Are you looking for a friendly, easy way to learn more about personal finance? We’ve done some of the work for you, scouring the internet and gathering some of the best blogs (and a couple of sites that started off as blogs) on personal finance, all in one place.

Whether you are wondering how others apply common financial advice to pay off debt or get rich, or you’re just nosey about other people’s financial reports, there is a blog for you. Different blogs have different personalities, so it’s worth looking at several before settling on the ones you find informative, entertaining, and helpful.

☝️ Remember that you’re always responsible for your own choices, so verify any recommendations independently before making financial decisions. If you aren’t sure, consulting a qualified financial advisor is always a good idea.

Let’s jump right in. Here are our top picks for the best finance blogs, in no particular order.

🏆 Best Finance Blogs

- FinMasters

- JLCollins

- Financial Panther

- Money Smart Guides

- Reach Financial Independence

- Myfabfinance

- Clever Girl Finance

- Beating Broke

- Good Financial Cents

- Get Rich Slowly

- Making Sense of Cents

- Miranda Marquit

- Logical Dollar

- Lazy Man and Money

- Well Kept Wallet

- Our Next Life

- Fitnancials

- Simple Thrifty Living

- What Mommy Does

- Investmentzen

- My Money Wizard

- Invested Wallet

- The Frugal Toad

- Financial Samurai

- Mr. Money Mustache

- Passive Income M.D.

- Rich and Regular

- Bitches Get Riches

- Arrest Your Debt

- Clever Dude

- Jackie Beck

- Retire Before Dad

- The Diary Of A Frugal Family

- A Wealth of Common Sense

- Three Thrifty Guys

- Disease Called Debt

- Investment Moats

- A Purple Life

- Her First 100K

- Physician on Fire

- Cash Flow Diaries

- Budgets Are Sexy

- Marriage Kids and Money

- Women Who Money

- Penny Pinchin Mom

- Saving Freak

- The Savvy Couple

- Frugal Woods

- Route to Retire

- Wallet Squirrel

- The Financial Diet

- Debt Free Guys

- Money Pantry

- Money Saved Is Money Earned

- Frugal Confessions

- Root of Good

- Don’t Mess With Taxes®

- The Mini Millionaire

- Curious Cat

- Broke Rich Girl

- Financial Residency

- The Frugal Farmer

- Monevator

- Time in the Market

- Bigger Pockets Blog

- Your Personal Finance Pro

- Save Spend Splurge

- Newlyweds on a Budget

- Suburban Finance

- Money Under 30

- Make Money Your Way

- Turtle Investor

- Financial Ducks in a Row

- Thrifty Nomads

- Len Penzo

- Radical Fire

- Blogging Away Debt

- Frugal Asian Finance

- Modern Frugality

- Blonde and Balanced

- The Blunt Bean Counter

- The Insurance Pro Blog

- Life Happens

- Gathering Dreams

- FinanceBuzz

- I Pick Up Pennies

- Financial Best Life

- VitalDollar

- The Outlier Model

- Money Ning

- Retire by 40

- 1500 Days

- Dinks Finance

- Busy Budgeter

- The College Investor

- NerdWallet

- Just Start Investing

- Money Crashers

- Wallet Hacks

- The Balance

1. FinMasters

Not to brag, but we are pretty awesome 🙂

FinMasters was launched in late 2020, and since then, we have published over 600 articles covering a broad range of financial topics.

If you ever wondered how inflation works, how much it costs to die, or why gas prices are so high, we have the answers.

2. JLCollins

You might know James L. Collins as the author of “The Simple Path To Wealth” in which he talks about the road to financial independence. But did you know that he also has a blog called JLCollins – The Simple Path To Wealth which he started in order to teach his daughter about what worked for him and what didn’t.

On his blog you can find articles related to money, life, travel and business which will help you pave your way to financial independence.

J.L. Collins is also known for his Stock Series which you can not afford to miss if you’re looking to start investing.

3. Financial Panther

Kevin is an attorney and blogger who understands the gravity of student debt. He was there himself after graduating in 2013 with over $86,000 in debt.

Getting rid of the debt by 2016 enabled him to regain his financial freedom and remodel his career path in tune with his definition of happiness.

He has been experimenting with a variety of side hustles, blogging his earning reports and sharing his wisdom.

4. Money Smart Guides

Jon spent 15 years in the finance industry, gathering valuable insights into the way people manage their personal finances.

His blog touches upon investing, retirement, saving money, building wealth, and getting rid of debt.

Some of the best content on his blog draws on his personal story with debt while offering concrete advice and real-world steps you can use to do improve your finances.

5. Reach Financial Independence

www.reachfinancialindependence.com

Pauline’s blog speaks to people who yearn for travel and adventure. Originally from Paris, France, she has traveled the world and lived in Guatemala, Spain, the UK, and Morocco.

The blog has valuable information on managing finances for freelancers bitten by the travel bug.

Besides blog posts about the cost of living in Guatemala, there are a plethora of guest posts and topics she is personally curious about, such as should you borrow money from parents.

