When volatility increases you can be fairly sure that emotions are driving a lot of the decisions investors make. In particular, fear and greed cause investors to buy and sell stocks at irrational prices. This creates opportunities for savvy investors to pick up bargains, and lock in profits at favorable prices.

This post will give you an overview of market sentiment, CNN’s Fear and Greed Index, and how you can use market sentiment to improve your returns.

In this post:

- How Fear and Greed Drive Asset Prices

- Emotional Decision Making

- Market Sentiment and Investing

- Sentiment Indicators

- CNN’s Fear and Greed Index

- Components of the Fear and Greed Index

- Pros and Cons of the CNN Fear and Greed Index

- Other Market Sentiment Indicators

- How to Use Market Sentiment

- Market Behavior of Stocks vs. Indices

- CNN Fear and Greed Index Example: March 2020

How Fear and Greed Drive Asset Prices

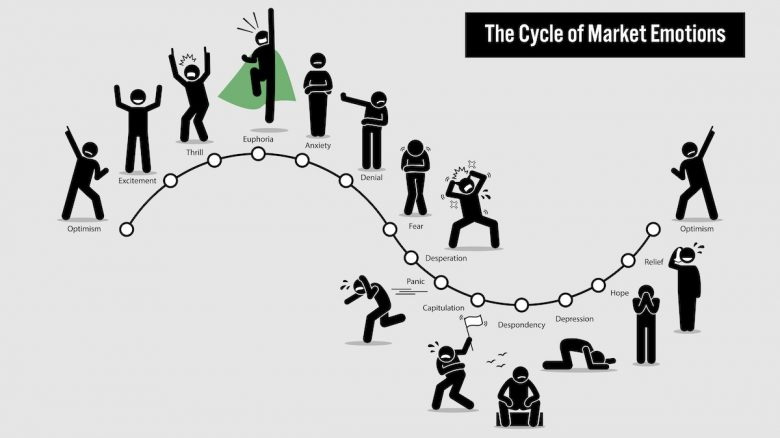

One of the great paradoxes of the financial markets is the fact that investors are at their most optimistic at market tops and most pessimistic at market bottoms. Emotional decision making creates this paradox. In particular, it is fear and greed that often causes the decision making that leads to major market highs and lows. Emotions play a key role in the way humans make decisions.

You only need to visit a casino, to see people putting money into slot machines when they probably know the odds are stacked against them. When you invest in stocks, or other financial assets, the odds are not necessarily stacked against you like they are in a casino. But, when you let emotions cloud your decision making, you can stack the odds against you.

On the other hand, if you understand a bit about market sentiment and behavioral finance, you can use these insights as a market timing tool. Rather than letting emotions cloud your decisions, you can wait for extreme fear or extreme greed to enter and exit positions at favorable prices.

Emotional Decision Making

People buy and sell stocks for lots of different reasons. Sometimes the decision to buy or sell an asset is the result of a rational decision-making process. In other cases, emotions like fear and greed compel people to trade. Fear and greed are the emotions that tend to dominate at market highs and lows.

Several other emotions can and do affect decision making at other times. These can include boredom and frustration, euphoria, excitement and hope. These emotions tend to affect different people at different times. They are also more common to certain investment strategies. Fear and greed are different because they can affect large numbers of investors at the same time.

When emotions drive decisions, investors often become less sensitive to the price they trade at. Large price moves occur when investors are more concerned with executing a trade, than the price they trade at. Price extremes usually occur when large numbers of investors become insensitive to the price they trade at.

Greed is associated with market bubbles and periods of irrational optimism. Rising prices are taken as proof that prices can continue to rise regardless of valuations or fundamentals. In many cases, new narratives will evolve to justify inflated prices regardless of whether they are realistic or not. The result is that asset prices can become divorced from reality. Often, prices will rise until there is just no more buying power.

Fear is associated with corrections, bear markets and market bottoms. Fear begins to affect investors when they see the value of their portfolios fall. This is when people begin to expect the worst and they are often motivated to sell securities to prevent further losses – even when they know prices are too low. Very often the bottom occurs when investors capitulate and sell their stocks for whatever price they can get.

Market Sentiment and Investing

Market sentiment is mostly used as a contra-indicator. Betting against the dominant emotion in the market is a fairly reliable way to sell stocks when sentiment is too bullish, and buy stocks when investors are too bearish. Like many investing tools, sentiment works a lot of the time, but not every time. Combining sentiment with other tools can produce more consistent results.

Contrarian investors typically look to sentiment as an investment tool when it is at extremes – either extreme greed and bullishness, or extreme fear and bearishness. However, market sentiment can also be used to confirm a change in the market’s bias when it shifts from bullish to bearish or vice versa.

