Energy is a fundamental need, and industrial societies consume it in gargantuan and ever-increasing quantities. This consistent demand makes the sector attractive to investors, particularly those looking for the best energy stocks to add to their portfolios.

The energy sector has been out of favor for a long time, with investors preferring the high growth potential of the tech sector. The sector rotation from bits (tech, software) to atoms (manufacturing, mining, energy) might be only getting started, given the relatively low P/E ratios and high dividend yields offered by many energy stocks.

Best Energy Stocks in 2024

The energy sector is very diverse, including renewables, oil, gas, coal, and nuclear, along with resource extractors, utilities, service providers, manufacturers, and more. The profiles of major companies vary, with focuses on growth, returning profit to shareholders, and developing new technologies.

So, let’s look at some of the best energy stocks.

This selection is focused on giving an overview of the sector and interesting companies in it, but cannot cover everything.

This list of the best energy stocks is designed as an introduction, and if something catches your eye, you will want to do additional research!

1. Petróleo Brasileiro S.A. – Petrobras (PBR)

| Market Cap: | $89.9B |

| P/E: | 2.54 |

| Dividend Yield: | 41.75% |

Petrobras, the national oil company of Brazil, is becoming increasingly significant in the world of best energy stocks, as the company is on its way to becoming the world’s 4th largest producer of oil.

The company has a profile with extreme contrasts. On one hand, the business itself has performed well, with steadily growing oil production and solid profitability, allowing for record-breaking dividend yields. The company is mostly producing from offshore oil fields, with 3.74 boed (Barrels of Oil Equivalent per Day) in Q1 2023.

The company has also used this profitability to reduce its debt from $79B in 2019 to $37.6B in Q1 2023.

On the other hand, Brazil is a country with serious reputation problems among investors, and the recent election of socialist Lula to the presidency has spooked markets. Riots storming several government buildings by his opponent’s supporters did not help either. Finally, the costs of decarbonization plans and expanding petrochemical activities could reduce the company’s profitability in the long term.

So Petrobras is a great oil company IF the political situation stays stable enough. And that could be a big ‘if”. This should make any investors cautious and looking to diversify despite the handsome dividend.

At the same time, the dividend is large enough that if Brazil stays together for even three years, an investment would be profitable based on dividend yields alone!

🛢️ Learn more: Explore our recent analysis for an overview of notable oil stocks and ETFs in the current market landscape.

2. EQT Corporation (EQT)

| Market Cap: | $14.1B |

| P/E: | 3.38 |

| Dividend Yield: | 1.54% |

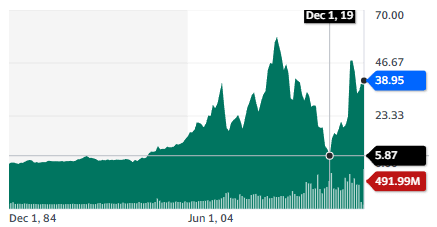

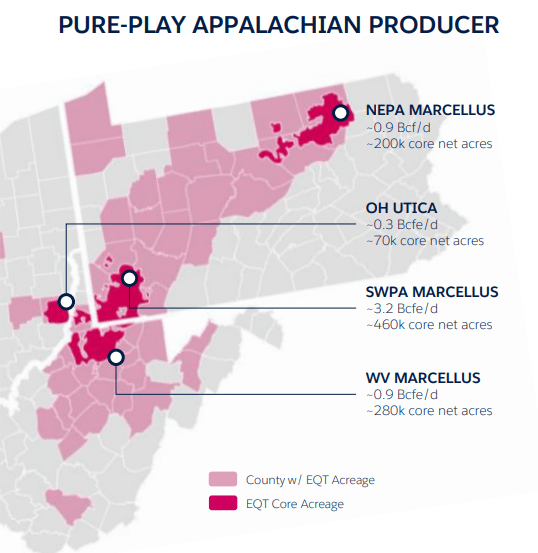

EQT is the leading producer of natural gas in the US, with operations in Pennsylvania, West Virginia, and Ohio (Appalachian Mountains). Or as the company puts it, “If EQT were a country, it would be the 12th largest producer in the world of natural gas“.

