Investing in the best tech stocks has been a path to substantial returns over the last decade. Fortunes have been made (and sometimes lost) by investing in technology.

A key factor is how capital-light the sector can be. Just a few lines of code can change the world. This is also a sector notorious for changing quickly, generating controversy, and producing wildly overvalued bandwagon stocks.

Being cautious not to overpay or ignore changes in the market is as important as correctly finding “the next big thing”.

Best Tech Stocks Compared

Tech is often associated with a few big names, some of which we will discuss below. Sometimes, smaller is better, with much more room for growth and more efficient organization. Some companies seem past their glory days but are reforging themselves into new organizations. Tech also spans a huge range, including hardware, software, services, and more.

We’ll try to offer a diverse view of the sector, but we won’t even come close to covering all the possibly attractive stocks.

This list of the best tech stocks is designed as an introduction; if something catches your eye, you’ll want to do additional research!

👩💻 Best Tech Stocks. Learn More: Get a fresh perspective on the revolutionary ways technology is influencing our financial habits in our newest article.

1. Apple Inc. (AAPL)

| Market Cap | $2,971B |

| P/E | 32.02 |

| Dividend Yield | 0.51% |

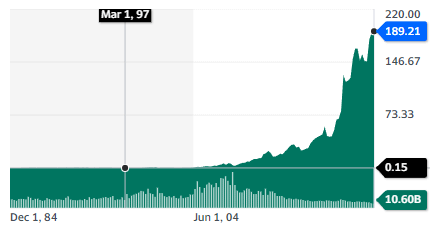

Apple, a frontrunner in the list of best tech stocks, is a company that does not really need a presentation. It is flirting with a 3 trillion market cap and almost every investor is aware of it. This is also a stock that went up x1000 since 1997, and it’s one of Warren Buffett’s top holdings.

But it is also a company whose core markets are reaching saturation, with only so many iPhones that can be sold and a price tag that can only be raised so much.

So, the real question is about Apple’s future. Can the company that partially invented the modern computer and the smartphone continue to change the world? The latest tentative is to take an early start in the VR segment with the recently revealed $3,499 Vision Pro.

VR has been a notoriously hard-to-crack market, with Facebook and its Oculus struggling to turn it into a mass consumer market for a long time now. But if one company can do it, it may be Apple. And maybe this is indeed the new smartphone/office/gaming device/computer/TV/etc.

An alternative option is simply Apple staying Apple, with its record smartphone sales, growing in any country with a growing middle class and a tight and highly profitable app store ecosystem. So, while the future is uncertain, it is likely that Apple is also here to stay, both for Apple fans and investors.

🤖 Learn more: Embarking on an investment journey in the metaverse? Our recent post provides a detailed guide to navigating this new frontier.

2. Microsoft Corporation (MSFT)

| Market Cap | $2,506B |

| P/E | 36.56 |

| Dividend Yield | 0.83% |

Ounce the arch-rival of Apple, Microsoft is now in a niche of its own among big tech. It does not rely on smartphones. It doesn’t have a huge social media presence, and it’s not an e-commerce giant. Despite this, it is a highly profitable company.

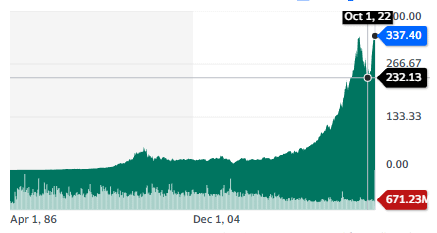

Over time, Microsoft has become a large conglomerate focusing mostly on “boring” parts of the tech sector. It still relies on Windows being the main OS of the world, it owns LinkedIn, and sells plenty of enterprise solutions, from Cloud to Office 365 to Team and Outlook.

Microsoft has also become a giant in video games through an aggressive policy of acquisition, as well as the growth of its XBOX consoles, to the point where the latest acquisition of Activision/Blizzard came under anti-trust scrutiny, not really a new thing for Microsoft.

This is despite gaming being only its 5th center of revenue, not much ahead of advertising and LinkedIn. This is just how big Microsoft really is, that a secondary and non-strategic department is big enough to trigger monopoly fear.

So even if it is less flashy than Apple, less social than Facebook, and less omnipresent than Amazon, Microsoft is a real tech giant.

