Financial literacy is a core requirement for a secure life. Many Americans still remain financially illiterate. According to the Financial Industry Regulation Authority, FINRA, for short, more than 6 out of every 10 Americans don’t have a grasp of fundamental financial concepts, making them susceptible to accumulating bad debt, making unwise spending decisions, or just not being prepared for the future.

As if that wasn’t bad enough, here are some somber facts that emphasize the urgency here:

- Almost 8 out of 10 Americans have no savings and are living paycheck to paycheck.

- Around 189 million Americans have at least one credit card, with the average credit card owner holding almost four different cards. As a result, credit card debt has reached $1.04 trillion, with the average interest rate at 24.16% as of March 28, 2023.

- Almost 44 million Americans are living every day with the immense weight of $1.5 trillion in student loan debt weighing down on their shoulders.

- In aggregate, the American population is grappling with a $12.58 trillion debt monster.

So, what is exactly financial literacy, and who should be teaching it to us?

What is Financial Literacy?

Simply put, financial literacy is all about fundamental financial skills that you can use in your everyday life. These skills include budgeting, managing your personal finances, and investing, and they can be the difference between you being a corporate slave for the rest of your life and you living the life you want, like retiring early, getting your kids through college, and enjoying your life.

What Are These Fundamental Financial Skills?

Financial literacy doesn’t only give you more control over your future; it prepares you for the rough blows that hit us all during stormy times. So, to build a sturdy ship that can make it to shore and face gargantuan waves along the way, here is what you’ll need:

- Budgeting: How much of your monthly income do you spend on everyday purchases? How much of it do you save for a rainy day? What about investing?

- Investing: How do you choose your investments? And do you take into consideration your risk profile, or do you just invest haphazardly?

- Borrowing: How are you when it comes to borrowing money? Do you factor in interest rates, or is your mortgage extremely overpriced without you knowing it?

- Taxes: Do you take advantage of the different allowances offered by the IRS when it comes to saving on taxes, or do you let the taxman take more of your annual income than necessary?

- Personal financial management: How do you mix all of the above skills together? Where are you strongest, and where are you weakest?

Combining these skills can help you take charge of your finances and manage your money more effectively.

Why is Financial Literacy Important?

Aside from providing financial stability, financial literacy has several advantages:

- It makes you a better negotiator. After all, when you understand how money works, you will have a better appreciation of the terms of a deal. Also, you will find it easier to decipher and interpret different financial documents and contracts.

- It improves your overall mental health. There is something to be said about the comfort and feeling of psychological safety that comes from knowing that were you to lose your job tomorrow, you and your family would still be taken care of.

- It makes you a better contributor to society. Not only does it encourage you to set aside a portion of your budget towards charity, but it also empowers you to be a more active participant in community affairs.

- Financial literacy can reduce social inequality. It is one of the best tools to enable people to improve their socioeconomic status and rise out of poverty.

There’s really not much debate over this. While some may say (accurately) that financial literacy alone will not solve many economic problems, almost any individual is better off with financial literacy than they would be without it.

Why Should We Teach Financial Literacy?

On one level, this is obvious. If we need to learn about personal finance, we need to be taught. We can learn by trial and error, but that’s not a great way to do it: by the time the lessons are learned, we can be deeply in debt.

There’s also a less obvious but even more compelling reason to teach financial literacy.

Bad Financial Habits are Taught Too

Most of us probably don’t realize that we are being encouraged from an early age to adopt bad financial habits, but the truth is that we are. From childhood onward, advertising urges us to want more and to define our self-worth by what we own and how we look.

As we get older, more pressure piles on.

- We’re urged to attend expensive private colleges, even if it means plunging into an ocean of debt.

- Buy now pay later (BNPL) plans promise easy payments and the ability to buy whatever we want.

- Car dealers offer shiny new rides with no down payment.

- Credit card companies send us prequalification notices with seductive signup bonuses.

- Lenders promise fast, easy cash, just sign on the dotted line and get your money.

That’s just a few: the list could go on for miles. Everywhere we look, we are urged to spend and to borrow, to want more and acquire more. There’s always an “easy” solution, get it now and pay some other time.

Every single one of these “deals” costs money, often a great deal of money.

It might be an overstatement to say that companies are spending trillions every year to teach financial illiteracy, but not by much. The money spent on trying to teach us good financial habits is dwarfed by the money spent to promote bad financial habits.

Teaching financial literacy is one small step toward addressing that imbalance.

Who Should Be Teaching Us Financial Literacy?