Thanks to a warm winter and a softening of the global energy crisis, natural gas prices have gone down a lot in the USA. So far, this has not hurt EQT’s free cash flow generation, which hit $774M in Q1 2023.

After a period of pursuing growth at all costs, like most of the rest of the shale sector, EQT is now focused on reducing debt ($1.5B by the end of 2023) and improving returns to shareholders, notably in the form of share buybacks ($1B in 2023).

EQT is one of the best energy stocks to consider if you’re betting on the ongoing boom in shale gas production. Its prospects look promising due to currently low gas prices in the US rebounding, coupled with a stable or growing global demand for LNG exports and industries from Europe relocating to the US.

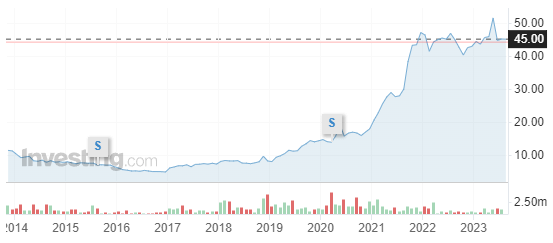

3. S. N. Nuclearelectrica (SNN)

| Market Cap: | $2.9B |

| P/E: | 4.64 |

| Dividend Yield: | 11.9% |

The sole national operator for nuclear power in Romania, Nuclearelectrica has one of the world’s best nuclear safety records. It is owned in the majority (82%) by the Romanian state.

The company relies on its Units 1 & 2 for power production, which together have a nominal capacity of 1.4 GW. Unit 1 should be refurbished from 2027-2029 to provide it with another 30 years of operational life after that date. Unit 2 should be refurbished in the same way after 2037.

The company is also planning to build 2 new reactors, Units 3 & 4, which would bring Romania’s energy mix to 36% nuclear and double Nuclearelectrica’s production. They are expected to be commissioned by 2030 and 2031.

Lastly, Nuclearelectrica should be the first European company to implement the SMR (Small Modular Reactor) technology, thanks to an agreement with US-based NuScale. This project should add 462 MW to Nuclearelectrica capacities. This project already has $275M in funding from a coalition of international partners.

Nuclearelectrica is a very high-performance nuclear operator in a nuclear-friendly country. It offers a generous dividend and plans to extend its capacity massively by the end of the decade.

Thanks to the refurbishing of Units 1 & 2 and the new production planned, the company is emerging as one of the best energy stocks fit for an income portfolio with a long holding period, with stable baseload energy production expected for the foreseeable future.

⚛️ Learn more: Understand the contemporary landscape of the nuclear world with our breakdown of the industry and its key players. Discover why nuclear is back in the spotlight.

