Are you part of the 70% of Americans who recognize the importance of budgeting but just can’t seem to build and follow a budget? The best budgeting tools can help.

You’re not alone, and the good news is there are resources to assist you in taking the first steps. In this article, we’ll delve into five top budgeting tools and provide additional tips on kickstarting your budgeting journey.

Best Budgeting Tools

Whether you have simple finances or a more complicated situation like managing multiple household budgets or planning for fluctuating income, many budgeting apps and tools can help. Here are the 5 we think are best:

- Quicken – 🏆 Best overall budgeting software

- YNAB – 🏆 Best for young adults and budgeting beginners

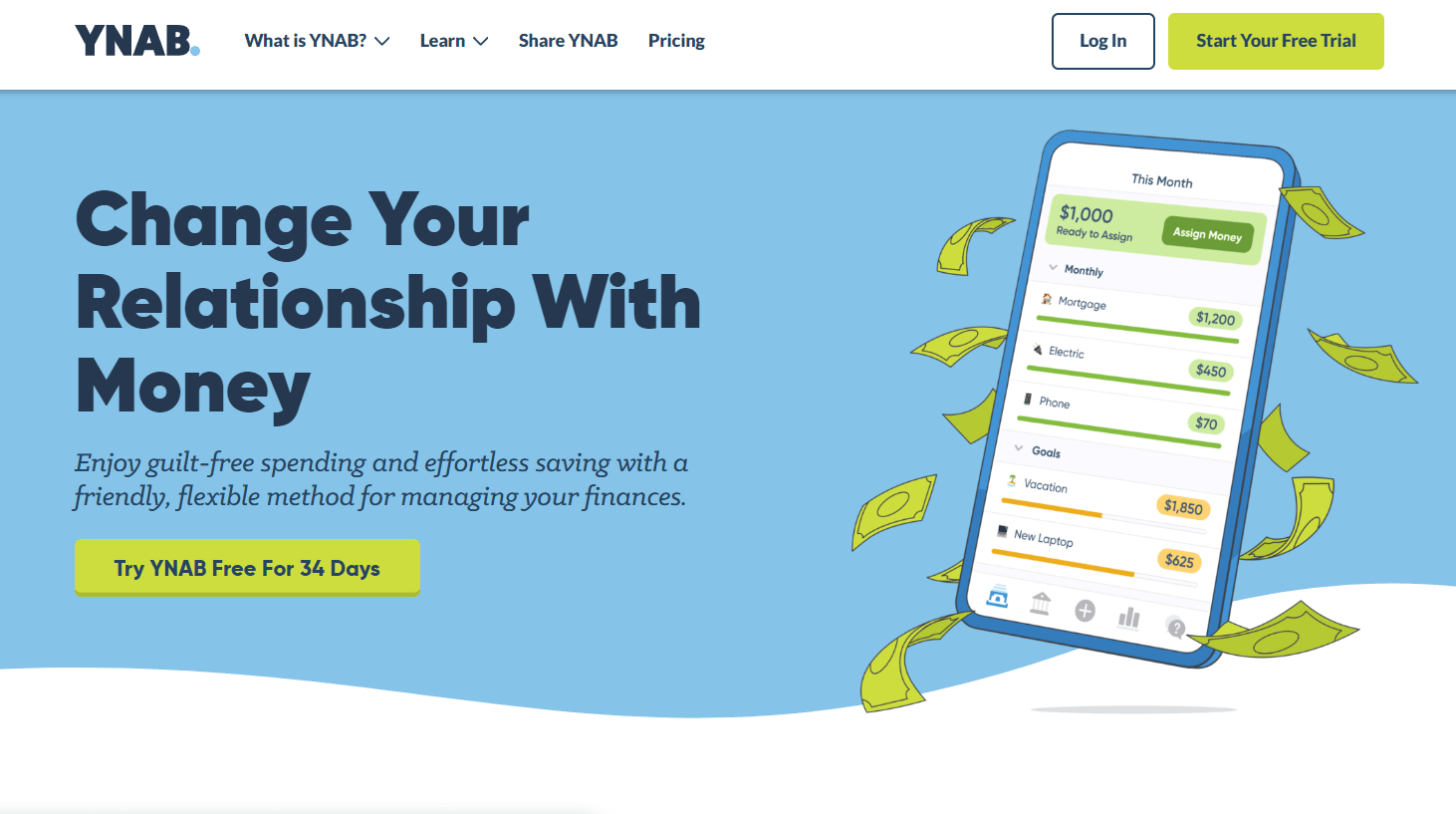

- Honeydue – 🏆 Best budgeting solution for couples

- Rocket Money – 🏆 Best budgeting app for improving your finances

All of these apps/software have robust features for helping you budget as well as manage the other aspects of your personal finances. Now, let’s explore each of these options in more detail.

💵 Learn more: If you’re new to financial planning, our article offers a straightforward guide on how to budget effectively.

BEST OVERALL

Quicken

Quicken is probably the most comprehensive piece of personal finance software on the market. It might be more than you need if you’re just looking to build a simple household budget, but if your finances are more complex and you want all the options, you’ll find them here. Read more

- 💵 Cost: Five plans, from $28.68 to $119.88 per year

- 🔎 Features: Comprehensive management of personal finances

BEST FOR YOUNG ADULTS AND BEGINNERS

YNAB

YNAB stands for You Need A Budget. If you do (and you do), YNAB can help, especially if this is your first voyage into budgeting. It’s a flexible program that allows you to adjust and refine your budget as you go along. Read more

- 💵 Cost: $14.99/month or $99/year

- 🔎 Features: Flexible budgeting designed for beginners.

BEST FOR COUPLES

Honeydue

Finances can be a huge stumbling point for couples. Honeydue is a budgeting app designed to help couples work together to manage their money. Read more

- 💵 Cost: $14.99/month or $99/year

- 🔎 Features: Flexible budgeting designed for beginners.

