Gas prices in the United States reached unprecedented highs in the summer of 2022, creating a significant challenge for consumers and contributing to elevated inflation. Gas prices have become a contentious political issue, sparking debates over who is accountable.

While the urge to find someone to blame is understandable, the reality of commodity prices is often complicated. Simple answers are frequently incomplete or inaccurate.

So, why did gas prices rise? Let’s take a closer look.

Jump to:

- Where does the money we spend on gas go?

- How much tax do we pay on a gallon of fuel?

- Why are gas prices different in different states?

- Why is gas more expensive in summer?

- How are oil prices set?

- Why are there many different oil prices?

- Why do oil prices change so much?

- Do OPEC or oil companies control oil prices?

- Why do we have to worry about OPEC? Can’t we produce our own oil?

- Why are oil prices so high right now?

- Has the US stopped producing oil?

- Why does the US both export and import oil?

- Would gas be cheaper if the US was energy independent?

- Why do US Presidents always ask the Saudis to pump more oil when prices are high?

- Why isn’t the US producing as much now as it was before the pandemic?

- Has the cancellation of the Keystone XL pipeline affected US gas prices?

- How much has the war in Ukraine affected oil prices?

- What could the US do to make gas cheaper?

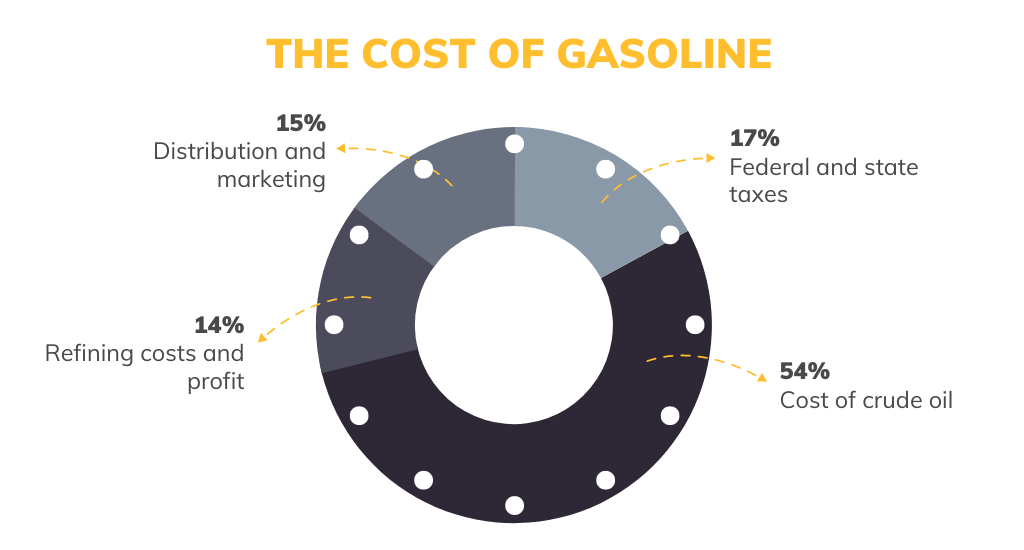

Where does the money we spend on gas go?

On average, the cost of gasoline breaks down like this.

- Cost of crude oil: 54%

- Refining costs and profit: 14%

- Distribution and marketing: 15%

- Federal and state taxes: 17%

This breakdown may change at any given time, but the differences are usually minor. Sometimes one or more elements of the price will surge and drive higher prices.

How much tax do we pay on a gallon of fuel?

As of January 1, 2022, the taxes on an average gallon of gasoline sold in the US were:

Federal: 18.4 cents/gallon

Average state: 31.02 cents/gallon

State Gas Taxes

State taxes vary widely and may be well above or below this average.

California imposes the highest gas tax at 66.98 cents/gallon.

The lowest is Alaska, at 14.98 cents/gallon.

Why are gas prices different in different states?

The single biggest difference in gas prices from state to state is taxes.

Some states also require specific fuel blends to control emissions, which may be more expensive.

Transport costs also vary. The farther a state is from major refineries, the higher these costs will be. The high cost of piping fuel over the Rocky Mountains adds an additional cost for gas on the west coast.

Why is gas more expensive in summer?

Gas is usually more expensive in the summer. There are three reasons for that.

- People drive more in the warm months, creating additional demand for gas.