Sentiment Indicators

We can’t really measure market sentiment itself. But we can estimate it with several indicators. These indicators come in many forms and reflect sentiment in different ways. Most of these indicators fall into the following categories.

- Investor sentiment and business surveys.

- Demand for risk-on assets like junk bonds.

- Demand for risk-off assets like gold and bonds.

- Demand for portfolio hedging products like futures and options.

- Market internals which evaluate the performance of stocks within an index.

Each market sentiment indicator has its pros and cons, so it’s advisable to consider several when conducting sentiment analysis.

CNN’s Fear and Greed Index

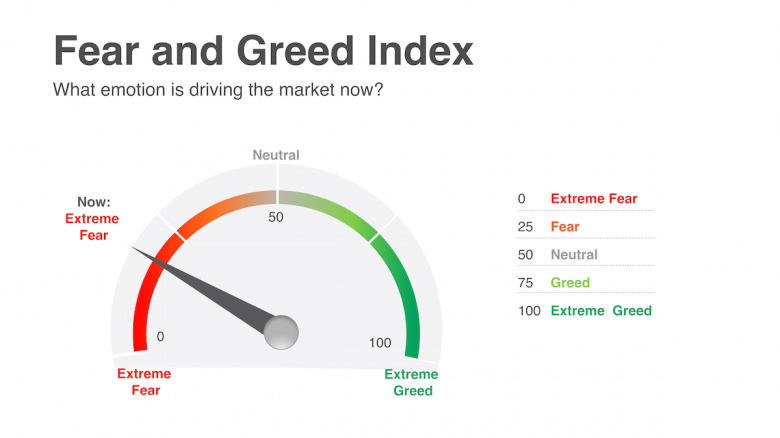

CNNMoney publishes its own Fear and Greed Index, which combines seven commonly used sentiment indicators. Each indicator is assigned a rating between extreme fear and extreme greed, with the overall indicator reflecting the average of these indicators. The index ranges between 0 (extreme fear) and 100 (extreme greed), with 50 indicating neutral investor sentiment.

The 7 Components of the Fear and Greed Index

The CNN Fear and Greed Index is made up of the following seven indicators:

- Stock Price Breadth

- Stock Price Strength

- Market Momentum

- Junk Bond Demand

- Safe Haven Demand

- Market Volatility

- Put and Call Options

1. Stock Price Breadth

Market breadth compares the number of stocks with rising prices against the number of stocks with falling prices. The CNNMoney Fear and Greed indicator uses the McClellan Volume Summation Index for the NYSE. This indicator keeps a running total of the McClellan Volume Oscillator, calculated by subtracting declining stocks from advancing stocks. This indicator is compared to its range over the previous 2 years to arrive at a rating between extreme fear and extreme greed.

2. Stock Price Strength

Stock market sentiment can also be measured by comparing the number of net new 52-week highs and lows in a given market. CNN calculates this indicator for stocks trading on the NYSE.

3. Market Momentum

The market’s momentum is gauged by comparing the index level for the S&P 500 index with its 125-day moving average. The indicator is expressed as a positive or negative percentage relative to the moving average.

4. Junk Bond Demand

Junk bonds are bonds with high yields that also have a relatively high-risk rating. When market sentiment is dominated by greed, investors seek out the higher yields that junk bonds offer. Demand for junk bonds is gauged by considering the spread between the yield on high yield bonds and investment grade corporate bonds. This spread narrows when junk bond demand is high and widens when greed subsides.

5. Safe Haven Demand

When market sentiment is dominated by fear, investors move capital from risk assets to safe haven assets like bonds. The CNN Fear and Greed Index measures safe haven demand by comparing the returns for bonds and stocks over a 20-day period. The difference in returns is compared to the historical range to determine a sentiment score.

6. Market Volatility

A popular sentiment indicator is the CBOE volatility index, or VIX. Implied volatility is a key component of the value of an option, and reflects the amount of uncertainty in the market. Typically implied volatility also rises when demand for put options rises.

The VIX is an index of the implied volatilities for a range of S&P 500 index options. The index is usually between 15 and 20%, but has reached over 90%, and fallen to below 10% in the past. For the Fear and Greed Index, CNNMoney compares the index to its range over the previous two years.

