Your credit score is a financial report card. This three-digit number has a huge influence on your life, from loan approvals and interest rates to apartment rentals and job opportunities. But what exactly is a credit score, how is it calculated, and how can you improve it? Let’s uncover these answers.

Key Takeaways

- Your credit score has a broad impact. Credit scores go beyond qualifying for loans and credit cards. Landlords, insurance companies, and even employers use them to evaluate your trustworthiness.

- Your credit score is based on your financial history. Paying bills on time, keeping your credit utilization low, and using credit wisely will help you build better credit.

- Knowing how your credit score is calculated can help you improve it. If you understand where your credit score comes from and how it is computed, you’ll have an inside track on making it better.

CHAPTER 1

Why Credit Scores Matter

Your credit score is a financial report card. It’s designed to predict the probability that you will default on a loan, but it has taken on much wider importance.

Any time you apply for a loan, credit card, or any other form of credit, the lender will check your credit score. If your score says you’re a risky borrower, they may raise your interest rate and fees.

If your score is really low, you may not get approved for credit at all.

Some employers will check your credit score before making a hiring decision. Landlords will check your credit before agreeing to rent to you.

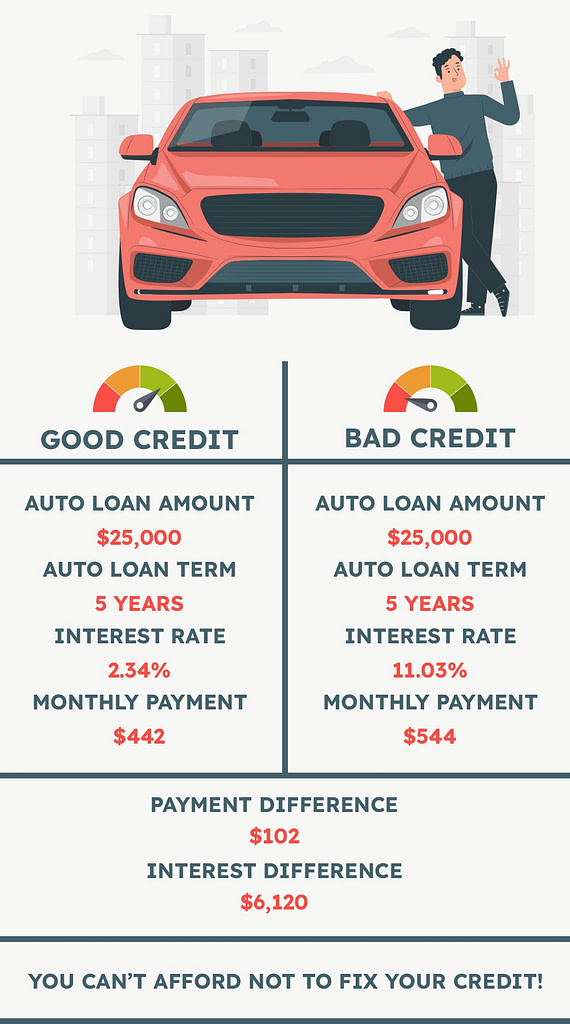

Bad credit can be expensive. If you can’t get approved for loans or credit cards you may be forced to use very expensive forms of credit like payday loans to cover a shortfall.

Paying a high interest rate can be a huge cost, especially on large loans like a mortgage or a car loan. If you routinely carry a credit card balance interest costs can add up to hundreds or thousands of dollars every year.

Good credit, on the other hand, can open doors and save you money.

Understanding your credit score and how it is generated can help you build better credit, gain opportunities, and save money.

☝️ A good credit score isn’t just about better loans and credit cards or better prices, though. It’s a sign that you are managing your money effectively. The same habits that help you build better credit will help you achieve other financial goals.

CHAPTER 2

Where Your Credit Scores Come From

Yes, that’s right: we said credit scores, plural. One credit score is confusing enough, but you don’t just have one, you have many. Let’s look at how that came about.

Credit Bureaus

Your credit score is based on information compiled by three credit reporting companies, often called credit bureaus. They are private companies, not government agencies.

These three companies – Experian, Equifax, and TransUnion – collect information from your creditors and assemble it into credit files.

Creditors are not required to report to the credit bureaus. In fact, they have to pay to report. For this reason, not all creditors report to all three credit bureaus. Major lenders and credit card issuers usually report to all three, but smaller ones may report to only one or two.