- The US requires the use of a different fuel blend in the summer to reduce emissions and air pollution. Summer-blend fuel is more expensive.

- The US hurricane season starts in June. Gulf Coast refineries are vulnerable to hurricane damage, which may cause supply interruptions.

The difference between summer blend and winter blend prices is usually three to six cents a gallon, though it may be increased by supply issues or unusually high demand.

How are oil prices set?

Oil prices are set in the global market by the global supply/demand equation. Oil prices are based on bids made by traders who buy and sell contracts for future delivery. These traders are constantly trying to anticipate supply and demand when the contracts mature.

There are two basic types of oil prices.

- The spot price is the price that you would pay to buy oil right now, for immediate delivery.

- The futures price is the price you would pay for a contract for delivery in the future. This price may vary with the delivery date: a three month contract might be different from a six month contract.

If a trader buys a contract for a future date and the contract price is lower than the spot price on that date, the trader has made money. If the spot price is lower than the contract price, the trader loses.

Oil traders bid based on the expected spot price when the contracts mature. They look at expected conditions in the future, but not very far in the future. Most contracts are for delivery in three to six months, and that’s the forward horizon traders consider. They are not concerned with conditions years down the line.

Why are there many different oil prices?

You may hear different prices quoted for oil. These are the two most common ones:

- Brent crude was originally the price of a blend of North Sea oil. It has become a benchmark price for Middle East, European, and African output.

- West Texas Intermediate or WTI is a blend of US-produced oil that has become a benchmark for the US market price.

These are benchmark prices, which means that oil may not trade at that exact price. For example, a contract for a very specific and uncommon grade of oil on a precise date might be priced at Brent plus 20%. A contract for a low grade of oil could be priced at WTI minus 15%.

The actual price of each transaction may vary, but these major benchmarks – and a large number of minor ones – are reference points for pricing.

The prices of Brent and WTI oil are usually very close. If there is a difference, WTI is usually slightly cheaper.

Why do oil prices change so much?

Oil is a very important commodity and relatively small changes in supply or demand, or even threats to supply and demand, can move prices dramatically.

Oil prices are extremely volatile, ranging from under $20/bbl to almost $140/bbl over the last 25 years.

Oil prices move in cycles. When supply is plentiful prices drop. That encourages oil use, and demand grows. Producers with high production costs stop pumping, cutting supply. Those trends increase demand and decrease supply, and prices rise.

When oil is expensive, users cut back and use less. Producers pump more to take advantage of the high price. That leads to lower demand and higher supply, and prices fall.

Outside of those broad cycles, many factors can affect prices. Political instability or war in producing countries can drive traders to rush to lock in supply, pushing prices up fast. Rapid economic growth can push demand up. Recessions push demand down, as we can see from the dramatic price drop in 2008.

The abbreviation BBL refers to a single barrel of crude oil. One oil barrel is 42 US gallons, approximately 159 liters or 35 imperial gallons.

You may come across these measures as well:

- kbbl or Mbbl – one thousand barrels

- MMbbl – one million barrels

- Gbbl – one billion barrels

- mbpd – million barrels per day

Do OPEC or oil companies control oil prices?

The Organization of Petroleum Exporting Countries (OPEC) does not directly set oil prices. They can influence supply by reducing or increasing output, which affects prices.

OPEC assigns production quotas to member countries. When oil prices are low they reduce these quotas to push prices back up. When prices are high they increase the quotas.

Members do not always follow these quotas if they feel that the quota conflicts with their national interests. Some members are unable to pump enough to fill their quotas.

What Is OPEC?

OPEC is an acronym for the Organization of Petroleum Exporting Countries. OPEC was formed in 1960 by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela as an intergovernmental organization with an aim to regulate the worldwide supply of oil and its price. Many economists have cited OPEC as a textbook example of a powerful anti-competitive cartel.

