Credit Saint is a standout in an industry with a shady reputation. Many credit repair companies don’t deliver results and some are outright scams. There are still a few that will work to improve your credit. Credit Saint is one of the best. Learn why that is in this Credit Saint review.

Credit Saint

Credit Saint experts have a long history of effectively repairing their clients’ credit for a fair price. There’s a solid guarantee and a good customer service track record. They aren’t the cheapest, but you get what you pay for.

Pros

Credit Monitoring Included

Private Account Page

90-Day Guarantee

Unlimited Disputes

Credit Education

Cons

High Initial Work Fee

Not Available In Every State

Key Takeaways

- Credit Saint is our #1 recommended credit repair company. They have a great reputation within the industry, a legit 90-day money-back guarantee, and an unlimited number of disputes per 45-day cycle in their premium package.

- If your credit problems are caused by a small number of negative entries on your credit report, a DIY approach could be your best move. If you have serious damage to your credit report or a large number of negative entries, a quality credit repair company can take over and do the heavy lifting for you. Credit Saint will be one of your top options for that.

In this review:

Who Is Credit Saint?

Credit Saint is a credit repair company based in Saddle Brook, New Jersey. It has been in business since 2007.

Credit Saint CEO Ross LaPietra states that Credit Saint focuses on removing inaccurate or erroneous entries from customer credit reports. They may also be able to remove entries that are accurate but unverifiable.

👌 Credit Saint was the first credit repair company to offer a 90-day money-back guarantee. If you don’t see any changes in your credit record after 90 days, you’ll get your money back.

What Does Credit Saint Do?

Credit Saint works to remove negative entries from customer credit reports. The main focus is on identifying and removing any erroneous or illegitimate entries.

Credit Saint may also dispute records that are legitimate but may be unverifiable. Some creditors, particularly collection agencies, may not have the information they need to verify a debt. It may be possible to have these accounts deleted, but there is no assurance of that.

👉 Credit Saint provides a private online account dashboard with full analysis and progress reports. You’ll always know what’s going on and where you stand.

More Than Just Disputes

Disputing incorrect and unverifiable entries may be able to improve your credit record in the short term. To keep improving your credit you’ll have to add positive entries and make sure you don’t add more negative ones.

Credit Saint provides continuing credit education that gives you the tools to get out of credit trouble and stay out.

Three Credit Saint Packages

If you choose to retain Credit Saint three packages: Credit Premium, Credit Remodel, and Credit Polish. Each has a “first work fee”, which you’ll pay at the start of the service, and a monthly fee.

| Credit Polish | Credit Remodel | Credit Premium | |

|---|---|---|---|

| Disputes per billing cycle | 5 | 10 | Unlimited |

| Hard inquiry disputes | ❌ | ✔️ | ✔️ |

| Credit monitoring | ❌ | ✔️ | ✔️ |

| Credit score analysis | ✔️ | ✔️ | ✔️ |

| Credit score tracker | ✔️ | ✔️ | ✔️ |

| Cease and desist letters | ✔️ | ✔️ | ✔️ |

| Initial fee | $99 | $99 | $195 |

| Monthly fee | $79.99 | $99.99 | $119.99 |

| Cost for 90 days | $338.97 | $398.97 | $554.97 |

There are two main differences in the packages.

The simplest package, Credit Polish, does not include credit monitoring and will not target hard inquiries. The other two packages contain both of those services.

Aside from that, the primary difference is in the number of disputes the package allows. Credit Polish allows 5 items per dispute cycle, Credit Remodel allows 10, and the Credit Premium package permits unlimited disputes.

👉 Every dispute filed by Credit Saint is a custom dispute tailored specifically to the account in question. They are not just firing off a mass of generic dispute letters and hoping one of them works (a common practice in the credit repair industry.

Unlimited Disputes

Credit repair usually involves disputing entries on your credit report. The dispute process allows you to contest erroneous entries of your report.

If you select the “Credit Premium” package, Credit Saint will dispute an unlimited number of inaccurate, obsolete, and unverifiable items from your credit report every 45-day cycle.

This feature will only help you if you have a large number of contestable entries on your credit report.

Credit Saint Availability

Credit Saint LLC does not provide credit restoration services in all states. Residents of Georgia, South Carolina, Kansas, Minnesota, Mississippi, Oregon, Idaho, Maine, and Washington DC cannot use Credit Saint services.

Credit Saint experts have a long history of effectively repairing their clients’ credit for a fair price. See what they can do for you!

Can You Do it Yourself?

You can repair your credit yourself, and if your credit problems are relatively simple, like one or two errors on your record, DIY may well be the best way to go. In a more complicated situation, Credit Saint may offer a better alternative.

Here’s why, in the words of Credit Saint CEO Ross LaPietra:

Sure. They can challenge things online by themselves. They can challenge things on paper by themselves.

The only difference is that we will write legally charged letters and we have systems in place that are in tune with the response times that are required by the Fair Credit Reporting Act.

