Paper checks are less common nowadays, but they’re not disappearing entirely. If you’re not a frequent check user, you might make mistakes or overlook security measures. Knowing how to write a check and safeguard it from fraud remains useful.

Electronic transactions dominate our digital age, but paper checks are still necessary in certain situations. If you aren’t familiar with checks, this guide will help you avoid mistakes.

How to Write a Check

Time needed: 5 minutes

Here’s a step-by-step guide that will walk you through how to write a check, as well as some additional information that you should know about how checks work and how to use them safely and securely.

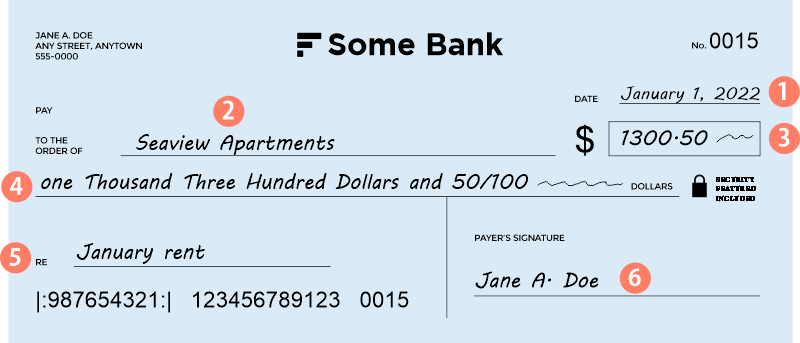

- Write today’s date

Locate the date line, which is usually printed in the top right corner of the check. Use the “month/day/year” format, and spell out the month: “January 1, 2022.”

- Write the name of the recipient

Locate the line that says “Pay to the order of.” Ask the recipient who you should make the check out to, and double-check the spelling. Write out the name of the payee (the person or company receiving the check). The payee has to be correct and spelled correctly or the check will not be negotiable.

- Write the amount of the check in digits

Find the small box on the right edge of the check. Write out the payment amount in digits, including cents. If the check is for an even dollar amount, it’s common to write the dollar amount followed by a line (e.g., $100—), as this prevents the recipient from changing the amount.

- Write the amount of the check in words

On the long line below the recipient’s name, write out the payment amount again. Use words for the dollars and a fraction of a dollar for cents. For example, you’d write $38.15 as, “Thirty-eight dollars and 15/100 cents.”

- Write what the check is for

Most checks have a memo line in the lower-left corner. While filling out this portion is completely optional, it’s a good idea to make note of what you purchased with the check for your records (and it helps ensure that the check recipient properly accounts for the payment).

- Sign the check

On the line in the lower right-hand corner of the check, sign your name. This is the most important part, as it makes the check legal. A check without a signature cannot be cashed or deposited.

- Record the check in the register

Your checkbook comes with a check register, which is essentially a manual spreadsheet that lets you keep track of your deposits, purchases, and withdrawals. Record your check in the register (along with your other credits and debits) to keep track of your account balance.

💡 Recording your checks in the register — also known as balancing your checkbook — used to be a key personal finance activity that helped you stick to your household budget and avoid overdrafts. But if you only write an occasional check, it might not be worth the time and effort, as the transaction will be recorded in your online banking account.

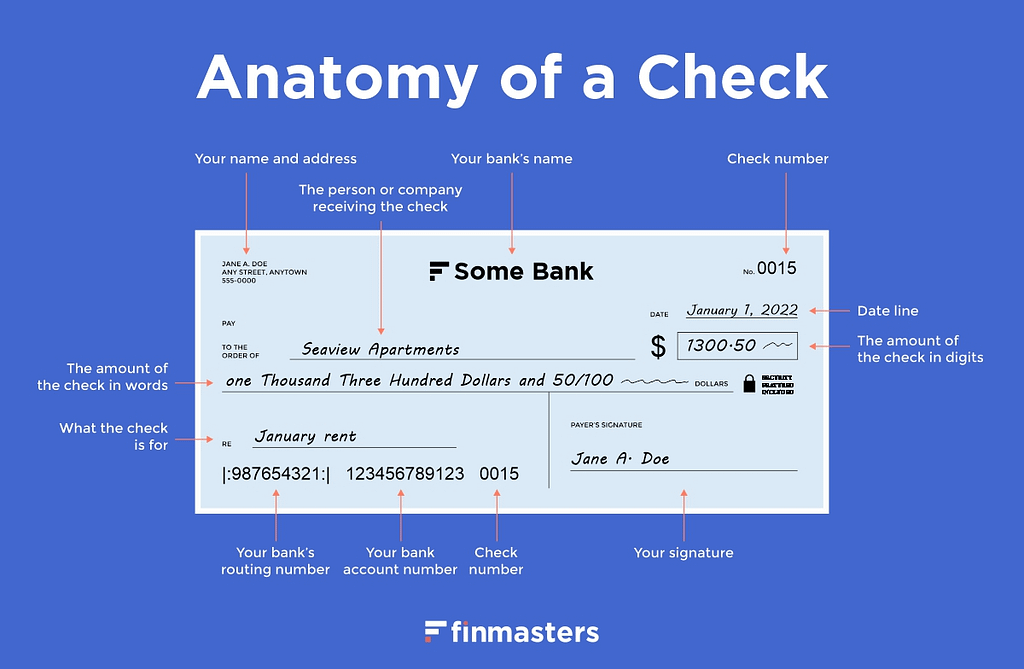

Other Parts of a Check

In addition to the above items, you’ll usually see a few more things printed on your checks.

