Table of contents:

Quick Stock Overview

Rakuten by the numbers.

1. Executive Summary

A brief discussion of Rakuten and it’s potential appeal to value investors.

2. Extended summary

A more detailed explanation of Rakuten’s business and competitive position

3. Investment Thesis

Why I see potential in Rakuten stock.

4. E-commerce Segment

The core business that built Rakuten justifies the Company’s valuation on its own: the rest is thrown in for free.

5. The Mobile Conundrum

The controversial segment that has dropped Rakuten’s valuation, and why that probably won’t last.

6. An Exportable Tech Expertise

An offshoot of the mobile expansion that has already generated a $2 billion contract in Germany and offers further export potential.

7. The Rakuten Ecosystem Moat

How Rakuten leverages its omnipresent position in the Japanese market to achieve an unbreakable moat.

8. The FinTech Segment

Japan lags behind the rest of the world in fintech growth. Rakuten is poised to dominate as fintech catches up.

9. Conclusion

Why Rakuten is worth a closer look.

Annex: VC, Foreign Acquisitions and Content

Rakuten businesses that are difficult to value reliably but which any potential investor should consider.

Quick Stock Overview

Ticker: RKUNY / 4755.T

Source: Yahoo Finance

Key Data

| Industry | Internet retail |

| Market Capitalization ($M) | $12,892 |

| Price to sales | 0.9 |

| Price to Free Cash Flow | 7.3 |

| Dividend yield | 0% |

| Sales ($M) | 14,002 |

| Net Cash per share | $6.20 |

| Equity per share | $6.46 |

| P/E | – |

| Free cash flow/share | $1.15 |

1. Executive Summary

Rakuten is the largest e-commerce company in Japan, the 3rd biggest economy in the world. In most countries, this position would allow the company to trade at very expensive multiples, riding a global boom in valuation of established tech companies.

With only a $12B market cap, the company is tiny compared to Alibaba ($339B) or Amazon ($1579B). Amazon’s revenues are 33.6x Rakuten’s, but its market cap is 122x larger.

At a price to free cash flow ratio of 7.3 and price to sales ratio of 0.9, Rakuten is far from bubble territory.

| Rakuten | Amazon | Alibaba | |

|---|---|---|---|

| Market cap ($B) | 12.9 | 1579 | 339 |

| Revenue ($B) | 14 | 470 | 128 |

| Price to free cash flow | 7.3 | – | 13.9 |

| Price to sales | 0.9 | 3.4 | 2.2 |

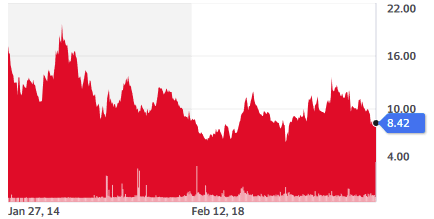

Market negativity toward Rakuten is mostly linked to its expansion in the unprofitable mobile services segment. Investors have widely judged it a strategic mistake that caused the company to lose large amounts of money in a capital-intensive sector.

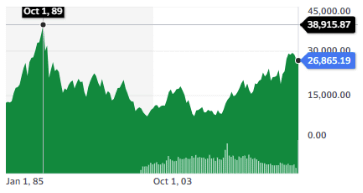

On top of the mobile expansion problem, Japanese equities have still not recovered from their highest point in 1989, 33 years ago (see below the Nikkei 225). There is little attention and enthusiasm for Japanese stocks in general.

Source: Yahoo Finance

This is something to keep in mind, as its influences how most analysts will judge any Japanese company, Rakuten included. Misallocation of capital and stagnation is not only common but expected. Any sign of trouble makes investors run away without a look back.

Until very recently, Rakuten was essentially operating only in Japan, with a focus on B2C sales. With an entirely new business line of international B2B service launching a month ago, inaugurated by a $2B contract, this is about to change. It should change investor perception of the company as well.

In this report, I will show the following:

- The quality and growth of e-commerce segment alone coils support a much higher market cap. We will also discuss why some Japanese equities deserve a second look, especially growing and modern companies.

- The capital intensive phase of the mobile operations is largely done. Their losses should drop dramatically and they might even turn profitable.

- The Rakuten ecosystem is a world-class moat, and the mobile activity reinforces it

- The financial branch of the company is largely not discussed, despite large opportunities available in Online Banking, FinTech, Insurtech, and for monetizing the data collected.

- The investment in mobile network technology has been used to develop a unique technology stack, similar to what Amazon did with AWS. It could be massively adopted abroad by low-cost mobile operators, as demonstrated by some recent high-margin sales of the solution. This will also transform Rakuten’s investing profile from “Japan e-commerce” to a diversified international tech conglomerate.

Let’s take a closer look at what Rakuten has to offer.

This report first appeared on Stock Spotlight, our investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 rational investors!

2. Extended Summary: Why Rakuten?

Rakuten is a large conglomerate of e-commerce, financial, telecom, and consumer service dominating the Japanese online economy. The telecom segment has been a major cash drain and spooked investors out. The strong growth and quality of the core business have been ignored and left the company undervalued. The mobile business is set to turn profitable and this should change the narrative (and valuation multiples) around Rakuten.

A High-Quality Core Business

Rakuten is the largest actor in the Japanese e-commerce sector and gaining even more dominance every year. It is highly profitable and with very strong margins compared to other generalist e-commerce platforms like Amazon or Alibaba.

As a stand-alone company, this segment could single-handily justify the current market valuation of the Rakuten Group, with all the rest of the company offered for free.

What’s Up With the Mobile Network?

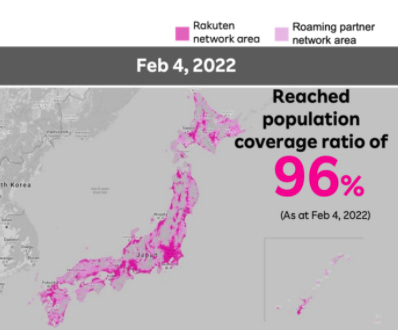

Rakuten is the 4th mobile operator in Japan. Reaching that position was a massively costly operation. It is now a done deal, with 96% of the population covered. The roaming charges that used to kill mobile profitability are now a thing of the past. Aggressive promotion and pricing have helped the launch. Market penetration is lower than ideal, but with a strong growth pattern.

The most concerning issue is that the telecom spectrum is hoarded by the competition and regulators are very slow to attribute a fair share to Rakuten. Profitability is hoped for 2023, but might also take a few years longer if there are delays in allocating more electromagnetic spectrum.

A New Income Stream

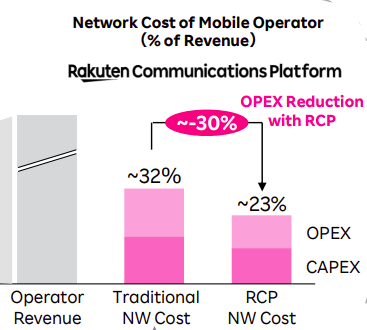

Rakuten developed a unique and innovative “open RAN” technology for building its mobile network. This cut CAPEX and operation costs by more than 1/3. This technology is now getting re-sold and deployed by Rakuten to mobile operators outside of Japan. The first confirmed deal is worth $2B just for the German market, with virtually every other developed country a potential target. The total addressable market for this solution could reach up to $150B.

