failure to warn the public were made as well.

In that situation, you could expect tobacco companies to have been terrible investments in the last 2 decades, right? So why is Altria, one of the largest tobacco companies, #24 in the rank of the “best 30 stock in the past 30 years“?

The fact is that the cost of the trial was grossly overestimated and the persistent demand for tobacco products was grossly underestimated. This resulted in tobacco companies being consistently one of the best possible investments for the last decades, sitting neatly together with Apple, Alibaba, Berkshire Hathaway, and Tesla.

I suspect the situation is similar for Bayer when it comes to litigation costs. The company has settled 80% of the cases for $11B. I imagine the $5B leftovers in provision should be approximately enough to cover the rest.

Don’t get me wrong, I think the company should pay up if it did wrong and caused cancer. But contrary to tobacco companies, it did not provide a toxic, addictive drug and hide the risk. It provided a very useful product key in keeping worldwide famine at bay, that after review by the EPA was considered to be not carcinogenic. Bayer’s main products, seeds, pharmaceutical treatment, and aspirin also do not cause cancer. So the business model as a whole was never in danger, contrary to that of tobacco companies.

Overall, I think most of the damages by the Glyphosate/Roundup trials are already done. Former shareholders of Bayer have paid for it. Newcomer investors will just get a great company at a discount if they are ready to brave the incertitude of the last 20% of cases not settled yet. So how strong is the rest of the company? This is the topic of the next chapter.

4. The Business Beyond the Roundup Controversy

Bayer’s Agricultural Dominance

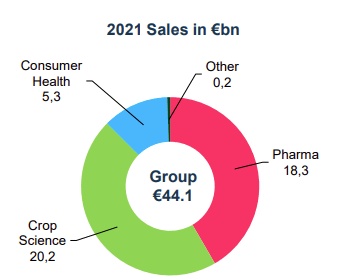

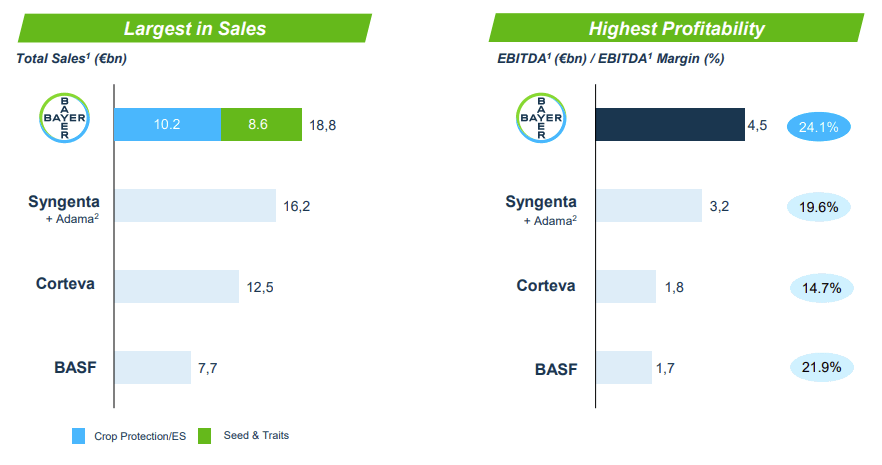

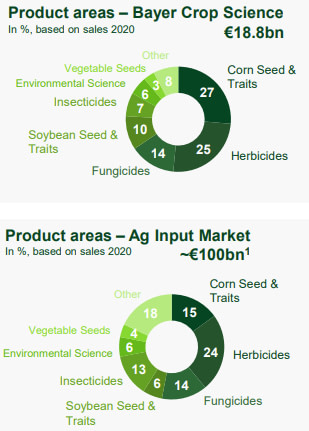

Growing food is a complex business. It requires the right seeds, pesticide, herbicide, insecticides, fertilizers, irrigation, tractors, soil, rainfall, etc. Currently, the crop sciences department is roughly 45% of Bayer’s sales and EBITDA.

