Identity theft is financially and emotionally devastating. Many victims need months or even years to recover, especially when theft is detected late. Identity theft protection services help avoid these scenarios by providing tools that help to prevent or quickly detect identity theft.

Best Identity Theft Protection Services

We looked at several prominent identity theft protection services, comparing their identity monitoring features, identity theft insurance coverage, and credit protection tools to find the best options. Here’s the list:

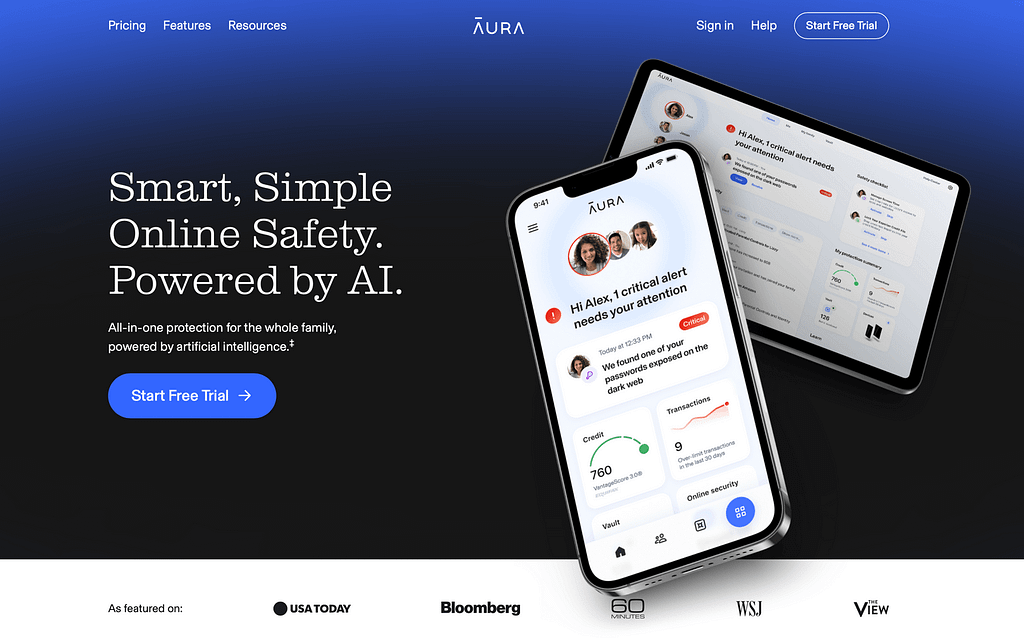

- Aura – Best online security

- LifeLock by Norton – Best value for money

- ID Watchdog by Equifax – Best for credit monitoring

- IdentityForce® – Best for restoring identity

- ReliaShield – Best for family protection

👇 Compare Identity Theft Protection Services

BEST ONLINE SECURITY

Aura

Summary: Aura is a one-stop-shop identity protection service for the entire family. You get access to real-time fraud alerts about any suspicious financial activity, personal data breaches, address changes, and credit card applications. A family plan includes comprehensive child identity theft protection and parental control tools. Learn more

💵 Price: Starts at $12/mo

- Malware protection and VPN software included

- Online personal data removal services

- Comprehensive stolen funds reimbursement

BEST VALUE FOR MONEY

LifeLock by Norton

Summary: LifeLock by Norton award-winning identity theft protection runs real-time address, court records, financial accounts, credit bureaus, and social security number monitoring. Receive aggregated reports about suspicious financial transactions and dubious personal data usage. Get fast incident resolution with the help of 24/7 identity restoration experts. Learn more

💵 Price: Starts at $8.99/month

- Dark web monitoring

- Instant credit lock with TransUnion

- Fictitious identity monitoring

BEST FOR CREDIT MONITORING

ID Watchdog by Equifax

Summary: ID Watchdog by Equifax offers real-time credit monitoring from three major credit bureaus (Equifax, Experian, TransUnion), including subprime loan monitoring. Track your credit score and financial transactions from one account. ID Watchdog also extends transaction monitoring and insurance coverage to investment accounts (401K/HSA). Learn more

💵 Price: Starts at $14.95/month

- Advanced credit score monitoring

- Monthly and annual credit reports

- $1 million identity theft insurance

BEST FOR RESTORING IDENTITY

IdentityForce®

Summary: IdentityForce monitors, alerts, and recovers stolen IDs and stolen funds. A certified team of identity protection experts is available 24/7 by phone, email, or chat. In case of fraud, they’ll help you complete all the paperwork, liaise with the officials, and facilitate the recovery of the stolen identity document(s). They also issue stolen funds reimbursement. Learn more

💵 Price: Starts at $17.99/month

- White-glove family ID restoration

- Medical ID fraud protection included

- Social media accounts monitoring

BEST FOR RESTORING IDENTITY

ReliaShield

Summary: ReliaShield protects you from bank account takeovers, runs regular credit file checks, and notifies you whenever your name or address comes up online (including in court records). The family plan includes children for free with $1 million identity theft insurance automatically extended to them. Learn more

💵 Price: Starts at $7.99/month

- Data breach notifications

- Bank and credit accounts monitoring

- Neighborhood predator alerts

The Reviews

Let’s look at those identity theft protection services in more detail.