The Ecosystem Moat

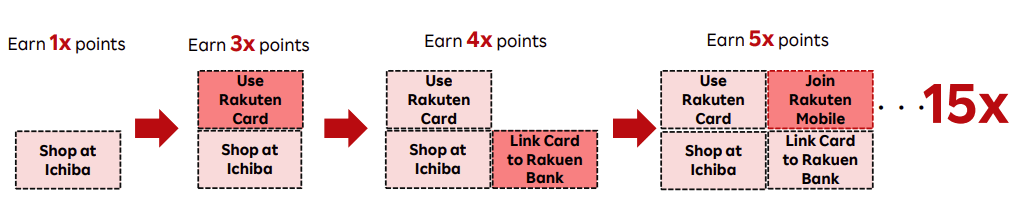

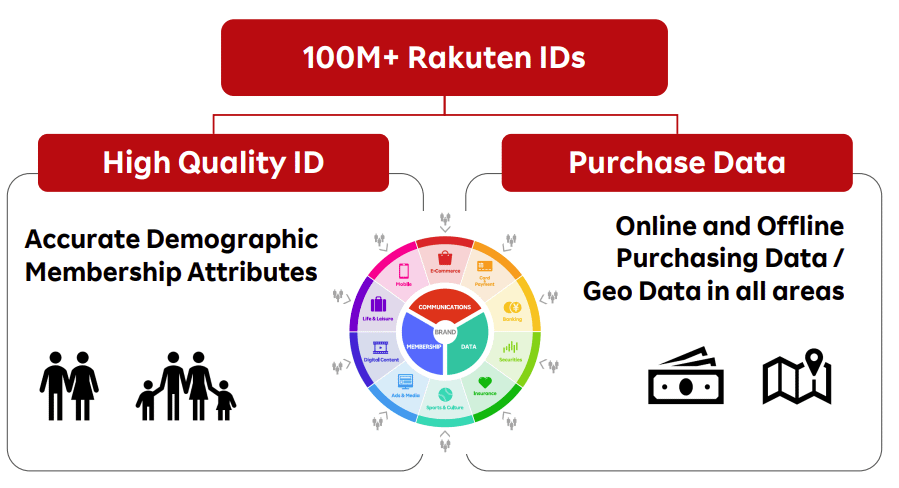

Using a point reward system allows Rakuten to cross-sell effectively between its different branches. If it is done online, the Japanese can use Rakuten (and Rakuten points) for it. With 100 million Rakuten IDs and 125 million Japanese people, this covers almost the whole population.

This gives the company a massive treasure chest of data allowing it to predict users’ preferences and interests.

FinTech as a Second Core Business

Rakuten has built a solid online fintech business on top of its e-commerce foundation. It covers everything from insurance, credit card, e-banking, and equity investment accounts. The segment is profitable with good margins. Japan’s financial system is still essentially offline and online activity would need to double or triple to reach the level of digitalization of the US. This leaves abundant room for growth.

3. Investment Thesis

Why Rakuten?

Rakuten is a large conglomerate of e-commerce, financial, telecom, and consumer service dominating the Japanese online economy. The telecom segment has been a major cash drain and spooked investors out. This has led investors to ignore the strong growth and business quality and left the company widely undervalued. The mobile business is moving closer to profitability, which should change the narrative (and valuation multiples) around Rakuten.

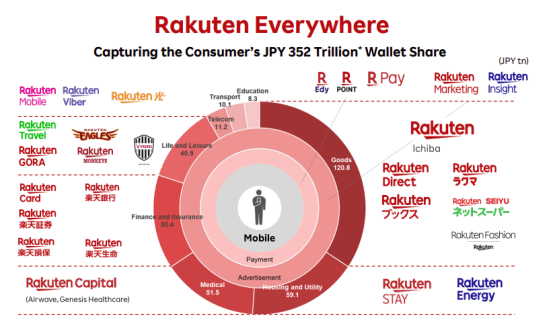

The (last?) Undervalued E-Commerce Giant

Because it is little known outside of Japan, Rakuten can appear to investors as a Tier 2 e-commerce company limited in business and geographical scope. The real situation is quite the opposite. The company is an entire ecosystem encompassing e-commerce, e-banking, online payment, credit cards, insurance, online ads, travel, mobile network, and even energy, food, healthcare, and entertainment.

The best comparison with a better-known company would be with China’s Alibaba. The model of e-commerce + banking/financial + other services was created by Rakuten first. If you are Japanese you know of Rakuten and probably use it.

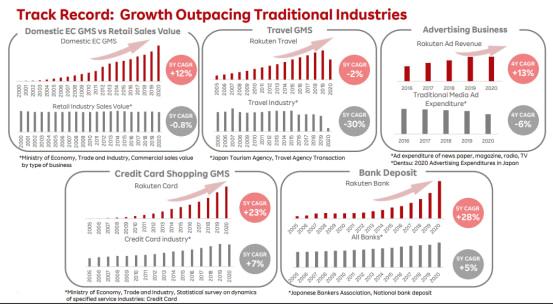

Below is a quick overview of Rakuten’s business lines. No need to go into the numbers in detail yet, you just need to know Rakuten Japanese businesses are in the red ones and the overall industry is in gray for comparison. The gray segment explains the complete lack of interest from most investors for the Japanese market. Retail, travel, ads, all are stagnant or low growth.

It is clear that by comparison, Rakuten has an edge over its competitors. All of Rakuten’s established businesses are growing at a steady and seemingly exponential pace (with the obvious exception of the Travel segment in locked-down 2020).

Source: Investor Relations | Rakuten Group, Inc.

Revenues are growing steadily at 12-15%, but so are its losses. Normally, I would assume this is like Uber or other profitless Internet companies with dubious business models. Some might turn out to be the new Amazon, many more will turn into the next failed, overhyped startup.

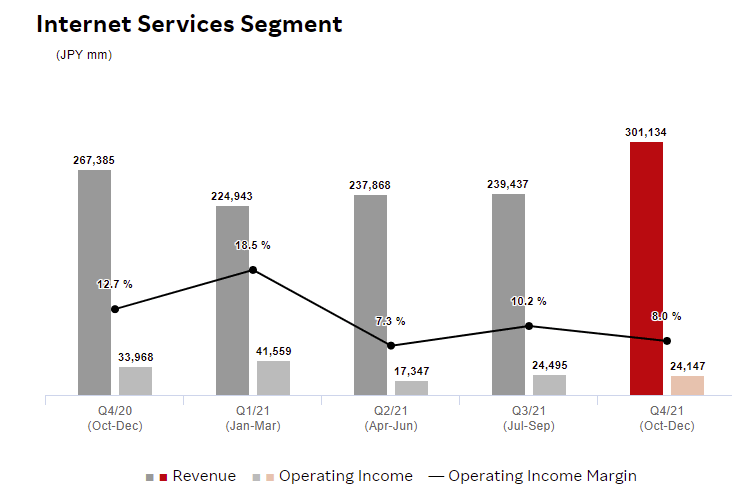

Rakuten presents a different picture. The core e-commerce business is highly profitable and has been so for a long while. Operating margins are stable or improving, standing at 8-10% for the retail segment (approximately double Amazon’s margins) and 12-14% for the financial services segment.