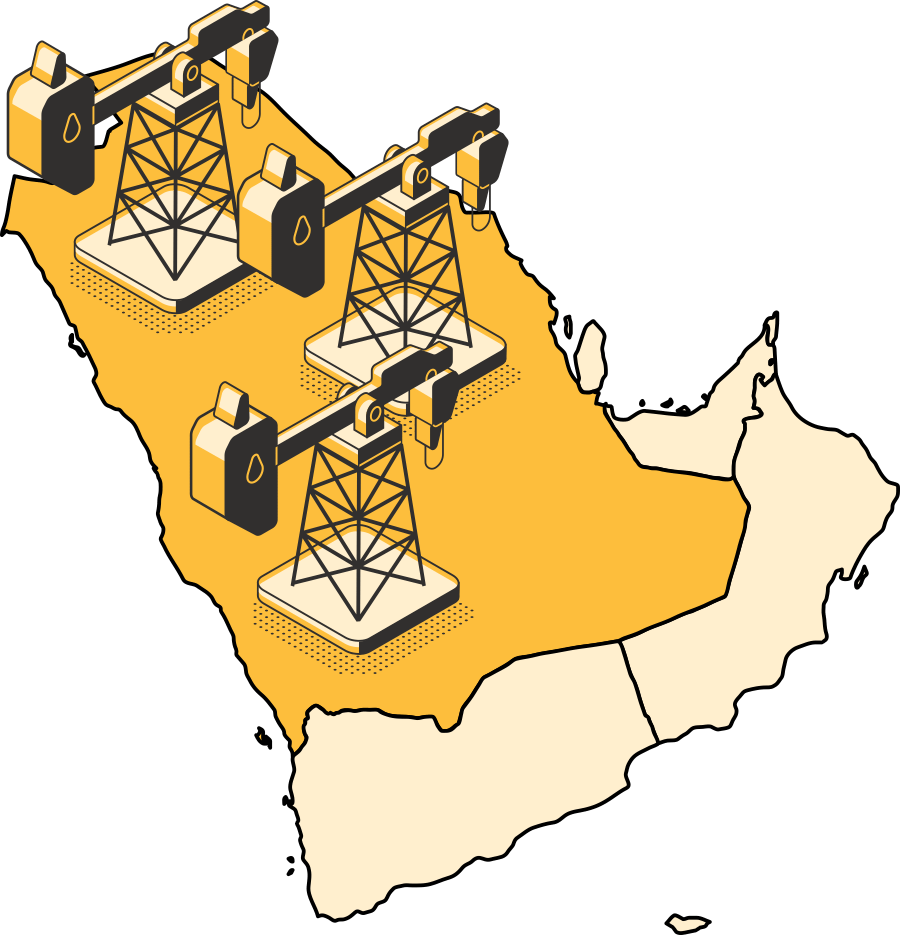

Today OPEC has 13 member countries which in 2020 accounted for 37.13% percent of global crude oil production and 79.87% of the world’s “proven” oil reserves. Saudi Arabia is the biggest producer of all OPEC members, accounting for 9.5 million barrels per day.

A group called OPEC+ was formed in 2016 bringing together OPEC members and 10 non-OPEC oil-producing countries.

Oil companies earn high profits when oil prices surge, and some have accused them of price gouging. It’s true that companies could sell gas for less and still earn a profit. It’s also true that many companies have chosen to put money into share buybacks and dividends rather than expanding production capacity.

At the same time, the oil company business model is built around volatile oil prices. They lose money when prices drop and make up for it when prices are high. Oil companies would say that we have to look at profits averaged over both high and low periods to get a real picture of their operations.

Why do we have to worry about OPEC? Can’t we produce our own oil?

Oil prices are set in the global market, and the US price tracks the world price closely. Even if the US doesn’t use any OPEC oil, changes in OPEC production will still move the global price and the US price.

For example, the United Arab Emirates (UAE) produces around 3 mbpd of oil. Almost all of this is sold to Asian buyers. If the UAE stopped producing, the refiners that are now buying oil from there would look for other suppliers. Demand would rise and the price would go up for everyone, even countries that don’t use any UAE oil.

Why are oil prices so high right now?

Oil prices were in a cyclic high period from 2010 to 2014, with prices continuously between $80 and $110 per barrel.

Prices crashed in 2014 and stayed in a low band (with a brief spike in 2018) until 2020 when the COVID-19 pandemic drove prices to extreme lows. This extended period of low prices drove many producers to reduce both production and investment in new production.

As demand recovered after the pandemic many producers were unable to increase production. Demand soared and supply couldn’t match it. OPEC in particular is pumping roughly 6 million barrels per day (mbpd) less than they were before the pandemic.

This supply shortfall was magnified by sanctions on Venezuela and Iran (which have the world’s largest and 4th largest reserves), export cuts due to political instability in Libya, and Russia’s war on Ukraine.

