People with bad credit retain credit repair companies to help them dispute entries on their credit reports and improve their credit scores. If you do choose to use a credit repair company, Lexington Law and Credit Saint will be among your top options. Both companies are established and highly visible players in the business.

Let’s take a closer look at how they stack up against each other.

📚 Learn more: Before hiring any credit repair company you should look closely at your credit situation and decide whether it’s worth the cost. Our guide on when to hire a credit repair company will help you decide!

What Do Lexington Law and Credit Saint Do?

Credit repair companies all offer the same basic service. They review your credit report, identify negative items that are dragging your credit down, and assist you in disputing any items that are erroneous or incorrect.

Most credit repair companies offer different service tiers, so you’ll have to decide which package best suits your needs. Many also provide credit education and ongoing credit monitoring.

It’s important to remember one basic fact that applies to all credit repair companies. The dispute process can only remove entries that are inaccurate or erroneous. It may at some times be possible to get a legitimate entry removed, but it is never certain and any company that promises to remove legitimate entries is not being honest.

If your credit reports are fairly simple and you don’t have a large number of disputable entries, DIY credit repair will be a better – and cheaper – option.

How Does Lexington Law Work?

Lexington Law follows a common pattern for credit repair companies:

- You set up a first-time consultation with Lexington Law by visiting the Lexington Law website.

- Your credit reports will be sent directly to you. You will have to submit them to Lexington Law for review.

- Lexington Law identifies negative records and uploads them to your online case valet program. You will have to provide details to establish whether the records are legitimate or not.

- The company contests the items that are potentially disputable.

- Lexington law monitors your credit and addresses each suspicious negative item in your reports as they appear.

- The company negotiates directly with creditors on any difficult items. This feature is available in all packages.

Lexington Law cannot guarantee that they can improve your credit. In fact, no credit repair company is allowed to issue such a guarantee.

👉 Read our full review of Lexington Law to learn more.

How Does Credit Saint Work?

Credit Saint’s process is similar to that of Lexington Law:

- Set up a free consultation on through the Credit Saint website. Experts review the harmful elements on your credit report one at a time.

- Based on the results of this analysis, Credit Saint creates a credit repair plan for you.

- Credit Saint works with the credit bureaus to remove any inaccurate items from your credit history.

- You get ongoing monitoring of your credit report.

- The company negotiates directly with creditors, but difficult negotiations are only available in the advanced packages.

The company covers all the bases, but they do not commit to difficult negotiations on all packages. This might be a point to consider if you think you have some tough creditors.

Remember that no amount of negotiation can force a creditor to remove a legitimate debt from your credit record.

👉 Read our full review of Credit Saint to learn more.

Compare Key Features

| Feature | Lexington Law | Credit Saint |

|---|---|---|

|  | |

| First Work Fee | $59.95-$139.95 | $99-$195 |

| Mobile Application | Android | None |

| Cancellation Allowed | Yes | Yes |

| BBB Accredited | No | Yes |

| Discounts and Promotions | Couple Discounts | Family Discounts |

| Free Initial Consultation | Yes | Yes |

| Money back insurance | No | Yes* |

| Market experience | 17 years + | 14 years + |

| Monthly fee | $59.95 – $139.95 | $79.99 – $119.99 |

| Visit Website | Visit Website |

*If you do not see any questionable items deleted from your credit in 90 days

Compare Monthly Plans

Both companies offer a tiered set of plans. The more you pay, the more services you get. Here’s a breakdown of the plans.

| Pricing | Services |

|---|---|---|

| Lexington Essentials | $59.95/month | 4 disputes/cycle with Equifax and TransUnion, 3 with Experian. 2 creditor interventions/month. |

| Concord Standard | $99.95/month | 6 disputes/cycle with Equifax and TransUnion, 3 with Experian. 3 creditor interventions/month. |

| Concord Premier | $119.95/month | Includes the complete Concord standard plan, plus TransUnion Score Analysis, Report Watch, and Inquiry Assist alerts. |

| Premier Plus | $139.95/month | 8 disputes/cycle with Equifax and TransUnion, 3 with Experian. 6 creditor interventions/month. Includes all that is in the Concord Premier package, plus additional features. |

| Pricing | Services |

|---|---|---|

| Credit Polish | $79.99/month | The plan allows you to dispute a maximum of five negative entries per billing cycle. It does not include targeting investigations, so the company will not assist in challenging difficult investigations but will intervene with creditors, analyze, and track scores. |

| Credit Remodel | $99.99/month | This plan allows you to go over ten negative points in each billing cycle plus extra features like intervening with creditors, analyzing and tracking scores, inquiry targeting, and challenges to the three credit bureaus. |

| Credit Premium | $119.99/month | The plan allows you unlimited challenges for all three credit bureaus. It analyzes and tracks scores, initiates creditor interventions, and provides target inquiries. |

👉 It’s important to note that the most expensive package is not necessarily the best for everyone. If you only have a few disputable records, an unlimited dispute package won’t help you, and some of the services in the premium packages may be available at less cost elsewhere and may not even be useful to you.