BEST FOR IMPROVING FINANCES

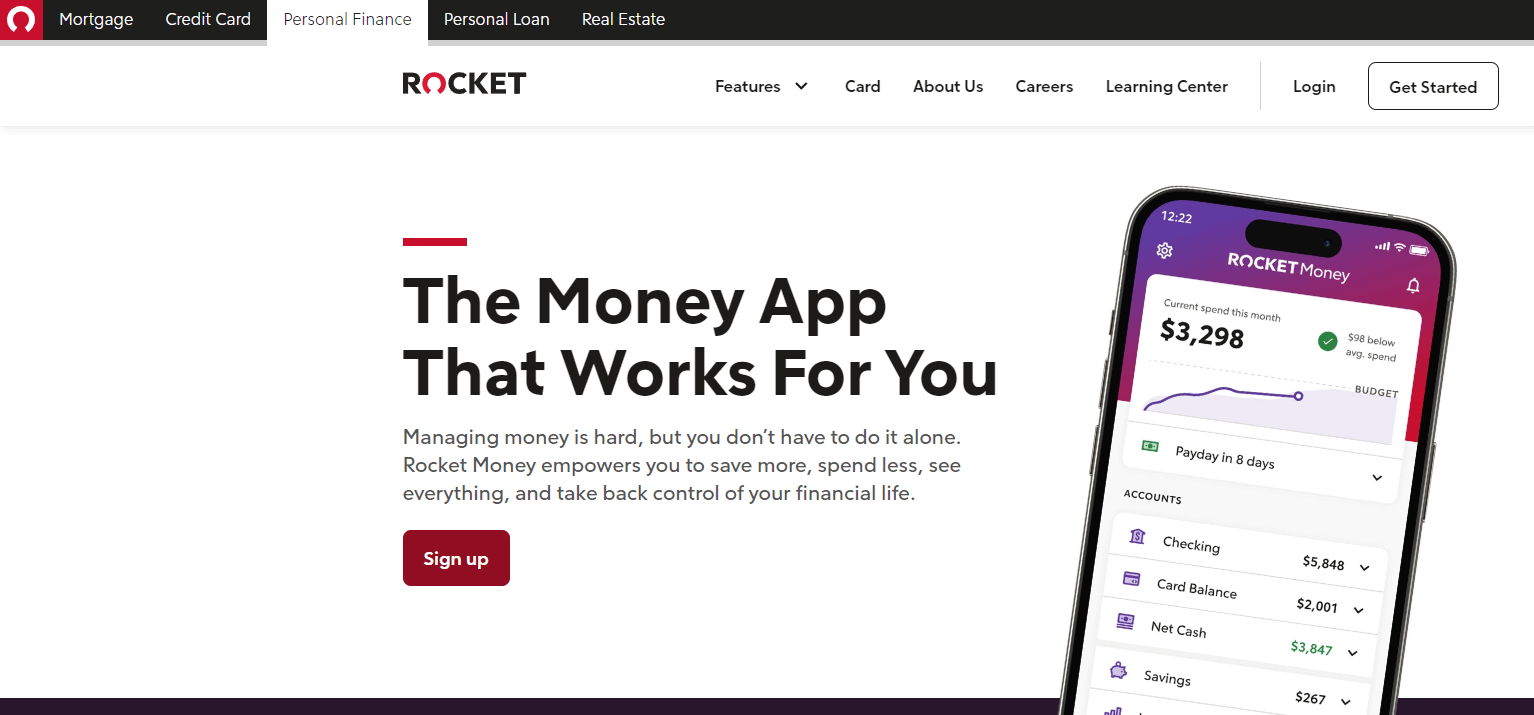

Rocket Money

Rocket Money combines a full suite of budgeting functions with bill negotiation and the option of finding and canceling unused subscriptions to help you save money. Read more

- 💵 Cost: $0-$15/month

- 🔎 Features: Bundles budgeting tools with bill reduction services.

1. Quicken

🏆 Best Overall Budgeting Solution

If you are looking for a full-service personal finance solution, one of Quicken’s subscription-based packages might be a good fit.

As with many other budgeting apps, you can create budgets, set up bill-due reminders, and view your net worth. Quicken also offers additional tools to help you manage your investments, track your business expenses, and budget for the whole year.

With a wide range of features appealing to multiple audiences (i.e., investors, small business owners, average budgeters, etc.), Quicken lands the top spot on our list as the best overall budgeting tool.

App/Software Features

Quicken offers a wide range of features and functionality. We’ll cover a few key features here, but be sure to check out Quicken’s product comparison tool for a full breakdown.

💰 Budgeting & General Finance Features:

- Create multiple custom budgets

- Link up all banking, credit, and investment accounts

- Track your home’s value

- Bank bill pay

- Free phone & chat support

📊 Investing Features:

- Track net worth

- Track investment tax info

- Download securities prices

- Use what-if tools

👨💼 Features for Business Owners:

- Export tax information (i.e., to TurboTax)

- Track business income and expenses

- Create custom invoices

- Track tenants and rental income

Budgeting with Simplifi

The budgeting process with Simplifi works a little differently. Instead of creating custom budgets, Simplifi creates a personalized budget for you. Simplfi can also help you differentiate between regular bills and subscriptions.

Pricing

Quicken offers 5 subscription-based plans for budgeting. Each comes with a different cost and a different set of features. We are omitting the 5th option, Starter, as it has limited features and a high cost.

| 1st Year Cost* | Annual Renewal Price* | Best For | |

|---|---|---|---|

| Simplifi | $28.68 | $47.88 | Basic budgeting |

| Quicken Deluxe | $35.88 | $59.88 | Budgeting and light investing |

| Quicken Premier | $50.28 | $83.88 | Investors |

| Quicken Home & Business | $71.88 | $119.88 | Rental property owners, small business owners, and freelancers |

*Quicken advertises monthly prices even though subscriptions are billed annually.

