When you’re under financial stress, you’re forced to make short-term decisions. Those decisions may help you at first but often end up making things tougher in the long run.

This is the cost of being poor in America, and it’s it’s a cycle that’s hard to break out of.

But what are the actual costs imposed by financial stress? Let’s take a look at how being low on money costs even more money and the factors that contribute to high costs in poverty.

Key Takeaways

- Poverty creates more poverty. – financial decisions forced by poverty often end up keeping poor people stuck in poverty.

- Poor people spend more of their income on necessities. Lower-income Americans spend more of their income on housing, food and groceries, and transportation, compared to mid and high-income individuals.

- Less expensive goods are often less economical. Poor people often buy low-quality goods in small quantities, leading to constant replacement and higher costs over time.

- Financial exclusion exacerbates poverty. People with poor access to credit often pay exorbitant interest rates and high fees for basic financial services.

The “Boots Theory”

Science fiction nerds may be familiar with the “boots theory,” which partially explains why being poor costs so much. The idea comes from the vivid mind of author Terry Pratchett. In the book Men at Arms, part of the Discworld series, one of the characters, Captain Samuel Vimes, offers this simple explanation: The rich are rich because they are in a position to make better financial decisions.

“Take boots, for example. He earned thirty-eight dollars a month plus allowances. A really good pair of leather boots cost fifty dollars. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about ten dollars. Those were the kind of boots Vimes always bought, and wore until the soles were so thin that he could tell where he was in Ankh-Morpork on a foggy night by the feel of the cobbles.

But the thing was that good boots lasted for years and years. A man who could afford fifty dollars had a pair of boots that’d still be keeping his feet dry in ten years’ time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet.”

Terry Pratchett, Man at Arms

When you can’t afford to take care of basic things, like covering your feet properly, problems snowball from there, and the cost of being poor is compounded.

Once you understand the “boots theory” you see examples of it everywhere.

Beyond Boots

Just like with the example of the boots, the cost of being poor does not start out with things being literally more expensive. A gallon of gas is a gallon of gas. It starts out as cost as a percentage of income, where everyday things require a bigger chunk of what you have and leave you with fewer choices. Let’s go from fictitious boots to the very real reasons for the high cost of being poor.

How the Poor Spend Their Money?

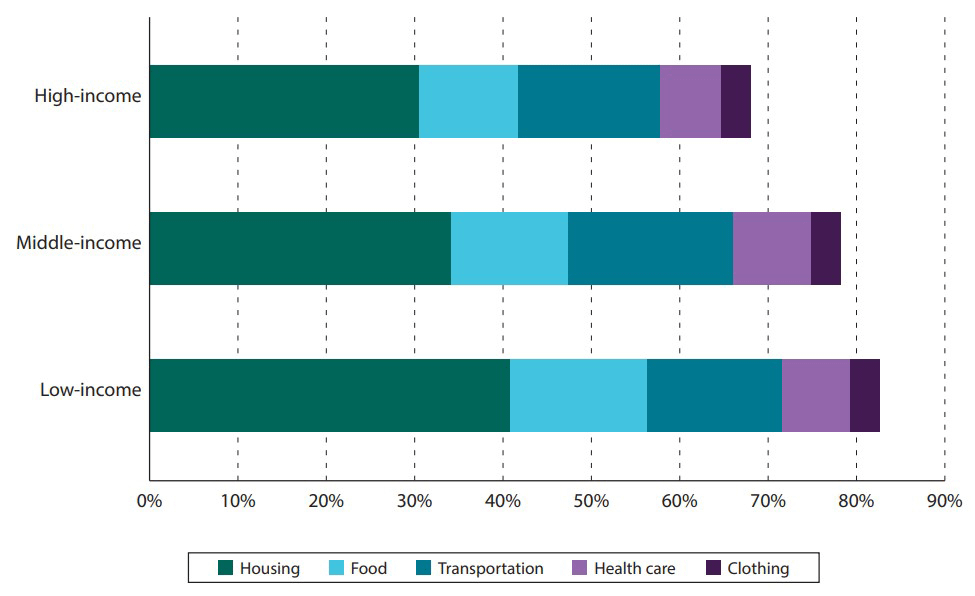

Understanding the cost of poverty starts with understanding how poor people spend their money. Data from one study of household expenditures is a starting point:

This chart reveals several key points.