4. Brookfield Renewable Partners L.P. (BEP)

| Market Cap: | $13.2B |

| P/E: | – N/A |

| Dividend Yield: | 4.53% |

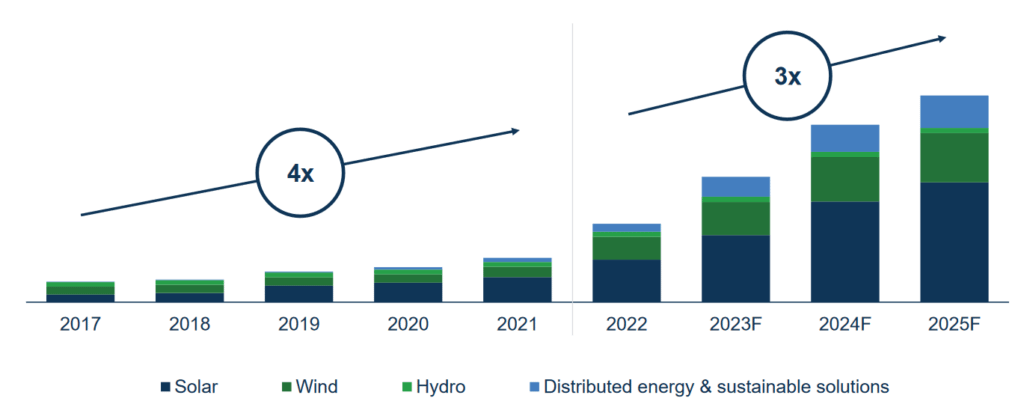

BEP is the renewable utility branch of the asset management giant Brookfield. It holds $625B in assets and manages 25 GW of power production, with plans to add a staggering 110 GW of new capacity.

Its current production is a mix of various renewables, with most of the planned expansion being in solar.

In 2023, BEP purchased 51% of Westinghouse (together with uranium miner Cameco), the leading builder of nuclear power plants in North America and a designer and parts & service supplier for most of the West’s existing nuclear power plants.

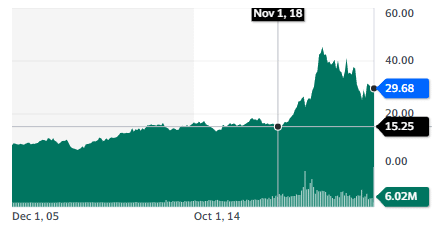

BEP’s distribution to shareholders has grown by 6% annually since 1999. Together with the stock price growth, it generated annualized returns of 16% for its shareholders in the same period.

BEP combines a focus on renewables, a newly added presence in the nuclear OEM (Original Equipment Manufacturer) business, and aggressive energy production growth in the next 5-10 years.

This makes it one of the best energy stocks for investors looking to bet on the energy transition and a speedy turn to a low-carbon energy mix (including nuclear) in Western countries.

5. Transocean Ltd. (RIG)

| Market Cap: | $4.8B |

| P/E: | – N/A |

| Dividend Yield: | – N/A |

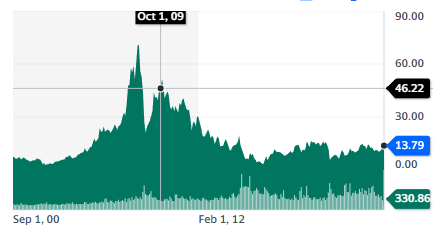

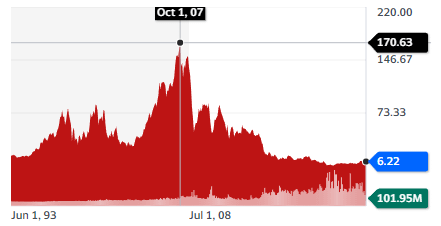

While the whole energy/fossil fuel sector suffered in the 2010s, none did as badly as the oil & gas services sector, especially the offshore sub-segment. With oil & gas prices down, most producers cut severely on capital expenditure. And while onshore spending in the US remained robust with the shale revolution, very few offshore projects were approved.

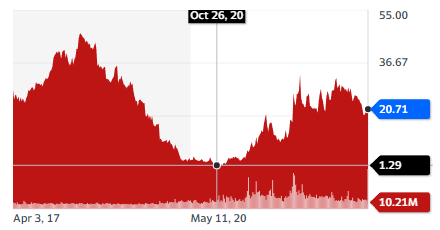

This led to a mass wave of bankruptcies in the entire offshore drilling sector, affecting many companies but not Transocean. At its lowest point, when the survival of the company was in question, the stock fell to $0.67/share, or 1/253th of its peak value in 2007.