So as soon as the time periods in the investigations have lapsed, we’re back on top of the credit bureaus with a new challenge, rather than getting sidetracked with life, which is what happens to normal people.

Credit bureaus will do their investigation and we will stay on top of them. Our people have been doing this for 14 years. We’re the kind of company that’s watching every minute. You have to keep the pressure on. There is no magic wand here.

Ross LaPietra, CEO, Credit Saint

If you contact Credit Saint, you will begin with a free consultation. A Credit Saint expert will review your credit report, assess its contacts, and explain what Credit Saint can and cannot do to help you.

How Much Does Credit Saint Cost?

Credit Saint is by no means the cheapest credit repair option.

Most credit repair companies charge a “first work fee”. This is an initial billing that starts the process after you have agreed to retain the company.

The Credit Saint first work fee is on the high side relative to many competitors, though monthly costs are closer to industry-standard levels. The differences are not dramatic, though, and it could be worth paying more for Credit Saint’s high level of service and comprehensive guarantee.

Below is a detailed breakdown of the pricing for each plan and their initial startup fee:

| Package | First Work Fee | Monthly Fee | 90-Day Cost |

|---|---|---|---|

| Credit Polish | $99.00 | $79.99 | $338.97 |

| Credit Remodel | $99.00 | $99.99 | $398.97 |

| Credit Premium | $195.00 | $119.99 | $554.97 |

👉 To compare these prices to those of other top-ranked credit repair companies, check our review of the best credit repair companies in 2022.

As with any credit repair company, you’ll have to assess the improvement you expect in your credit and decide whether the cost is worth it.

Choosing Your Package

Which package should you choose? It’s easy to see these packages as a “good-better-best” lineup, but the best overall package might not be best for you.

Unlimited disputes are an important feature if you have a large number of disputable records on your credit report. There is no point in paying for the right to dispute more records if you have a relatively small number of disputable records in your credit file.

If you have only a few problematic accounts or if there is a clear, verifiable error on your credit report, you can file the disputes yourself. If you do choose to engage Credit Saint – or any credit repair company – choose the package that best suits your needs and your situation.

What Credit Saint Can’t Do

Credit Saint cannot guarantee you a specific outcome but they will give you a 90-day money-back guarantee. If you see no change on your credit report in 90 days they will return your fees.

No credit repair organization can guarantee that they will improve your credit. Guarantees of credit improvement are prohibited by the Credit Repair Organizations Act (CROA).

Credit Saint probably won’t be able to help with:

Student Loan Removal

Unless your student loan is creating an unreasonable financial burden or you can find a loan forgiveness program, getting a student loan removed from your credit report is going to be nearly impossible.

There are things you can do to lessen the blow of poor student loan payment history and Credit Saint can help with that.

Bankruptcies

Credit Saint can contest a bankruptcy, but unless the bankruptcy is on your credit report due to an error they are unlikely to succeed. It is almost impossible to remove a legitimate bankruptcy from a credit report.

👉 Because of the guidelines laid out by the CROA, no credit repair company can guarantee that they will improve your credit score.

Credit Saint Customer Reviews

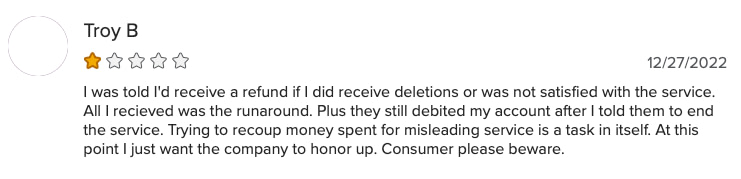

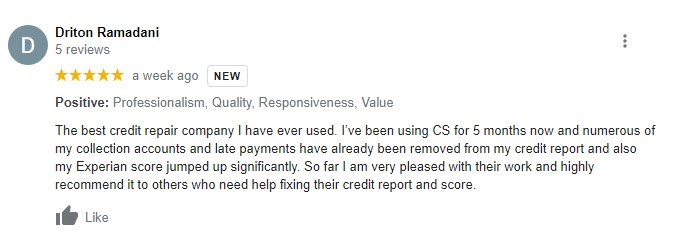

Negative reviews are commonplace in the credit repair industry, but Credit Saint Reviews are generally extremely positive.

Many negative reviews of credit repair companies are from clients who don’t understand the nature of the process and had unrealistic expectations. If you expect a credit repair company to make legitimate, verifiable negative entries vanish from your credit report, you are going to be disappointed.

Not all negative records can be successfully removed no matter which credit repair company that you hire. Some people blame the credit repair company for not being able to remove all of the credit mistakes they have made and voice their displeasure in negative reviews.

Overall, the Credit Saint complaints that are negative are of this variety, but the majority of the reviews are incredibly positive.