Lenders who report to credit bureaus don’t just have to pay, they are also subject to regulation under the Fair Credit Reporting Act (FCRA). That’s why many utility companies, rental property owners, and other companies that bill you don’t report.

👉 Payments that are not reported to the credit bureaus will not affect your credit score.

Credit Score Providers

The three major credit bureaus collect the information that goes into your credit score, but they don’t provide the score itself. Most credit scores come from two companies.

- The Fair Isaac Corporation, or FICO, is the dominant provider of credit scores. Most lenders base decisions on FICO scores. FICO provides multiple scores, including scores used by specific types of lenders.

- VantageScore, a newer score provider, was developed by the three major credit bureaus to compete with FICO. It is not used by many lenders but it is widely used by free credit score providers.

These companies use different algorithms or scoring models to generate credit scores. Both are based on the information in your credit reports. If you have an excellent FICO score you are likely to have at least a very good VantageScore as well, but there may be significant differences between the two scores.

There are two variables that generate different credit scores:

1. Different Models

Each of the credit score providers upgrades its algorithm periodically, and lenders can choose which score to use. For example, FICO’s latest general-purpose score is the FICO 9 score, but many lenders still use FICO 8. These scores may be different.

In addition, FICO in particular generates specialized scores for specific types of lenders. The FICO Auto Score, for example, prioritizes your record in making car payments and is used by auto lenders.

👋 You cannot get specialized FICO scores from any free credit score provider. If you want to see all your FICO scores the only way to do it is by signing up for MyFICO. Learn more about this service in our MyFICO review.

2. Different Bureaus

When a lender pulls your credit score they typically get it from one credit bureau. Because not all lenders report to all bureaus, these scores can be different. A FICO 8 score from Experian may not be the same as a FICO 8 score from Equifax.

👉 For example: Imagine that you have a debt with a small lender that reports only to Equifax. If you don’t pay that debt and it is charged off, that will only appear on your Equifax credit report. Your scores based on an Equifax credit report will be lower than scores based on other reports.

How Many Scores Do You Have?

There are 28 types of FICO scores, but only 16 are in current use. Each of those may vary depending on which credit bureau it’s drawn from.

Keeping track of one credit score can seem complicated, so how do you keep track of 48?

The answer is simple: you don’t have to.

If you want to track your credit, stick to the basics.

- You are entitled to one free credit report every year from each credit bureau. You can get these reports from www.annualcreditreport.com. Check each report each year so you know which accounts are reported to which bureaus. In most cases, your reports will be similar, though not necessarily identical.

- Find a way to track your credit score. Many credit cards, banks, and other institutions allow you to see your score for free. Tracking your score on a regular basis will give you a general sense of how you are handling credit.

- Understand that there may be differences. If you are applying for a loan or credit card, avoid applying if the score you know is close to a cutoff point. The score the lender pulls could be lower. Give yourself a margin of safety.

The credit reporting and scoring system is complicated, but don’t let that keep you from keeping track of your credit and understanding it.

☝️ If you’re going to be using credit, you need to understand your credit reports. Unfortunately, there’s a lot of information packed into them and no small amount of financial jargon. You’ll need to learn how to read a credit report.

CHAPTER 3

What Affects Your Credit Score?

Most credit scoring models use the same basic criteria to determine your credit score, Different models may give different weights to these factors or interpret them differently, but the basic ingredients that make up your credit score will be similar.

FICO uses five elements to create your credit score.

VantageScore uses similar elements, though the weighting varies.

Let’s take a closer look at the components that make up your credit score.

1. Payment History

Payment history is the single most important element in both VantageScore and FICO scoring models. Creditors want to know whether you have paid previous debts reliably and made on-time payments consistently.

In most cases, a payment will be reported as late if you have not paid within 30 days after the due date. A late payment will damage your credit score. If you still haven’t paid after 60 and 90 days that will be reported and will do more damage to your score.

After 90 days your creditor may charge off your account. At this point, they consider the debt uncollectible. A charge-off will do serious harm to your credit score. If the account is sold to a collection agency a collection account will be listed on your credit report and your credit score will fall further.

On-time payments, on the other hand, will build a higher credit score.

☝️ The single most important part of improving your credit score is making on-time payments.