Microsoft stands as one of the best tech stocks for growth potential, as it has barely started to monetize LinkedIn, it is still growing in gaming, and it recently essentially bought out AI phenomenon Chat GPT, which might or might not be the future of search beyond the 2-3 decade-old search engines.

🏦 Learn more: Curious about the role of AI in the evolving banking landscape? Our latest post sheds some light on this topic.

3. NVIDIA Corporation (NVDA)

| Market Cap | $1,025B |

| P/E | 217.24 |

| Dividend Yield | 0.04% |

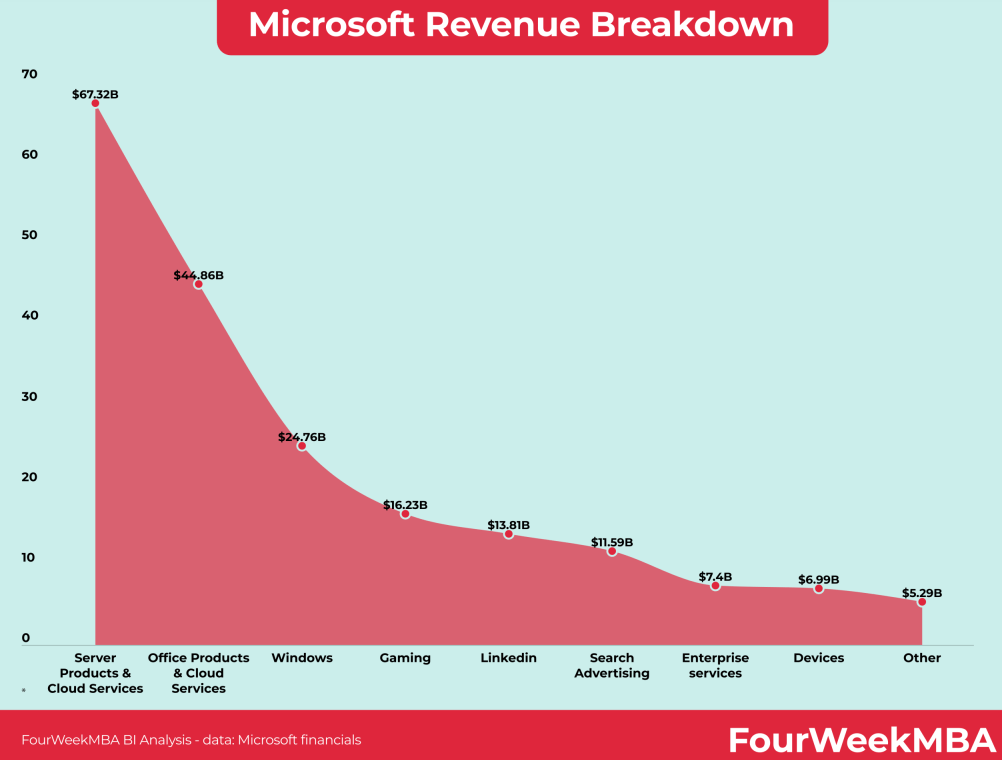

NVidia had a rather modest beginning in a narrow niche, being a beloved manufacturer of graphic cards (GPU) for avid PC gamers. With the growth of online gaming and ever more demanding visuals in both gaming and work software, its graphic cards were in high demand but somewhat limited in terms of the total addressable market.

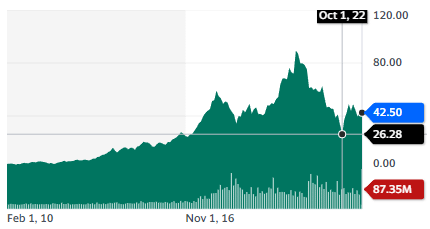

Then came the cryptocurrency craze, with graphic cards proving to be a lot better than CPUs at “mining” crypto. This led to years of depleted inventory, with NVidia unable to produce enough GPUs no matter how quickly it ramped its production. With crypto cooling off in 2021, the situation came back somewhat to normal, and the stock dropped back down from a highly elevated valuation.

But this was before a new application for NVidia high-performance GPUs was discovered: training and running AI. With the surge of interest in Chat GPT, the possibility of self-driving cars, and the idea that we are on the verge of an AI revolution, NVidia stock went back to a vertical climb, more than tripling its stock price since September 2022, becoming one of the best tech stocks on the market.

AI will likely stay at the center of the tech industry for the foreseeable future. Will that be enough to justify the stratospheric rise of NVidia?