1. Should It Be Our Schools?

One popular view is that schools should teach students the basics of financial literacy. You’ve probably even seen this view on social media.

So, should schools teach students financial literacy?

Well, 21 states seem to believe so, mandating that schools include the subject within their curriculum. And, there are plenty of reasons to support this decision: Not only does it encourage students to start saving as early as possible, but it also helps them understand the lifelong repercussions of their college loans.

Moreover, several studies indicate the effectiveness of our schools taking an active role in our financial education. For instance, one study found that after taking a personal finance class, students became 23% less likely to finance their collegial journey with loans and debt. Moreover, those same students became much more confident about their ability to invest and much more appreciative of the power of having savings in the bank[2].

What’s more, even teachers are feeling more confident about integrating financial literacy into their curriculums.

Unfortunately, schools are often limited in how much financial education they can deliver.

While it would be great to have schools teach financial literacy, there are obstacles. Financial literacy isn’t mandatory in most states, and many schools just don’t bother with it. Many teachers don’t feel comfortable teaching the subject and aren’t able to come up with age-appropriate lesson plans and teaching materials.

More importantly, a school’s influence is limited. Financial literacy is not just about communicating information. It’s also about adapting our behaviors and reining in the psychological factors that could lead us astray. Schools are not always in the best position to shape behavior.

2. Should Financial Literacy Be Taught at Home?

Personally, I believe that some of the responsibility of teaching financial literacy does fall on the parents, and the reason is that they can instill the proper behaviors and beliefs early on in their children.

They can achieve this in several ways:

- They can start talking about money and finances when the kids are young. And these conversations can play a crucial role in how the children end up managing their personal finances. This also makes money an everyday topic to talk openly about and discuss rather than a taboo subject shrouded in secrecy.

- Parents should act as role models, showing their children how to handle both good and bad times. What we show is more important than what we tell. Moreover, when parents show kids how to save for a certain financial goal or invest in an index fund, these all end up becoming lasting learning experiences.

- Parents can empower their kids by opening up a bank account for them and helping them get their first job. This job can be as simple as pet-sitting the neighbor’s dog or removing the snow from the driveway. Armed with an account and job, kids will be able to start saving and working towards their own personal goals.

Parents have access to numerous tools to help them educate their children during different life stages. So, whether the kids are in Kindergarten or in Elementary school, they can benefit from the right tool and learn important lifelong lessons.

Unfortunately, parents are also limited.

In an ideal scenario, the responsibility would be split between our schools and our parents. The schools would give us valuable money lessons, and our parents would instill in us the right behaviors.

However, just as schools may be limited in what they can offer our kids, so are the parents:

- Many parents may be unqualified to teach their kids valuable money lessons. Remember that almost 60% of American adults are considered financially illiterate. So, despite their best intentions, parents may find themselves in a scenario where the blind are leading the blind.

- Yet, the more worrying problem is that when it comes to money, our actions rarely align with our words and beliefs, making many of us ill-suited to be role models to our children. Many parents grew up in households that didn’t talk about money, and it’s hard to break that pattern.