6. Myfabfinance

Tonya has been inspiring Millennials to stop living paycheck to paycheck since 2013, the year she started rewriting her money story and never looked back.

Money lessons from her father and her mother highlight that the way our families manage money has a lot to do with our financial decisions in adulthood.

She also understands that we associate money talk with shame, guilt, and stress. Changing your mindset can bring you a couple of steps closer to achieving your monetary goals.

7. Clever Girl Finance

Bola Sokunbi, a Certified Financial Education Instructor, started her blog to empower women and encourage them to budget, invest, get rid of debt, and more.

More women work than ever before, but there is still an existing gender pay gap. Read all about it in her blog post.

The blog is diverse and covers topics from recession-proof job ideas to having a will in your 30s.

8. Beating Broke

Melissa is a writer and mom who shares her insights on saving, cutting back expenses, and frugal living in a family context.

She draws from her own experience when writing about personal finance and has a lot to say about topics such as how to feed hungry teenagers while staying on a budget.

9. Good Financial Cents

Jeff Rose, a certified finance professional, started a blog on personal finance to answer FAQs from his clients and share lessons from his personal financial journey.

Now the website Good Financial Cents covers topics from every aspect of finance and keeps growing article by article.

The website covers basics, but there are also interesting reads such as posts on whether you should invest in cryptocurrency and how to make your first $1000 selling ebooks.

10. Get Rich Slowly

J.D. Roth started the blog to document his journey towards financial freedom in 2004. At the time, that meant getting rid of debt he had been accumulating for 15 years.

After following his three-year plan to get out of debt, he became a debt-free man.

His approach to finances is holistic, and he acknowledges that fostering a money mindset and slowly working towards change is just as important as getting the math right.

11. Making Sense of Cents

Michelle is a Finance MBA graduate who created a blog to track paying off her student debt, which she did in only seven months.

She has been living her best life since, traveling full time and blogging about her life on a sailboat and RV.

Her blog is a motivation to readers to live life on their own terms.

Plus, you’ll find some great blogging tips.

12. Miranda Marquit

With over 15 years of experience as a freelance writer in the finance niche, Miranda has garnered vast knowledge of personal finance, writing craft, and freelancing.

Her blog is a valuable resource for both inspiring writers, people who define their freedom in the terms of a freelance career, or anyone interested in investing.

However, her crème de la crème content includes this deeply personal post on ruined credit.

13. Logical Dollar

Like many financial bloggers, Anna Barker graduated with debt that got her interested in all things finance. She started the blog to make personal finance information accessible to a wider audience.

The blog covers budgeting, investing, saving, and making money.

What makes her blog stand out is that she occasionally writes posts for teens, a group that is frequently left out of money talk.

14. Lazy Man and Money

The blog Lazy man is an anonymous journal that has been active since 2006. Besides passive income reports, the blogger shares his experiences with investing, saving, and more.

What makes his content unique is the consumer protection category on the blog.

Some products may not have a scam written all over them, but they can hurt one’s finances and sometimes even health. This is where “the lazy man” comes to save the day.

15. Well Kept Wallet

Deacon Hayes’ story of how he started the blog will sound familiar: like many other blogs on finance, he wanted to get rid of his debt and document the journey to becoming debt-free.

The combination of his experience with managing his own finances and his work as a financial planner make his blog a valuable and informative resource on everything personal finance.

You’ll find out where to get free stuff on your birthday, how much money to keep in your 401k, get passive income ideas, and much more.

16. Our Next Life

Tanja and Mark embarked on a journey towards early retirement in 2015. They wanted to leave their stressful careers and retire by the end of 2017.

Blogging helped them to retire early. It came with accountability, encouragement, and proof. Now their blog dispels myths about early retirement with a day-to-day account of what it is like in practice.

Following successful early retirement, life presented them with new challenges. Find out which ones they didn’t expect and what they learned one year into early retirement.

17. Fitnancials

Fitnancials is a blog started by a Millennial woman who wanted to pay off her debts.

It’s been active since 2013 and it has transformed into more than just a blog: it inspires women worldwide to take control of their finances.

Find out what you can change by following the budgeting, saving, and making money tips from the blog for a single month.

18. Simple Thrifty Living

The blog shares financial advice from the perspective of a psychologist, journalist, finance expert, and regular folk who contribute.

They cover loans, insurance, investing, money-saving tips, and more.

Read the articles that weigh the risks and benefits of virtual banking or comparison between rentals for vacation and hotels.

19. What Mommy Does

Lena, a stay-at-home mom and CPA, started the blog to share her couponing and playdate tips with other parents.

As the blog grew, she learned a whole lot about blogging, extra income, and managing finances as a parent.

Need ideas for your kid’s school market day or advice on the best things you can do for your finances as a parent? She’s got you covered.

20. Investmentzen

Spending less, earning more, and investing what’s left is Investmentzen’s financial philosophy in a nutshell. It’s that simple and that intricate at the same time.

Interested in personal stories of people who manage their finances or want solid advice on investing, real estate, credit cards, saving money, or retiring early? They’ve got it.