Rakuten Financials

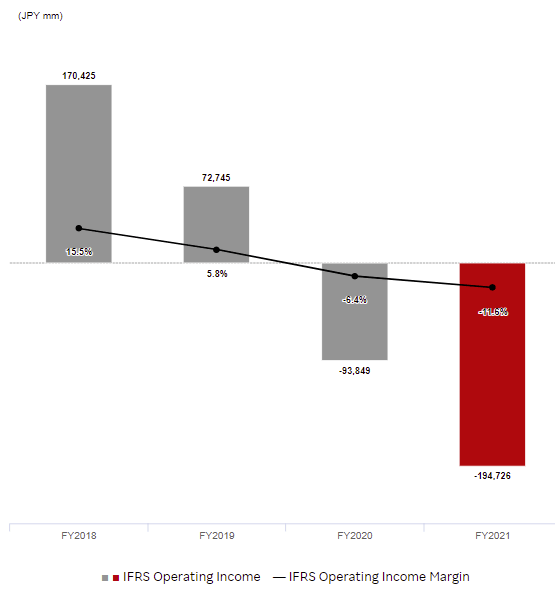

One reason for Rakuten’s low price is a quickly declining operating income since 2018, which turned negative in 2020.

Source: Investor Relations | Rakuten Group, Inc.

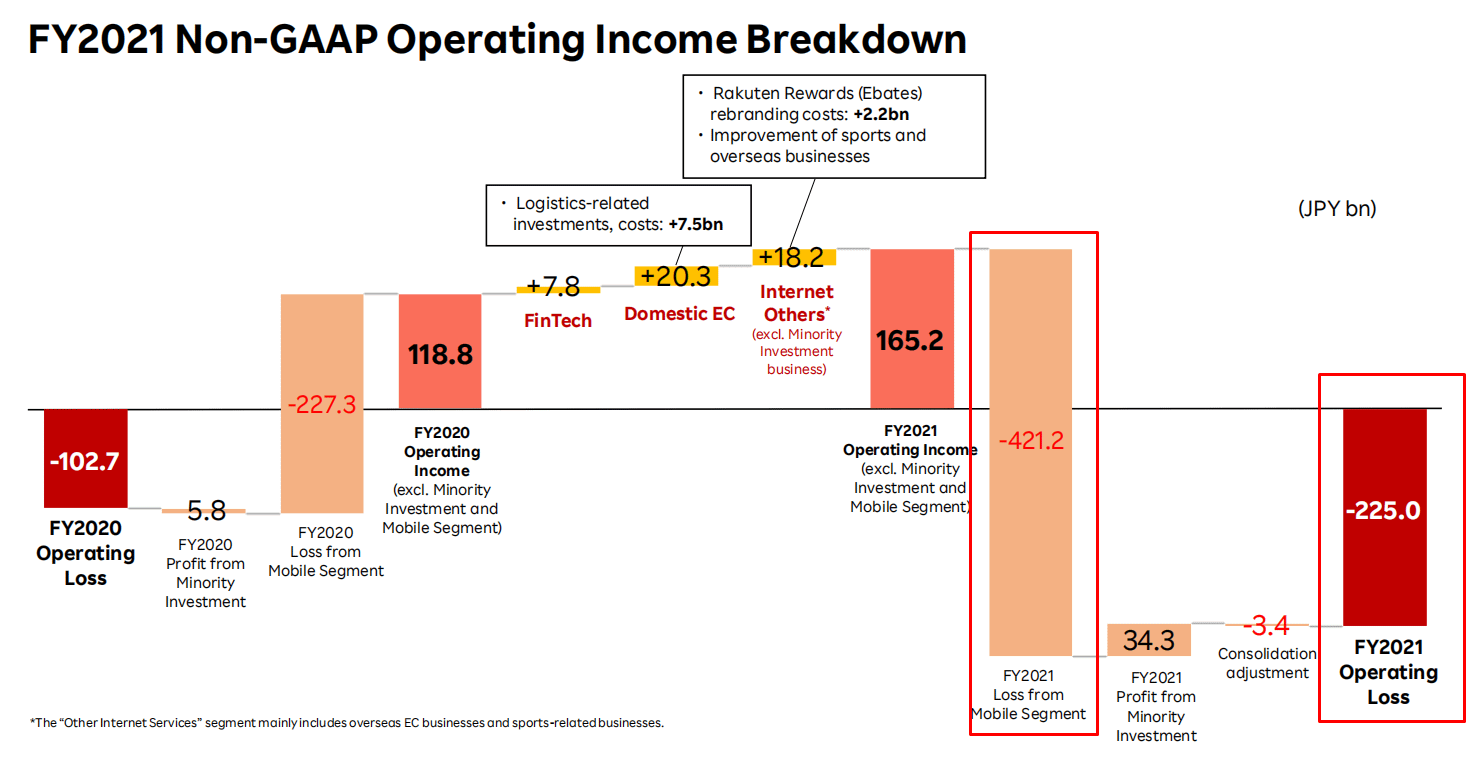

The recent losses come exclusively from the massive costs linked to Rakuten’s development of its own nationwide mobile network (I outlined them red in the graph below). Since 2018, these losses have exploded and entirely overwhelmed the rest of the profitable businesses of the company.

Source: Investor Relations | Rakuten Group, Inc.

Markets are not kind to profitable growing tech companies suddenly showing massive losses. Venturing into a capital-heavy sector well perceived when the fashion is to focus on a capital-light business model is also not well received.

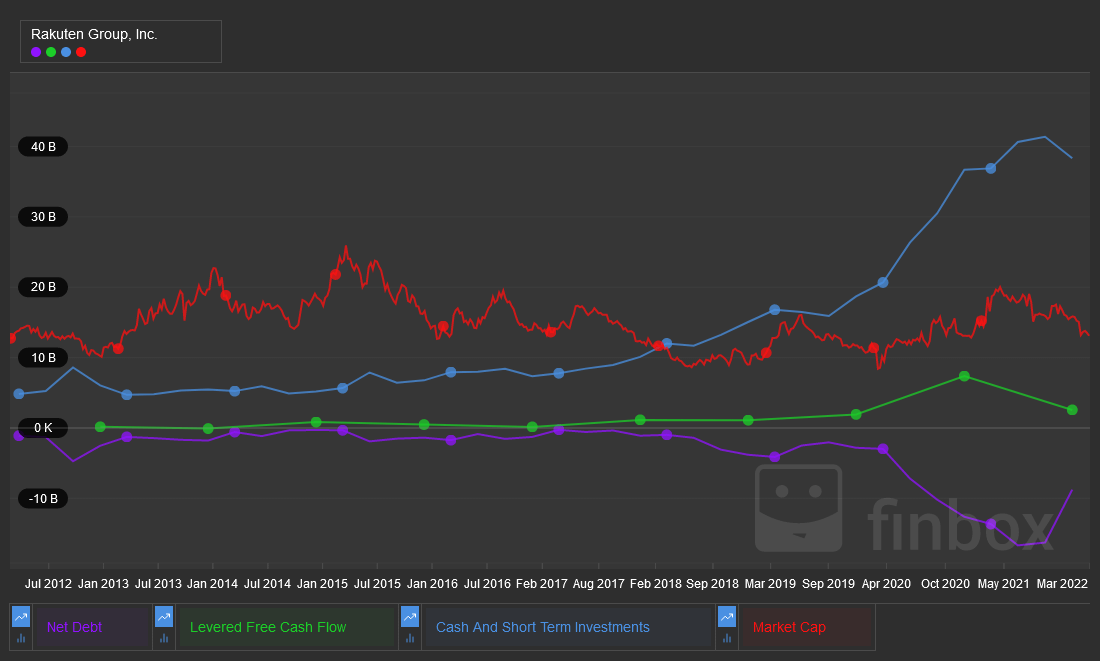

The negative earnings have obscured massive cash accumulation. The shares are trading at $8.4, despite net cash per share of $6.20 and free cash flow per share of $1.15. Thanks to this cash accumulation, Rakuten’s net debt is now deeply negative.