2. Amounts Owed / Credit Utilization

These are two ways of describing the same concept: how much you owe relative to your total available credit. It’s typically computed using only revolving credit accounts, such as credit cards.

Each of your revolving credit accounts has a fixed credit limit: the maximum amount you can borrow on that account. Each account also has a balance, which is the amount you owe at a given time.

Your credit utilization ratio is the percentage of your limit that you actually use.

👉 For example: If you have a credit card with a $5000 credit limit and your balance is $1000, your credit utilization ratio on that card is 20%.

Credit scoring algorithms look at your combined total credit utilization and at your credit utilization on each account. Even if your total credit utilization is low, one maxed-out account can still harm your credit.

👉 For Example

Imagine that you have three credit card accounts.

| Credit Item | Credit Limit | Amount Spent | Utilization % |

|---|---|---|---|

| Credit Card 1 | $2,000 | $1,800 | 90% |

| Credit Card 2 | $2,000 | $500 | 25% |

| Credit Card 3 | $2,000 | $0 | 0% |

| Total | $6,000 | $2,300 | 38% |

Your total credit utilization ratio is 38%. That’s not catastrophic but it is on the high side and could bring your score down. You also have one account with a 90% utilization ratio, which is dangerously close to being maxed out. That will hurt your score.

Most experts advise keeping both your total credit utilization and your credit utilization on each account under 30%. That is not a magic number and your credit score will not fall off a cliff if you exceed it. It is a general rule, and a ratio below that level will not harm your credit.

It’s important to remember that your credit utilization rates are based on your balance on the day that your card issuer reports to the credit bureaus.

💡 It’s a good idea to learn when your issuer reports and pay off large balances before then. Keeping those balances low all the time is even better!

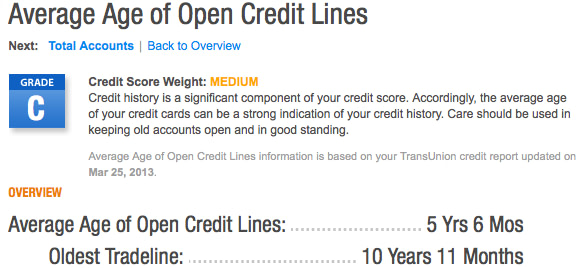

3. Age Of Credit Accounts

This factor, which is often referred to as the AAOA or Average Age Of Accounts, is one factor that you can’t do much about.

Basically, it’s the age of your oldest credit account, the newest accounts, and the average ages of all the accounts on your credit file.

Here’s a sample report on a consumer’s age of credit accounts.

💡 It will help to keep your oldest accounts open for as long as possible, even if you aren’t using them.

This is because if the oldest account falls off your report, it will shift your average age of accounts and affect your credit score. Closed accounts will not contribute to the average age of your accounts.

A potential conflict may arise if your oldest credit account is a credit card that you aren’t using and that card carries an annual fee. You’ll have to decide whether it’s worth it to keep paying that fee just o keep the account open. You can consider asking the issuer if they will upgrade your account to a fee-free card.

If the fee is high and you can’t upgrade, it is probably better to close the account. The damage to your credit will be temporary and it’s not worth paying fees just to keep the card alive.

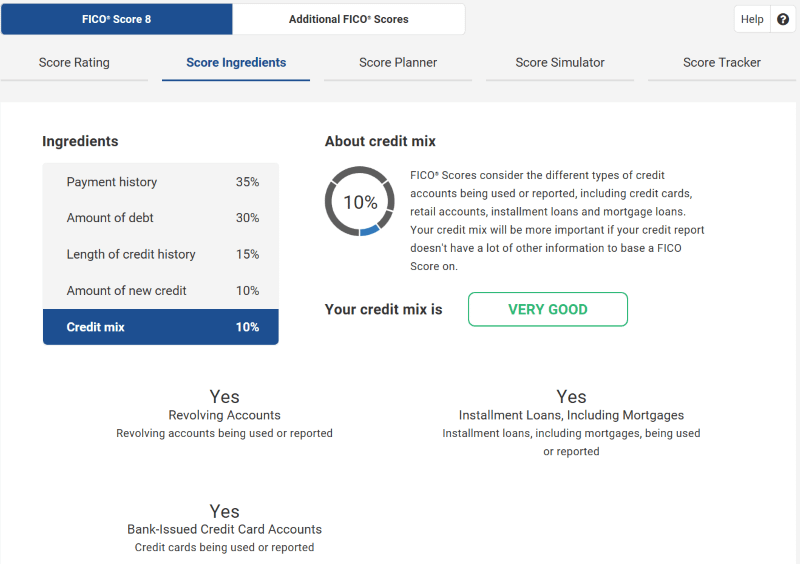

4. Types Of Credit Accounts (Credit Mix)

Credit scoring models favor consumers that have shown that they can handle multiple types of credit. A good credit mix includes a blend of revolving credit (like credit cards) and installment credit (loans).