Read the post on how a million dollars can buy happiness or how much you need to have saved up in your retirement fund.

21. My Money Wizard

Money Wizard is all about saving and earning money. The blog shares the exact net worth and monthly financial reports of its anonymous owner.

Starting in 2016 with $127,259 saved up towards the early retirement fund, the net worth currently counts $526,651 and it’s only going up.

It’s motivating to follow the progress and watch how it’s possible to accumulate wealth by setting money aside and diversifying your income.

22. Invested Wallet

Todd learned how to manage his money the hard way. After losing his job in 2014, he was left in debt and had to educate himself on personal finance.

He has now paid his debts and learned the ins and outs of personal finance, and his blog reflects that, with a category for every aspect of personal finance.

This blog is a resource for both beginners and the money savvy. You can start with basics such as the differences between debit and credit cards or how to recognize a toxic work environment.

23. The Frugal Toad

Started by a personal finance enthusiast, this blog has been growing since 2011 and currently covers personal finance for beginners, travel, frugal living, and more.

The blog’s interpretation of frugality is aligned with minimalist philosophy in that it’s not about depriving yourself and becoming an extreme cheapskate, but about buying only essential things.

Therefore, travel can be a part of your life because the goal is to live a fulfilled, financially free, and happier life. Frugality can help you get there.

24. Financial Samurai

The blog was born amid the economic chaos of 2009. Its goal was to create a place to get away from the chaos and make sense of it.

Run by a financial expert with over 20 years of experience in the finance industry, the blog is informed by both personal experience and vast theoretical knowledge.

Learn about real estate, stealth wealth, taxes and more, all in one place.

25. Mr. Money Mustache

Living frugally and within his means enabled Mr. Money Mustache to retire in his 30s and live a calm family life.

The blog is fun and informative and covers frugal family life, life in early retirement, how to do the math and retire early, and where you can cut down your expenses.

As a parent, he also shares his insights on education and passing down his values and money lessons.

26. Passive Income M.D.

Peter is a Los Angeles-based anesthesiologist who started his blog to document his journey towards financial freedom.

The key to his financial freedom was passive income, so you’ll learn a lot about stocks, real estate, saving, and more.

What makes his content unique are true doctor stories that cover finances in the medical field.

27. Rich and Regular

Kiersten (corporate ladder escapee) and Julien (marketing and culinary expert) started the blog after discovering the F.I.R.E. (Financial Independence, Retire Early) movement in 2017. The movement emphasizes extreme frugality, high savings, and investment.

The blog is deeply personal as the couple shares both financial and life updates.

They share how to handle difficult conversations like a pro, how to eat good food on a budget, their financial plan, and more.

28. Bitches Get Riches

As you might have concluded from the blog’s name, this is not your regular blog on finance.

Kitty and Piggy (not their real names) write blog posts that are unfiltered, honest, hilarious, and offer valuable life lessons.

The blog covers debt, making and saving money, social issues, navigating careers, wellness, and relationships.

Read why you should stop supporting Amazon, how to avoid financial scams, or how to live life on your own terms.

29. Arrest Your Debt

Police lieutenants need to manage their finances too. Ryan Luke, who is also a financial advisor when off duty, started the blog to share the financial lessons he learned the hard way.

He’s now debt-free, saving towards his retirement, and sharing all that he did to get rid of debt. You can do it too, whatever your salary.

With budget templates and multiple categories that cover different aspects of money management, any first responder – or anyone else – can use the information to become financially free.

30. Clever Dude

Brock, a software engineer, has been blogging on personal finance since 2006. Frugal living is a major part of his lifestyle.

Besides novel ways of cutting back expenses, he has been sharing his journey towards a debt-free life and tools and tricks that can help you get there yourself.

31. Jackie Beck

Jackie is a debt expert, but she hears your debt woes because she’s been there herself.

Tracking money was the key to her becoming debt-free, and she believes that paying off debt and enjoying life shouldn’t be mutually exclusive.

In the blog, she shares how to get rid of debt, how to manage the money you have, and recover your credit score while you’re at it.

32. Retire Before Dad

Creating a better life by learning from their parents’ mistakes and retiring at 55 to have more time for the family and travel are the goals of the investors writing this blog.

Multiple streams of income have been the key strategy for reaching these goals, but as the author gets closer to retirement the blog posts increasingly explore life beyond finances.

Read why you should avoid following the money when choosing your career path and how to form a healthy relationship with money.

33. The Diary Of A Frugal Family

The blog is a journal for the entire family. It keeps you updated and also gives you valuable advice on frugal living.

Keeping to a budget as a family is not always easy. The blog offers tips on how to introduce frugality into every corner of your home can give you a lot of ideas on where to cut back.

Their guide for frugal Christmas is an interesting read.

34. A Wealth of Common Sense

https://awealthofcommonsense.com/

Ben Carlson started “A Wealth of Common Sense” in order to explain the complexity of finance and its intricacies in a way that every reader could understand. He believes that in the world of money, common sense and self-awareness are highly undervalued qualities.