1. Aura

Aura is a new arm of Identity Guard, another veteran identity theft protection service, with a greater focus on digital security. Each plan includes VPN, antivirus, and password manager software.

Aura includes automated protection against spam emails, texts, and robocalls. In contrast to other identity protection services, you also benefit from free online data removal services. Aura will scrap personal data from the web to minimize ID theft risks.

Even on the lowest-tier account, you get three-bureau credit monitoring and monthly credit score reports from Experian. Aura sends real-time alerts about suspicious financial activity, such as new bank account openings, credit card applications, and high-volume transactions.

➕ Pros:

- Transparent pricing

- Convenient mobile app

- Online and device security

- Family plans include parental controls

- Comprehensive SSN monitoring

- Identity restoration and recovery assistance

- 14 days free trial

- 60-day money-back guarantee

- $1 million insurance per adult

➖ Cons:

- No tax-refund fraud alerts

- No social media monitoring

- Public information removal from data brokers can be slow

- The Family plan is on the expensive side

Pricing Plans

| Individual | Couple | Family Plan (5 adults, unlimited kids) | |

|---|---|---|---|

| Monthly billing | $15/mo | $30/mo | $50/mo |

| Annual billing | $12/mo | $24/mo | $37/mo |

2. LifeLock by Norton

Norton has transformed their cybersecurity knowledge into a full ID theft protection service. They’re so confident in their product that LifeLock CEO once posted his SSN number online. He got it stolen 13 times and then saw it rapidly recovered by the company’s specialists.

LifeLock’s best identity theft protection relies on a patented ID monitoring system for tracking users’ names, addresses, dates of birth, and SSNs across all web, financial, and court records. When combined with Norton’s online security tools, LifeLock becomes the best identity protection coverage you can get.

➕ Pros:

- Great value for money with regular discounts

- Stolen wallet protection with funds recovery

- USPS address change verification

- Fictitious ID monitoring online

- Up to $1 million for legal fees compensation

- Excellent US-based customer service

- 30-day free trial

- 60-day money-back guarantee

- $1 million insurance per adult

- $25K in stolen wallet funds reimbursement per adult/child

➖ Cons:

- VPN and anti-malware software not included

- Sometimes over-report regular transactions

- Pricing plans increase after one year

Pricing Plans

| Standard | Advantage | Ultimate Plus | |

|---|---|---|---|

| Individual | $8.99/month $90/year | $22.99/month $179.88/year | $34.99/month $239.88/year |

| Couple | $23.99/month $149.88/year | $45.99/month $287.88/year | $69.99/month $395.88/year |

| Family | $35.99/month $221.88/year | $57.99/month $359.88/year | $79.99/month $467.88/year |

3. ID Watchdog by Equifax

Comprehensive credit report monitoring is the most attractive feature of ID Watchdog. You get monthly credit reports from one bureau on a Standard plan and three bureaus on a Premium. Each package includes free credit score tracking, subprime loan monitoring, and dark web monitoring. Premium users also enjoy high-risk transactions and investment account alerts.

ID Watchdog guarantees 100% identity theft resolution if you get hit by a crime. However, the insurance policy doesn’t cover retroactive incidents. ID Watchdog doesn’t guarantee you’ll get all your money back, but they’ll do their best to help you navigate an identity crime.

➕ Pros:

- Stellar credit history monitoring capabilities

- Multi-bureau credit report lock with the Premium plan

- Integrated credit score tracker and annual reports

- 401k/HSA stolen funds reimbursement on the Premium plan

- Social media accounts monitoring and protection from a takeover

➖ Cons:

- No free trial plan

- No partial monthly refunds

- Premium plan is superior to Select

- Real-time financial account monitoring is only available with Premium

Pricing Plans

| ID Watchdog Select | ID Watchdog Premium | |

|---|---|---|

| Individual | $14.95/mo $150/year | $21.95/mo $220/year |

| Family | $23.95/mo $240/year | $34.95/mo $350/year |

4. IdentityForce

IdentityForce is an identity theft protection company launched by TransUnion. It boasts an excellent credit monitoring service for one or three credit bureaus (depending on the plan). A higher-tier plan includes monthly credit score reports from Vantage, annual credit reports from 3 bureaus, and a credit score simulator.

IdentityForce constantly evolves its product. Unlike others, they protect against COVID-related scams, tax, and medical fraud. On a family plan, you can also access advanced child ID protection with social media identity monitoring suite and parental control app.

They also have the best ID recovery services and compensation scheme. Get $1 million in ID theft insurance plus $2,000 for each of the following:

- Travel expenses

- Lost wage

- Elderly/childcare

IdentityForce specialists will thoroughly deal with your ID restoration and even replace stolen funds.