The US gasoline supply is also being hit by a lack of refining capacity. A large refinery in Louisiana shut down in 2021 after flood damage, and another refinery in Philadelphia closed after a serious fire. US refining capacity is down 1 mbpd from 2019. Refiners are also rushing to produce more profitable jet fuel as air travel ramps up again post-COVID.

Has the US stopped producing oil?

As of June 2022, the US is the world’s largest producer of crude oil, pumping around 12 mbpd. Russia produces roughly 10.5 mbpd and Saudi Arabia pumps around 9.5 mbpd.

US production peaked at just over 13 mbpd in March 2020, then plunged to 9.7 mbpd by August 2020 as the pandemic crushed demand. It has recovered steadily since then. US weekly production reached 12 mbpd in the second week of June 2022 and is expected to average 12.8 mbpd – the highest annual average ever – in 2023.

Why does the US both export and import oil?

The US government does not control the sale and purchase of oil. US producers can sell to any buyer, foreign or domestic. US refiners can buy from any supplier, foreign or domestic. Aside from sanctions on some sellers and buyers, the government has little control.

Different refineries are designed to use different types of crude oil. Many refiners buy different grades of crude oil and blend them to get the ideal mix for their refineries. Some of these grades are not available from domestic producers.

Some refiners also have long-running supply relationships with foreign suppliers that they don’t want to disrupt. In some cases, the links are very close. One of the largest refineries in the US, in Port Arthur, Texas, is owned by Saudi Aramco, the Saudi Arabian state oil company. If they buy from Saudi Arabia they are buying from their own company.

Would gas be cheaper if the US was energy independent?

In 2019 and 2020 the US was a net oil exporter, meaning the country exported more oil than it imported. Some media outlets and politicians called this “energy independence”. This description was not accurate.

U.S. petroleum consumption, production, imports, exports, and net imports, 1950-2021

Even if the country exported more than it imported, many US refiners still need grades of crude that they cannot get in the local market. They still need to import.

More important – we’ll repeat it – oil prices are set in the global market, not the US market. Even if the US doesn’t use a drop of OPEC oil, we still depend on their production to stabilize the price. If the US price is much lower than the global price, US producers will simply export their oil to get a better price.

Why do US Presidents always ask the Saudis to pump more oil when prices are high?

Whenever prices are high, US presidents ask the Saudis to pump more oil. There are several reasons for that.

- Reserve capacity. The Saudis are one of the only producers with a large reserve capacity. They are now pumping under 10 mbpd. Their official capacity is 12 mbpd. That may not be realistic, but they can certainly pump more than they are pumping.

- Central control. The Saudi government owns the oil industry and can change production levels with a single instruction. The US government can’t tell its producers how much to pump. The Saudi government can.

- Leverage. The Saudis rely on the US for military equipment and defense assistance in a potential conflict with Iran. In theory, this gives the US some leverage over the Saudis. In practice it doesn’t always work: the Saudis don’t always follow US requests.

When the US asks the Saudis to pump more oil, they are not asking the Saudis to send more oil to the US. It doesn’t matter who buys it. If more oil goes into the world market there is downward pressure on prices.

Why isn’t the US producing as much now as it was before the pandemic?

Usually, when prices go down, production goes down as well. This is especially true in the US, where production costs are high and many producers can’t sell at a profit if the price is low.

In 2019 and 2020 this pattern was reversed. Prices fell and producers in other countries cut back. US production continued to rise, peaking at over 13 mbpd. Why did they expand production even while prices fell?

The answer is that US producers had taken on large amounts of debt. As prices fell they had to pump more to generate money to pay debts. The investments in production had already been made, so even if they were losing money they still had to pump to pay back the loans.

Many failed. Bankruptcies in the US and Canadian oil sectors spiked dramatically n 2019 and 2020.

Now prices are high, but producers are still reluctant to invest in new capacity. There is a time lag between investment and production. Oil may be high now, but if a company invests now it may be from 1-3 years before those investments start producing. There’s no assurance that oil prices will still be high that far into the future.

US producers are investing and production is increasing, but don’t expect a dramatic spike. The US Energy Information Administration (EIA) expects US production to increase steadily and reach 12.8 mbpd in 2023. That could change if prices fall.