On his blog, he touches on topics such as wealth management, investments, financial markets and investor psychology.

Here are some of the articles that really caught my attention:

- How Long Does It Take For Stocks To Bottom In a Bear Market? (very well explained by Ben who is a specialist in stocks and managing portfolios)

- The Present and The Past Of Inflation (shows a great overview of how inflation fluctuated over the years)

35. Three Thrifty Guys

Charlie, Eddie, and Aaron are a power trio of writers who combine their money and life lessons in blog posts about finance and lifestyle.

The blog has the usual finance categories such as retirement, making and managing money, saving, retirement, and more.

Read what changed Aaron’s opinion on universal healthcare or how to reduce a vet bill.

36. Disease Called Debt

Determined to pay off the debt they accumulated on their credit cards, this couple started a blog to document the process of getting out of debt. In a short 22 months, they paid off a debt of $65K.

Their financial goals have expanded since and you can read about saving and building wealth as well as the things you say that keep you in debt.

37. Investment Moats

Kyith, a software engineer by day and blogger by night, has been sharing his experiences with money-making, saving, and investing since 2009.

Investment Moats now features dozens of posts that elaborate on all things personal finance.

Free calculators that help you predict how long it might take you to build wealth or pay off a car are helpful for both those just getting started and for spreadsheet enthusiasts.

38. A Purple Life

The early retirement movement has been on the rise since 2010,particularly among Millennials. But what happens after you save enough money to pay bills and leave work?

This blog follows a Millennial who has been sharing her plans for early retirement and her progress toward reaching those goals since 2015.

In 2020, she successfully retired, but is early retirement meeting her expectations?

39. Her First 100K

Tori has a knack for personal finances and entrepreneurship (she started her first business at the age of nine). She now helps other women to get their finances in order one blog post at a time.

She helps other women to get their finances in order one blog post at a time.

Need some side hustle ideas or want to learn how to save $100K? Tori is your woman.

40. Physician on Fire

Leif is an anesthesiologist who retired early, at the age of 43. He discusses finance topics and shares all the tips that led him to achieve the final phase of the F.I.R.E. movement.

However, there are also medicine-related topics such as how to deal with burnout as a doctor and a tale of four physicians that explores how lifestyle affects your personal freedom.

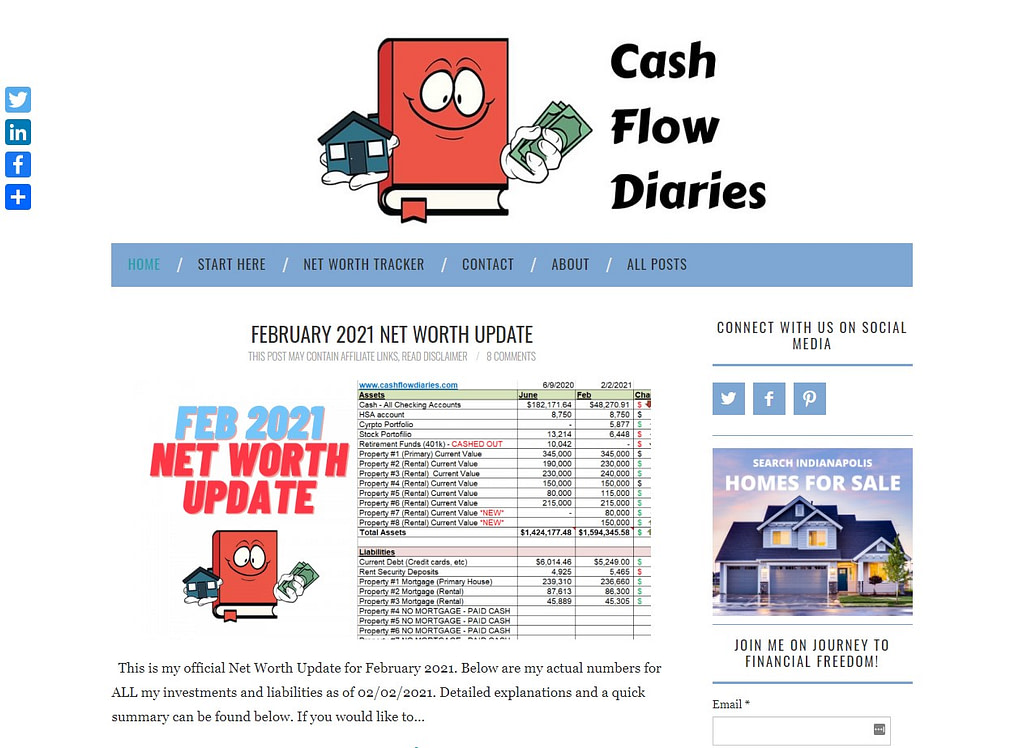

41. Cash Flow Diaries

Alexander’s definition of financial freedom is living off passive income. His goal is to get to $100K a year.

The blog is a journal that follows his progress and milestones on the road to financial freedom. He shares monthly net worth from property renting and blogging for all of you nosey people out there.