- Low-income Americans spend over 80% of their income on necessities. That leaves little or no cushion when things go wrong.

- Housing, food, and transportation dominate spending. Housing, in particular, represents over 40% of an average low-income budget.

Let’s look at some of these core expenses and how they contribute to the high cost of being poor.

📚 Things that cost more when you’re poor:

1. Housing

If you can qualify for a mortgage, you have a big leg up on people who rent. You’ll still make a payment every month, but every payment builds your equity and your wealth. It’s not just vanishing into someone else’s pocket.

Home ownership tends to be more expensive when you’re poor, for two main reasons.

- Higher interest rates. Higher-income individuals usually have better credit[1]. That gets them lower interest rates on their mortgages.

- Higher maintenance costs. People who buy homes on limited budgets often have to settle for older homes in poor condition. That jacks up maintenance costs.

Of course, most low-income people don’t own their homes. The US homeownership rate for families with incomes under $30,000/year was 36% from 2010 to 2017. The other 64% had to rent or were homeless.

But what if you are in a housing market where you can’t pull together first/last/and security deposit to get a rental? You wind up spending more money even in the short run because you can’t afford the cost of getting into a rental unit.

Here in my town of Albuquerque, NM you can find a 550 square foot studio apartment and pay $595. That’s if you look carefully and aren’t picky about the neighborhood. But to get into that apartment, you have to come up with $1,800 for the first month, last month, and a security deposit. If your credit is bad you may have to pay even more upfront.

Your options become limited, and if you can’t come up with the $1800 all at once, you might pay $290 a week at an extended stay hotel[2]. That won’t be sustainable for very long.

2. Food and Groceries

Low income families don’t just pay a higher percentage of their income for food and basic household needs. They also pay higher prices. There are several reasons for this.

Access to Food

Many low-income people live in food deserts, areas with few or no stores selling food[3]. They may also lack access to transportation to cheaper food stores. That can leave no option but to buy at convenience stores or fast-food restaurants.

Studies confirm that families with access to large stores pay lower prices than those who shop in small neighborhood stores[4]. Here are some hard figures.

| Product | Small Store Average Price | Large Store Average Price | Difference |

|---|---|---|---|

| Bananas (lb) | $1.18 | $.77 | 53% |

| Skim Milk (gallon) | $4.05 | $3.54 | 14% |

| Peanut Butter (17 oz) | $3.89 | $3.00 | 30% |

| Eggs (dozen) | $2.43 | $2.27 | 7% |

| Cheerios (18 oz) | $7.41 | $4.82 | 54% |

| White Rice (16 oz) | $2.02 | $1.35 | 50% |

Survey performed in Minneapolis/St. Paul in 2014

Smaller stores often have limited capacity to handle perishable goods, which means less access to fresh vegetables and other healthy foods.

Inability to Buy in Bulk

Buying in bulk can generate substantial savings on goods that can be stored. Higher-income families are more likely to have access to stores stocking bulk quantities of generic or store-brand goods (think Costco) and more likely to have space to store these purchases and a vehicle that will let them transport them. Lower-income families may not be able to afford the more economical sizes even if they have access to them.

The differences can be substantial. For example, a bag of 200 Huggies Snug & Dry diapers costs $43.00, or $.215 per diaper. A pack of 34 pieces costs $21.99, or $.64/diaper. For a month’s supply (200 diapers) that’s a difference of $85!

Those prices come from Amazon.com. Families that have to buy diapers at a convenience store are likely to pay even more.

Restrictions on Cooking

Low-income families may not have kitchens or may not be permitted to cook in their residence. If they have kitchens they may lack refrigerators and freezers, making food storage more difficult and increasing spoilage and waste.

Lack of cooking facilities can force families to rely on fast food bought outside the home. That means less nutrition for more money. Children raised in this situation may develop a taste for fast food that compromises their health for years to come.