The company is also the uncontested leader in this sector. Margins are solids and also the highest among the other industry leaders.

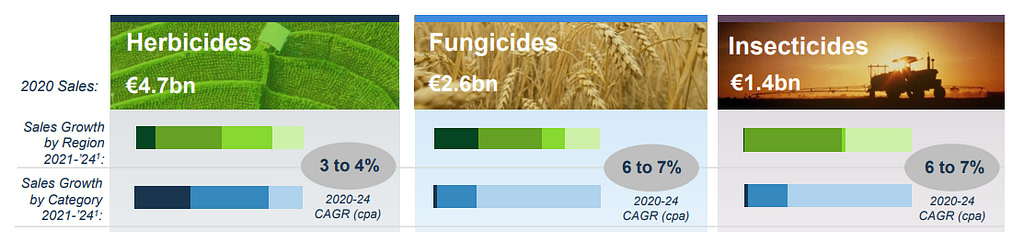

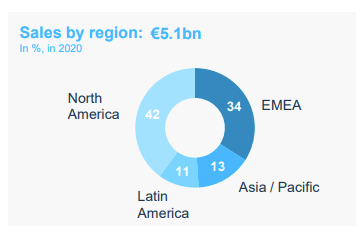

It is #1 in market position for corn and soybean seeds, #1 for herbicides, #2 for vegetable seeds and pesticides, and #3 for insecticides. The business is truly global, with an equal split between EMEA, Asia, North America, and South America.

Most farmers of key crops trust and rely on Bayer products for their next harvest. In a business vulnerable to drought, flood, storm, machinery breakdown and market fluctuation is it very important to know that at least risks from seed quality, pest control, and weed control are predictable. This means that farmers will not easily change suppliers or try other products, and will instead stick to what worked so far.

While Roundup does not make up the totality of the Bayer herbicide line, it is a large part of it. So it is important to check if the worst-case scenario of a ban on the product could lead to problems. Herbicides are a large segment of the crop science division, but still only 25% of the whole (and so 10% of the company’s total sales only). Overall, Bayer could take a hit up to 5% of total revenues from a total, worldwide Roundup ban, but it would not be dramatic.

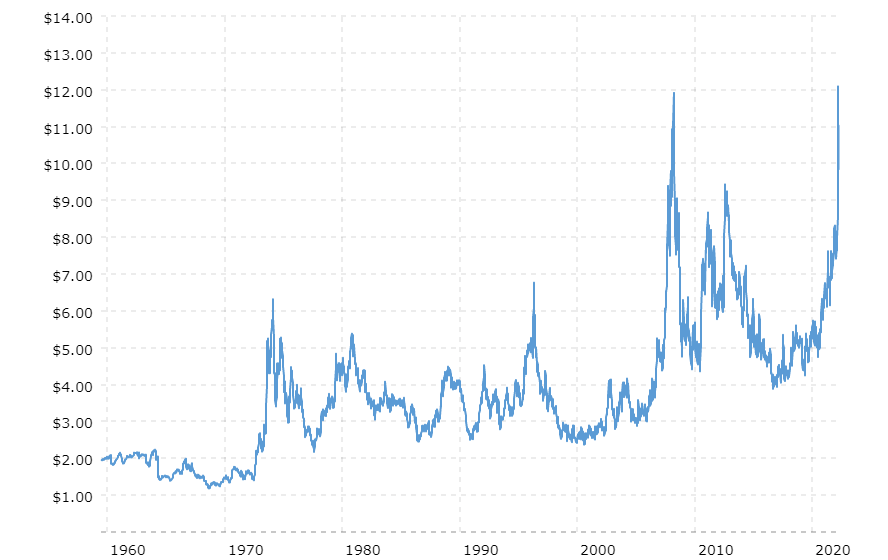

Following the FAO projections for 2050, in 30 years we will need 50% more agricultural production (food, animal feed, and biofuels) while compensating for a 20% reduction of arable land by capita and 17% harvest loss from climate change. This leads to a 100% jump in crop demands at least. And this was before geopolitics threw a wrench in the world’s food supply. We can look at the recent response to the Ukraine war from wheat prices vertically rising to see how unstable it could be during worsening shortages:

The last time food prices spiked up this much, they triggered the Arab Spring revolutions, destabilizing the entire region. Bayer expects consistent sales growth at 3-7% until 2024 depending on the product categories. And again, this forecast was before the current looming food shortage from war and embargo.