As the primary focus is real estate, you’ll find a lot of tips on home renting and renovation loans.

42. Budgets Are Sexy

The blog has been around since 2008. J. Money started it to track his goal, hitting $1 million. After 11 years, he succeeded and let Joel take over the blog.

Joel is an early to bed and early to rise makes a man retire early type of person. His blog posts on personal finance are fun yet informative to read.

Find out what is the difference between successful and unsuccessful investors, how to manage time and money, and more.

43. Marriage Kids and Money

Andy Hill started this blog in 2016 to share thoughts and experiences involving family finances. It has since developed into a business with accompanying podcasts.

It took five years for his family to pay off their mortgage and ten years to become millionaires.

Young families who are still figuring out how to manage money, pay off the mortgage, and budget can find a lot of helpful posts that can help them achieve their goals.

44. Women Who Money

Vicki and Amy are personal finance veterans who joined forces to create a blog for women who want to manage their money more effectively.

They share advice and resources that can help you get a hold of your finances whether you are a beginner or just getting started.

Find out whether you’re following the right advice on paying off credit card debt or if you’re unintentionally committing tax fraud.

45. Penny Pinchin Mom

Tracy managed to get out of debt and her blog is a collection of her advice on finances, family matters, and lifestyle based on her own experiences and the lessons she learned along the way.

She understands how your finances change with children, how to get rid of debt, and what makes artificial Christmas trees better for your family and your budget.

46. Saving Freak

Paul and Amy have a lot of ideas on where to cut back your expenses. They are a power couple who know their personal finances and want to share their experiences with others.

Whether your goal is to save for the future, learn about investing, or seek new ways to contribute with extra income in your family, they’ve got you covered.

Read about low-risk investments, which jobs for beginners pay $20 an hour, or which restaurants are your go-to if you want free meals for kids.

47. The Savvy Couple

Kelan and Brittany make finance approachable and fun for families. They have been publishing regular blog posts on earning, saving, and investing since 2016.

Their blog has since grown into a full team of experts on finance and hundreds of posts that answer every finance question imaginable.

Find out all about building generational wealth and whether you can afford a dog.

48. Frugal Woods

This blog is for families who are always on the lookout for ways to make their financial lives simpler and less stressful.

Take a peek at the spending of a frugal family or more tips and tricks on how to live a financially independent and simple life, which can apply even to your credit card.

49. Route to Retire

Does your job feel like an endless Groundhog Day? Every day is the same and you spend a lot of time daydreaming about projects you never got around to doing?

Jim has been there.

Despite financial hurdles such as credit card debt and student loans, he’s currently enjoying his early retirement with his family in Panama.

Find out his secret to early retirement and what’s he up to lately.

50. Wallet Squirrel

Adam and Andrew are best friends who can help you to bring your A-game to the challenge of making money.

They share fresh ideas on how to earn more, their monthly income reports, and blogging advice.

Since they started the blog in 2016, they’ve been testing many creative ways to get that extra income. Find out which ones don’t pay peanuts here.

51. The Financial Diet

What started as Chelsea Fagan’s humble blog for budget tracking in 2014 developed into a company run by eight women who can offer you a solid financial framework and elaborate how well Rachel Green’s budget from Friends would hold up in 2021.

They understand that our impulses can inform our spending patterns and the role our mental health has in managing personal finance.

Make sure to check out their YouTube channel for adulting tips, lifestyle hacks, financial insights, and more.

52. Debt Free Guys

David and John are husbands who empower the LGBTQ community with the fabulous financial tips they learned after accumulating debt and living beyond their means.

They found their key to financial freedom in getting rid of debt and creating the lifestyle they always dreamed about.

How to manage your finances and time to achieve that?

Check their posts on how to build wealth or the list of budget-friendly gay cities.

53. Money Pantry

Whether your goal is to earn money, save money, or plan your finances, blog posts featured on this site can help.

Read which sites can pay you for something you’d be doing anyway or which low-stress jobs that pay well you should consider.

54. Money Saved Is Money Earned

Sebastian and Tawnya are two hard-working bloggers that share all the financial lessons they’ve learned in a blog covering saving, earning, developing the right mindset and more.

The blog covers topics for beginners such as interest 101 and travel tips such as what to do in Vegas cost-free.

Sebastian’s and Tawnya’s personal stories with debt, prejudice, and paving their path to financial freedom are good reads as well.

55. Frugal Confessions

Amanda, a certified financial instructor, writes a blog on how to make money management simple. She’s all about money systems that will teach you how to work smarter and not harder.

Read how to turn common money mistakes into your advantage or how to organize your monthly bills.

56. Root of Good

Wonder how early retirement works in practice? This blog will tell you, along with personal finance advice, regular life updates, and various money hacks.

After accumulating enough wealth to leave his daily job and retire, this financially independent man has been sharing what it’s like to enjoy life with his family.

This is everything he did to achieve early retirement at 33.