Common themes found in Credit Saint Reviews include past customers raving about the success they had and great customer service.

| Review Platform | Number of Reviews | Average Review |

|---|---|---|

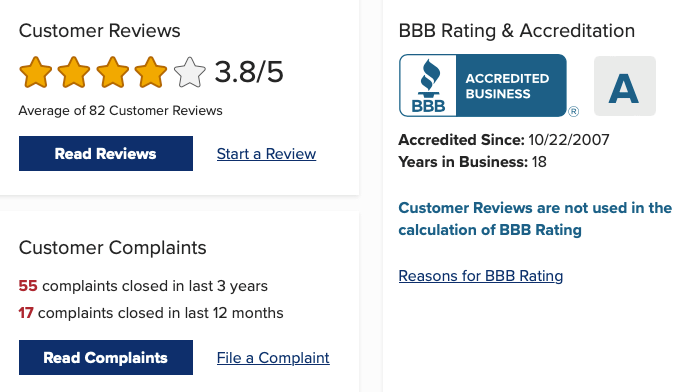

| BBB (A Rating)* | 82 | 3.8 |

| Best Company | 251 | 4.7 |

| Google Reviews | 6339 | 4.8 |

| Consumer Affairs | 128 | 4.8 |

| Trustpilot | 90 | 4.1 |

*Better Business Bureau (BBB) ratings are based on responsiveness to complaints, not customer reviews.

Better Business Bureau Rating (BBB)

The Better Business Bureau, more commonly referred to simply as the BBB, allows buyers to review customer ratings.

Credit Saint gets an “A” BBB rating due to their length of time in business, pricing and policy transparency, and handling of BBB complaints.

What To Expect

When you contact Credit Saint you will be offered a free credit evaluation, and you will be paired with a personal advisory team. After evaluating your record the team will develop a personalized credit repair plan based entirely on your unique circumstances.

If you decide to proceed with the plan, they will begin to dispute negative items in your credit file. Approximately 45 days after signing up, you will start to receive copies of your credit reports from the three major credit bureaus.

These credit reports will contain the results of the first round of negative record challenges.

Upload the reports to your personal online account page and your advisory team will update your progress report.

Credit Saint experts have a long history of effectively repairing their clients’ credit for a fair price. See what they can do for you!

The Credit Saint 90-Day Money-Back Guarantee

You have to love a company that stands behind its work with a 90-day money-back guarantee. If you do not see any negative items deleted from your credit file within 90 days, you may be entitled to a full refund.

According to the Credit Saint website, to be eligible you must meet and comply with the following terms:

- You must be an active participant in the program for 90 days. If you cancel the program or fail to pay within 90 days, the guarantee is void.

- If you put new derogatory trade lines on your credit report after you start the program the guarantee will be void.

- You must make all required payments to Credit Saint on time.

- You must mail, fax or email to Credit Saint proof of your identity (such as a copy of driver’s license and copy of social security card) within five days of the effective date of this agreement.

- Credit Saint will take 30 days from the date of your refund request to review your credit reports and audit your account to verify that no negative items have been removed from your account.

Within these constraints, you will get your money back if Credit Saint fails to remove any negative items from your credit record.

How to Contact Credit Saint

Credit Saint is located in Saddle Brook, New Jersey.

You can find them in Park 80 West at 250 Pehle Ave #200, Saddle Brook, NJ 07663.

They can be reached by dialing the toll-free Credit Saint Phone Number 877-637-2673.

Sales: 7 days a week

Monday – Friday 9am – 10pm EST

Saturday 10am – 8pm

Sunday 12pm – 8pm

Service: Monday – Friday 9am- 7pmEST

How To Cancel Credit Saint

The fastest way to cancel your membership is to contact them by phone at: (877) 637-2673 between the hours of 9 am-7 pm EST Monday through Friday.

They allow customers to cancel for a full refund so long as they do so within five business days of your sign-up date. Monthly fees are pro-rated and access to your account page will be canceled immediately.

Once past the five-day window, cancellations will be processed immediately, however, they will not pro-rate your monthly service fee.

Best Alternatives

There are many credit repair services available. You can read about some of the more reputable ones in our review of the best credit repair services.

If you look at other companies, remember that there are lots of dodgy ones out there, and they often make deceptive claims in their advertising. Stay alert for credit repair scams.

If you have a relatively simple credit report with only a few accounts that you want to contest, your best alternative might be to do it yourself. Start by learning to understand your credit report. Identify any errors or accounts that might not be legitimate.

Once you have identified the accounts you want to contest, write and send dispute letters. Once you have dealt with erroneous or problematic accounts, start rebuilding your credit.

Credit repair companies can help you rebuild your credit, but in many cases, you can do the same thing yourself at a much lower cost.

Taking Action On Your Credit

If your credit record is holding you back, there are several ways to improve it. Hiring a legitimate credit repair company is one option. DIY credit repair is another. In many cases, your best bet will be to simply improve your budgeting and spending habits, understand how your credit score is generated, and work on slowly building better credit.

Whatever you choose to do, the most important step you can take is to start. Your credit won’t fix itself. You’ll need to work at it, but others have improved their credit and you can do it too!