3. Transportation

Transportation is an unavoidable daily necessity. Getting to and from work, bringing kids to and from school, purchasing your necessities… the list goes on and on. Unfortunately, many parts of the US have limited public transportation, and where it is available it’s far from cheap. If you can’t afford a car and public transportation is not accessible you may be forced to rely on taxis or Uber rides. That raises your transportation costs and contributes to the high cost of being poor.

Many people need cars, and if you’re living on a low income a car can be a serious burden. Let’s look at some of the factors in play.

- Financing. As with mortgages, people with lower credit scars will pay substantially higher interest rates on car loans.

- Maintenance. If you’re on a tight budget you’ll be likely to end up with an older second-hand car. You won’t have a warranty and repairs may be frequent and expensive.

- Fuel. Older cars generally get lower fuel economy than newer ones.

- Insurance. Car insurance is more expensive when you’re poor[5]. Lower-income drivers pay 59% higher insurance rates than higher-income drivers with similar safety records, a difference of $681/year.

All of these factors make transportation more expensive for low-income Americans. These differences are exacerbated if you can’t afford housing near your job or school, or if you need to travel to get to services like laundromats.

4. Healthcare

Healthcare is a significant expense and multiple factors combine to make it a particular minefield for low-income Americans.

More Health Problems

Poverty isn’t healthy. Low-income individuals and families often live in unhealthy, polluted areas, because those areas are cheaper. Cheap apartments are often laden with mold and dust. Low-income people have less healthy diets, often work in stressful, dangerous jobs, and are more likely to be exposed to workplace contamination.

Poor Americans face numerous health challenges. They have higher rates of diabetes and heart disease than their more affluent counterparts. Their children are more likely to have asthma. The elderly poor are far more likely to face health issues. All of these add up to higher health costs.

Less Access to Insurance

America’s insistence on tying health insurance to employment has left many low-income people facing an insurance crisis. Low-income Americans often work in seasonal, part-time, or occasional jobs. They are often uninsured. If they are insured their coverage is likely to be of low quality and they may face high deductibles, co-pays, and out-of-pocket costs.

The high cost of health care is wildly out of proportion to the resources of low-income families. Individuals with no insurance or inadequate insurance can face financial ruin from a simple illness or injury.

Less Access to Preventive Care

Lack of insurance or inadequate coverage leaves many Americans skipping necessary health services or medications[6]. This can rebound into much more expensive problems down the line.

Without insurance, standard dental cleaning and exam can cost $150-$300. That can be prohibitive for a poor household, but skipping it can lead to spending $200 to $600 on a filling. Skip that and you could be looking at $700 to over $1000 for a root canal.

These costs multiply as low-income Americans skip more services to avoid costs and become less healthy as a result. The combined cost of care and lost work can be enough to drive a family into extreme poverty.

5. Financial Services

We’ve already looked at how weaker credit records leave low-income people paying more for mortgages and car loans. The same applies to all kinds of loans, and to credit cards: with weak credit, you’ll pay more interest and you’ll get fewer rewards. And that’s just the tip of the iceberg.

Poor people live on a shoestring, and any unexpected event can leave them in a hole. When your expenses for the basics, food, shelter, transportation, outstrip your income, you soon find yourself in a position where you need to borrow to account for the day-to-day plus emergency expenses that come along.

That’s why rent-to-own stores exist. That’s why payday lenders exist. When you are out of options, these options may seem like the only way to go. They all have one thing in common: they are expensive.

Payday Lending

The CFPB defines a payday loan as a short-term, high-cost loan of $500 or less. In one scenario, a customer went online for a payday loan for around that much. When they read the fine print, they realized that they would be paying back $950 even if they paid the loan back by the end of the week, and around $2,500 if they took the full length of time the loan allowed for payback. They said, “no thanks.”

Many people don’t say that. According to Pew Research, borrowers spend $9 billion per year on payday lending fees[7]. That is one massive poor tax.

Credit and Rent to Own

We all do this to some extent. If you take a full 30 years to pay off a mortgage, you have paid MUCH more for your home than the actual value. But you’ve also been able to leverage the equity in your home to do other things. Plus you have something of value that you can sell.