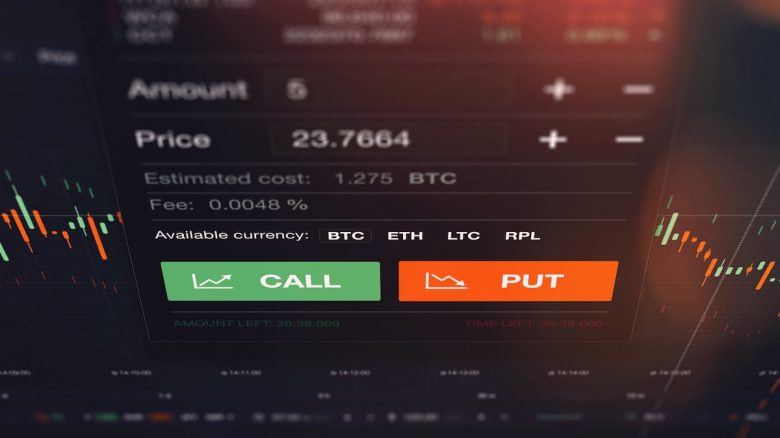

7. Put and Call Options

Investors buy and sell options for several reasons. However, when investors are bullish, volumes for put options lag call options. Conversely, when investors are bearish, volume for call options lags put options. The put/call ratio simply divides put option volume by call option volume over a rolling 5-day period. The most commonly cited put/call ratio uses data for CBOE equity options.

Pros and Cons of the CNN Fear and Greed Index

CNN’s Fear and Greed Index is a useful tool, but like any investment tool it has strengths and drawbacks. It’s especially important to take note of its limitations before using it to make decisions.

Pros of the Fear and Greed Index

- The index can help you identify favorable periods to buy and sell stocks by betting against the crowd.

- You can use the index to quickly understand market sentiment and how the underlying indicators contribute to the overall score.

- Technical issues unique to a specific market often affect individual sentiment indicators. By combining several indicators, the CNN index reduces the impact of these factors on the overall reading.

Cons of the Fear and Greed Index

- The index is not always consistent over time. An underlying reading that signals extreme fear today, may have given a neutral signal in the past. This prevents proper backtesting of the index.

- Stock prices can continue to fall after the index reaches extreme fear and continue to rise after the index reaches an extreme greed level.

- The index is not a silver bullet, and is best used alongside other investment tools and stock valuation metrics.

Other Market Sentiment Indicators

CNNMoney’s Fear and Greed Index combines seven widely followed indicators. These are a few other sentiment indicators worth knowing about:

- The AAII Sentiment Survey reflects US individual investor sentiment in the US. Respondents are asked whether they are bullish, bearish or neutral on the market outlook for the next six months.

- The CFTC publishes a Commitment of Traders report. This report reflects the open futures positions held by various types of market participants. It covers stock index futures as well as other futures markets.

- TradingView also has a sentiment indicator based on several technical analysis tools. The indicator is available for most major indexes.

- The Dollar Index (DXY) also reflects safe haven demand as investors prefer to hold dollars during periods of uncertainty. The index tracks the performance of the USD against a basket of currencies.

- Due to the popularity and success of the CNN Fear and Greed Index, there are now also comparable indicators for cryptocurrencies available on various websites.

How to Use Market Sentiment

The CNN Fear and Greed Index is quite accurate when it comes to gauging market sentiment. But it is not always accurate when it comes to timing. The fact that there is extreme fear or greed in the market does not mean that stock prices will reverse.

Whether index prices reverse or not will often depend on the issues contributing to sentiment and the underlying trend. For this reason, market sentiment indicators should always be used in conjunction with technical, fundamental, or quantitative analysis. There are also a few differences between market tops and bottoms to consider.

Market Tops and Greed

Bull markets often continue for a lot longer than investors think possible. Market tops can also occur a long time after valuations become excessive. Sentiment indicators like the fear and greed index can also reach an extreme greed level some time before the top.

Typically, a market top only forms when the market runs out of buyers (i.e. everyone is already fully invested), or when a catalyst occurs. Catalysts can come in the form of a black swan event, a geopolitical event or unexpectedly bad corporate or economic news.

An extreme greed reading isn’t necessarily a sign to sell all your stocks. But it can be taken as a signal to take some profits, manage risk carefully or avoid very speculative stocks. It’s also a good time to start looking for a catalyst that may lead to a sell-off.

Market Bottoms and Fear

When it comes to looking for market bottoms, there are more factors to consider. A stock market crash or correction may be caused by geo-political events, a financial crisis, disappointing corporate earnings, or an economic shock. Very often, the fear is motivated by speculation about what might happen, rather than what is actually happening.

This is the type of situation that often sets up a great buying opportunity. There are some occasions when stock prices can continue to fall. This is likely to happen when more than one of the following conditions are present:

- News flow: If news and events continue to deteriorate or are worse than expected, there’s a reason for further downside. We are talking here about actual news and events – not the forecasts made by market pundits. When pundits warn of further downside, it’s often a bullish sign.