On one hand, it is entirely possible. On the other hand, a P/E of 217 for a well-established company with a trillion-dollar market cap poses some uncomfortable questions, especially as this might be reminiscent of the 1999 dot-com bubble. So investors might want to consider NVidia but not lose all prudence about a very volatile valuation.

📈 Learn more: Interested in the AI market? We’ve rounded up the stocks and ETFs that are making waves this year in our recent post.

4. Tencent Holdings Limited (TCEHY)

| Market Cap | $408.2B |

| P/E | 15.60 |

| Dividend Yield | 0.72% |

Looking at trillion-dollar valuations and meteoritic changes in stock price, we could be forgiven for believing that all tech stocks are American. But on the other side of the Pacific, China has nurtured another extensive and impressive tech ecosystem, often centered around its tech capital of Shenzhen.

Tencent is a complex company. It’s little known in the West and absolutely everywhere in Asia. It is:

- the world’s largest investor in the videogame sector.

- the first Asian tech company to pass the $500B market cap mark.

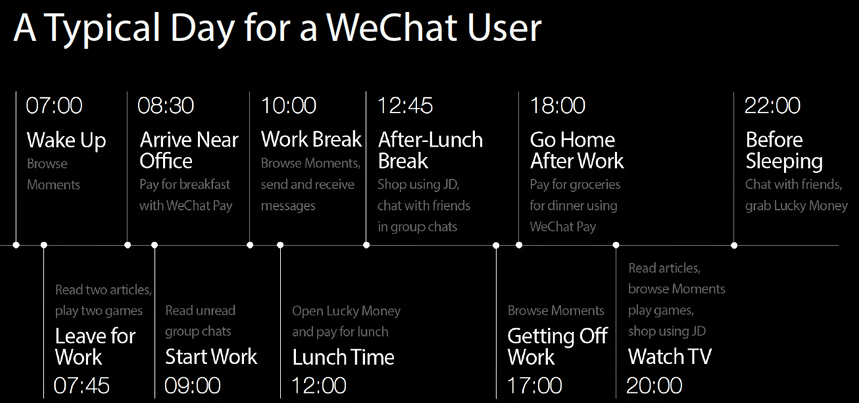

- The manager of more than 1 billion users on WeChat, a super-app for everything: chat, payment, social media, e-commerce, streaming, etc…

- Able to “casually” invest $70B in cloud computing, artificial intelligence, and cybersecurity.

- A massive VC investing firm with participation in almost all parts of the Asian tech sector, as well as overseas.

Tencent is hard to understand. It’s as if most of the US Big Tech had merged their most successful divisions into an absolute juggernaut.

If not for foreign investors’ skepticism about any Chinese stock, especially Chinese tech stock, Tencent might be one of the largest companies in the world and one of the best tech stocks out there, rivaling the valuations of Apple, Tesla, and Microsoft.

5. Nokia Oyj (NOK)

| Market Cap | $23.5B |

| P/E | 4.95 |

| Dividend Yield | 2.87% |

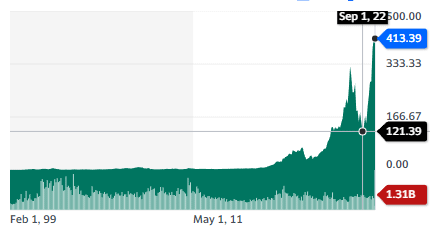

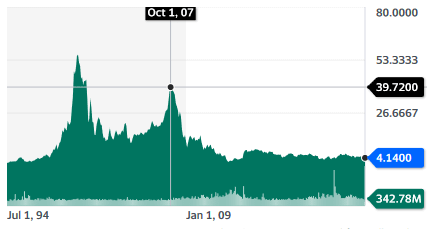

Another one of the best tech stocks in today’s market is Nokia. This tech giant was the uncontested leader of mobile phones until it missed the smartphone revolution and almost entirely collapsed. This image of a “failed” tech company still lingers over Nokia.

Nokia has entirely re-invented itself. The company holds strong IP and patents in telecommunications, including in optical fiber networks and 5G, and has been consistently profitable from monetizing its intellectual property into enterprise hardware and services.

This makes Nokia a network-focused, B2B hardware company, already preparing for the arrival of the 6G, VR/AR/Metaverse solutions, optical/photonic computing, setting tech international standards, partnerships with relevant startups, AI & Machine Learning, automation, and even a mobile network on the Moon (yes, really).