This means that while negative earnings are a concern, the company is still generating free cash flow and is at no risk of bankruptcy in the foreseeable future.

At this rhythm, the Rakuten share price is on the way to falling below its net cash per share. This is a rather incredible discount for a company dominating its home market and growing 12% year-to-year.

Source: Finbox

In addition to the growth, the quality of the operations is outstanding. Consumers entering the Rakuten ecosystem from e-commerce or banking have strong incentives to start using the other services as well. The dynamic and modern culture of the company (an oddity among Japanese firms) is also giving it an edge against its more established and conservative rivals.

Rakuten’s Real Value?

Just Rakuten’s core businesses could make it a good deal at the current share price. If the mobile business is actually that bad, the company could simply ditch it and cut its losses. And the financial services, e-commerce, and other activities would justify higher prices.

Using valuation metrics like the price to sales, price to free cash flow or gross transaction value (GTV) Rakuten seems undervalued compared to its peers.

| Rakuten | Amazon | Alibaba | Etsy | |

|---|---|---|---|---|

| Market cap ($B) | 12.9 | 1579 | 339 | 18.8 |

| Revenue ($B) | 14 | 470 | 128 | 1.7 |

| Price to free cash flow | 7.3 | – | 13.9 | 36.5 |

| Price to sales | 0.9 | 3.4 | 2.2 | 9.8 |

| GTV ($B) | 192 | 490 | 1187 | 10 |

But I will later in the report argue that mobile losses are going to, at the very least, get smaller. Rakuten needed massive investments and marketing costs to attack the dominant oligopoly formed by the historical 3 operators. It has re-enforced its position as a fair and cost-effective service supplier in Japanese consumers’ minds. Capturing mobile data is also a great way to boost the value of Rakuten’s ecosystem.

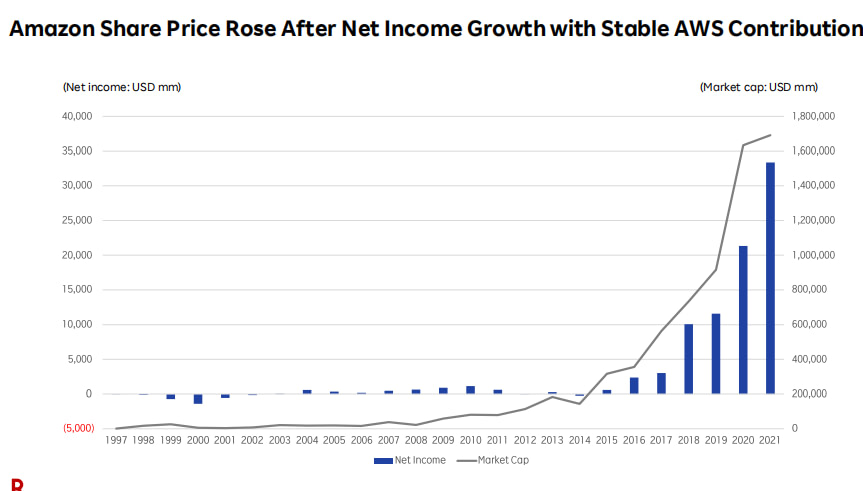

Finally, it must be understood that the Rakuten mobile venture was not just a massive dump of cash to capture part of that market. It re-invented from the ground up the hardware required to develop a mobile network. This gave Rakuten total control over its equipment and software. And made it develops a modern, open solution in direct competition with the legacy hardware manufacturers. In essence, it is very similar to how Amazon used its own massive need for data centers to develop innovative and more open AWS cloud services.

Telco and mobile networks are famous for being dominated by a few operators with monopolistic tendencies. While profitable in the short term, this often leads to unfair pricing, dissatisfied customers, and keeping legacy technology way after it should have been replaced. These conditions make mobile markets ready to be disrupted by new actors using more open and modern IT systems.

Rakuten’s new solution for building mobile networks is now going to be licensed abroad to companies willing to challenge the status quo in their respective market. This is demonstrated by the first licensing of this technology stack to German company 1&1 for its entry into the German mobile network market. This deal is valued at $2B.

4. E-commerce Segment

A High-Quality Core Business

Rakuten is the largest actor in the Japanese e-commerce sector. It’s gaining even more dominance every year. It is highly profitable and offers very strong margins compared to other generalist e-commerce platforms like Amazon or Alibaba.

As a stand-alone company, this segment could single-handily justify the current market valuation of the Rakuten Group, with all the rest of the company offered for free.

High Growth, Solid Margins

It makes sense to start from the e-commerce segment as this is also where Rakuten started in the late 90s. The company started with only 6 people back then and now employs 20,000 people.

The e-commerce segment, known in Japan as Rakuten Ichiba, includes 50,000 merchants. These merchants pay for accessing Rakuten customers through a mix of fixed “subscriptions” and a percentage fee on each sale.

Rakuten also operates a few other marketplaces abroad (obtained during a period of aggressive acquisitions), notably in France, but these foreign ventures did not earn as expected. They are not losing money, but they also failed to turn Rakuten into a truly global actor. They seem to have become an afterthought for the Group, which is now fully focused on the Japanese market.

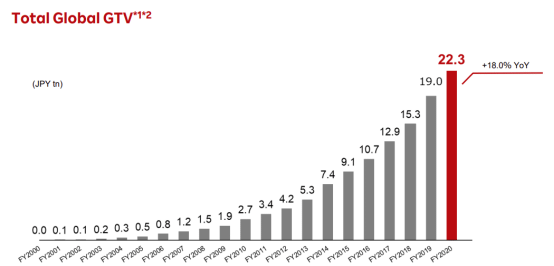

Rakuten controls 25% of the Japanese e-commerce sector. Gross Transaction Value (GTV) on Rakuten’s retail platform is showing no sign of slowing down, with an 18% year-to-year growth in 2020. Over the last 5 years, the average growth was 12%.

Source: Investor Relations | Rakuten Group, Inc.

Comparison to the general growth of the Japanese e-commerce sector of 8% indicates that Rakuten is also increasing its domination of the domestic business.

Margins are still high by e-commerce standards, even if they have slightly decreased in the last quarter. This is mostly due to the points reward system that we will discuss further when analyzing the Rakuten ecosystem.

Source: Investor Relations | Rakuten Group, Inc.

Japan is a surprisingly offline market for a developed economy, with less than 9% of retail purchases done online. This is to compare to the 12%-20% for other advanced economies like the USA, China, and Korea. Cashless transactions are similarly very low at 20-25% only and expected to almost double in the next 5-10 years.