- Valuations: If stock valuations are still at historically high levels after a correction, there may be more downside ahead.

- Technical support: If analysis confirms a downtrend, or the index is trading below a key support level, it’s more likely there will be more downside. An index is generally considered to be in a downtrend if it is trading below its 200-day moving average.

These conditions point to the potential for further downside. That doesn’t mean you shouldn’t do any buying as prices often don’t fall much further. You can begin to scale into high-quality stocks that you would like to own for the long-term, and then add to those positions if prices do fall further.

Market Behavior of Stocks vs. Indices

Market sentiment indicators like the fear and greed index reflect overall sentiment for the market. This generally aligns with the broad market indexes. Most stocks will follow a similar pattern to the indexes, with a few exceptions.

Speculative stocks (and other riskier assets) are worth paying extra attention to. After a shallow correction, these stocks will usually recover very quickly. However, when there is a prolonged downtrend, speculative stocks may take some time to recover – and some may never regain their previous highs.

It’s usually a good idea to focus on high-quality, profitable stocks when the market is making a potential low. These are the stocks large institutions are most likely to buy on weakness which will provide support. While valuation is also important, you should try to avoid value traps. These are stocks that at first glance appear cheap, but may have poor business prospects going forward.

CNN Fear and Greed Index Example: March 2020

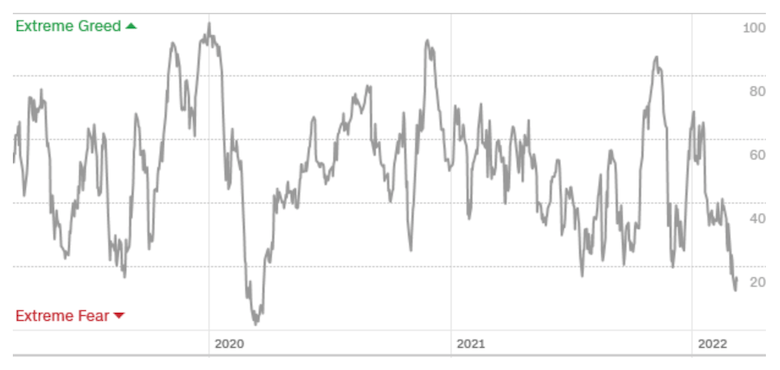

The beginning of the COVID-19 pandemic was a great example of the fear and greed index doing a decent job of indicating both a market top and bottom. The index reached its highest greed rating in years just a few weeks before the market top. And then the index fell into extreme fear territory just as the market bottomed.

This was an example of extreme fear indicating that the market was overreacting to actual events. Travel restrictions and social distancing policies absolutely decimated the travel and hospitality industries, but these industries are just a fraction of the world economy. The S&P 500 fell over 30% because people expected the worst – not because of what was actually happening.

The fear and greed index actually carried on falling for a few weeks after the market bottomed. This illustrates the value of scaling into new positions as soon as the index reaches an extreme fear level.

Conclusion: CNN Fear and Greed Index

Warren Buffett said, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful”. Contrarian investing using market sentiment is one of the best ways for investors to lock in great prices. The CNN Fear and Greed Index is a useful tool to gauge sentiment. However, just like other tools and indicators, it should be used alongside other methods of market analysis.

Stop-loss orders prevent emotions from taking over and limit your losses. It is important that you do not adjust the stop-loss limit when the stock price is going down. It makes more sense to adjust the stop price when the stock moves up.

What can really be a good support in the fight against fear in trading is a strict money management plan and a well thought out trading plan. Trading risk should be limited and losing trades should be considered an essential part of trading – something that leads to success. It should evoke all negative and positive emotions – you should be absolutely indifferent to it.

Dealing with fear – There are two kinds of fear in this world: legitimate fear and illegitimate fear. Legitimate fear is the kind of fear that is based on the fact that there is real danger. Illegitimate fear is based on perceived danger when none actually exists. Illegitimate fear can also co-exist with legitimate fear. Fear in trading is both legitimate and illegitimate. Illegitimate fear is any fear that is not based on fact. It is fear based on a misunderstanding of the facts, over- exaggeration of the facts, or misperception of what the facts are or are not. The most common source for illegitimate fear is lack of knowledge. Take, for example, my incident with ghost stories. A bunch of us college-age guys sat in a room over a morgue, in the dark, telling ghost and horror stories that we had read. We scared each other so badly that none of us could move until daylight. We were literally frozen in our tracks I mean complete physical paralysis. It was one of the longest nights of my life. Deep down inside, I knew what we had done, but I allowed my emotions to override any rational thought actually, any… Read more »