It’s worth noting that the Home & Business package is not designed to track complicated business finances.

Canceling Quicken

In lieu of a free trial, Quicken offers a 30-day money-back guarantee. If you cancel within that 30 days, you will receive the entire year’s subscription price refunded.

After 30 days, no refund will be issued for cancellation. You can cancel automatic renewal at any time to avoid future charges.

📈 Learn more: If you’re looking to optimize your financial management, our article offers insights on the best personal finance software available.

2. YNAB

🏆 Best For Young Adults & Beginners

YNAB, which appropriately stands for You Need A Budget, is a zero-dollar budgeting system that lets you fully account for every dollar you earn.

YNAB’s goal is to help you plan for all expenses, even those pesky non-monthly expenditures like insurance, Christmas, etc. Using their 4 rule budgeting system accurately, YNAB claims the average user is able to save up to $600 in just the first 2 months.

This, coupled with a free trial and support of automatic and manually updating accounts, earns YNAB the vote for the best tool for young adults and those new to budgeting.

App Features

When it comes to budgeting and personal finances, YNAB offers a variety of features. 🔑 Key features include:

- Manage account automatically (linked), manually, or through import (i.e., statements)

- Track every dollar of spending

- Reconcile your budget

- Set and track savings goals

- Create multiple budgets

- YNAB Together – a system for managing and sharing family budgets under one subscription

To learn more about the most recently added features, check out YNAB’s New Features page.

Pricing

YNAB offers a free trial period, but once that is up, you’ll need to pay a subscription fee to continue using its budgeting resources.

| Free trial | Monthly price | Annual price | |

|---|---|---|---|

| YNAB | 34 days | $14.99 | $99 |

| YNAB Together family members | N/A | Free with YNAB group manager subscription | Free with YNAB group manager subscription |

| College students* | 365 days | $14.99 | $99 |

*you’ll need to prove you are a college student using a student ID, transcript, or tuition bill

As you can see, if you pay annually, you’ll get a significant discount. $179.88 ($14.99 X 12 months) versus $99.

3. Honeydue

🏆 Best For Couples

Designed with couples in mind, Honeydue is an app that helps couples manage their money together.

Honeydue has the same features for linking accounts and creating budgets as most budgeting apps offer but with added features for couples, like joint accounts, shared budgets, and in-app chat.

These couple-forward features and free access are what help make Honeydue our pick for the best couples’ budgeting app.

App Features

Honeydue offers general budgeting features and features designed for couples. Here are a few of the key app features:

💰 General budgeting features:

- Track accounts manually or automatically

- View your net worth

👫 Features for couples:

- Set up joint bill-due reminders

- Toggle between individual and joint accounts

- Chat in the app with your spouse/partner

- Choose which accounts you do and do not want to share

- Hide individual transactions (i.e., gifts)

- Split expenses

- Open a JointCash account

The JointCash account is a free, FDIC-insured joint bank account with a Visa debit card offered exclusively through Honeydue.

Pricing

Honeydue does not charge anything for the use of its budgeting app. And, unlike some other free platforms, Honeydue does not make money from partner referrals.

Instead, every few months or so, Honeydue asks each of its users to tip the app. Tips range from $1 to $10 and are charged on a recurring basis. So, if you set up a $2 tip for this month, you’ll continue to tip $2/month until you cancel. Tips are 100% optional.

4. Rocket Money

🏆 Best For Improving Your Finances

From the creators behind Rocket Mortgage comes the new budgeting app, Rocket Money.

The Rocket Money app lets you track all your accounts in one location, view your spending, and track your net worth. But Rocket Money goes one step further by helping you improve your finances through subscription cancellation, bill negotiation, and credit score tracking.

These money-saving tools/resources set them apart from the competition and earned them our pick for the best choice to improve your finances.