Overall, this paints the picture of a generally offline economy, maybe not so surprising considering Japan’s demography. This is one of the most rapidly aging societies on Earth, with a very low birth rate for decades. The next two decades should see a radical transformation where digital natives are finally becoming the majority of consumers. This should speed up the transfer of more economic activities online, from retail to banking to insurance and entertainment.

The presence of large, government-supported, and technologically backward conglomerates, who traditionally dominate the Japanese economy, did not help either. In addition, linguistic and cultural barriers have proven an effective hindrance to foreign tech giants’ entry into the Japanese market.

Comparison to Other E-Commerce Companies

If we want to compare only Rakuten’s retail segment to other e-commerce companies, it is easier to compare to equivalent-sized companies than to giants like Amazon or Alibaba. For example, we can use Etsy, which does not provide web hosting, FinTech services, venture investment fund, etc.

| Rakuten | Etsy | |

|---|---|---|

| Company Total Market Capitalization ($M) | $13.2B | $18.8B |

| Revenues ($M) (2020) | $2.6B | $1.7B |

| Gross margins | 8% | 20% |

| GTV (2020) | $192B | $10B |

I intentionally singled out Etsy as this is a well-known niche marketplace with high margins. I consider that Etsy’s higher market cap is justified when considering these higher margins, even if revenues are lower. A conservative estimate of the Rakuten e-commerce segment alone seems to justify roughly the current market capitalization for the whole company.

This would mean that ALL the other parts of the business are essentially thrown in for free. Or that the mobile business is so bad that it completely negates all the value created by the FinTech segment, the abroad acquisitions, as well as the various other activities, like insurance, healthcare, energy, travel, etc…

Considering that the other non-mobile segments are almost all profitable on their own, the current valuation is only making sense if the mobile segment is an absolute disaster able to almost destroy the company.

So let’s look at the mobile activity.

5. The Mobile Conundrum

What’s Up With the Mobile Network?

Becoming the 4th mobile operator in Japan was a massively costly operation. It is now a done deal, with 96% of the population covered. Roaming charges used to kill the mobile profitability; with the deployment finalized those costs should be eliminated. Aggressive promotion and pricing have helped the launch. Market penetration is lower than ideal, but with a strong growth pattern.

The most concerning issue is that the telecom spectrum is hoarded by the competition and regulators have been slow to attribute a fair share to Rakuten. Profitability is hoped for 2023 but could take longer if more electromagnetic spectrum is not allocated to Rakuten.

A Massive Undertaking

Mobile network services in Japan are dominated by 3 actors. Persistent rumors of secret price agreements and monopoly practices have been fueled by high prices with no viable alternative. For reference, Japanese consumers spend almost 50% more of their income on mobile connectivity than Americans (3.7% vs 2.5%).

Other mobile markets used to operate in very similar ways. For example, the Internet and mobile providers in France used to be split between 3 companies offering expensive and relatively poor services. The arrival of a 4th low-cost actor was hailed as both a business success and a win for customers.

Discounts and Cost-Cutting

Rakuten went on to launch a low-cost offer, around 20% cheaper than the competition for light data usage and as much as 60% for heavy consumers of data. We can easily imagine that heavy consumers are also a lot more likely to be more IT proficient and more likely to buy online, use e-banking, etc. So in the context of using mobile users to get more people into the Rakuten ecosystem, it makes sense to put a lot of effort into this sub-group.

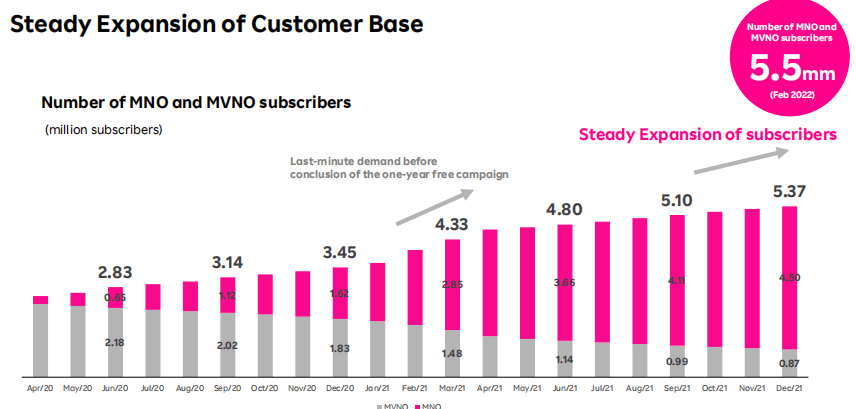

They also offered no less than 1 entire year for free for new subscribers until April 2021. Since then, new subscribers have gotten “only” 3 months free. This was very popular and led to a massive wave of subscriptions. That large surge of subscribers in March 2021 will only start paying in a few months.

I could any data on the churn rate, so I suspect this strategy might have been a tad too aggressive. Nevertheless, it forced Rakuten’s foot into the door and made it a competitor no one could ignore or dismiss easily. It also temporarily reduced the profitability of the mobile division, which was carrying numerous free users. As those users move out of their free service period revenues should surge.

The Way Forward

Rakuten incurred major losses during the network construction period. Today’s consumers are completely unwilling to accept areas with poor or no coverage, contrary to a decade or two ago when mobile networks were new.

This meant that Rakuten had to “rent” the infrastructure of its competitors. This way it could still offer coverage in areas where it had no antenna yet. They had been forced by state regulators to give such access but they did not do it cheaply. It is unclear exactly how much it cost per user, but some estimates put it around the same price per user as the entire cheapest low-data contract by Rakuten. In these conditions, it’s no surprise that profitability has been more than elusive. With the physical infrastructure of Rakuten’s network now nearly complete, these costs should be eliminated.

Rakuten has announced it is expecting profitability for its mobile operation by 2023. This is concurrent with the announcement of reaching 96% population coverage this February.

This means that by next year, except for some exceptionally remote areas, roaming costs should no longer be incurred. Finishing the network construction also means that from now on, any new subscribers will generate a lot more profit, as it helps amortize relatively constant network costs on more users.

Source: Rakuten Blog

The user base is expanding, but still not as quickly as one could have expected from the combination of lower price and aggressive marketing.

At 5.5 million subscribers (compared to a total of 180 million mobile phone contracts in Japan), there’s a lot of space to expand. It might also take longer than hoped for to drive a large percentage of the user base to switch to Rakuten mobile.

Source: Investor Relations | Rakuten Group, Inc.

The Frequency War

With Rakuten’s lightning-speed deployment of its mobile network, profitability might be on the horizon soon. It would, however, be naive to expect the incumbent 3 giant operators to not fight back. Unable to compete on price or even quality, they chose what they are the best armed for, political influence, and lobbying.

Mobile telecommunications are dependent on using specific electromagnetic frequencies, each booked by one operator for its antenna. There are not that many frequencies usable. This is a large reason why most mobile markets tend to gravitate toward an oligopoly.

Rakuten was attributed only 20% of the 4G spectrum held by the other operators. In many regions, it only got the 5Mhz frequency when the competition hold the higher performance 20 Mhz band. This means that Rakuten data debit is at best okay, but not as good as it should be. It also increases costs somewhat.