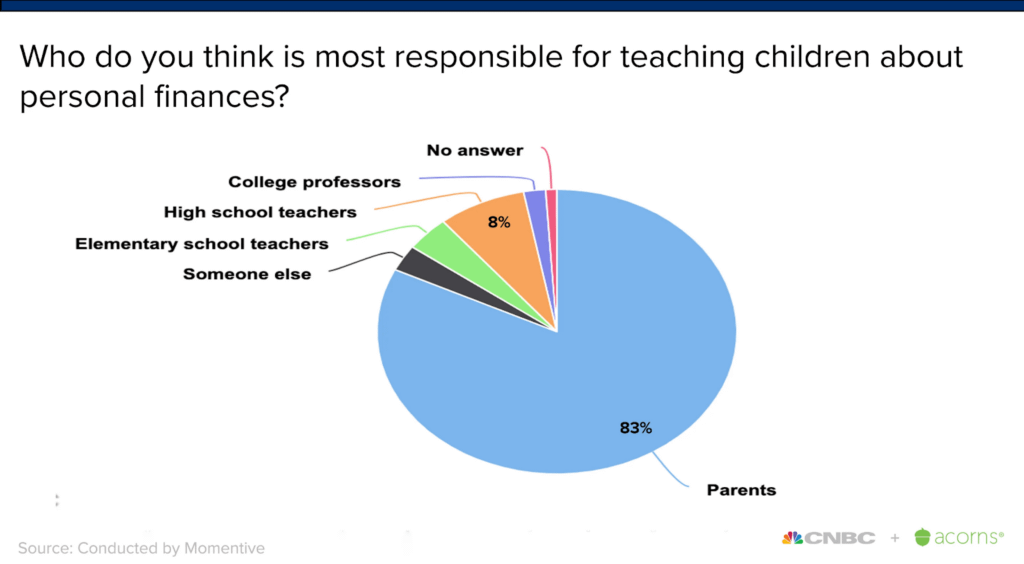

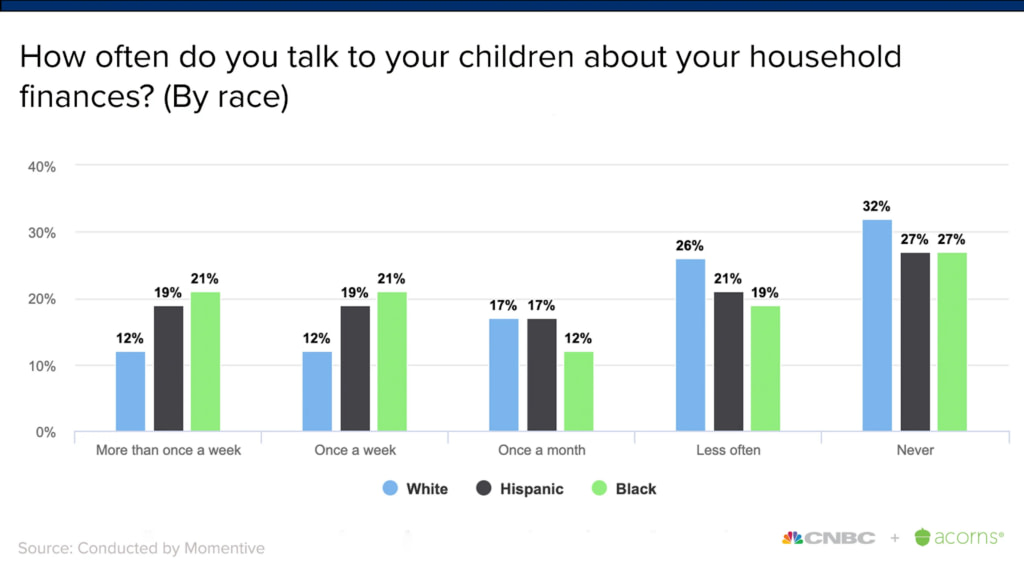

- Furthermore, even though several parents believe that they should teach their children about money, few of them actually pull through. According to one survey, around 83% of Americans believe that parents should be the main ones responsible for their children’s financial education. But, a meager 15% of those same adults took the time to talk to their children about money more than once every 7 days[1].

Most of us think we should teach our kids about money, but too many of us don’t do it.

3. The Responsibility is Ours

So, if both schools and parents are limited, then where does the bulk of the responsibility ultimately lie?

I believe the answer is with us.

There are countless online resources nowadays that can teach us everything we could possibly want about finance. You have books, Youtube channels, and Facebook Groups, all dedicated to teaching us how to manage our finances better.

At the end of the day, the health of your finances relies on your behaviors and attitudes way more than on your understanding of the intricacies of the banking system. It is your responsibility to learn to control yourself financially.

It is also on you to know yourself well enough to know which types of investments you will be comfortable with and which types will keep you up at night. At the end of the day, very few things are worth your peace of mind.

As with our other options, self-guided learning also has its limitations. One is that the decision to pursue financial knowledge requires an awareness of finance that many young people just don’t have. As a result, many young people don’t get serious about financial literacy until they have already made serious and avoidable mistakes.

Putting It All Together…

It can be easy to blame the school system or our parents for not teaching us how to do taxes or invest our money. But, I personally believe that that mind frame robs us of our agency.

Yes, it would be great if we could learn about money at school, and it would be even better if our parents could discuss with us the finances of the home regularly. But, even if we had neither of those options growing up, we now live in the age of information, where anything we want to learn is literally at our fingertips.

So, who should teach you about financial literacy?

👉 My answer would be 10% is the school’s responsibility, 20% is the parents, and the remaining 70% is all on you.

The problem, of course, is that in order to teach ourselves effectively, we have to wake up to the need for financial literacy, ideally before we’ve already dug ourselves into a hole. That means that while schools and families may not be the ideal source of financial knowledge, they play a vital role in getting us started on the path to financial knowledge!