57. Don’t Mess With Taxes®

https://dontmesswithtaxes.typepad.com/

Don’t Mess With Taxes® was founded in 2005 by Kay Bell, a journalist from Texas who also happens to be a tax geek. She writes extremely useful tax-related articles where she offers tips on how to handle and master taxes. She covers pretty much everything that is tax related from tax tips, credits, deductions, and refunds to state taxes and politics/laws.

If you struggle with taxes, check out her blog where she will show you how to avoid larger penalties even if you missed Tax Day and options if you can’t pay your tax bill in full.

58. The Mini Millionaire

Besides multiple posts on finance gathered on the site since 2014, there are a variety of posts that cover more than saving and making money.

Find out how to negotiate house prices, how to get paid for shopping, and how to start a Lego business while being your own boss.

59. Curious Cat

This blog shares various posts on investing and economics, and various financial literacy topics.

Their investing dictionary and resources such as books on investing can save you a lot of headaches when trying to understand the world of economics or get your finances in order.

60. Broke Rich Girl

Mel started the blog to hold herself accountable for saving and learn about finance management.

The blog covers earning, travel, school tips, frugal living, and stage management (her profession).

Find out how to calculate your net worth or what to do in case of a workplace accident.

61. Financial Residency

If you’re a physician who missed their personal finance college courses (perhaps because there weren’t any), this blog has all the information you need to get you started.

Whether you want to retire, buy your first home, escape that student debt, organize your finances, or feel clueless on where to start in general, there is a blog post here that will help you.

Read how to mend your relationship with money, manage taxes as a physician, or start your practice.

62. The Frugal Farmer

Whether you’re thinking of living off the grid and wondering if that is the right life for you or you’re already there and need some insight on farming and finance, this blog can help.

The content is mostly about finances: making money, retiring, saving, etc. However, you can also find survival tips and gardening tips.

63. Monevator

Two bloggers share their approaches to investing and earning money. They understand that money is a valuable resource and share their tips on how to be smart with it.

Find out what makes investing overseas beneficial for your portfolio, how rich stay rich, or who’s your Star Wars hero?

64. Time in the Market

Armed with a degree in Finance, the guy behind the blog puts complex financial lingo into simple terms and shares his advice on how to manage your money to live well.

For him, financial independence is not about extreme frugality, it’s about not having your options restricted when you reach the retirement age.

Find out how to eat well, travel far, and set your financial goals.

65. Bigger Pockets Blog

The blog is part of a larger website that covers various aspects of personal finance for both rookies and professionals. Their specialties are investing and passive income.

You’ll find a lot of advice on investing in real estate and making a better life for your family, which includes your pets.

Read how to rent your house or what you should expect from tenants with pets.

66. Your Personal Finance Pro

The blog is run by money-making and saving enthusiasts. It’s been up since 2012 and it focuses on making money, becoming financially stable until retirement, and everything in between.

Find out what you can learn from minimalist living, what affects the value of a painting, or which day of the week should you quit your job?

67. Save Spend Splurge

Sherry blogs on money and lifestyle and encourages readers to splurge on the things that matter.

She values high-quality items, making time for things that enrich your life, and travel experiences.

Find out how to budget for travel, what’s in her closet, and whether there’s hope for you to become filthy rich.

68. Newlyweds on a Budget

The blog covers different financial worries that particularly affect newlyweds.

Have you been wondering if:

- newlywed partners should have a will?

- there’s the best way to split the wedding cost?

- you can have a honeymoon without breaking a bank?

You know where to go to find those answers.

69. Suburban Finance

The blog covers personal finance topics and tips and tricks for changing your habits and lifestyle to achieve your goals.

Find out how you can support local businesses, protect your bank account from hackers, and what makes private health insurance better.

70. Make Money Your Way

Pauline started this blog in 2013 to share ideas on how to earn more.

She doesn’t believe in get-rich-quick schemes but has many suggestions on how to hack your career and earn that coin, whether online, through passive income, through investing, or by side hustling.

Read how to become a successful business owner, how to achieve a 10% savings rate, or how to manage a crisis at work.

71. Money Under 30

David Weliver has founded Money Under 30 in order to document his efforts to pay off $80,000 of debt in three years and to help young adults to make smart decisions regarding where their money goes.

What’s great about this blog is that the writers are all people who have gone through the same financial problems as the readers and they know exactly what struggling with debt at a young age feels like.

The website is full of useful resources for people who don’t know much about finance. You can learn how to choose a credit card (super useful in order to prevent debt in the first place), or if you struggle with banking, you can check their 101 Banking Guide to refresh your memory on this subject.

72. Turtle Investor

Kevin started his blog to share his knowledge of investing.

While the blog has plenty of valuable information on this front (for both new and experienced investors), you’ll also find posts that cover early retirement, travel, and multiple streams of income.

Take a sneak peek into his financial plan, income reports, or frustrations with cryptocurrency.

73. Financial Ducks in a Row

Finance planner Jim helps people get their finances straight by blogging on IRAs, social security, income tax, and everything in between.

Does he recommend a 401(k)?

Which earnings count towards the annual earning test?

What is the underpayment penalty all about?

Find out in the blog.