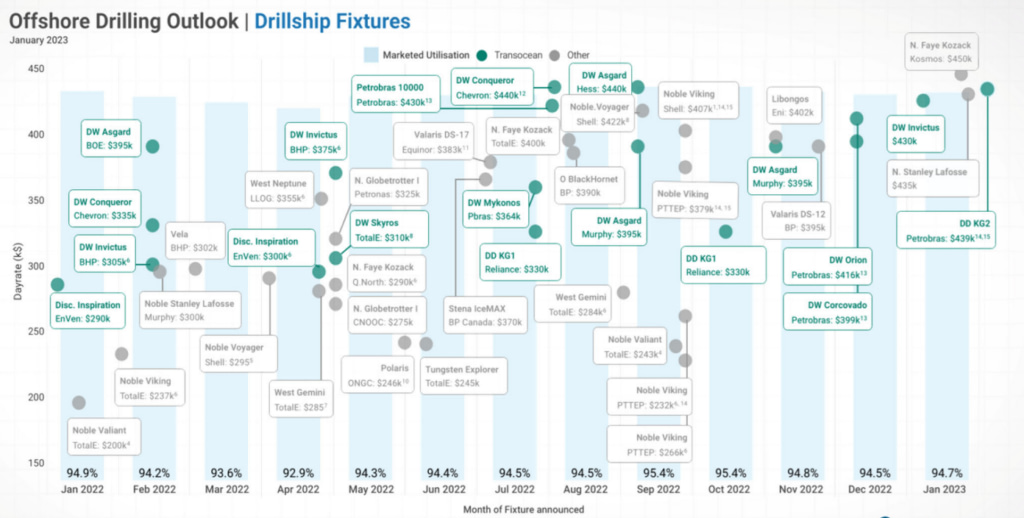

With a focus on ultra-deepwater and newer generation drillships, Transocean has consistently achieved among the highest dayrates (the standard metric for the industry) for new contracts in 2022.

The company now has an $8.5B backlog for future work contracts, twice that of the nearest competitor. The company is currently focused on repairing its balance sheet, as well as putting multiple drillships that were put in long-term storage (“cold stacked”) back to work.

Transocean stock is a bet on the continuous need for new oil & gas resources, and especially offshore resources, one of the lowest-cost sources of new supply. If you’re looking to diversify your portfolio, this could be one of the best energy stocks to consider.

The largest risk would be a major recession or any other event sending oil into a sustained low price range, which could hit the demand for offshore drilling. In such a scenario, Transocean could struggle to manage its still heavy debt load.

6. Peabody Energy Corporation (BTU)

| Market Cap: | $2.9B |

| P/E: | 1.91 |

| Dividend Yield: | 0.37% |

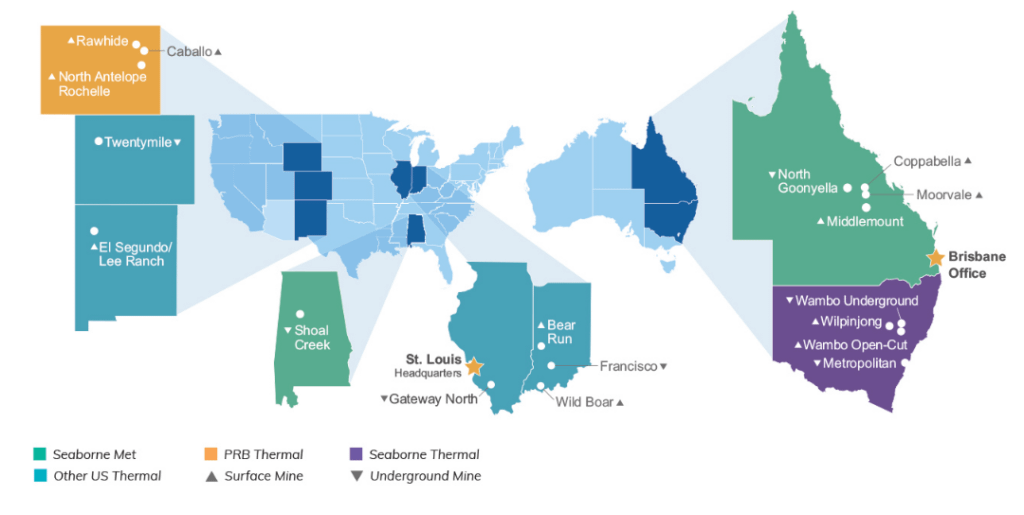

Peabody is a coal miner with operations in the USA and Australia. If you’re interested in the best energy stocks, understanding companies like Peabody can offer valuable insights. They produce a mix of thermal coal (for power production) and coking/metallurgical coal (indispensable for steel production, in green on the map below).