App Features

💰 While most of Rocket Money’s selling features require a Premium subscription, there are a few basic budgeting features:

- Linking all your accounts

- A personalized budget

- Heads up on potential overdraft situations

- Net worth tracking

- Custom asset tracking (i.e., an action figure collection or designer handbags)

💵 Rocket Money Premium offers several features designed to help you save money. These include:

- Subscription management – view all your subscriptions in one place and have Rocket Money cancel the ones you don’t need.

- Bill negotiation – Rocket Money’s staff will search for better deals and negotiate savings on common bills like insurance, cable, internet, etc.

- Autopilot savings – a savings account offered by Rocket Money with automatic withdrawals and personalized recommendations on when and how much to save.

- Credit score tracking – track changes to your Experian credit report and VantageScore.

The one significant downside to budgeting with Rocket Money is that they do not currently support adding and updating accounts manually.

Pricing

The Rocket Money app, along with its basic budgeting features, is 100% free. However, if you want to use any of the advanced money-saving features, you’ll need a paid subscription.

Rocket Money’s pricing is honor based, meaning you pay what you think the service is worth. Below is a breakdown of the options and associated pricing ranges. Rocket Mortgage users get Rocket Money Premium for free.

| Cost | Billing | |

|---|---|---|

| Savings Account Only | $24 | Billed $2/month |

| Premium Low-Cost | $36 – $48 | Billed annually |

| Premium | $60 – $144 | Billed $5 – $12/month) |

| Bill Negotiation | 30% – 60% of savings | Immediately* upon approval of successful negotiation |

* You can pay in one lump sum or set up a payment plan.

The bill negotiation service is a custom pre-set charge based on the negotiated savings. So if Rocket Money saves you $240 a year on your internet bill and you offered 40% for the successful negotiation, you’ll owe $96.

Best Budgeting Tools – Honorable Mentions

The options we listed above are not the only budgeting tools available on the market. There are thousands of budgeting apps, websites, software, systems, etc.

While the ones that we have covered are, in our opinion, the best options, we do want to take a minute to highlight some additional apps/tools.

- Zeta – a good alternative to HoneyDue for couples’ finance

- Goodbudget – an app version of the envelope system

- Empower – useful for managing your investments with budgeting tools on the side

- BusyKid – a great app for teaching young kids how to create a budget

- Fudget – bare-bones app for budgeting without syncing financial accounts

While the above options did not make our best-of list, we believe they deserve to be mentioned because of their unique features.

Comparing the Best Budgeting Tools

Below is a quick review of our best budgeting apps/software and how they compare to one another with their basic budgeting features.

| Budgeting style | Option to add offline accounts | Option to share budgets | Create multiple budgets | Cost | |

|---|---|---|---|---|---|

| YNAB | Zero-based | Yes | Yes | Yes | $14.99/month or $99 annually |

| Honeydue | Envelope | Yes | Yes | No | Free |

| Quicken | Zero-based or envelope | Yess | Yes | Yes | $2.39/month up to $9.99/month |

| Rocket Money | Envelope | No | Yes (requires subscription) | Yes (requires subscription) | $0 – $12/month |

The DIY Budgeting Alternative

You don’t have to use a dedicated budgeting app to help establish a budget. There are other tools and resources available to you that can help you track your finances and wealth.

The downside to a DIY system is it may take a bit longer to set up and manage when compared to an all-in-one app. But the upside is that you have infinite control over creating and managing your budget as well as ensuring your financial privacy.

Best DIY Budgeting Tools & Resources

DIY budgeting can work in any way you desire. You can craft a complex budgeting system or pursue a streamlined approach. Regardless of how you choose to budget, several budgeting tools may already be available. This can include tools from

- Banking accounts

- Retirement accounts

- Credit monitoring websites

- Credit cards

- Loans

- Spreadsheet templates (i.e., Google Sheets or Excel)

- Investment apps

- Finance websites

- Tax software

You can use as many tools and resources as you want in whatever way you choose.

It doesn’t matter how you budget. It only matters that you are budgeting.