➕ Pros:

- Fully managed restoration ID restoration

- Daily credit report and monitoring with three bureaus

- Sex offender search for fraud alerts and neighborhood monitoring

- Dark web monitoring and online data analysis

- Online security tools (VPN, password manager, safe browsing)

- Extra protection against medical ID fraud

- 30-day free trial

- Add a child for $2.75/mo

➖ Cons:

- No home title monitoring available

- Doesn’t provide FICO credit scores

- Canceling an annual subscription can be complicated

Pricing Plans

| UltraSecure | UltraSecure+Credit | |

|---|---|---|

| Individual | $17.99/mo $179.50/year | $23.99/mo $239.50/year |

| Family | $24.90/mo $249.90/year | $35.90/mo $359/year |

5. ReliaShield

ReliaShield is a Tennessee-based ID theft protection service with local support and ID protection specialists available 24/7. The company offers comprehensive credit history monitoring (including non-credit loan monitoring) with credit report reminders. It also covers your bank and investment accounts.

Unlike competitors, court records monitoring and address change monitoring are available on all plans (even the basic one). You also get notified whenever your personal details come up in a data breach.

The biggest boon is ReliaShield’s affordable family plan. You only pay for two adults, and children get protected automatically. Parents also like the neighborhood predator monitoring feature, alerting you to any offenders in the area.

➕ Pros:

- Credit monitoring and non-credit loan monitoring

- Stolen wallet protection and recovery service

- New bank account opening notifications

- Social media monitoring for your personal details

- SSN, name, and address monitoring

- Free plans for kids

- Up to $1 million in expense reimbursement

➖ Cons:

- No free trial or money-back guarantee

- Prorated refund if you pay for a year of coverage upfront

- Bank account takeover and notifications are only available with the highest tier

Pricing Plans

| Essential | Prime | Elite | |

|---|---|---|---|

| Individual | $7.99/mo $87.99/year | $14.99/mo $164.99/year | $21.99/mo $241.89/year |

| Family | $14.99/mo $164.89/year | $24.99/mo $274.89/year | $34.99/mo $384.89/year |

Comparison Table of Best Identity Theft Protection Services

| Aura | Lifelock | ID Watchdog | IdentityForce® | ReliaShield | |

|---|---|---|---|---|---|

| ID fraud monitoring and alerts | yes | yes | yes (on the highest tier) | yes | yes |

| Credit monitoring and reports | yes (3 bureaus on lowest tier) | yes (1 bureau on lowest tier) | yes (1 bureau on lowest tier) | yes (3 bureaus on the highest tier) | yes (3 bureaus on the highest tier) |

| Credit score reports | yes | yes | yes | yes (on the highest tier) | yes (on the highest tier) |

| Credit lock | yes (only on Experian) | yes (only on TransUnion) | yes (on the highest tier, multi-bureau) | no | no |

| Financial activity monitoring (transactions and takeover) | yes | yes | yes (on the highest tier) | yes | yes (on the highest tier) |

| Personal information & SSN monitoring | yes | yes | yes | yes | yes |

| Change of address monitoring | yes | yes | yes | yes | yes |

| Dark web monitoring | yes | yes | yes | yes | no |

| Home title monitoring | yes | yes (on the highest tier) | no | no | no |

| Data breach monitoring and notifications | yes | yes | yes | yes | yes |

| Court records monitoring | yes | yes | no | yes | yes |

| Fictitious identity monitoring | no | yes | no | no | no |

| Stolen-funds replacement (up to $1 million) | yes | yes | yes | yes | yes |

| Online security tools (VPN, antivirus, password manager) | yes | no (with a separate subscription) | yes (on the premium plan only) | yes | no |

| White-glove ID recovery services | yes | yes | yes | yes | yes |

| Stolen wallet protection & recovery | yes | yes | no | yes | yes |

| Neighborhood predator monitoring | no | yes (on the highest tier) | no | yes | yes |

| Parental control app | yes | no (only as a separate product) | no | yes | no |

| Social media monitoring | no | yes (on the highest tier) | yes (on the highest tier) | yes | yes |

| Online personal data removal services | yes | no (only as a separate service) | no | no | no |

| Medical ID fraud protection | no | no | yes (on the highest tier) | yes | no |

How to Pick the Best Identity Theft Protection Services

Before you shop for an identity theft protection service, consider whether you really need identity theft protection. If your risk level is low you may be adequately protected by a less expensive (or free) credit monitoring service.

If you’re convinced that identity theft protection is necessary, take these steps.

- Check which other online security tools you already own to avoid paying for redundant features (e.g., credit score reporting, VPN, or parental control).

- Pay attention to the number of tracked credit bureaus on each plan and the types of reported credit scores since these differ greatly.

- Always read the fine print to understand what expenses are covered by insurance policies and what type of assistance you’ll get in the worst-case scenario.

Stay safe and sound!