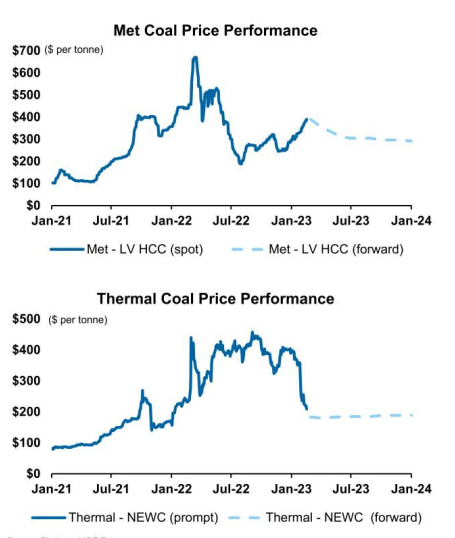

Thermal coal experienced a boom followed by a bust during the 2022 energy crisis. Prices have already risen back up in 2023. Overall, Peabody made a little more than half of its 2022 revenues from thermal coal.

2022 has shown that when facing energy shortages, even countries committed to reducing carbon emissions, like Germany, turn back to coal to keep the power grid stable. With the demand for energy growing, it is likely that coal will stay in demand for power generation, especially in Asia and developing countries.

There is no ready substitute for metallurgical coal in steelmaking, so its demand should stay stable in line with overall steel demand.

Due to these factors, Peabody can be a good bet on the durability of coal demand, while the market somewhat dismisses the long-term value of the company’s assets, as illustrated by the low valuation multiples.

Still, investors will need to be cautious. The company’s stock has risen substantially since its 2020 lows, and coal markets are notoriously volatile, even when compared to other commodities.

ETFs (Exchange Traded Funds)

If you’re looking to diversify your portfolio and considering some of these best energy stocks we’ve featured above, you may also want to explore the sector as a whole. There are several energy-focused ETFs available, providing different levels of exposure to the various segments of the energy industry.

1. Energy Select Sector SPDR Fund (XLE)

With a focus on “Big Oil”, this ETF includes all the big international fossil fuel majors, like Exxon, Chevron, ConocoPhillips, etc. It provides direct and diversified exposure to oil & gas production.

2. VanEck Oil Services ETF (OIH)

This ETF is focused on services companies for the fossil fuel industry. Its top holdings are industry leaders Schlumberger, Halliburton, and Baker Hughes. It also includes Transocean as its 8th largest holding. The ETF is primarily focused on US-based companies (90%), with only 5% in the UK and 5% in Bermuda.

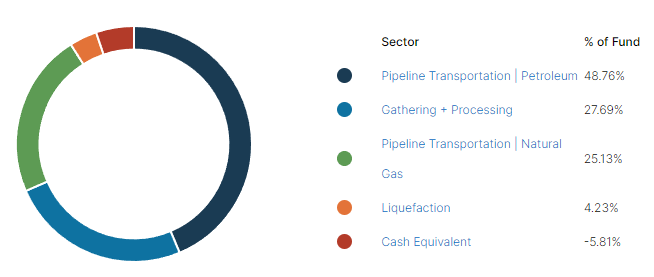

3. Alerian MLP ETF (AMLP)

This ETF is focused on the so-called mid-stream sector, the gas and oil pipelines that transport energy throughout the USA. This is a sector that tends to be less volatile than energy producers and also distributes generous dividends, relying on its quasi-monopoly and the high value of its transportation assets.