Another factor that is still developing is the synergy between Bayer and Monsanto. Bayer used to be most dominant in Europe, while Monsanto was dominant in the USA. They also had no large overlap in crop type (Bayer with a focus on cereals, Monsanto on corn). By leveraging each other’s sales and distribution networks, it is likely that both Monsanto and Bayer products will achieve higher market penetration in both USA and Europe.

The growth will be driven by both the general market growth and new product lines, notably insect and herbicide-resistant soybean, short-stem corn, RNAi insect-resistant corn, etc. Overall, Bayer has 500 new varieties of corn, soybean, cotton, and vegetables in preparation. Of which 5 new traits (like new resistance to specific insect species for example). On the chemical side, 300 new crop protection registrations are awaiting approval.

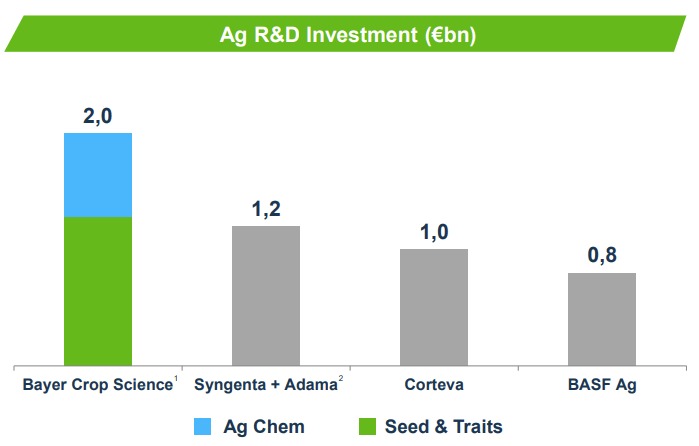

The superior market position and margin have allowed Bayer to outspend its rivals on R&D, with a total investment as high as its next 2 largest competitors. The flood of new seed, resistance, and crop protection products is evidence of that R&D dominance.

The Pharma Business

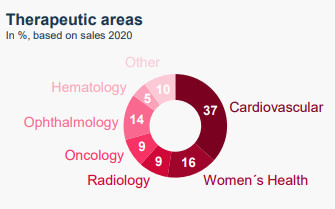

With all the talk of Roundup trials, seeds, and pesticides, the crop science division takes the spotlight away from the equally large pharmaceutical component of Bayer. The company has a diversified portfolio, with a focus on cardiovascular and women’s health.

The sector is attractive, with high margins and long-term positive trends. The aging population, rising access to healthcare in the developing world, and digitalization are all trends supporting the pharmaceutical business.