In addition to 4G, the 5G deployment is also at risk. The poor spectrum allocation to Rakuten is slowing it down, and it is unlikely to improve for maybe several years, as the regulator are slow to reallocate spectrum to Rakuten Mobile.

Rakuten is petitioning the government for more spectrum allocation, allowing fairer competition. Entrenched deep in relation with the regulators, the largest operators are likely to be able to delay that for a while. This is a reality of business in Japan that investors need to acknowledge.

While this is not catastrophic, as illustrated by the decent technical performance of the existing network, this might still be a serious long-term problem for Rakuten. I consider this the most serious threat to Rakuten mobile, and also the most difficult one to solve. This might push mobile profitability to 2024-2026.

If the thesis of this report goes wrong, I fully expect this will stem from the frequency allocation issue. For a bearish perspective on Rakuten related to this, you can read this article as a counterpoint to this report.

6. An Exportable Tech Expertise

A New Income Stream

Rakuten developed a unique and innovative “open RAN” technology for building its mobile network. This cut CAPEX and operation costs by more than 1/3. This technology is now getting re-sold and deployed by Rakuten to mobile operators outside of Japan. The first confirmed deal is worth $2B just for the German market, with virtually every other developed country a potential target. The total addressable market for this solution could reach up to $150B.

Open Tech = Long-Term Success

The deployment of the 200,000 units of the Rakuten network was impressive by any metrics. Not only did it cost 1/3 less than traditional deployment, but it was also 4 years ahead of schedule. The 40% reduction in capex and 30% in operating costs have been confirmed by outside analysts.

Source: Investor Relations | Rakuten Group, Inc.

The key is using the so-called open-RAN architecture. This was developed by a startup that Rakuten finished acquiring in 2021. I will not pretend to be a telecom engineer and to have understood all the technical details of it. But here is what I understand:

Until now, a small group of suppliers (mostly Nokia and Ericsson, and more recently Huawei) had total control over both hardware and software used at each of the mobile network nodes. This gave very little control to the mobile operators, both on the technology itself and on its costs. It also made any change or upgrade range from a headache to an impossibility.

By comparison, open-RAN networks allow for different components and software to interact freely, “unlocking” more options for the mobile operator. It can combine virtually any off-the-shelf hardware, servers as well as software and radio manufacturers.

In addition, Rakuten uses a virtualized network where the computing power is not necessarily located at the node. This allows centralizing the computing power required, reducing the need for manpower and security while increasing the reliability and efficiency of the system.

For the more tech proficient among you, imagine a Rasberry-Pi / Linux-like open-source mindset for both hardware and software, combined with the flexibility and sturdiness of an AWS-style cloud system. For mobile operators, this is a fundamental change from supplier-driven and controlled solutions to open-ended technology.

Together, this technology is now handled by Rakuten Symphony, under the Symworld branding.

Exporting Symworld

Why did no one develop it before? Partially this is just due to inertia. Legacy operators keep using legacy technology instead of doing a complete and costly overall of their pre-existing infrastructure. Sunken costs, internal politics, and supplier relations all play a role in keeping things unchanged.

Few players were ready to incur the tremendous risks and costs needed to not only develop but successfully deploy such a system. Without a country-wide deployment as a proof of concept, it would have been impossible to sell. Frankly, considering markets’ punishment of Rakuten for having done so, I believe it was probably the biggest issue. Only a founder-operated company like Rakuten could pull it off.

The official launch of Symworld was on 10th December 2021. I think the marketing is on point, talking directly about the main pain point for mobile operator’s engineers: flexibility and upgrade options. Instead of locking its customers in a suboptimal solution like Ericsson and Nokia used to do, Rakuten offers a solution that can evolve endlessly.

Never again will you have to worry about a hardware upgrade. Never again will you have to worry about a genration upgrde.

Tareq Amin, Rakuten Symphony CEO & Rakuten Group CTO

In addition, Rakuten will practice an open policy on pricing. This means markup will be known, and some customers will want to buy the hardware only, but keep control of the software part. Others will prefer to buy the whole service and let Rakuten handle the upgrading over time. In both cases, these customers will effectively subsidize the mobile network in Japan, by sharing the R&D costs over a larger user base than Rakuten could do alone.

On a side note, until recently, the segment for low-cost mobile equipment was dominated by Huawei. But with the Chinese company banned from many markets under American pressure, the launch of Symworld could not have been better timed.

New Revenues

Last August, Internet giant 1&1 has announced that Rakuten will build out its 5G network in Germany. The deal is rumored to be worth up to $2B (or 1/7th of Rakuten yearly revenues).

Thanks to pre-existing relations, France is likely to be one of the next steps for exporting Symworld, with Europe, in general, the first focus of the expansion. The expansion is supported by strategic partnerships announced on 1st March 2022 with Cisco, AT&T, Qualcomm, and Nokia. The fact that so many leading telecom giants are now partnering with the Japanese e-commerce company is a reassuring endorsement of the open-RAN technology.

The market is estimated by Rakuten’s CEO to be around $100-150B in a few years. With Rakuten having done $14B in sales last year, just capturing 5% of this new market would mean a $7.5B, or a 50% increase in revenues on top of the existing growth from the core businesses. Such revenue would also be with very high margins (20-40%), as the R&D costs are already paid. So capturing just 5% of this new market could double Rakuten’s operating income.

Management seems rather frustrated with the current stock valuation and actively tries to draw the comparison with Amazon AWS services, as in the slide below. Open-RAN technology does not operate at the same scale as AWS (as it is a more niche B2B product), but I think that the comparison is fair in terms of business type and tech profile. It is easy to forget, but at the time, venturing into cloud computing was perceived as a bad idea for Amazon, instead of sticking to the “safer” e-commerce only.

Rakuten’s mobile seems to be one of the key factors for discounting our valuation.

Rakuten CEO

We aim to make the mobile business, including Rakuten Symphony, a major pillar and profit source in the future.

As you can see, Amazon also had a hard time proving that their business model could be successful.

Source: Investor Relations | Rakuten Group, Inc.

7. The Rakuten Ecosystem Moat

The Ecosystem Moat

Using a point reward system allows Rakuten to cross-sell effectively between its different branches. If it is done online, the Japanese can use Rakuten (and Rakuten points) for it. With 100 million Rakuten IDs and 125 million Japanese people, this covers almost the whole population.

This gives the company a massive treasure chest of data, allowing it to predict users’ preferences and interests.

The Point of a Vibrant Ecosystem

If we were to look only at e-commerce, the current valuation might still be justified considering how high-risk high-reward the mobile segment is. That would ignore everything else that Rakuten is doing.

The Rakuten consumer journey is to start at some point, either buying something online on Ichiba, getting a credit card, or opening a trading account, etc. The consumer then starts to receive Rakuten fidelity points that can be used to get free or discounted offers. The trick is that the more other Rakuten service they join, the more points they collect. So there is a strong incentive to at the very least try the other services. Cross-selling is at the heart of the Rakuten business model and explains the seemingly haphazard diversification.

Source: Investor Relations | Rakuten Group, Inc.

This means that anything that brings a customer to try any Rakuten services is very likely to just progressively get him more and more involved with the rest of the ecosystem. Japanese consumers love collectible points and coupons, a fact that the ecosystem effectively exploits.

