Stripe is one of the most highly valued venture-backed private companies in the US: its last funding round placed the payment processing giant’s value at $95 billion. An IPO is inevitable and could value the company at well over $100 billion, making it the biggest tech IPO since Facebook.

Can you buy Stripe stock ahead of the IPO? It may be difficult, and there are real risks to any pre-IPO investment, but it may be possible.

Let’s take a closer look at Stripe, at the reasons you might want to buy pre-IPO shares, and at some of the ways that you may be able to buy stock in Stripe.

What Is Stripe?

| Stripe: Fast Facts | |

|---|---|

| 🏭 Industry | Financial services, Payment processor |

| 🤼 Key Competitors | Adyen, Square, PayPal |

| 🏢 HQ | San Francisco, California, United States |

| 📅 Founded | 2010 |

| 🧑💼 Key People | Patrick Collison (Co-founder, CEO), John Collison (Co-founder, President) |

| 👥 Employees | 8,000 |

| 🌐 Website | www.stripe.com |

| 💵 Current Valuation | $74 billion |

| 🔒 IPO Status | Private |

Stripe is a technology company that builds economic infrastructure for the internet. Stripe’s payment processing solutions are used by companies like Amazon, Google, Shopify, Instacart, Zoom, Lyft, and many others.

Aside from payment processing, Stripe offers e-commerce APIs (application programming interfaces) that allow multiple systems and databases to communicate seamlessly. Other products include an in-store point-of-sale solution, subscription-based payments, invoicing, card issuing and lending services, and risk and fraud management.

Stripe offers a large number of third-party integrations that allow the platform to work with analytics, shipping, CRM, and accounting software. Stripe features a high degree of interaction with regulators, financial institutions, and payment networks, removing compliance and service burdens from clients.

This suite of financial services produced more than $12 billion in revenue in 2020, up 48.5% from $7.4 billion in 2020. We won’t know whether Stripe is profitable or not until the Company files financial statements, but the business is well established, has substantial sales, and appears to be growing fast.

Invest in global and local stocks with ZERO commission

Financing and Growth

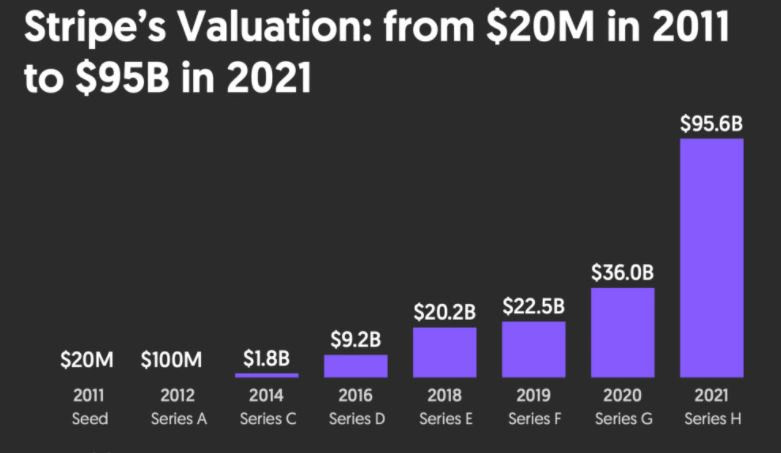

Stripe has held ten equity funding rounds since 2010, raising $2.2 billion from 39 different investors.

In the latest round, in March 2021, Stripe received $600 million, pushing its valuation to $95 billion, nearly triple the previous valuation of $36 billion in April 2020.

This valuation made Stripe the second-highest valued venture capital-backed US company: Elon Musk’s SpaceX recently moved past Stripe with its latest funding round. This makes Stripe the fifth highest valued VC-backed company in the world.

As of July 2022 Stripe slashed its internal estimate of its own valuation by 28%. It remains to be seen whether this revised valuation will be reflected by the market in a subsequent funding round.

When Will Stripe Hold Its IPO?

There’s no schedule for the IPO yet, and no initial registration documents have been filed. Most observers still believe that the Company is preparing for an IPO, and the 2020 hiring of CFO Dhivya Suryadevara, formerly Executive Vice President and CFO of General Motors, was widely seen as a step toward going public.

An IPO is widely expected in early 2022 and promises to be a major entry in the year’s IPO calendar. That could still change if market conditions take a dramatic downturn.

How Can I Buy Stripe Stock?

Stripe is still privately held, meaning its shares are not available on the public stock market yet.

The latest private funding Stripe received in March 2021 pushed its valuation to $95 billion, nearly triple the previous valuation of $36 billion from April 2020. This valuation made Stripe the highest valued venture capital-backed US company at that time. Today Stripe is the fifth highest valued VC-backed company in the world, behind ByteDance, Ant Group, Shein (all based in China) and Elon Musk’s SpaceX.

There are other possible ways to invest in Stripe pre-IPO. Let’s look at some options.

Invest Through a Pre-IPO Secondary Market

There are ways to buy shares in privately held companies before the IPO. The process may not be simple, and there’s no guarantee that you will be able to acquire shares.

Here are three pre-IPO markets that may have Stripe shares available for purchase before the IPO.