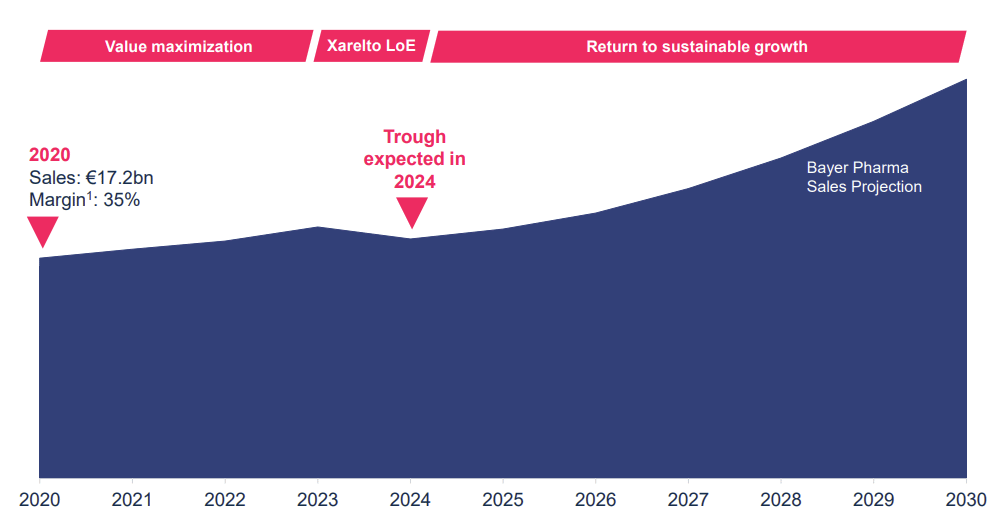

The near-term future of the company will be affected by the loss of exclusivity (patent expiring) of its flagship product, the anti-blood clot drug Xarelto. The company is forecasting a decline in sales during that period before the new product lines arrive in the market and restart growth.

Xarelto’s decline might even be less dramatic. Finding new use cases or getting approval for a new type of patient is a classic way for pharmaceutical companies to extend the value of expiring patents. New applications extending the exclusivity might still increase Xarelto’s residual value, like the recent US approval for the treatment of children and the 2 years extra of patent protection by the EU for the 1/day formulation.

Around 5 products (2 cancer drugs, 2 cardio, and 1 women’s health) are expected to come into the Bayer treatment portfolio, with an average Peak Sale Potential (PSP) of $1B on average. PSP represents the estimated peak maximum annual sale for a product (most pharmaceutical products will be covered by a patent exclusivity for 10 years or so). Interestingly, Nubequa’s PSP has recently tripled to $3B. You can see more about the approval of these new drugs on the news section of the Bayer website, notably Vitraki in China, Kerendia in Japan, and the EU.

The company is also investing heavily in long-term R&D and technology able to create new classes of treatments, like RNAi, RNA-SMOLs, PROTACs, AI, gene therapy, and cell therapy.

The pharma division is likely to somewhat stagnate for the few years ahead, but should not experience negative impacts either. It is likely to bring value only from the 2026 period onward when the most innovative treatments like gene therapy and RNAi enter more advanced stages of clinical trials for yet incurable diseases.

Over-The-Counter (OTC)

Bayer’s pharma division covers patented drugs used under medical supervision. The OTC or Consumer Health division produces drugs you can buy without a prescription, very often older with a patent that expired a long time ago. This means that any pharmaceutical company can manufacture the active molecule and sell it. This does not mean that branding and marketing cannot help the legacy products to continue dominating the market once the patent is expired.

The OTC department, or Consumer Health, is managing the sales of such products. You are actually likely to know some of Bayer’s products and have them in your medicine cabinet. Many are old drugs with a stable market and faithful customers. The staying value of OTC brands is best illustrated by Aspirin, around since 1898. There are plenty of functionally equivalent pills of acetylsalicylic acid, but only one Aspirin. Most people are fine paying $0.3 extra more for the “real one”.

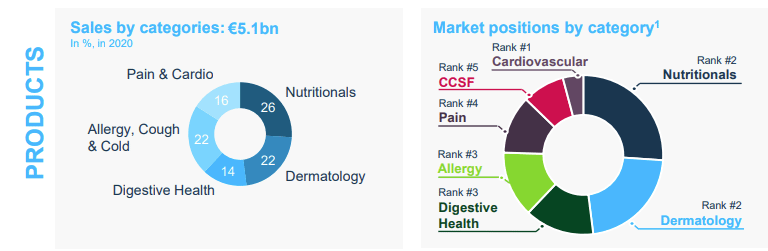

Here too, Bayer is among the top players worldwide, notably #1 in Cardiovascular OTC products (likely building on the expertise and reputation of its pharma department) and #2 in Nutritionals and Dermatology. Allergy, digestion, and pain raking are pretty good too.