There are several types of accounts:

- Credit Cards (Revolving Account)

- Line Of Credit (Revolving Account)

- Store Card (Revolving Account)

- Personal Loan (Installment Account)

- Student Loan (Installment Account)

- Mortgage Loan (Installment Account)

- Auto Loan (Installment Account)

💡 Maintaining a balance of these types will improve your credit mix and help you build better credit.

5. New Credit / Number Of Credit Inquiries

Every time you apply for new credit, a hard inquiry is registered on your credit report. This will have a negative impact on your credit score.

It’s important to understand the difference between hard and soft inquiries. Hard inquiries affect your credit, soft inquiries do not.

A single hard inquiry will have a very minor impact on your credit score, and the impact will fade quickly. A large number of hard inquiries in a short period of time can do much more harm to your credit: a mass of hard inquiries makes you look like you are desperate to add credit accounts.

A hard inquiry can only be added to your credit report with your written permission. When you sign an application for credit you are authorizing the lender to make a hard inquiry.

💡 If you see a hard inquiry on your credit report that you do not recognize, call the lender (the number will be listed on your credit report) and ask why they are on your credit report. It could be a mistake or an early sign of identity theft.

💡 If you are shopping for the best deal on a loan or credit card, keep all of your applications within a 15-day period. The credit bureaus will recognize that you are shopping and record only a single hard inquiry.

Bankruptcy and Other Public Records

At this time the only public record that will appear on your credit report is a bankruptcy. A Chapter 13 bankruptcy will remain in your credit report for 7 years. A Chapter 7 bankruptcy will remain on your credit report for up to 10 years.

Other public records, like tax liens, civil judgments, or child support decrees, will not appear on your credit report. However, many lenders will perform public record searches before making a lending decision, so these records may still affect lending decisions.

Factors That Don’t Affect Your Score

None of these factors will have any impact on your credit score:

- Race

- Religion

- National origin

- Sex, gender, sexual preference, or marital status

- Age

- Salary

- Occupation

- Title

- Employer

- Date employed or employment history

- Where You Live

This information is not recorded on your credit report, and it cannot affect your credit score.

How Long Do Records Stay on My Credit Report?

Negative entries on your credit report are not there permanently. They will drop off eventually.

Most negative records will disappear from your credit report seven years from the date when the account became delinquent and was not subsequently brought up to date.

👉 For Example

For example, let’s say you missed credit card payments in May and June of 2020, then paid the account up in July. You missed another payment in October but never caught up. The account was charged off in February 2021 and sent to collections in April 2021.

The entire account will drop from your credit record seven years from October 2020, or October 2027.

The impact that a record has on your credit also fades with time. Newer records have more weight than older ones. A Chapter 7 bankruptcy will be on your credit report for 10 years, but if you add consistently positive records its impact on your score will be reduced to a minimal level well before the account itself drops off your record.

CHAPTER 4

What Is A Good Credit Score?

Most credit scoring systems range from 300 to 850. Each credit score provider has its own credit score ranges, which define what score the provider considers excellent, good, fair, or poor.

Credit score ranges determine how likely you are to be approved for a loan or credit card and what interest rate you will pay. If your credit score is good you will be approved for most credit products and you’ll pay low interest rates.

If your credit score is low it may be difficult to get approved for a loan or credit card. If you are approved you will pay high interest rates, because the lender sees you as a high-risk borrower.

What Is A Good FICO Score?

The FICO score was created by the Fair Isaac Corporation in 1956 and has become the score of choice for over 90% of lenders.