But what about smaller items like home furnishings and electronics? Not being able to pay for these outright winds up costing you a lot of money, whether you are using a high-interest credit card or purchasing from a “rent to own” store.

Here’s a real-time example: as I write this, you could purchase an Ashley Furniture Beuland Accent Bench for $291, on sale from its regular retail price of $399. Or you could pay it down at Aaron rent-to-own for $57 a month for 18 months. That’s $1,026 for the same piece of furniture.

Credit Card Cash Advances

Credit card companies make it easy. If you run out of cash before your next paycheck comes, you can pull a cash advance from your card. That convenience comes at a price. The average interest rate on credit card cash advances is around 25%, as opposed to 12.85-15.99% for purchases. You’ll usually pay a transaction fee, and there’s no grace period. Interest will accrue from the day you draw your advance. That makes credit card cash advances a very expensive way of covering a cash shortfall.

There are many much more drastic examples. Poor people often need credit, because they haven’t got the cash. Credit is also very expensive when you’re poor. That creates a cycle of debt that is hard to break.

Fees, Fees, Fees

Many poor people live paycheck to paycheck and have barely any reserves. That leaves them open to financial disruption from any unexpected event. Financial service providers offer many ways to escape these traps. All those ways have one thing in common: you’ll pay.

You can make a late payment on a loan, installment purchase, or credit card. You’ll pay a fee. You can overdraw your checking account, but you’ll pay a fee for that too. If your bank balance falls too low you may pay a fee.

Those fees add up, and the more you fall behind the higher they get. That adds one more burden, often at a time when you’re able to carry it.

6. Childcare

Heading to work when you have preschool or school-age children means figuring out childcare. That can add up quickly. If you are spending ¼ to ½ of your income on childcare and at ⅓ to ½ on housing, the pie isn’t going to slice off much more than that!

If you can’t afford childcare one parent may have to quit work and stay home, further reducing your income. A single parent could even be forced onto public assistance, losing the opportunity to build work experience that can lead to better jobs.

7. Communication

The modern world runs on high-tech communications. Without a phone and email, you’ll have a hard time looking for work or doing business. If you’re starting out poor all of this will cost you more than it otherwise might.

When high-income people look for a phone plan they have a range of postpaid plans, often with their choice of hardware. They are likely to have home wifi and an internet connection bundled with other services. If you’re poor you’re likely to be using a pay-as-you-go plan and relying on mobile data. Have you ever stopped in a coffee shop just to use the wifi? Add the cost of your drink to your communication bill.

8. Taxes

Even government gets in on the action. You’ll often see figures indicating that the wealthy pay a larger share of federal income taxes, but taxes don’t stop there. When you factor in state and local taxes, sales taxes, and others, the tax burden lands most heavily on the poor. One analysis of tax burdens relative to income suggests that in ten US states the percentage of income spent on taxes by low-income people is six times greater than that paid by the wealthy[8]. The same study found that in 45 out of the 50 states incomes were more unequal after taxes than they were before.

Living in Survival Mode

From my own experience of spiraling debt and decreased income after the Great Recession, being in survival mode means you are less able to think creatively about the future. You are so focused on making it through the current crisis that exploring the next big idea and making sound long-term decisions are pipe dreams. The impact of poverty on economic decision-making has been documented in numerous studies and is an integral part of the high cost of being poor.

Writing from the platform Scary Mommy, Rita Templeton thinks back on her own experience being poor. “Why does happiness depend on money? …Because nothing else keeps the bills paid.” There was a time not long ago when they couldn’t pay the electric bill and the power was shut off. Over a week with no heat, no light, no stove to cook on. Food spoiled.

She writes of pawning anything of value for pennies on the dollar. Filling tubs and anything with water while the water was still turned on. She writes of the feeling of being beaten down every day and how hard it is to find the emotional stamina to get out of that headspace.

Final Thoughts

Nobody wants to be poor, especially when you understand the exorbitant cost in dollars and well-being. When you see or interact with someone who is down on their luck, remember that it probably wasn’t just one thing that put them in that situation. And with the high cost of being poor, they are literally paying for it every day.