It is worth noting that the points are so versatile that treated as equivalent to cash in Japan. This is a super solid moat that is maintained continuously at a somewhat reasonable cost. This is similar to the marketing budget of Coca-Cola for example. In the short-term a cost, in the long-term, a moat that’s almost impossible to replicate.

This gives Rakuten access to precious information about not less than 100 million consumers. Essentially, if someone in Japan is at least occasionally online, Rakuten knows about it. This is a level of market penetration most Western tech companies would kill for.

Source: Investor Relations | Rakuten Group, Inc.

Rakuten For Almost Everything

Rakuten is such a sprawling empire that is hard to give an quick overview. This is why in the next chapter I singled out the most important one, FinTech. This segment is almost as profitable and promising as the e-commerce one.

The rest of the activities is impressive its diversity. To give you an idea of how wide a net Rakuten is spreading to catch in its ecosystem the Japanese consumer, you can see this list of all of the other, non-FinTech activities:

- Rakuten Capital: VC investment branch (more on that in the annex).

- Rakuten Farm: organic farming on unused rural lands.

- Rakuten AirMap: drone service.

- Rakuten Super English: English language learning center.

- Rakuten Energy: electricity provider.

- Rakuten Ticket: online event ticket store.

- Rakuten Music: streaming service.

- Rakuten TC: video distribution.

- NBA Rakuten: official NBA live streaming.

- Rakuten Min-Shu: student recruiting.

- Rakuten Recipe: online recipes.

- Rakuten Infoseek: Internet portal and search engine.

- Rakuten Pasha: Advertising combined with the point reward system.

- Rakuten Linkshare: online and affiliate marketing .

- Rakuten Travel: online travel and reservation.

- Rakuten Car: sale, maintenance, and washing of cars.

- Rakuten Gurunavi : food ordering and deliveries.

- Rakuten Magazine: online subscription to 250 magazines.

- Rakuten Data marketing: (see next paragraph).

Strong Culture and a Gold Mine of Data

Rakuten’s strategy is to spread wide enough to be able to capture virtually any demand for online service: not online e-commerce and FinTech, but everything else, from food to travel.

The reason it worked is the very unique culture of the company. First, this is one of the rare Japanese corporations where English is the internal language. Most employees are Japanese, but they have to communicate in English with each other. This is completely at odds with how business is conducted in relatively closed and self-centered Japan. This self-selects a specific type of employee far from the typical Japanese company man and closer to the typical international startup employee.

Rakuten launches a new business by gathering a team of 6, the same number that started the company. This group is given funding and technical resources and is left free to figure it out. So each of the diverse segments of Rakuten has started as a “small startup” with the backup of a tech giant. Think of the famous “moonshots” of Google, but actually generating real profitable services one after the other. In that sense, Rakuten is better understood as a serial incubator for interlinked Internet companies.

One risk of this strategy is that it could take on too many things at once and end up with a very distracted organization. But this is dwarfed by the wealth of data it generates. Rakuten has recently developed AIs able to analyze each of the 100 million users through 920 parameters. It uses this to detect patterns and determine interests, behaviors, and lifestyles that are useful to offer new products and services to the user.

For example, if you have a car and pets, maybe you might be interested in a cover for dog hair for your car seats. Or if you are looking for a cooking recipe with tomatoes, you might like to know Rakuten can also deliver to your home Rakuten-grown organic tomatoes.

This is why the reward point system makes sense beyond generating more cross-selling and maintaining the moat. The Rakuten user giving his data about 10 services is a lot more valuable than the one using only 1 or 2. First, he gets used to getting and consuming Rakuten points to keep buying from the ecosystem. Secondly, the data support an ad business similar to Facebook and Google.

Rakuten controls 55% of the total Japanese Internet advertising budget. In 2020 Rakuten’s advertising income overtook TV ad budgets. No less than 7 subdivisions of Rakuten deal with monetizing this data. At the moment, most of Japan’s economy is still offline and cash-based. With the segment growing at 8% a year and the younger generation slowly coming forward, the value of these data has enormous space for growth.

Rakuten Super Point Screen

Advertisement delivery app for smartphones with which Rakuten members can earn Rakuten Super Points

Core legal entity: Rakuten Group, Inc.

Rakuten Pasha

Advertising service which allows businesses to reward customers with Rakuten Super Points for their in-store purchases

Core legal entity: Rakuten Group, Inc.

Rakuten Insight

Internet market research services

Core legal entity: Rakuten Insight, Inc.

LinkShare

Online marketing solutions including affiliate marketing

Core legal entity: LinkShare Japan K.K.

Rakuten Marketing Platform

Providing full funnel ad and marketing products

Core legal entity: Rakuten Group, Inc.

Rakuten Data Marketing

Providing marketing solutions utilizing big data

Core legal entity: Rakuten Data Marketing, Inc.

Rakuten SQREEM

Developing and providing digital marketing solutions built on AI-based behavioral pattern analysis

Core legal entity: Rakuten SQREEM, Inc.

8. The FinTech Segment

FinTech as a Second Core Business

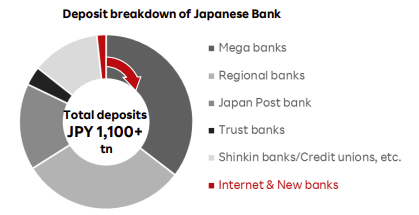

Rakuten has built a solid online bank business on top of its e-commerce foundation. It covers everything from insurance, credit card, e-banking, and equity investment accounts. The segment is profitable with good margins. Japan’s financial system is still essentially offline and online activity would need to double or triple to reach the level of digitalization of the US. Again, this offers enormous room for growth.

A Diversified and Growing FinTech

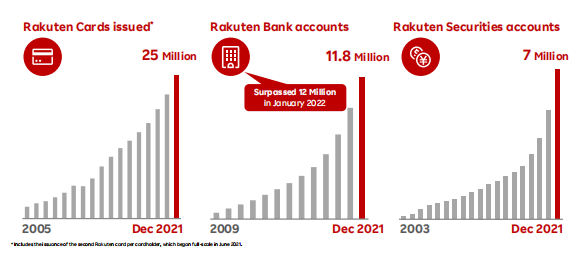

I will try to keep this chapter short, because, or this report will get way too big. So I will heavily rely on Rakuten infographics. Rakuten operates an e-bank service, together with credit cards and securities accounts, as well as insurance services. Each of the segments has grown between 3-5x in a decade. Each generates and can be paid for with Rakuten points. Imagine if fidelity points from Amazon could be converted to Robinhood investment!

Source: Investor Relations | Rakuten Group, Inc.

The segment is profitable, with margins stable in the 12-14% range.

These profits and growth hide the fact that Japan’s financial system is essentially still offline. The credit card penetration rate is only 22%, compared to 30% in the US and 75% In Korea.

Only the Beginning of Growth

Japanese banking is entirely dominated by traditional banks, with e-banks barely counting for anything in the market. Here too, there is plenty of room to grow.

The same is true for insurance, with Internet-based insurance only at 10%. Rakuten offers almost every insurance possible, including life, car, medical, pet, travel, device, golf, fire, etc…

Source: Investor Relations | Rakuten Group, Inc.