These are FICO’s current credit score ranges:

| Score | Rating | % Of People | APR/Rates Impact | Risk |

|---|---|---|---|---|

| 800-850 | Exceptional | 21% | Almost certain approval, will receive best rates from lenders. | Very Low |

| 740-799 | Very Good | 25% | High probability of approval, will receive above-average rates. | Low |

| 670-739 | Good | 21% | May not be approved for high-end products, will receive average rates | Medium |

| 580-669 | Poor | 17% | Will only be approved for high-risk products, will pay high interest rates. | High |

| 300-579 | Very Poor | 16% | Very difficult to access credit. Will pay very high rates if approved. | Very High |

Remember that lenders may have their own classifications for what constitutes a good credit score.

What Is A Good Vantage Score?

The VantageScore is a relatively new type of credit score that more lenders are starting to use.

Your VantageScore may be different than a FICO score, but it is based on similar criteria. If you have a good VantageScore you are likely to have a good VantageScore as well.

These are VantageScore’s published credit score ranges:

| Score | Rating | % Of People | Impact | Risk |

|---|---|---|---|---|

| 781-850 | Exceptional | 23% | Approval is almost certain, will receive best rates from lenders. | Very Low |

| 661-780 | Very Good | 38% | High probability of approval, will receive above-average rates. | Low |

| 601-660 | Good | 13% | May not be approved for high-end products, will receive average rates. | Medium |

| 500-600 | Poor | 21% | Approval may be difficult, will pay above-average rates. | High |

| 300-499 | Very Poor | 5% | Approval will be very difficult, rates will be very high if approved. | Very High |

☝️ Most lenders use FICO scores to determine your creditworthiness. If you are checking your score through a free credit score provider, you are probably seeing a VantageScore. They may be different.

It’s always worthwhile to try and improve your credit score. A good or even fair score may be enough to get you approved, but you’ll pay higher interest rates that could cost you thousands of dollars over the life of a large loan like a mortgage or car loan.

CHAPTER 5

How To Improve Your Credit Score

Improving your credit score doesn’t really take that much skill as long as you don’t try to rush the process. The steps you need to take are pretty simple and they will improve both your credit score and your overall financial management.

Most people who are trying to improve their credit fall into one of two categories.

- People with no credit have an advantage. When you start with a blank slate you can build a great record with no negative records to drag you down. Find out more about how to start building credit at 18.

- People with bad credit will need to take more time and work a little harder. Those negative records will stay on your credit report for some time, and you’ll need to balance them out with good ones. Find out more about how to rebuild damaged credit.

Either way, don’t expect to build credit overnight. The process takes time, but it’s worth the effort!

These steps will help you build better credit.

1. Pay Your Bills On Time

It sounds simple, and it is. It’s still the single most important part of building your credit score. Payment history is the most influential component of your credit score, and making every payment on time will build a solid payment history.

Paying every bill on time is not just a way to improve your credit. Late payments can rack up costly late payment fees and pile up debts that can quickly become unmanageable. If you can’t make payments on time, something is wrong and you need to do something about it.

👉 If you already have late payments on your record, you can still improve. Credit scoring models give recent records more weight than older ones. Start making on-time payments today and your score will improve.

2. Take Charge of Your Credit Utilization

Credit utilization is a major influence on your credit score. You’ll need to avoid maxed-out cards at all costs and keep your balance below 30% of your limit. Lower is better.

Follow these steps.

- Limit card use. If you use your card for everything it will be hard to keep your utilization low, especially if your card has a low limit. Only use your card when you really need to and use it wisely.

- Make multiple payments. Making payments several times a month will help you keep your balance down.

- Know when your issuer reports. Your credit utilization is a snapshot taken on the day your issuer reports to the credit bureaus. Find out when your issuer reports each month and make your payment well before that day.

- Pay your balance in full each month. Carrying a balance will make it very difficult to keep utilization low. You’ll also be paying interest at very high rates.

- Ask for a credit limit increase. A higher credit limit will lower your credit utilization. Just be sure you don’t raise your spending to match your new limit!

A proven trick for building credit

- Get a no-fee card. Use a secured card if you can’s qualify for anything else.

- Put a single recurring expense, like a Netflix subscription or your internet bill, on that card.

- Set up an automatic payment from your checking account to cover it.

- Put the card away and use cash for everything else.

Your card will stay active, your utilization will be low, and every payment will be made on time.