To keep growing the OTC segment, Bayer is looking to boost the higher margin e-commerce sales from 7% in 2020 to 15% and more by 2024. It was just 3% in 2018, so the growth target feels reasonable, especially with the pandemic having boosted online adoption.

Consumer health is a slowly growing business, at 3-5% per year. Additional growth might come from new markets like China, India, and SE-Asia, as Asia represent only 13% of OTC sales at the moment.

Inter-Division Synergies

At first glance, it can feel that Bayer is 3 different companies grouped together without much coherence. But this is ignoring that biology & medicine are not separate fields. When Bayer develops new technology or insight about RNA, it can be used to create RNAi maize, resistant to a specific type of fungus. Or it can work on new RNA-SMOLs technology to develop a whole new drug category. More importantly, the ideas and challenges of the plant team might help the progress of the pharma team.

At this level of technicity/abstraction, the best researchers for both agro and pharma divisions have similar profiles. An expert on organic chemistry can work in both fields. So a strong HR department able to find/poach them for both divisions at once will come in handy.

Similarly, producing a massive amount of a specific chemical, be it aspirin or Roundup, require strong in-house technical skill. The scale of operation also helps with cheap and efficient procurement of the required pipes, curves, bioreactors, and other advanced pieces of equipment needed to run chemical plants.

And last but not least, the merging of the different branches allows sharing of the corporate overhead costs. For a life science company, this is not only the offices, the headquarters, and the accounting department. The sector is highly regulated and requires a lot of legal expertise. So these synergies also cover the legal teams, lobbyists, regulatory affairs, medical marketing department, medical representatives, pharma representatives, clinical trials, toxicology, etc.

There have been calls by investors to split the company into its parts for years. That might create value for shareholders in the short term but I suspect that as a long-term shareholder, you might be better off if they stay together.

Partnerships & Venture Capital

Digitalization is the last aspect where Bayer divisions work well together. I mentioned personalized medicine, and access to medical data will be an important aspect of consumer health in the future.

This is equally true in agriculture. With the Bayer-Microsoft partnership that just got signed, Bayer will leverage Microsoft Azure cloud technology to power their agricultural technology revolution and provide a framework for companies working with agricultural data. This includes data on crop yield, satellite imagery, carbon emissions, farm supply chain, and much more.

Another partnership with a tech giant was the collaboration with Alibaba on the use of blockchain in agriculture.

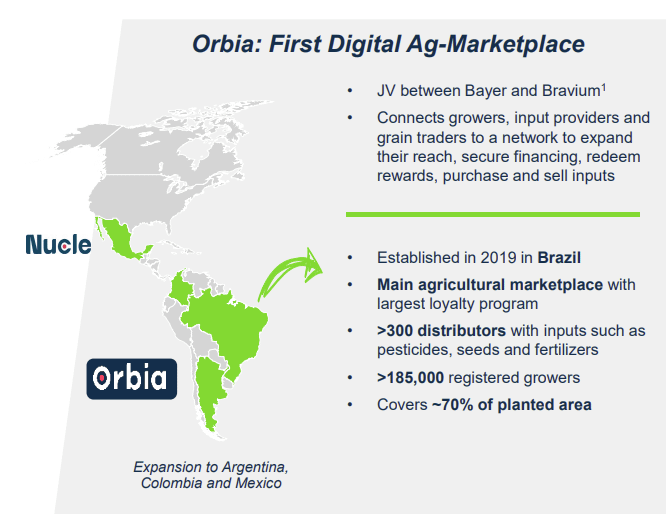

Another project is the first digital agricultural marketplace, in partnership with Bravium, a Brazilian marketing agency. These are still in the early stages, but they are examples of the potential Bayer’s scale can create.

Bayer’s investment in innovative solutions for agriculture and health does not stop there either. The Leaps by Bayer program invests in a multitude of startup and tech companies in these fields.

