AmOne Personal Loans are a great option if you are looking for a personal loan and you want to compare multiple offers to get the best possible rates.

AmOne has been around since 2001 and they specialize in finding you the best rates for personal loans. They don’t charge a fee for matching you with their network of lenders. The lenders pay, not you.

AmOne Personal Loans

AmOne Personal Loans are a great option if you are looking for a personal loan and you want to compare multiple competing offers to get the best possible rates.

Pros

Multiple Loan Offers

Competing Lenders

Personal Loan Specialists

Bad Credit OK

Cons

Rates By Lender

Must Provide Personal Info

Phone Calls From Lenders

AmOne provides customers with multiple offers from their network of banks and lenders.

The loans do not actually come from AmOne. The Company is a loan broker that links borrowers to a network of lenders. There is no minimum credit score.

They match customers with multiple lenders who compete by offering the best interest rates possible.

There are many advantages and a few disadvantages to AmOne Loan offers.

Prequalify for a Personal Loan

Check your personal loan rates by answering a few questions. It only takes two minutes and has no impact on your credit score.

Who Is AmOne?

AmOne Corp. started in 1999, making small personal loans online out of Fort Lauderdale, Florida.

They are not an actual lender but provide a platform for borrowers with bad credit or good to find the best rates by receiving multiple offers from different banks or lenders.

What Makes Them Different?

We read countless reviews raving about AmOne’s customer service and accessibility.

Not only do their customer service reps appear to care, but you have multiple options to reach them, including by a toll-free number or on their websites live online chat feature.

They have relationships with a wide variety of banks and lenders, which allow them to offer personal loans to people with bad credit, no credit, or limited credit.

Even if you have bankruptcies, repossessions, and judgments, AmOne may have a lender willing to lend money.

Keep in mind that if you have a lower credit score or a flawed credit record, you will be charged a higher interest rate because you present a higher risk of default.

Based on AmOne reviews, they are one of the few marketplaces where there are no credit or income requirements, in fact, all you have to be is 18 and a U.S. citizen to apply.

AmOne Corp. also offers you the ability to apply and complete the entire loan process from your mobile phone on their app.

How Do AmOne Personal Loans Work?

AmOne has one of the easiest platforms to use and it only takes about 30 seconds to find your best rate.

AmOne works by sending your information to lenders in their network that may match up well with you.

The lenders then send you an offer for a personal loan based on your credit score, credit history, and your ability to pay.

1. Find Your Rate

The first thing you do is select “Personal Loans” and fill out the short form. It takes about 1 – 2 minutes to enter your information.

You need to provide basic information and income, as well as the amount of the personal loan you are looking to apply for.

AmOne Corp. doesn’t check your credit score to get lender offers. They only do a soft credit check.

This means you get to see what rates you can get without the worry of it affecting your credit.

2. Compare Your Options

Once you put your information in and submit the form, you will be taken to a dashboard.

This dashboard will have multiple pre-approval offers from different lenders.

👉 Keep in mind, these are Pre-Approvals, and your actual approval is not guaranteed. You will get to see your actual pre-qualified rates.

The rates you see are usually very accurate as long as you can verify your information and nothing changes on your credit report.

Once you confirm and verify everything, the rates are pretty solid. The best thing is that you get to see your options upfront and know exactly which option is best for you.

3. Apply For Your Personal Loan

Once you pick a lender, it’s time for you to apply. During the application process, you’ll get asked more in-depth questions about your use of the loan and your financial history. The lender will run a credit check. This all happens on the AmOne website.

Once this step is done the lender will work with you directly to finalize all of the loan details.

👉 Need more options? Check out our reviews of other online lenders.

AmOne Personal Loans Rates and Terms

Since AmOne lets you see offers from multiple lenders, we wanted to show you the absolute minimum and maximum you can be offered. Different lenders will offer different amounts.

- Loan Amount Range: $1,000 – $50,000

- APR Range*: 3.99% – 35.99%

- Fees: Origination, Late Payment, and NSF fees all vary by the lender.

- Prepayment Penalties: None

- Loan Terms: 1 to 7 years

- Payments Directly To Creditors: Varies by lender.

👉 Remember, once you pick a lender, they will pull your credit report and create a hard pull on your credit. If you apply with several lenders, keep your applications within a 15-day window, and only one hard inquiry will be placed on your credit report.

AmOne Personal Loan Eligibility

In order to be eligible for AmOne personal loans, you must meet the below AmOne personal loan requirements:

- Be a U.S. Citizen or Permanent Resident

- You are at least 18 years old

Those are the only absolute requirements. There’s no minimum credit score.

What Information Will You Need To Apply?

You will need this information to fill out the online form.

- Your date of birth.

- How much do you want to borrow?

- What do you plan to use the money for?

Have this information ready before you start.

AmOne Personal Loan Calculator

Use the AmOne Personal Loan Calculator to help determine the payment amounts based on interest, length of personal loan, and amount borrowed.

The interest rate will be determined primarily by your credit score and your ability to repay the loan. Each lender will set their own rate based on their own criteria.

This calculator lets you adjust the different loan variables to give you a good understanding of how each affects your monthly payment.

As you increase the term of the loan, the monthly payments decrease, but your total interest payment increases.

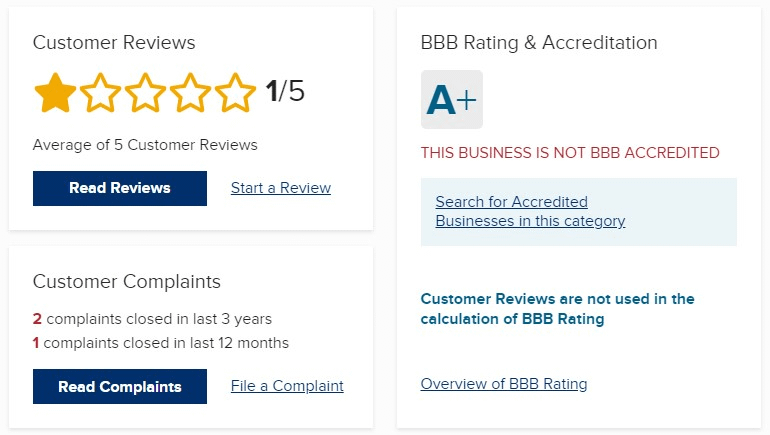

Customer Reviews

AmOne customers predominantly praise their customer service team for their friendliness and ability to resolve problems.

Customers also appreciate that loans are available to people with bad credit or no credit.

Overall, after reading hours of AmOne reviews, we feel confident in recommending them for any future financing you may need.

AmOne BBB has had a file at the Better Business Bureau since 2001.

Taking Action & Getting A Loan

Personal Loans are a great option to consolidate credit card debt, meet necessary expenses, or even start a business.

If you need a personal loan, AmOne Corp.’s lender network will be a prime choice, especially if your credit is flawed.

You can click the button below to complete your application process and get a loan in under 2 minutes.