3. Manage Your Applications

Every time you apply for new credit, a hard inquiry is registered on your credit report. A single hard inquiry will have a minor impact on your score. If you start piling on the hard inquiries you’ll look desperate, and your credit will suffer.

Only apply for new credit if you really need it. Try to space your inquiries out. If you’ve just applied for a loan or credit card, wait six months – or even longer – before you apply for another one.

If you’re shopping for the best deal on a loan, keep all of your applications within a 15-day period. The credit bureaus will recognize that you are shopping and record only a single hard inquiry.

4. Don’t Close Old Accounts

If you have an old credit card that you’re not using, you may be tempted to close the account. If you do you will reduce the length of your credit history, which can cut your credit score. It’s best to keep those accounts open, even if you’re not using them.

The exception to that rule would be a card that has an annual fee. The whole point of building credit is to save money, and you shouldn’t have to pay to do that.

If your old card has a fee, ask the issuer if they will upgrade you to a no-fee card. If they won’t, it’s probably best to go ahead and close it. Your credit will recover, but the money you pay in fees is gone forever.

5. Watch Your Credit Reports

You are entitled to a free credit report from each credit bureau every year. You can get these reports from annualcreditreport.com.

Get your credit reports regularly. Many people choose to get one every four months. Read them in detail and be sure you know how to understand a credit report.

Over a third of credit reports contain errors that can damage credit scores. Inspect your credit reports carefully and look for accounts or hard inquiries that you don’t recognize. If you find them call the company – the phone number will be listed in the entry – and ask why they are on your credit report. It could be legitimate, it could be an error, or it could be an early sign of identity theft. You need to know which.

If there is a mistake on your credit report you can dispute the entry and have it removed.

6. Negotiate With Creditors

If you have a delinquent account or you think you can’t make a payment, take the initiative. Contact the creditor, explain the situation, and ask to set up a payment plan.

Many creditors are willing to work with debtors who are experiencing financial trouble, especially if it’s due to factors beyond their control, like medical bills or job loss. Taking the first step is a sign of good faith.

You may be able to prevent a late payment from being reported or stop an account from being sent to a collection agency. That will prevent further damage to your credit score.

👉 If you already have an account with a collection agency, start by learning how to deal with collection agencies.

If you’re sure the debt is yours and the statute of limitations has not expired, offer a debt settlement. Debt collectors pay an average of 4 cents for every dollar of debt they buy, so they can accept less than the full amount of your debt and still make a profit.

You may be able to get a collection agency to delete your record with the credit bureaus in return for a settlement. Use a pay for delete letter to propose this arrangement. It’s not guaranteed to work, but it’s worth a try.

7. Add New Accounts Strategically

If you have no credit or a thin credit file adding accounts will be a core part of your credit-building strategy. If you have a bad credit record adding new accounts will be less effective, but it can still help.

Here are some ways to add accounts to your credit record.

- Become an authorized user. A friend or relative can add you as an authorized user on their credit card and share their credit history.

- Use a secured credit card. Secured credit cards are readily available and many are fee-free. Use it wisely and it will build your credit.

- Get a credit-builder loan. Credit-builder loans aren’t free, but they can be an affordable way to add an installment loan to your credit record.

- Report your utilities. Services like Experian BOOST™ and eCredable Lift can put your utility payments on your credit record.

- Try rent reporting. Rent reporting services can put up to two years of rent payments on your credit record. These services can be expensive, so compare carefully. Choose one that reports to all three credit bureaus.

- Use credit-building products. There’s a wide range of new ways to build credit out there, from credit-building debit cards to ways to report streaming service payments. Choose carefully!

You won’t need to use all of these methods. Compare carefully and select the best mix for you.

⚠️ Watch for hidden costs: some store credit cards offer low fees or no interest but restrict you to buying overpriced goods at their stores!

💡 Before you pay for a credit-building product, remember that you can build credit for free!

8. Don’t Fall For Hype or Scams

Lots of people will promise to fix your credit overnight. You’ll hear all kinds of stories about 100% effective credit repair, or about magic letter templates or dispute methods that will make even legitimate accounts disappear from your credit report.

Take a deep breath and be skeptical. If it sounds too good to be true it probably isn’t true, especially if someone wants you to pay them!

9. Wait… Seriously… Just Wait

My last tip is that you need to wait.

This is probably the oddest thing you can do to get a better credit score; however, it is the most crucial step.