You can see the full portfolio here, including drone cop spraying, vertical farms seeds, soil mapping, carbon capture, mental health AI, stem cells therapies, machine learning drug discovery, AI-assisted diagnostic, or a biotech startup incubator in Israel.

Studying the venture investment portfolio of Bayer could probably be a full report in itself. For now, let’s consider it as a cherry on the cake on top of the core businesses.

5. Financials

Balance Sheet

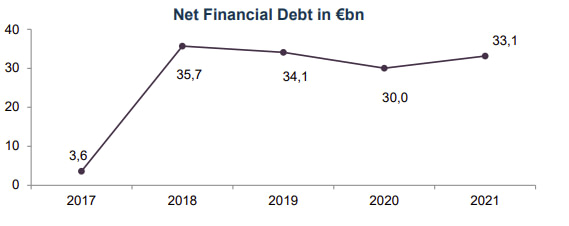

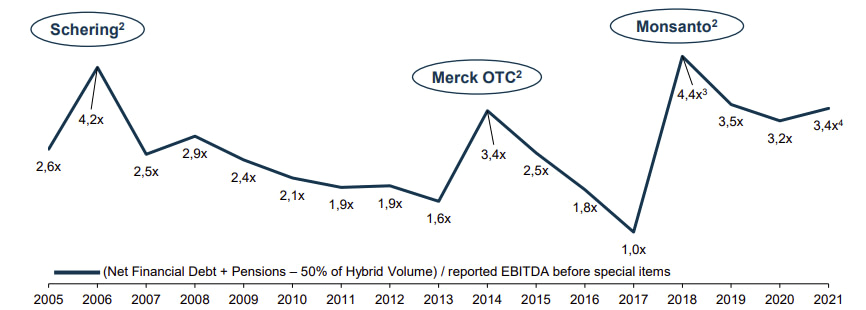

Considering how troubled the Monsanto acquisition was, this feels like a good start for studying Bayer’s financials. The acquisition increased the company’s net debt drastically, from almost zero to €35B. Considering it also came with almost €20B worth of litigation costs, this was a very expensive acquisition.

This increased the leverage of the company, in a similar way to what previous successful acquisitions did, like Schering in 2006 and Merck OTC product line in 2014. What changed this time is that Bayer failed to quickly work on reducing its leverage right after.

The tens of billions of euros put aside for litigation were presumably money initially intended for reducing debt. Now that only 20% of lawsuits are left and a large cash allocation is in place to cover them, the threat of excessive debt can be reasonably treated as minimal.

2022 Outlook

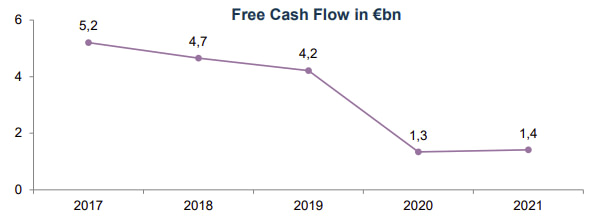

After an okay 2021 year, 2022 is expected to bring growing earnings per share and free cash flow. This would bring the free cash flow toward a more normal, pre-crisis level, even if there is still a long way to go.

| 2020 | 2021 | 2022 (outlook) | |

|---|---|---|---|

| Revenues | €41.4B | €44.1B | €46B |

| Core EPS | €6.4 | €6.5 | €7 |

| Free cash flow | €1.3B | €1.4B | €2.0-€2.5B |

| Net debt | €30B | €33B | €33B |

On a side note, Bayer just announced it will also get extra cash from selling its non-crop business, like forestry, for $2.6B. This should reduce the net debt by 10% and help focus the company’s agro division on farming only.

Valuation

With a current price to free cash flow ratio of 26, Bayer seems fairly valued, but not cheap. Of course, if its free cash flow would return to just 2019 levels, this would more than halve this ratio and make it very cheap for a growing company of this size. But this is hope and hardly constitutes a margin of safety. The current 3% dividend yield is equally nice to have, but not enough by itself. The extra costs from the Roundup trials are obscuring what real profitability might be.