This is an impressive turnaround story, and a tech stock that most investors have not realized is now completely different from its legacy public image. And in the current environment, tech stocks trading at a P/E ratio below 5 are a rare occurrence.

6. Samsara Inc. (IOT)

| Market Cap | $14.4B |

| P/E | – N/A |

| Dividend Yield | – N/A |

The “Internet of Things”, or IoT, is something that tech enthusiasts have been waiting for a while. The goal is a hyper-connected world where every device and machine is transmitting and receiving data.

While this is slow to start for consumer products (does a fridge really need a WiFi connection?), it is quickly becoming a reality in multiple industries, from logistics to e-commerce and manufacturing.

Samsara offers a wide array of solutions for:

- Safety: AI Dashcams, on-site cameras, driver monitoring, health & safety records.

- Machinery: GPS Fleet tracking, fuel management, maintenance and equipment monitoring, fleet electrification.

- Worker management: Workflow reporting, safety procedure checklist, location tracking.

- Data integration: with internal companies’ apps, supplier integration, and third-party software solutions (240 integrations).

The company has highly predictable revenues, with 98% of revenue from 3-5 year subscriptions. Payback for the clients is very quick (saved fuel, lower insurance, maintenance, downtime, etc.), usually just a few months.

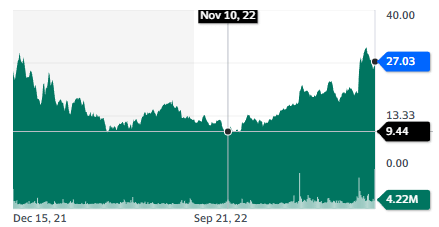

Annual Recurring Revenue (ARR) has grown almost 10x since 2020.

Samsara is an interesting candidate when considering the best tech stocks, operating in a very quickly growing industry, with very predictable, lasting, and “sticky” income streams.

Best Tech ETFs Compared

Tech is a diverse and multifaceted sector, making it challenging to identify the best tech stocks on your own. ETFs offer a solution by providing broad diversification without having to analyze the ins and outs of tens or hundreds of technology companies. The largest tech ETFs tend to cover all the same mega-cap stock, while others offer more niche and diverse selections.

1. Investco QQQ (QQQ)

This massive ETF tracks the Nasdaq-100 and, therefore, covers virtually all of the largest US-listed tech stocks in multiple industries. It is often seen as the simplest go-to choice among tech ETFs.

2. ARK Innovation ETF (ARKK)

At times controversial for its extremely optimistic forecasts, ARK and its flagship ETF ARKK are at the center of tech rising as the dominant investing sector in the late 2010s and early 2020s. The ETF is split between genomics, automation, energy, AI, and fintech.

3. Global X Robotics & Artificial Intelligence ETF (BOTZ)

Robotics and automation might be one of the most promising sectors in tech, with radical growth expected in the next decades. With a narrower focus than other ETFs, BOTZ includes stocks often not included in tech ETFs, like robotic surgery specialist Intuitive Surgical or equipment manufacturers ABB or Keyence.

4. VanEck Semiconductor ETF (CHIU)

Almost all tech companies are built around the backbone of semiconductor hardware. This ETF is centered on the designers and manufacturers of this hardware, like NVidia, TSMC, ASML, and Texas Instruments.

5. iShares Cybersecurity and Tech ETF (IHAK)

The more connected we are, the more precious data gets, and the more important cybersecurity becomes. This ETF covers a sector that is full of companies indirectly benefiting from growing connectivity and tech penetration in all sectors.

6. KraneShares CSI China Internet ETF (KWEB)

China is quickly becoming as important to the tech industry as the US, and KWEB tracks companies covering this important 1.4 billion-person market. This is a relatively diversified ETF, with no holding above 10% of the whole. The top holdings are Tencent, Alibaba, Meituan, and Pinduoduo.

Conclusion on the Best Tech Stocks & ETFs

Tech is at the heart of both our daily lives and the global economy, making the search for the best tech stocks a highly relevant endeavor. The sector offers tremendous growth opportunities.

It is also a financial segment that is potentially overvalued after a decade and a half of explosive price action. Investors will need to be cautious and target sub-segments of the industry that are not overpriced and have significant growth potential.