4. Global X Renewable Energy Producers ETF (RNRG)

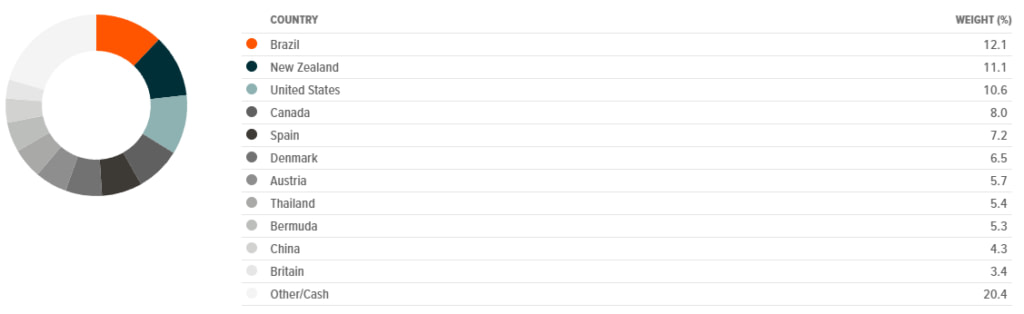

This fund is almost exclusively investing in utilities producing power through renewables. It is very geographically diverse and includes BEP in its 6th largest holdings, with the largest holding being Danish wind farm leader Orsted.

5. VanEck Low Carbon Energy ETF (SMOG )

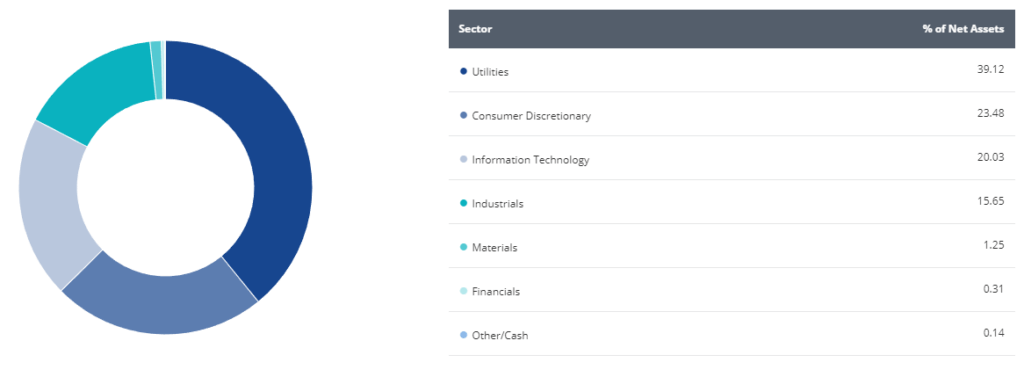

This ETF focuses on low-carbon energy and is more diverse than RNRG, with only 39% invested in utilities. It also covers consumer goods, IT, industries, and materials with companies like Tesla, Samsung Sdi, BYD, and First Solar.

6. Utilities Select Sector SPDR Fund (XLU)

If you think energy will be in high demand but have no opinion about the best energy source, XLU, with a wide selection of utilities relying on hydropower, nuclear, fossil fuel, and renewables, might be best. It is also likely to provide steady dividend income.

7. VanEck Uranium+Nuclear Energy ETF (NLR)

This ETF provides exposure to nuclear power overall, from large utilities to uranium miners and technology companies. It can be a good pick for investors optimistic about nuclear energy or in complement to other energy ETFs.

Conclusion on the best energy stocks

Energy is a complex sector and can also be a very profitable one. It is also a very diverse industry with many different profiles and technologies.

For this reason, investors will either need to learn a lot about a specific sub-segment or take a diversified approach to cover the sector as a whole and find the best energy stocks on the market.

It will also be highly recommended to take an apolitical approach, even if energy, fossil fuels, nuclear power, climate change, and afferent technologies tend to be very hotly debated topics. The future energy mix will probably be as diverse as the current one, and an energy portfolio should reflect this fact.