💰 Both companies offer ongoing credit monitoring. In most cases, it will not be worth it to keep paying the monthly fee after all disputable records have been addressed. There are cheaper ways to monitor your credit.

Compare Customer Reviews

Both companies have been around for a while, so they have accumulated some positive and negative reviews.

In both cases, some negative reviews may be due to unrealistic expectations. Clients who expect to see legitimate entries removed from their credit reports are bound to be disappointed.

✍️ Note: Credit Saint has far more positive reviews than Lexington Law has. Lexington Law has a consistent stream of complaints about poor communication.

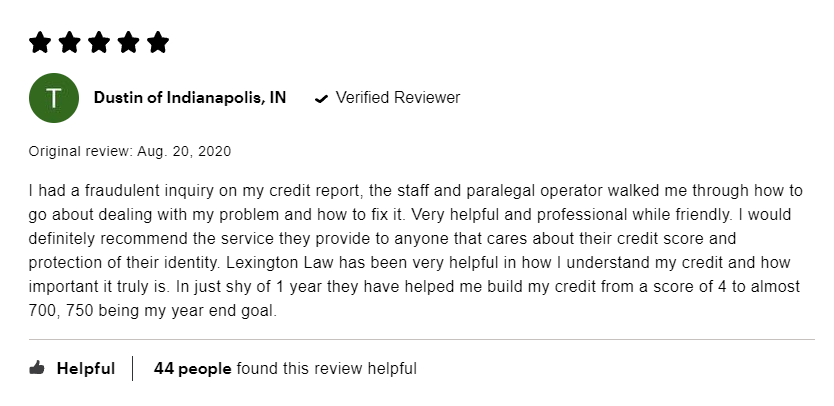

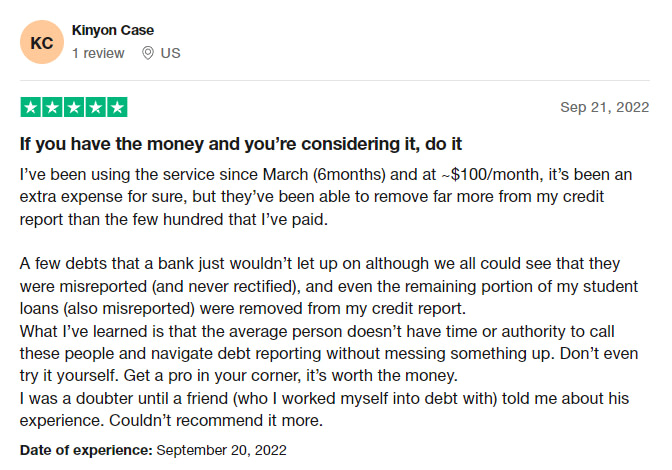

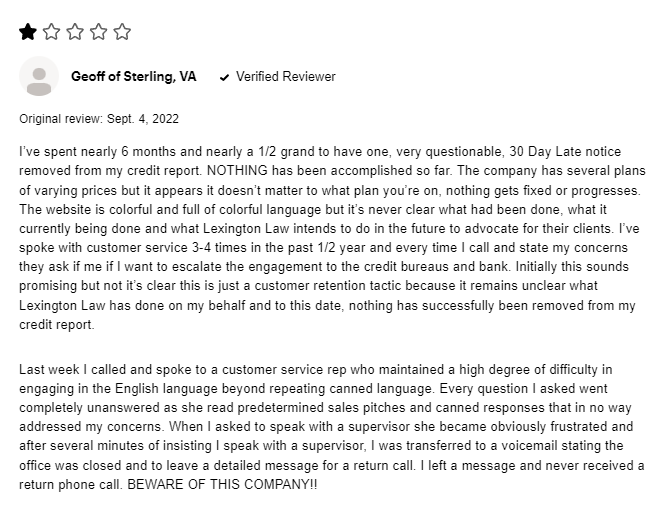

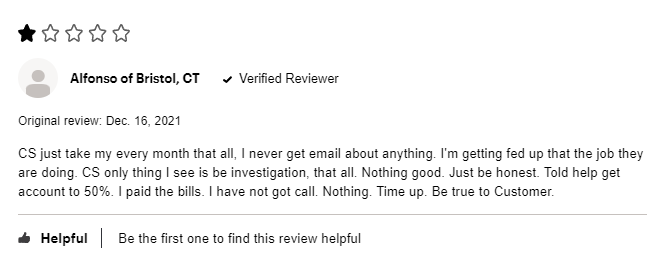

Lexington Law Customer Reviews

The negative reviews for Lexington Law are often about poor communication. Some customers claim they couldn’t get any verification of any action being taken. The positive reviewers, however, indicate a smooth experience.

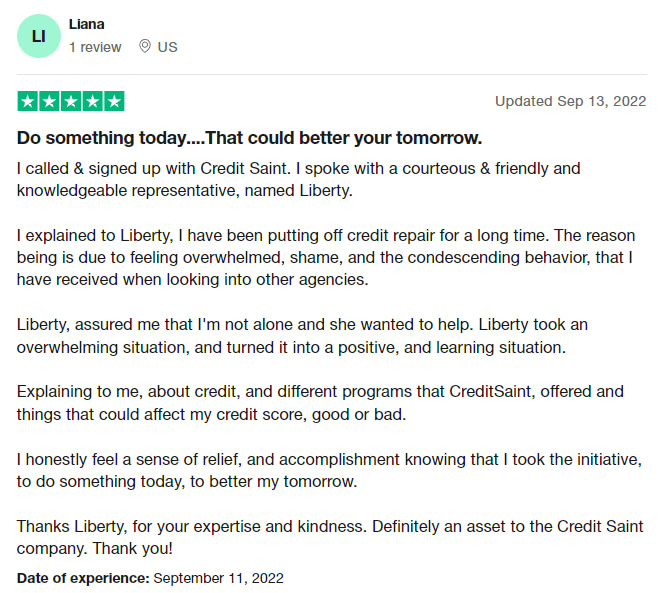

Credit Saint Customer Reviews

Credit Saint shows the same trend as Lexington Law when it comes to reviews. Customers complain that they don’t hear anything when their credit reports are not getting better. On the other hand, the positive reports are about how easy and effective the service is.

Lexington Law: The Legal Issue

In 2019 the Consumer Financial Protection Bureau (CFPB) filed a lawsuit against Lexington Law, accusing them of illegal marketing and billing practices. The billing practices cited in the suit are actually common in the credit repair industry, and Lexington Law may have been singled out because it is the largest and most visible credit repair company.

The marketing issues are more complex. The CFPB lawsuit alleges that Lexington Law paid marketing affiliates that engaged in fraudulent actions, like promising credit lines to clients that agreed to use Lexington Law, and that Lexington Law was aware of these actions.