Most people want to see an instant change in their credit, and they want to be able to buy that car or get the home they dreamed of.

Unfortunately, the one thing you have to do with credit is to wait.

Expect to take at least a year to put a plan into action, put new accounts on your credit, and allow old ones to fall off or fade away.

Waiting also helps you increase your average age of accounts, which can only increase with time.

I know you didn’t want to hear that, but it’s the last and best piece of advice for increasing your credit score.

BONUS CHAPTER

What’s A Good Credit Score For Loans By Type?

Credit scores are used by lenders to help predict the likelihood of default. Lenders want to be paid back and credit scores help them assess the risk of losing their money.

Different loan types require different credit scores. Remember that these are averages, and different scores will have different requirements.

What Is A Good Credit Score For An Auto Loan?

Auto loan rates by credit score are divided into five categories, with Super Prime being the highest and deep sub-prime the lowest.

Auto loans are secured loans. The Vehicle is collateral for the loan. This lets lenders extend credit to less qualified buyers, but the interest rate will be high.

| Category | Score Range | Average interest rate | Average loan amount | Average term (months) | Average monthly payment |

|---|---|---|---|---|---|

| Deep subprime | 300-500 | 14.17% | $36,272 | 72.63 | $737 |

| Subprime | 501-600 | 11.86% | $40,660 | 73.87 | $769 |

| Near prime | 601-660 | 9.29% | $43,360 | 74.13 | $769 |

| Prime | 661-780 | 6.88% | $41,890 | 70.26 | $733 |

| Super prime | 781-850 | 5.61% | $36,450 | 62.23 | $693 |

What Is A Good Credit Score For A Personal Loan?

Personal loans are broken into four credit score categories, and to keep things confusing, they are usually referred to them as excellent, good, fair, or bad/poor.

Personal loan APRs for each credit score range vary widely with the lender, but as always, higher credit scores will get lower rates.

| Score Range | Personal Loan APR |

|---|---|

| 760-850 | 9.30% |

| 720-759 | 13.32% |

| 680-719 | 17.82% |

| 640-679 | 22.16% |

Personal loans are the Swiss army knife of loans. They can range from $1,000 to $100,000 with payment terms as short as six months and as long as seven years.

Personal loans can be used for a variety of needs:

- Debt Consolidation

- Payoff Credit Cards

- Home Improvement

- Emergency Cash

- Medical Bills

- Education

- Business Start-up

- You name it!

Most personal loans are unsecured by any collateral and have lower interest rates than credit cards but higher rates than secured loans.

People with excellent and good credit scores will receive the best rates because they are at a lower risk of not paying back the lender.

As your credit score become fair and lower, the number of lenders willing to risk giving an unsecured personal loan dwindles fast.

Even with a bad credit score, there are still some personal loan options, albeit, at interest rates between 35% and 155%.

While these are personal loans, they are usually also marketed as ‘installment loans,’ which is basically a payday loan that has longer payment terms between 6 months to 7 years.

⚠️ Caution! A personal loan with an APR rate of 100% will double in value each year. If you have to take out a bad credit loan, use the smallest amount possible for the shortest possible length of time.

What Is A Good Credit Score For A Mortgage?

A mortgage is the largest loan most people will ever take out. Your credit score has a large impact on your chances of approval and on the interest rate you will pay.

Mortgage rates per score range (February 2022):

| FICO Score | Mortgage APR |

|---|---|

| 760-850 | 3.285% |

| 700-759 | 3.507% |

| 680-699 | 3.604% |

| 660-679 | 3.898% |

| 640-659 | 4.328% |

| 620-639 | 4.874% |

You may be able to get an FHA mortgage with a score as low as 580, but you will pay for mortgage insurance and your interest rate will be high.

Because mortgages are very large loans with long terms, a small difference in rates can translate to a very large difference in cost. The difference between 3.507% and 4.328% doesn’t sound large, but with a 30-year fixed-rate mortgage of $423,100, that adds up to an additional $71,713 in interest cost!

If you’re considering buying a home it will be very much worthwhile to build up your credit score first!

Your Turn To Take Action

Now that you know what a good credit score is and how to get one it’s your turn to take action.

You know the exact steps it will take to step away from having bad credit or no credit and build a better credit score.

You have a ton of options so don’t waste any time. The sooner you build a better credit score the better your overall financial life will be.