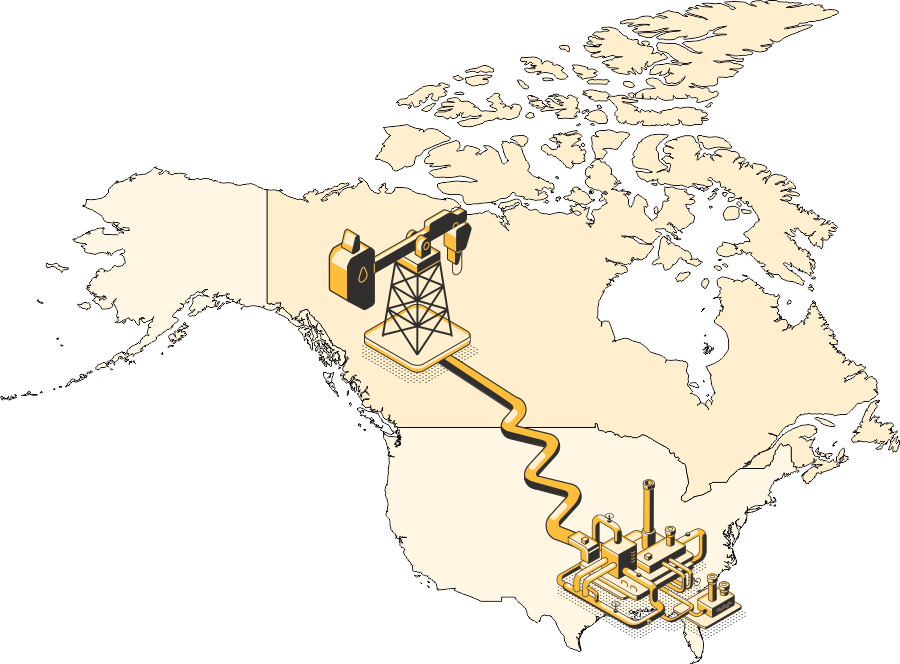

Has the cancellation of the Keystone XL pipeline affected US gas prices?

Shortly after taking office, President Biden canceled Keystone XL, a proposed branch of the existing Keystone pipeline. Some say this decision increased gasoline prices. Is it true?

The US currently imports near-record levels of oil from Canada, over 4 mbpd. Much of this oil is heavy, sour (high sulfur) tar sands oil.

Some of this oil is used by US Gulf Coast refineries that used to use Venezuelan oil, which is very similar to tar sands oil. The rest is exported directly from US ports.

Canada is currently at near-record production levels and its oil is coming to market. Upgrades currently in progress to the existing Keystone and Trans-Mountain pipelines will carry more oil than Keystone XL would have.

Oil prices (again) are set in the global market, and in global terms, the impact of Keystone XL is a small drop in a large bucket, with minimal impact on prices.

How much has the war in Ukraine affected oil prices?

Russia is the world’s second-largest producer of crude oil (behind the US) and second-largest exporter (behind Saudi Arabia). It’s a major player in the oil export market and anything that reduces its exports will have an impact on oil prices.

Right now it’s not clear how much Russia’s oil exports have dropped. Some customers have stopped buying Russian oil due to sanctions or just as a question of policy. Other destinations have increased purchases, as Russia sells below the world price to attract new buyers.

In theory, if Russia sells more oil to India or China, those countries will then buy less from other suppliers, who will then sell to the countries that stopped buying Russian oil. Global supply should not be affected as long as the oil comes to market.

In practice, the Russia/Ukraine situation has produced uncertainty in oil markets. The concern is not so much that supply has been cut, but that it might be cut in the future. Oil markets hate uncertainty. Traders worried about future supply rush to lock in delivery contracts even at higher prices, and push the price up.

It’s impossible to say how much the war has pushed prices up, but it’s certainly a factor.

What could the US do to make gas cheaper?

The US government actually does not have much power to reduce gas prices. The government does not control the oil industry (we’re not Saudi Arabia) and can’t order companies to increase output or open new refineries. Even if US output rose 1 mbpd to match peak levels the impact on global prices would not be large.

The government could reduce taxes, but as we saw above, state taxes are larger than federal taxes.

Dropping sanctions on Iran and Venezuela could increase supply and push prices down but it will take years for these countries to ramp up production. It wouldn’t be a quick fix.

So there’s not much government can do. If there’s one consolation, it is that oil price spikes do pass. High prices encourage producers to ramp up production and provide capital to expand. They also encourage users to cut back and use fuel more efficiently.

If history is any guide, prices will fall, not because of anything government does, but because that’s the way oil markets work.