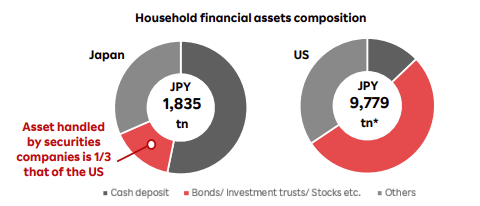

Finally, investing in stocks and financial markets is simply not a Japanese habit. Japanese households hold less than 1/3 of their wealth in securities. The majority of household assets are held in cash deposits. Decades of deflation are the main reason. Once again, younger generations and changing macroeconomic tides might cause more secular growth for modern, online securities accounts like the ones provided by Rakuten.

Source: Investor Relations | Rakuten Group, Inc.

9. Conclusion

To me, Rakuten appears as a hidden gem.

It is operating in an unloved geographic position. The Japanese market is widely seen as stagnant, offering limited growth potential. This may be true of traditional businesses, but it’s clearly not the case for Rakuten.

Most investors have never heard of the company and the ones who have are spooked by the mounting losses of the mobile business.

As I hope I demonstrated, the mobile business is far from the unmitigated disaster most analysts seem to see. The Japan mobile operation was a massive endeavor that might or might not turn profitable. In any case, the completion of the capital-intensive construction phase, the reduction in roaming fees, and the migration of customers from free promotional periods to paid plans should reduce the bleeding soon. Even if it fails to turn profitable, the ecosystem effects (cross-sales, but also geolocalisation for ads) should be enough to be worth the effort.

In addition, the open-RAN technology is a game-changer for the company, as it is its first serious venture in the B2B market. The $2B deal with 1&1 is likely to be followed by many others over the world. The potential to catch an early AWS type of business is worth some short-term risk.

Beyond the mobile discussion, the core businesses are rock solid: consistent double-digit growth, increasing market share, and high margins (for the sector). The core e-commerce business is now reinforced by a growing FinTech segment that is only getting started. The ecosystem, continuously reinforced by the point rewards, is a moat that any newcomers, either Japanese or foreign, would be very hard-pressed to replicate.

In addition to the company’s intrinsic quality, the sector in which it operates is growing quickly. Compared to other advanced countries, there is still a lot left to digitalize in the Japanese economy. The decline demography of Japan should not be too much of a concern, as the rise of digital natives should keep compensating for the decline in absolute population number.

So I personally think that market pessimism on Rakuten is unwarranted. Expansion into mobile was a risky venture that might pay off more than anyone expected. And even if this was not the case, the value of e-commerce, FinTech, and overall ecosystem justify a higher valuation.

Ultimately, if the mobile venture turns out into that much of a disaster, it could still be liquidated or sold, and the rest of the business would be worth more than the current market cap. And that’s without counting any income from licensing the open-RAN tech.

This is an investment for the most patient and long-term investors, as I expect it might take 1-2 years for the mobile turnaround to become apparent. Maybe the open-RAN deals do the job before, but this might take a few more quarters as well. The large growth possibilities make Rakuten a typical long-term compounder, probably the best fit for retirement accounts.

As a final note, I will refer you to the annex below for the content and VC activities. I consider them as a “too hard to analyze” thing, so I mark them at zero value. This might be unfair and positive surprises might come from it. But in any case, I do not expect them to be central to Rakuten’s investment thesis.

Annex: VC, Foreign Acquisitions and Content

VC Investment

As if Rakuten was not complicated enough, the Company has also invested in multiple companies.

Source: Rakuten Capital

The most notable figures on that list include social media giant Pinterest (sold already), Indonesian e-commerce leader Gojek, and US ride-hailing enterprise Lyft. It is difficult to calculate the potential value of this segment and I prefer to not make an uneducated guess. Many of these companies are not making a profit, so their real value is anyone’s guess.

Nevertheless, some of these investments might pay off in a one-time surge in cash somewhere in the future (like after a successful IPO or acquisition). You can learn more about it on the Rakuten Capital page.

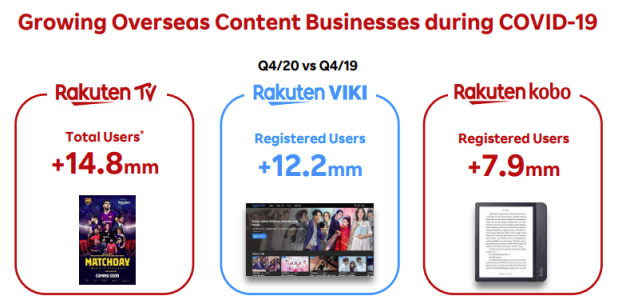

Content & Viber

Rakuten own e-reader Kobo, as well as the video on demand platforms Rakuten TV and Rakuten VIKI. Here as well, it is too difficult to attribute value to these businesses. The user base seems to be growing, but profitability is elusive. This might nevertheless be a good source of data about interest and habits to feed back to the ads & marketing AIs.

Source: Investor Relations | Rakuten Group, Inc.

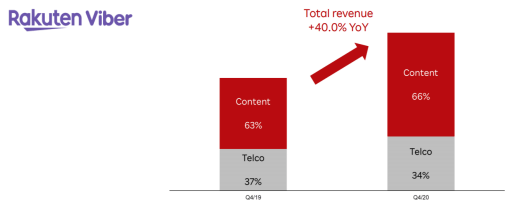

In the early 2010s, Rakuten went on an aggressive foreign expansion campaign. It notably bought online message chat Viber (a competitor to Facebook’s What’s App). Viber’s revenues are up 40% year-to-year since 2019 with a growing user base. The app is expected by management to be profitable going forward.

Source: Investor Relations | Rakuten Group, Inc.

This segment of activities is slowly becoming profitable after accumulating losses continuously since 2014.

It is hard to assess the probability of durable profits from this sector. Losses were shrinking since 2017, so it could be a long-term trend. Alternatively, turning positive might only be due to Covid-19 effects and not be durable. In any case, they are likely to not be a serious burden on Rakuten results going forward.

Foreign Marketplaces

The expansion by acquisition also involved buying foreign e-commerce marketplaces. From this, Rakuten still operates one of the leading French online marketplaces, re-branded Rakuten France.

In Taiwan, Rakuten operates a copy of its domestic Ichiba marketplace. In the UK, Germany, Spain, and USA, Rakuten has converted its legacy presence to a membership-based online reward site.

Except for Rakuten France, these overseas activities do not seem to be much of a focus for the Group, nor a significant source of income.

Europe

Rakuten

Online shopping in France

Core legal entity: Rakuten France

Rakuten

Membership-based online reward site in the U.K., Spain and Germany

Core legal entity: Rakuten Europe S.a.r.l

Americas

Rakuten

Membership-based online cash-back site in the U.S.

Core legal entity: Ebates Inc. dba Rakuten

Rakuten Super Logistics

Fulfillment services for e-commerce retailers in the U.S.

Core legal entity: Webgistix Corporation dba Rakuten Super Logistics

Asia Pacific

Taiwan Rakuten Ichiba

Online shopping in Taiwan

Core legal entity: Taiwan Rakuten Ichiba, Inc.

Because these activities are impossible to credibly value, I’ve left them out of the primary analysis. They offer limited risk, and they could ultimately produce some reward.

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in RKUNY and no plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this article.