While BadCreditLoans.com is not an actual lender, they do provide the platform for its lenders and customers to come together to get the best deals.

BadCreditLoans.com

BadCreditLoans.com is a good option only if you are looking for a personal loan of up to $10,000 and have little choice of lenders because of bad credit. They don’t charge a fee to use their service of matching you with their network of lenders.

Pros

Multiple loan offers

Competing lenders

Bad credit OK

Cons

High APR rates

Phone calls from lenders

Prequalify for a Personal Loan

Check your personal loan rates by answering a few questions. It only takes two minutes and has no impact on your credit score.

Who Is BadCreditLoans.com?

BadCreditLoans.com started in 1998 by bringing together traditional lenders, peer-to-peer lending networks and tribal loans (from Native American Indian Funds).

Today, they have grown to offer personal and installment loans across the United States to all credit types.

They are not an actual lender but provide the platform for borrowers with bad credit or good to find the best rates by receiving multiple offers from different banks or lenders.

They offer traditional personal loans, personal installment loans, and peer-to-peer loans which may be funded by individuals or companies.

What Makes Them Different?

BadCreditLoans is unique in that it offers a robust platform for peer-to-peer borrowing and access to tribal loans.

Tribal loans offer the opportunity for people who are self-employed or have a varied credit history to qualify for personal loans that they may not qualify for with a traditional lender.

Keep in mind that tribal loans are funded from sovereign native American lands and do not always have to meet state APR maximums.

They have relationships with a wide variety of banks and lenders which allows them to offer personal loans to people with bad credit, no credit, or limited credit.

Even if you have bankruptcies, repossessions, and judgments, BadCreditLoans may have a lender willing to lend money.

Based on BadCreditLoans reviews, they are one of the few marketplaces where you can qualify for a loan as short as 90 days.

They also offer you the ability to apply and complete the entire loan process from your mobile phone on their BadCreditLoans app.

How Does BadCreditLoans Work?

BadCreditLoans have one of the easiest platforms to use and it only takes about 30 seconds to find your best rate. Here’s how it works:

1. Find Your Rate

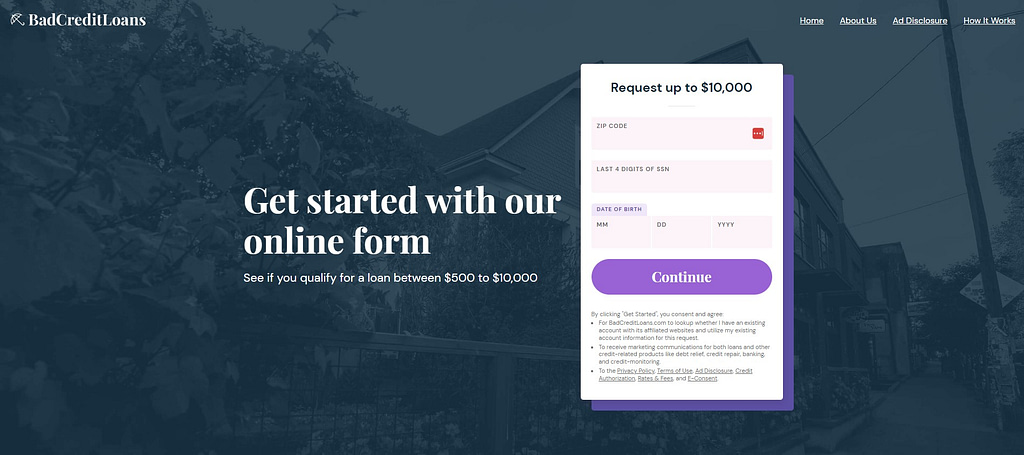

The first thing you do is go to their website and fill out the short form on their home page. It takes about 1 – 2 minutes to enter your information.

You need to provide basic information and financial income, as well as the amount of the personal loan you are looking to apply for.

BadCreditLoans.com doesn’t check your credit score to get lender offers, they only do a soft credit check. This means you get to see what rates you can qualify for without the worry of it affecting your credit.

2. Compare Your Options

Once you put your information in and submit the form you will be taken to a dashboard.

This dashboard will have multiple pre-approval offers from different lenders.

Keep in mind, these are Pre-Approvals and your actual approval is not guaranteed; however, you will get to see your actual pre-qualified rates. The rates you see are usually very accurate as long as you can verify your information and nothing changes on your credit report.

3. Apply For Your Personal Loan

Once you pick a lender, it’s time for you to apply. During the application process, you’ll get asked more in-depth questions about your use of the loan, your financial history, and the lender will run a credit check.

Once this step is done the lender will work with you directly to finalize all of the loan details.

Note: This all happens on the BadCreditLoans.com website.

What Can You Use BadCreditLoans For?