74. Thrifty Nomads

Created by travel enthusiasts, the blog focuses on travel guides and managing your finances before and while you travel.

It’s all about affordable travel and not depriving yourself of life-changing experiences like travel.

Read what you can do for your finances while you’re still at home, which travel destinations are worth the hype, or all about budgeting in the name of travel.

75. Len Penzo

Alive and kicking since 2008, this finance blog will turn you into an economically responsible individual, or at least give you the resources to work towards being one.

Find out what is your millionaire neighbor hiding from you, which wedding gifts he doesn’t hate 25 years after (is it a swan-shaped chip and dip set?), or all about mortgage basics.

76. Radical Fire

In 2018 Marjolein decided to become financially free. She’s been building her dream life ever since and has a blog to prove it.

So far, she has saved most of her income, increased her salary, started investing, and traveled while still hitting her financial goals.

Get inspired by her story, or check out her posts on saving, making money, or which jobs are introvert-friendly the most.

77. Blogging Away Debt

Tricia’s need to pay off $36,000 in debt inspired this blog in 2006. After she paid her debt off, she passed the baton to the next blogger to share her getting out of debt journey.

Current members of the getting out of debt relay team are Rebekah, Sara, Elisabeth, Ashley, and James.

Follow their journeys to get inspired or check out their comprehensive guide to leaving that debt behind (without having to change your identity and leave the country) here.

78. Frugal Asian Finance

Frugality, finances, family matters, this blog has it all. Started in 2017, this blog is steadily turning into a complete business, as Mrs. Frugal Asian Finance shares in her earnings reports.

Besides blogging tips, check out posts on whether you should live with your in-laws, which pricey items are worth it, or common financial expectations in Asian families.

79. Modern Frugality

Jen got rid of her $78,000 debt in two years and she’s been helping others to get their money makeovers ever since.

Her approach is frugal and infused with a minimalist philosophy.

She has a lot of frugal tips that can save your wallet from getting sad, recommendations for the best places with free furniture, how to handle having to pay for your parent’s financial mistakes, and more.

80. Blonde and Balanced

Rachel is a Millennial writer who shares her ideas on all things finance.

She knows why you always need more money, all about the cost of handmade soap, and how to sell stuff on Craigslist fast.

81. The Blunt Bean Counter

Written by an accountant, this blog has been challenging the myth of the boring accountant since 2010.

He covers different tax conundrums such as how long you should keep your tax records, elaborates on how much money you need to retire, and reminds you that your kids are likely to fight over your real estate.

82. The Insurance Pro Blog

Licensed insurance agents Brandon and Brantley have been sharing their wisdom on insurance matters since 2011.

They’re great at explaining and demystifying insurance for beginners, but they also discuss specific in-depth topics such as converting your 401K into life insurance.

There’s also this handy life insurance calculator.

83. Life Happens

For life insurance beginners, the blog offers 101 guides that deliver relevant information about life insurance, disability insurance, and long-term care insurance.

Find out why even single people need life insurance, which insurance words are frequently misinterpreted, or more about the existing gender gap in life insurance.

84. Gathering Dreams

For Sara, regaining her financial freedom meant she could free up time for things that truly matter in life.

After working hard (60+ hours weekly), she learned how to work smart to take control over her resources and regain control over her money and time.

Read all about expense tracking, saving up for world travel, or get some recipe ideas for summer.

85. FinanceBuzz

FinanceBuzz was founded by Greg Van Horn, Ryan Van Horn and Christine Yaged who embarked on a mission to help people get ahead with their finances. Their goal is to make financial independence accessible for everyone.

On their blog, you can learn how to make $10,000 a month and read about how much should music lovers of each genre budget for concerts this summer? How cool is that?

86. I Pick Up Pennies

This blog is about celebrating our imperfections, frugal money management, and mental health.

It also includes a spending diary for all of you nosey people.

Read how every penny you save adds up to a significant amount over time, what are your rights if you get a ticket after being caught by a traffic camera, and all about the challenges of frugal living with depression.

87. Financial Best Life

Lauren shares advice on how to earn, save, pay off debt, and more. She had serious debt issues after college due to her shopping addiction and understands that money is more than numbers in your bank account.

Her posts help others to take control over their finances and find the motivation to turn money into a useful tool that enables us to live our best life instead of being a major source of stress.

Check out how to overcome a shopping addiction, whether you can earn money blogging, or how a balance transfer can help you out with debt.

88. VitalDollar

Marc launched the blog in 2008 to improve his finances. Today the blog covers every aspect of financial management.

Read how he earned $1 million blogging, his top passive income ideas, or how to save money.

89. The Outlier Model

Allen got on the personal finance train after realizing that he lacked financial literacy.

For him, money management is all about recognizing your needs and prioritizing them over your wants.

You’ll get some ideas for summer entertainment on the budget, get a grasp of the financial steps you should take in your 20s, and find great side hustles for teachers.

90. Money Ning

The blog has been covering frugal lifestyle, investing, and the general intricacies of money management since 2007.

David has a lot of tips on retiring early, finding the right savings account, and explores subjects such as who should finance an engagement ring.