- EquityZen acquires pre-IPO shares from early investors, employees who want to liquidate stock options, and other insiders and makes them available to qualified investors. There’s a $10,000 minimum investment, which may be higher for some shares.

- Forge Global is the biggest pre-IPO marketplace in the world. The minimum investment is $100,000. There may be higher minimums for some shares and buyers may have to meet qualification criteria.

- SecFi links employees that want to liquidate their stock-based compensation with outside pre-IPO investors.

- Nasdaq Private Market provides access to private company shares for investors who meet SEC accredited investor criteria.

- EquityBee is a marketplace that allows investors to fund an employee’s stock options in return for a share of the proceeds.

Stripe shares may not be available on any of these marketplaces at any given time. You’ll need to visit the websites and set up an account and log in to get information on currently available shares.

📚 See ALL the ways you can get in on pre-IPO investing: How to Buy Pre-IPO Stocks?

Invest in the IPO

Pre-IPO investing is not easy, and shares may not be available. Another option is to invest in the IPO. You won’t get the same price that you’d get in the pre-IPO market, but your risks will be lower. At least you’ll know that the Company will go public and you will be able to dispose of your shares.

Retail investors can participate in IPOs through several major brokers. You will have to meet requirements and you may need to supply information on your finances to meet qualification requirements.

- TD Ameritrade allows account holders to participate in IPOs where it is part of the selling group. You will need a minimum account balance of $250,000 unless you have made at least 30 trades in the last calendar year.

- Fidelity customers who are in the Private or Premium groups may participate in IPOs. Others may be able to join if they meet a minimum household asset requirement.

- Charles Schwab allows IPO participation for account holders with an account balance of $100,000 or at least 36 trades in their account history.

- E*Trade has no account balance or trading history restrictions on IPO participation. The underwriter of the IPO will supply a qualification questionnaire.

Companies holding IPOs are making an effort o make more shares available to retail investors. The recent Rivian IPO saw the Company offer shares to retail investors through SoFi. Follow the news on the upcoming IPO for announcements of IPO share allocations for private investors and the brokers that will handle them.

In any case, you will have to request IPO shares from your broker after qualification. There is no assurance that the full amount of your request – or any shares at all – will be allocated to you by your broker.

Invest After the IPO

The easiest way to buy Stripe stock is to wait until after the IPO and buy it through your regular broker. You won’t get in at the lowest possible price, but that doesn’t mean you won’t make a profit.

Many investors compare the pre-IPO prices paid by venture capital investors to the IPO price and dream of matching those gains. That’s not always easy, and it may not be possible. It’s also important to recognize that many pre-IPO and IPO shares are subject to lockup periods and can’t be sold immediately.

If you are really convinced that a company has a bright long-term future, investing immediately after the IPO is a perfectly reasonable move, especially if you don’t meet the qualifications for pre-IPO or IPO investing. If you bought Telsa, Google, or Facebook on IPO day you might not have the same gains as the earliest investors, but you’d still have made a great deal of money!

Once Stripe concludes its IPO you can buy shares through any conventional broker.

If you don’t have a favorite broker yet, we recommend eToro.

Invest in global and local stocks with ZERO commission

- 30 million users worldwide

- Free demo account upon signup

- Regulated by FINRA and the SEC

Are There Any Concerns About Stripe?

There are several online payment platforms, so Stripe is working in a competitive environment.

Although the company is growing worldwide, Stripe is only available in few countries compared to, for example, PayPal. That said, PayPal has been around for a lot longer, so there’s plenty of room for Stripe to grow and expand into more markets.

Finally, Stripe needs to catch up with its competitors and continue bringing unique value, or otherwise, it will risk becoming obsolete.

There are inherent risks in all pre-IPO investing if market conditions change the Company could postpone or cancel the IPO. If that happens it could be difficult to liquidate shares. Always consider the risks before making any investment, especially in a private company.

Read our guide on pre-IPO investing for more information on how pre-IPO stocks work and the potential risks and rewards that they present.

Conclusion

Stripe is a leading payments processing company with a strong growth record. The company has attracted major venture capital investments. It is the largest venture-backed private company in the US and one of the largest in the world.

Stripe is expected to go public in early 2022. The IPO will be heavily watched and shares will be highly sought after.

Pre-IPO investing is always risky, but if the IPO takes off early investors could see large gains. Shares may be available on several pre-IPO secondary markets.

If pre-IPO shares are not available, investing in the IPO or immediately after it are also viable ways to get an early piece of Stripe’s future.

Get notified when Stripe goes public – sign up for our newsletter.

FAQs

Stripe is a technology company that builds economic infrastructure for the internet in a simple, scalable, and secure way. They specialize in payment processing solutions, fraud prevention, analytics, and new business models like marketplaces and crowdfunding.

Stripe produced $7.4 billion in revenue in 2020, up 393% from $1.5 billion in 2019. The Company is currently valued at roughly $95 billion.

Stripe is still privately held, meaning its shares are not available on the public stock market yet. You may be able to acquire shares in a pre-IPO secondary marketplace, buy into the IPO, or buy shares immediately after the IPO.

There are multiple options for online payment platforms, so Stripe is working in a competitive environment. There is no assurance that an IPO will be held as expected.