The lawsuit does not address Lexington Law’s delivery of credit repair services, but it could affect your view of the Company’s overall business ethics.

Update

On August 28, 2023, the CFPB announced that it had entered into a proposed settlement with Lexington Law. The settlement will have to be approved by the court.

The settlement imposes a $2.7 billion judgment and over $64 million in civil penalties against Lexington Law and its partner companies. The group behind Lexington Law is also banned from any telemarketing activities for 10 years.

Lexington Law has filed for Chapter 11 bankruptcy protection, laid off 900 employees, and shut down 80% of its operations. It is not clear how much of the fine will be paid or whether Lexington Law, CreditRepair.com, and their related companies will remain in business.

The Verdict

If you have a simple credit report with only a few disputable items and you’re looking for the cheapest plan, consider Lexington Law’s Lexington Essentials plan (or just go DIY). But if your situation is very complex and you are willing to spend more, you may get more value by choosing Credit Saint’s higher-end packages.

Remember that Credit Saint offers unlimited disputes in some packages, while even the highest-priced packages from Lexington Law have limits on the number of disputes and creditor interventions.

Since you have the option of getting your money back with Credit Saint, you can try it out and see how well it goes. Be diligent during the first 90 days to make sure negative items are being addressed. If you don’t see results, you can request your money back. Credit Saint is less expensive than Lexington Law, though its initial fee is slightly higher. However, if you anticipate staying with a credit repair company for the long term (generally not a good idea), Credit Saint’s lower monthly costs are attractive.

Remember that the more expensive package may not be best for you. You gain nothing by paying extra for services you don’t need!

☝️ Looking for more options? Check out our review of the best credit repair companies for 2022.