There are several reasons you may need a personal loan for. Here are some of the things you can use BadCreditLoans for:

- Debt consolidation

- Major purchases

- Home improvements

- Medical expenses

- Moving/relocation

- Vacating

- Starting a business

- Education

Eligibility

In order to be eligible for BadCreditLoans you must meet the below personal loan requirements:

- Be a U.S. Citizen or Permanent Resident

- You are at least 18 years old

- Have a regular income, either from full-time employment, self-employment, or disability or Social Security benefits

- Have a checking account in your name

- Provide work and home telephone numbers

- Provide a valid email address

Before filling out the online form make sure you have the below information ready:

- Date of birth

- How much do you want to borrow?

- What do you plan to use the money for?

Loan Terms

Since BadCreditLoans.com lets you see offers from multiple lenders, we wanted to show you the absolute minimum and maximum you can be offered. Actual rates and terms will change by lender.

- Loan Amount Range: $500 – $10,000

- APR Range: Varies by Lender (5.99% to 35.99% APR* Estimation)

- Fees: Origination, Late Payment, and NSF fees all vary by lender

- Prepayment Penalties: Varies by lender

- Loan Terms: 3 to 72 months

- Payments Directly To Creditors: Varies by lender

Keep in mind that if you have a lower credit score you will be charged higher APR interest rates because, statistically, you are a higher risk to default.

👉 Need more options? Check out our reviews of other online lenders.

BadCreditLoans Customer Reviews

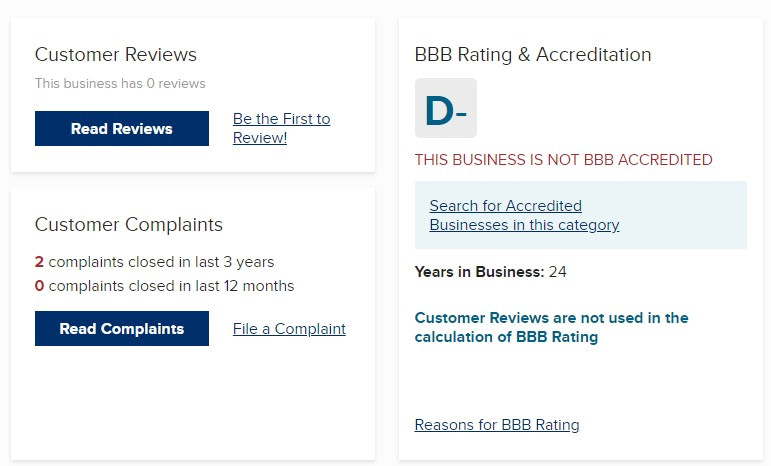

BadCreditLoans has a D- rating on BBB, but they only have two complaints in the past three years.

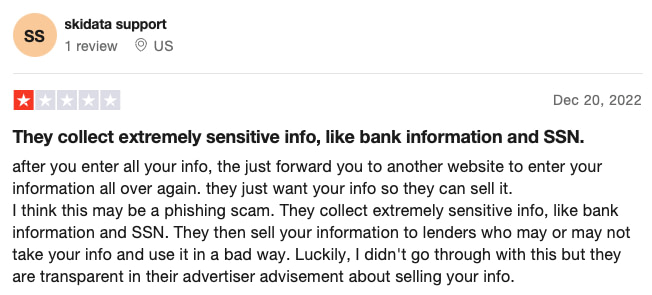

BadCreditLoans has an average rating of 2.7 on Trustpilot. Reviews from their customers predominantly praise the platform’s ease of use and their excellent customer service team for their friendliness and ability to resolve problems.

Customers also appreciate that BadCreditLoans are available to people with horrible credit, no credit, limited credit, bad credit and fair credit.

Many customers praised the speed at which they received larger loans for home projects and emergency needs.

On the negative side, most customers are very concerned about giving out their personal information to a company that will then share their information with multiple lenders.

☝️ This is a valid concern and something you should take into account whenever you choose to use a loan matching service.

What to Do After You Get a Loan

It feels great getting approved for something, no matter what it is, you feel like you have just won something. But, now that you have been approved, there are some things you should be doing with your accounts.

Make On-Time Payments

I am sure you are tired of seeing everyone saying “on-time payments”. But it is super important and is one of the largest factors in helping grow your credit score.

Of course, you probably didn’t obtain this loan for building your credit.

However, you still need to be mindful that this product can harm your credit if you don’t manage it correctly.

No matter what, avoid late payments.

Pay Back The Loan ASAP

Along with making on-time payments, you should definitely pay this loan off as soon as possible.

Large personal loans tend to linger when you only pay the minimum. While this does keep more cash in your pocket in the initial phase, eventually you end up spending thousands of more dollars in interest payments.

Getting your credit utilization ratio below 30% will also be great for helping your credit score grow.