I think where the company shines in the value of its assets. Remember, both pre-crisis Monsanto and Bayer itself were worth as much as Bayer’s market cap today. Essentially, markets are valuing the new Bayer as if the Monsanto division was entirely worthless.

We are slowly sliding into a global food crisis while I am writing this report. Grain and oil exports from breadbaskets of Russia and Ukraine threaten to be poor to non-existent. But you also have Serbia, Bulgaria, and Hungary banning grain exports. Argentina is limiting exports of soy. Indonesia, producing 1/3 of the global cooking oil supply, just banned all palm oil exports as well.

Considering the broader context, I think Bayer agribusiness is undervalued. Especially considering that governments all over the world are likely to start subsidizing fertilizer/pesticide/herbicide/seed purchases to keep yield up and social order stable. The combination of Monsanto and Bayer’s pre-existing crop business will be at the forefront to keep yields up and starvation at bay.

I expect this change of context to also change Bayer’s perception by the public, politics, and investors. We observe a similar phenomenon with fossil fuels. In October 2021 at the Cop26 conference, they were evil and “with no future“. Only 6 months later, Western leaders are making desperate pleas for OPEC to increase production. Shortages of vital commodities have a way to make everyone a hardened realist quickly.

Besides the agro-business, Bayer pharmaceutical sales, OTC sales, and venture investment all have significant upside potential. R&D spending and startup investing have stayed steady and created a massive pipeline of new products in both medicine and agriculture.

At the current price, you get a growing blue-chip company at a reasonable valuation. Any extra upside or positive surprise comes “for free”:

- Smaller costs than expected for leftover RoundUp cases.

- Synergy from fusing together of Monsanto & Bayer sales network.

- R&D success from Monsanto & Bayer research projects merging.

- Larger than expected addressable market from drugs in development.

- Prolongation of existing drug patents through new applications.

6. Conclusion

Bayer is a complex case study. The Roundup trials make it looks, on a surface level, like a tobacco company. This actually would make a good case for investing in it considering the tobacco sector’s track record, but might still scare off most investors. It is also a successful pharmaceutical company solving life-threatening ailments. And it is a household brand of consumer products, holding onto century-old brands like Aspirin.

I think the company’s scope and complexity are what lead investors to reduce it to a simpler, but inaccurate narrative. “Bayer the pharmaceutical company” became overnight the “Roundup/cancer trial company“. I would not be surprised in 2022-2025 to see Bayer becoming the “food growing/crop yield company” while the shocks of the Ukraine war still echo. And maybe, later on, the “growing pharmaceutical company” back again, going full circle in narrative over a decade.

After the lows of the last 2 years, Bayer stock has started to rebound. The fading away of out-of-control trial settlement risks is the first catalyzer for a re-pricing. The food crisis and a global realization of the importance of basics (food energy, defense) over the superficial (software, media, etc.) is the extra catalyst to power this turnaround.

In previous reports, companies have been presented as belonging to a firm investing category and strategy. But Bayer resists this categorization.

- It is a growth company, compounding steadily through R&D and acquisition for over a century.

- It is a defensive stock, a pharmaceutical blue-chip with high-quality patents and century-old OTC brands.

- It is a deep value asset play, with unloved, ignored valuable assets.

- It is a turnaround story, emerging from the Roundup crisis not nearly as damaged as everyone assumed.

- And it is a macro/geopolitical play, capitalizing on worldwide dire demand for higher and reliable crop yields.

- It is a leading AgriTech and MedTech incubator for groundbreaking technologies.

I think this has left many investors confused and not daring to try to understand such a complex situation.

As I see it, a company that is simultaneously undervalued, turning around, growing, and carried by geopolitical tailwinds seems like an interesting bet on the future.

Even if some of these angles about Bayer turn out wrong, we just need a few to be right at current prices. Of course, only time will tell.

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in Bayer or plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this article.