While you don’t need to write on or alter any of these other parts, it’s good to understand the full anatomy of a check and how each part is used.

- Your name and address. This information is pre-printed in the top left corner to state the person or business the check comes from.

- Your bank’s name and address. Your bank’s contact information is usually printed on the check. That way, if there’s a problem with the check, the recipient knows who to call. In most cases, this is the location of the issuing bank’s main office — not your local branch.

- The check number. Each check has its own identifying number. This appears both in the upper right corner and after the account number in the lower right corner. You are not required to use checks in sequential order, and you can order them starting with any number you like.

- The routing number. Each bank has a unique nine-digit routing number, which identifies the institution the funds are coming from. It’s printed on the bottom left of the check.

- The checking account number. This is printed after the routing number, telling the bank which specific account to pull the check funds from.

Avoid Fraud With These Check Writing Tips

Since checks lack the security features of currency and credit card transactions, it’s relatively easy for a criminal to do some serious damage to your bank account.

Here are a few tips to make your checks less likely to be targeted by fraudsters.

Tip #1: Always use a blue or black pen. Checks written in pencil can be erased and altered by the recipient. Blue and black ink show up well on bank scanners. By using blue ink, you can easily tell if a check is an original or a black-and-white photocopy.

Tip #2: Don’t sign blank checks. Your signature makes the check legal. If you don’t fill out the recipient or payment amount, anyone could write their name as the payee and make the check out for a million dollars or more. If you have enough money in the account to cover the check, it will go through.

Tip #3: Don’t make checks payable to “cash.” If you write “cash” instead of the name of the person who is the payee, anyone in possession of your check can cash it. If the check gets lost or stolen, you’re out of luck.

Tip #4: Leave no empty space in the amount box — either between the dollar sign and the first number or before the decimal. An easy way to alter a check is to just add a digit in the amount box somewhere (making $10 into $100, for instance). You can prevent this by aligning the numbers at the left of the box and drawing a line after the amount to fill the remainder of the box.

Tip #5: Always “void” mistakes or unused checks. If you mess up on a check, don’t just throw it away; if someone finds it in the trash, they could finish writing the check and cash it. Write “void” in large letters over the check to prevent anyone from using it in the future.

Alternatives to Paper Checks

Because of the risk of fraud, you may want to avoid writing a check if you can. For transactions that aren’t suited to credit cards or cash, you can use one of the alternate payment means below.

- ACH payments: Automated clearing house payments (also known as direct payments or direct deposits) go straight from one financial institution to another without the need for checks or cards. Most online bill payments — such as when you pay your credit card from your bank account — are ACH transactions.

- Wire payments: You can pay money upfront to a bank or transfer provider such as Western Union, and for a fee, they will transfer the money to the recipient’s bank account.

- Peer-to-peer payments: You can use mobile apps like PayPal, Venmo or Cash App to send money to people for free (as long as they also have the same app). These apps usually link to your checking account, but you may also be able to pay through them using a debit or credit card.

- Online bill pay: This feature is often offered with checking accounts, allowing the owner to send online payments automatically without having to write and mail a check.

All of these are secure paper-free ways to make payments that you might otherwise make by check.

How to Fill Out a Check FAQs

Theoretically, all the bank needs to cash a check is the routing and account numbers, but pre-printed checks require your name and address. Many institutions will not accept a check without a pre-printed name and address on it.

Yes, although unless you are standing next to the teller, it’s not advisable. Anyone can cash a filled-out check made out to “cash,” even if the check is lost or stolen. Additionally, some banks have adopted policies that prevent them from handling checks that fill out a check without a defined payee.

A postdated check is one that has a future date in the date field, as opposed to the current date. However, postdating a check does not ensure it won’t be deposited before then. In most cases, a check can be deposited at any time.

Some people use “XX” when writing out the check amount to ensure that the value isn’t changed. For example, “00/100” means “no cents,” but it could theoretically be changed to “100/100,” which would mean “one dollar.” A fraudster could try to fill out a check and change “00/100” to something like “10,000/100” (which would mean “one hundred dollars”), but no responsible bank would accept this. As such, there’s no need to use the “XX” designation.

Checks can be made payable to anyone, including yourself. This can be useful if you need to transfer money between different financial institutions. However, if you need cash today, it’s best to visit a no-fee ATM instead.

No. Check numbers are primarily for your convenience. They help prevent fraud, duplicate payments, and skipping over unused checks in your checkbook.

While carbon copy checks are not necessary, they are certainly convenient. They create a copy of the check as you write it, making a useful record of what check you wrote and when.