91. Retire by 40

Early retirement has been Joe’s major financial goal ever since he launched his blog in 2010.

After successfully retiring, he has been sharing his monthly financial reports from multiple streams of income.

Find out what he has to say eight years after retirement.

92. 1500 Days

The goal was to retire early 1500 days after the start of the blog. The blog is a collection of the experiences, lessons, and financial milestones along the road to achieving the goal.

Investing has been a major part of the financial journey, along with the realization that there is more to life than work and money.

93. Dinks Finance

The blog is currently written by money enthusiasts James, Gina, and Melissa. It covers financial management in relationships, building wealth, and ways to make money.

Find out what makes getting rich difficult, what you should know about prenups, and whether his money strategy is smart or selfish.

94. Busy Budgeter

Rosemarie is all about saving money, budgeting, and enjoying your life while you’re at it.

She has not always been good with money, but she got rid of debt and her finances are under control.

Now she inspires others to do the same by sharing posts that will organize every corner of your home, from your paperwork to your pantry.

95. The College Investor

Robert Farrington started this blog on personal finance in 2009. It grew into a business and a major resource for personal finance enthusiasts.

The site features expert advice on various aspects of personal finance, but student loan debt is their forte. Learn how to save for college, how much college costs, how student loans work, and more.

96. NerdWallet

NerdWallet started as a credit card comparison site in 2009. Now they cover every aspect of personal finance.

On the site, you can read the basics of banking, credit cards, mortgage, investing, loans, insurance, and travel.

There are also in-depth articles that tackle specific questions such as purchasing crypto with a credit card or entrepreneurs’ from rags to riches stories and lessons they learned along the way.

97. Just Start Investing

This website launched with the idea of making investing accessible and easy to understand, but it explores topics beyond investing.

You’ll find 101 guides on investing, banking, budgeting, and credit cards as well as step-by-step guides that break down complex topics such as investing in index funds.

The blog on the site dissects the net worth of different celebrities, such as Will Ferrell’s and John Legend’s, while offering insight into how they have built their wealth.

98. Money Crashers

What began in 2009 as a passion project to compensate for the lack of financial education developed into a full-time job for the founders of popular site Money Crashers.

This major personal finance blog covers all facets of managing your personal finance, including banking, loans, investing, and small businesses.

It’s a valuable resource for the basics of personal finance, but some of their best content sheds light on managing money with your roommates, significant other, or family.

99. Wallet Hacks

Wallet Hacks is another personal finance blog that grew post by post and became a major resource. They cover standard personal finance categories such as loans, investing, making, and saving money.

They also get personal and some of their best content includes articles on managing anxiety caused by our expectations and success and crucial financial decisions that will make the next Jeff Bezos out of you.

100. The Balance

The Balance has been publishing finance content for over 20 years and currently counts over 9000 articles.

A team of professional finance writers covers every aspect of personal finance imaginable. You’ll find information on budgeting, credit cards, banking, investing, loans, and more.

The site has the answers to all of your burning finance questions, be it guidelines on writing a check or which US president accumulated the highest debt.

✍️ Are you interested in starting your own finance blog? Building a successful blog is often a long process but you have to start somewhere. Our friends at DomainWheel have written a great guide on how to start a finance blog which will get you off to a quick start.

🤔 Are you a financial blogger stuck for ideas on what content to create next? Here are some topic suggestions to help you fill up your content calendar.

What I Learned After Visiting 100 Blogs?

Personal finance is personal. Very personal indeed.

We come from different backgrounds and sometimes may not even understand why we spend impulsively, splurge when we cannot afford it, or how to be financially responsible adults. Monetary troubles sneak into every part of our lives and affect our relationships, mental health, and often the overall quality of life.

Our personal finances include others. Whether we want to collaborate with them, share living expenses, or need their help, personal finance gets most complex when there’s more than one person involved.

Bloggers’ stories have patterns: most bloggers are either about getting out of debt or retiring early. I’ve been amazed over and over how fast people can get out of debt simply by creating a plan and following it religiously.

There are also a lot of successful blogs whose target audience is women of all ages, reminding us that gender disparities in finance still exist.

Generational differences also stuck out. Many of the blogs on the list are run by a specific generation, the Millennials, and reflect anxieties they have over their financial futures. Millennials were hit very hard by the 2008 financial crisis, and the experience of coping with that impact inspired many to record their experiences.

Many blogs were inspired by the eagerness to get rid of debt or find alternatives to nine-to-five jobs. In many cases, the blog ended up being their full-time job. Every post is a journal entry that collects their thoughts and creates accountability since people read and follow their content.

Many also share how many management practices learned from their families got deeply ingrained in their adult selves.

It’s going to be interesting to see how the next generations, raised by more financially literate parents, handle finances as adults and in what way will they define their financial freedom. Will it be in terms of early retirement, traveling, living debt-free, or something entirely new?

Did your blog get featured on our list? Show off with a badge:

Love the way you write the blog. Awesome! Thanks for sharing ~

Very Interesting & informative blog. Thanks for sharing.